Global Long Term Care Software Market

Market Size in USD Billion

CAGR :

%

USD

5.51 Billion

USD

12.52 Billion

2024

2032

USD

5.51 Billion

USD

12.52 Billion

2024

2032

| 2025 –2032 | |

| USD 5.51 Billion | |

| USD 12.52 Billion | |

|

|

|

|

Long Term Care Software Market Analysis

The global long term care software market is experiencing significant growth due to advancements in healthcare technology and the increasing demand for efficient management of long term care facilities. These software solutions are designed to streamline operations, improve patient care, and enhance regulatory compliance in nursing homes, assisted living facilities, and home care agencies. Key advancements in the market include the integration of Electronic Health Records (EHR), Revenue Cycle Management (RCM), Electronic Medication Administration Records (eMAR), and Staff Management systems into comprehensive platforms. These innovations allow healthcare providers to deliver more personalized and efficient care while reducing administrative costs. Additionally, the adoption of cloud-based and web-based solutions is on the rise, offering scalability, data security, and remote accessibility, making it easier for care providers to manage patient information and streamline operations. The market is also driven by an aging population, which increases the need for long term care services and digital solutions. Emerging economies in regions such as Asia-Pacific and Europe are adopting long term care software at a rapid pace, fueled by the digital transformation in healthcare. With the ongoing advancements in artificial intelligence (AI) and machine learning (ML), the future of the long term care software market looks promising, offering more intelligent and data-driven solutions.

Long Term Care Software Market Size

The global long term care software market size was valued at USD 5.51 billion in 2024 and is projected to reach USD 12.52 billion by 2032, with a CAGR of 10.80% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Long Term Care Software Market Trends

“Rising Integration of Cloud-Based Solutions”

The long term care software market is witnessing a significant trend toward the integration of cloud-based solutions to enhance operational efficiency and patient care. Cloud-based platforms offer scalability, flexibility, and improved data accessibility, making them ideal for long term care facilities such as nursing homes and home care agencies. For instance, MatrixCare, a leader in long term care software, has expanded its offerings by integrating cloud-based Electronic Health Records (EHR) and Revenue Cycle Management (RCM) solutions, enabling providers to streamline operations and reduce administrative overhead. These solutions also enhance patient care by providing real-time access to health data, improving care coordination and compliance with regulatory standards. The adoption of cloud technology in the long term care sector is also supported by the growing need for cost-effective solutions and the increasing demand for remote monitoring, particularly in aging populations. As more providers adopt cloud-based long term care software, the market is expected to see continued growth and innovation.

Report Scope and Long Term Care Software Market Segmentation

|

Attributes |

Long Term Care Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

illumifin (U.S.), Veradigm LLC (U.S.), Oracle (U.S.), Intellitec Solutions (U.S.), Sunrise Senior Living (U.S.), Atria Senior Living, Inc. (U.S.), ADL Data Systems, Inc. (U.S.), CVS Health (U.S.), Omnicell, Inc. (U.S.), Netsmart Technologies, Inc. (U.S.), ResMed (U.S.), McKesson Corporation (U.S.), Yardi Systems (U.S.), PointClickCare (Canada), MatrixCare (U.S.), and UKG Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Long Term Care Software Market Definition

Long term care software refers to a range of digital solutions designed to manage and streamline the operations of long term care facilities, including nursing homes, assisted living centers, and home care agencies. These software solutions typically include tools for electronic health records (EHR), medication management, resident care tracking, revenue cycle management (RCM), staff management, and regulatory compliance.

Long Term Care Software Market Dynamics

Drivers

- Rising in Aging Population

The aging population is a key market driver for the long term care (LTC) software market. According to the United Nations, the global population aged 60 years or older is projected to reach 2.1 billion by 2050, up from 1 billion in 2020. In developed countries, such as the U.S., the elderly population is expanding rapidly. The U.S. Census Bureau estimates that by 2030, all baby boomers will be older than 65, and the number of Americans aged 65 and older will exceed 70 million, representing approximately 20% of the total population. This demographic shift increases the demand for long term care services, as older adults often require assistance with daily living activities or specialized medical care due to chronic conditions. To manage this rising demand efficiently, LTC providers are turning to software solutions that help with patient management, medical record-keeping, care coordination, and operational workflows. This growing need for streamlined care management directly contributes to the expansion of the LTC software market. As such, the aging population plays a pivotal role in driving market growth.

- Increasing Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases is a significant driver of the global long term care (LTC) software market. For instance, according to the World Health Organization (WHO), the global burden of chronic diseases, including diabetes, cardiovascular diseases, and Alzheimer’s disease, continues to rise. As of 2021, over 422 million people worldwide were living with diabetes, and cardiovascular diseases account for 31% of global deaths. Additionally, the Alzheimer’s Association reports that approximately 6.7 million Americans aged 65 and older are living with Alzheimer's disease, a number expected to nearly double by 2050. These conditions necessitate continuous monitoring and management, which has driven the demand for LTC solutions that streamline care planning, track patient data, and enhance decision-making. LTC software plays a crucial role in improving the quality of life for patients with chronic conditions by enabling more efficient management of care plans, medication schedules, and clinical interventions. The demand for such software is thus closely linked to the increasing incidence of chronic diseases, making it a key market driver.

Opportunities

- Growing Technological Advancements in Long Term Care Softwares

Technological advancements, particularly the integration of artificial intelligence (AI), machine learning, and the Internet of Things (IoT), present a significant market opportunity in the long term care (LTC) software sector. These technologies enhance the efficiency of care delivery by enabling predictive analytics, real-time patient monitoring, and remote management of patients, all of which contribute to better patient outcomes and reduced operational costs. For instance, AI algorithms can analyze vast amounts of patient data to predict potential health risks, such as hospital readmissions or worsening chronic conditions, allowing healthcare providers to take proactive measures. IoT devices, such as wearable sensors, enable continuous monitoring of vital signs such as heart rate and blood sugar levels, transmitting this data to caregivers or family members for timely interventions. These advancements create significant market opportunities, as LTC providers seek to adopt technology that improves the quality of care and reduces costs and enhances operational efficiency. The increasing adoption of such technologies in LTC software is expected to drive substantial growth in the market, as it directly addresses the needs for better, more cost-effective care solutions.

- Expansion of Home Care Services

The growing preference for aging in place has significantly contributed to the expansion of home care services, positioning long term care (LTC) software as a critical tool in facilitating remote care management. As more seniors choose to remain in their homes rather than move to assisted living facilities, there is an increasing demand for technology that supports home-based care. LTC software enables healthcare providers to remotely monitor patients, track health metrics, manage care plans, and ensure consistent communication with family members and caregivers. For instance, Honor, a leading home care company, uses advanced technology platforms to connect caregivers with patients, enabling real-time updates, care coordination, and personalized care management. The demand for home care services is expected to grow substantially, driven by both the aging population and the desire for more personalized, convenient care options. This creates a market opportunity for LTC software providers to develop solutions that cater specifically to the needs of home care providers, offering tools for remote monitoring, medication management, and seamless communication between patients and their care teams. As home care becomes a preferred option, the need for robust LTC software to support these services is a key factor driving market growth.

Restraints/Challenges

- Data Security and Privacy

Data security and privacy represent a significant challenge in the long term care (LTC) software market due to the highly sensitive nature of healthcare data, including personal health information (PHI), medical histories, and payment details. LTC software must incorporate advanced cybersecurity protocols, such as encryption, secure access controls, and continuous monitoring, to protect this data from breaches. For instance, in 2018, a major breach affected the personal data of over 1.5 million residents in U.S. nursing homes when hackers exploited vulnerabilities in healthcare databases. Ensuring compliance with stringent data privacy regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. or the General Data Protection Regulation (GDPR) in the EU, adds another layer of complexity. Providers must regularly update their systems to meet these evolving standards, which can incur significant costs. These concerns create a market challenge as both developers and LTC providers must balance the integration of robust security measures with the need for affordable, user-friendly software solutions that protect patient data while maintaining operational efficiency.

- High Initial Costs Associated with Purchasing and Implementing Long term care

The high initial costs associated with purchasing and implementing long term care (LTC) software, coupled with ongoing maintenance and update fees, present a major barrier for smaller or resource-constrained facilities. For instance, the installation of a comprehensive LTC software system, including training, hardware requirements, and integration with existing systems, can easily reach several thousand dollars, which is a significant financial burden for many smaller care homes or independent living centers with limited budgets. Additionally, the need for regular software updates, bug fixes, and technical support to ensure smooth operation further increases the total cost of ownership. For instance, a small nursing home might struggle with the recurring expenses of system updates and troubleshooting services, as these can be ongoing financial commitments. This issue creates a market challenge, as the software must meet functional and regulatory needs and be affordable for a wide range of providers, from large hospitals to small, independent LTC facilities. The high cost of implementation and maintenance limits the adoption of advanced LTC software solutions, especially among providers who are already working within tight financial constraints.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Long Term Care Software Market Scope

The market is segmented on the basis of application, deployment type, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Application

- Electronic Health Records (EHR)

- Staff Management

- Revenue Cycle Management (RCM)

- Resident Care

- Electronic Medication Administration Record (eMAR)

- Others

Deployment Type

- Web-Based

- On-Premise

- Cloud-Based

End-User:

- Home Care Agencies

- Hospice Care Facilities

- Nursing Homes & Assisted Care

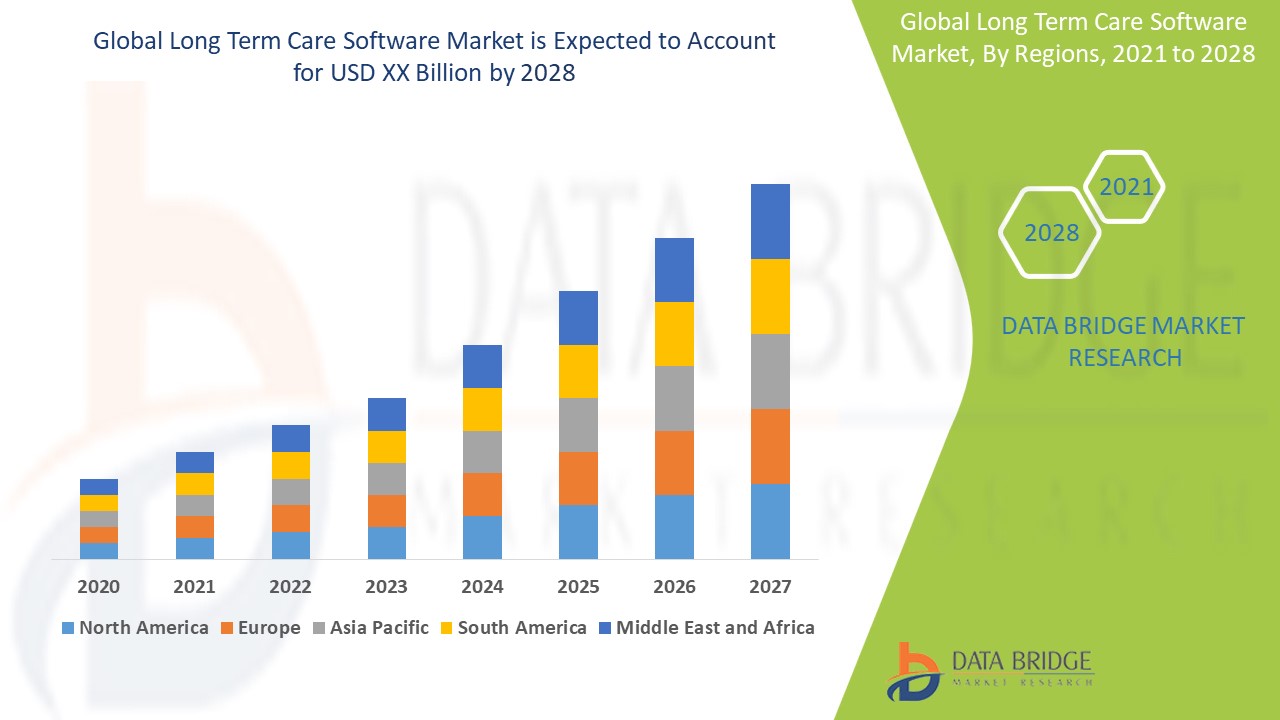

Long Term Care Software Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, application, deployment type, and end user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America leads the long term care software market, primarily due to the high adoption rate of such solutions across the region. This strong presence is driven by widespread recognition of the benefits that digital solutions bring to long term care facilities, including improved patient outcomes and operational efficiencies. Additionally, the region’s advanced healthcare infrastructure and supportive regulatory environment further encourage the integration of long term care software. Consequently, North America remains at the forefront of this market’s growth.

Asia-Pacific and Europe are anticipated to see significant growth in the long term care software market, largely due to rapid advancements in their healthcare sectors. These regions benefit from increased investments in healthcare technology and infrastructure, enabling facilities to adopt innovative software solutions. Emerging economies in particular are experiencing a surge in the deployment of web-based and cloud-based long term care software, driven by the need for scalable and cost-effective digital tools. This trend positions Asia-Pacific and Europe as promising markets for long term care software expansion.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Long Term Care Software Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Long Term Care Software Market Leaders Operating in the Market Are:

- illumifin (U.S.)

- Veradigm LLC (U.S.)

- Oracle (U.S.)

- Intellitec Solutions (U.S.)

- Sunrise Senior Living (U.S.)

- Atria Senior Living, Inc. (U.S.)

- ADL Data Systems, Inc. (U.S.)

- CVS Health (U.S.)

- Omnicell, Inc. (U.S.)

- Netsmart Technologies, Inc. (U.S.)

- ResMed (U.S.)

- McKesson Corporation (U.S.)

- Yardi Systems (U.S.)

- PointClickCare (Canada)

- MatrixCare (U.S.)

- UKG Inc. (U.S.)

Latest Developments in Long Term Care Software Market

- In May 2024, MatrixCare (ResMed Inc.) formed a strategic partnership with NHS Management, LLC, which provides administrative and consulting services to skilled nursing and rehabilitation facilities in the Southeast U.S. This collaboration aims to improve out-of-hospital healthcare solutions using MatrixCare’s advanced technology

- In March 2024, MatrixCare (ResMed Inc.), a global provider of post-acute technology, announced plans to integrate HEALTHCAREfirst’s services, including revenue cycle management, coding, and clinical documentation review, into its software suite, enhancing its offerings for healthcare providers

- In January 2024, Aline, a senior living software provider, acquired VITALS SOFTWARE, expanding its enterprise-scale solutions to Vitals' customers while maintaining support for their existing platform

- In March 2023, Sapiens International Corporation introduced its advanced Customer Acquisition solution in partnership with EquiTrust, a major North American life and health insurance provider. This solution enables EquiTrust's marketing partners to present, sell, and finalize digital applications for "Bridge," a new Annuity/Long Term Care hybrid insurance product, utilizing Sapiens' IllustrationPro and ApplicationPro for a modernized digital experience

- In February 2022, Creative Solutions in Healthcare (CSNHC) launched the Connected Care Center software platform to enhance transparency across its 92 skilled nursing facilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.