Global Lip Gloss Market

Market Size in USD Billion

CAGR :

%

USD

4.20 Billion

USD

6.16 Billion

2024

2032

USD

4.20 Billion

USD

6.16 Billion

2024

2032

| 2025 –2032 | |

| USD 4.20 Billion | |

| USD 6.16 Billion | |

|

|

|

|

Lip Gloss Market Size

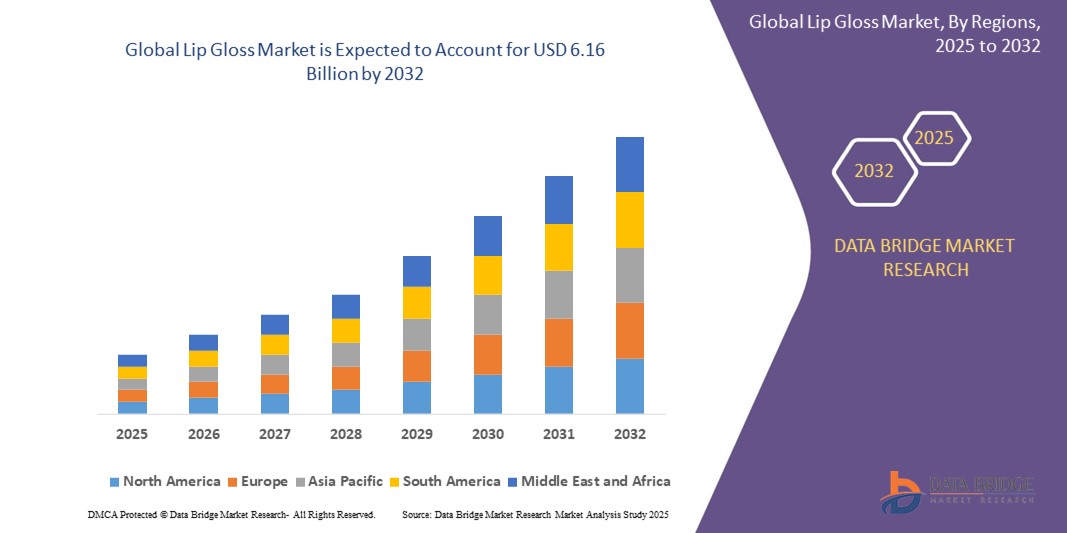

- The global lip gloss market size was valued at USD 4.20 billion in 2024 and is expected to reach USD 6.16 billion by 2032, at a CAGR of 4.9% during the forecast period

- The market growth is largely fueled by rising beauty consciousness, the increasing influence of social media and beauty influencers, and growing demand for multifunctional cosmetics that combine aesthetics with skincare benefits

- Furthermore, consumer preference for personalized, clean-label, and inclusive beauty products is establishing lip gloss as a staple across diverse demographics. These converging factors are accelerating the uptake of lip gloss solutions, thereby significantly boosting the industry's growth

Lip Gloss Market Analysis

- Lip gloss is a cosmetic product designed to add shine, color, and hydration to the lips, often enriched with ingredients that provide nourishment, plumping, or UV protection. Available in various finishes including glossy, matte, and glitter, lip gloss caters to a wide range of style and skincare preferences

- The escalating demand for lip gloss is primarily driven by evolving beauty trends, increasing female workforce participation, and the surge in e-commerce and influencer marketing, which enhance product visibility and accessibility across global markets

- Europe dominated lip gloss market with a share of 31.5% in 2024, due to strong demand for premium beauty products, a rising preference for clean and natural formulations, and a well-established cosmetics industry

- Asia-Pacific is expected to be the fastest growing region in the lip gloss market during the forecast period due to a rapidly expanding middle class, rising interest in Western beauty standards, and increased influence of K-beauty and J-beauty trends

- Conventional segment dominated the market with a market share of 58.8% in 2024, due to its accessibility, cost-effectiveness, and wide availability across global markets. These products typically offer a broader shade range and faster innovation cycles due to lower regulatory barriers and established manufacturing processes. Consumer loyalty to well-known conventional brands also supports sustained demand, especially in developing economies

Report Scope and Lip Gloss Market Segmentation

|

Attributes |

Lip Gloss Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gloss Market Trends

“Rising Demand for Hybrid Lip Gloss with Skincare Benefits”

- The global lip gloss market is experiencing robust growth as consumers increasingly favor hybrid formulations that blend color cosmetics with skincare properties. Today's leading lip glosses deliver shine and color and also hydrating, protective, and soothing benefits, responding to a broader “skin-first” mindset in beauty

- For instance, Schwan Cosmetics launched a lip gloss-balm hybrid that combines the moisturizing benefits of a balm with the aesthetic appeal of gloss, while brands such as Goop Beauty have introduced peptide-infused gel glosses that hydrate, plump, and strengthen the lips’ skin barrier—demonstrating a shift towards products that treat lips as well as they beautify them

- Demand is rising for non-sticky, long-wear formulas using ingredients such as hyaluronic acid, natural oils, and peptides. Eco-conscious shoppers are driving the adoption of vegan, cruelty-free, and “clean” glosses free from parabens, sulfates, and synthetic fragrances

- Multi-purpose glosses offering features such as SPF protection, customizable tint, or even lip-plumping benefits are gaining ground, adding value and convenience to daily routines

- Digital innovations—such as AI-powered shade-matching, virtual try-on apps, and influencer-driven collaborations—are transforming how consumers discover and shop for lip gloss, increasing personalized experiences and brand loyalty

- Advances in packaging technology, from leak-proof applicators to eco-friendly materials, are improving both functionality and sustainability, aligning with demands for performance and environmental responsibility

Lip Gloss Market Dynamics

Driver

“Rising Product Innovation and Formulation”

- Continuous innovation in product formulation is a central driver, with brands leveraging advances in cosmetic science to create glosses that are more nourishing, lightweight, and effective in delivering both care and color

- For instance, the collaboration between Clinique and Kate Spade resulted in a unique lip gloss collection merging the skincare pedigree of Clinique’s formulas with Kate Spade’s playful designs, showing how partnerships and innovation can refresh brand appeal and attract new consumer segments

- Matte glosses, customizable finishes, and gloss-stick hybrids—such as those launched by Marc Jacobs Beauty—are broadening options for different looks and preferences, especially among Gen Z and Millennials looking for functional, fun beauty products

- The clean beauty movement has prompted major reformulations to deliver safe, non-irritating products that align with consumer desire for transparency and ethics

- Packaging innovation, sensorial experiences, and tailored functionalities (moisture, plumping, sun protection) support product differentiation in a crowded market. Increasingly, social media engagement and influencer marketing play key roles in launching and popularizing new gloss innovations through digital-first strategies

Restraint/Challenge

“Changing Consumer Preferences”

- The lip gloss market faces ongoing challenges from rapidly evolving consumer preferences, creating a need for constant adaptation and innovation by brands

- For instance, after the surge in interest for bold, high-shine glosses, the trend quickly shifted toward natural “your lips but better” looks, fueling demand for sheer, subtle glosses and hybrid care formats—a cycle that challenges manufacturers to anticipate and respond to these swings in style and functionality

- Preferences have also shifted toward sustainable and ethical products; those brands slow to adopt “clean,” vegan, or eco-friendly standards risk being left behind by increasingly discerning buyers

- Diversification of shopping habits—such as the move from in-store sampling to virtual try-on—requires constant digital innovation and agile marketing

- Increased competition from lip balms, oils, or hybrid “gloss-sticks” can erode market share and confuse consumers, necessitating sharp product positioning. Rapid shifts in social media-driven trends and influencer endorsements can alter demand overnight, challenging inventory management and new product launches

Lip Gloss Market Scope

The market is segmented on the basis of finish, category, and distribution channel.

- By Finish

On the basis of finish, the lip gloss market is segmented into glossy, matte, glitter, and others. The glossy segment dominated the largest market revenue share in 2024, owing to its long-standing popularity among consumers seeking a hydrated, shiny look that enhances lip volume and softness. Glossy finishes are widely favored for daily wear and special occasions alike, especially among younger consumers influenced by beauty trends across social media platforms. The segment continues to benefit from frequent product innovations, such as non-sticky formulations and infused moisturizing agents, making it a staple in both premium and mass-market cosmetic lines.

The matte segment is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by the rising demand for long-lasting, smudge-proof lip products. Matte lip glosses are increasingly preferred for their bold color payoff and sophisticated look, especially among working professionals and consumers in urban markets. In addition, brands are introducing hydrating matte formulas with skin-friendly ingredients, overcoming earlier limitations of dryness and enhancing their appeal across a broader demographic.

- By Category

On the basis of category, the market is segmented into conventional and organic and natural. The conventional segment held the largest market share of 58.8% in 2024, driven by its accessibility, cost-effectiveness, and wide availability across global markets. These products typically offer a broader shade range and faster innovation cycles due to lower regulatory barriers and established manufacturing processes. Consumer loyalty to well-known conventional brands also supports sustained demand, especially in developing economies.

The organic and natural segment is projected to register the fastest CAGR from 2025 to 2032, reflecting growing consumer preference for clean beauty products formulated without synthetic additives, parabens, or artificial fragrances. Increased awareness about the potential health impacts of chemical-laden cosmetics and the rise of eco-conscious consumers are driving demand. In response, brands are expanding their organic lip gloss lines using botanical extracts, vegan ingredients, and sustainable packaging to capture this rapidly growing niche.

- By Distribution Channel

On the basis of distribution channel, the lip gloss market is segmented into store-based and non-store-based. The store-based segment dominated the market revenue share in 2024 due to consumer inclination toward physical retail experiences, where buyers can test shades and textures before purchase. This segment includes specialty cosmetic stores, supermarkets, and departmental outlets that offer personalized beauty consultations and product trials, which significantly influence purchasing decisions.

The non-store-based segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing penetration of e-commerce platforms and the convenience of online shopping. Social media marketing, influencer endorsements, and digital try-on technologies are enhancing online visibility and engagement for lip gloss products. Moreover, frequent online-exclusive deals and the ability to access global brands are encouraging consumers, particularly millennials and Gen Z, to shift toward non-store-based purchases.

Lip Gloss Market Regional Analysis

- Europe dominated the lip gloss market with the largest revenue share of 31.5% in 2024, driven by strong demand for premium beauty products, a rising preference for clean and natural formulations, and a well-established cosmetics industry

- Consumers in Europe show a high affinity for innovative textures, ethical sourcing, and eco-friendly packaging, encouraging manufacturers to invest in sustainable lip gloss offerings

- The presence of globally recognized cosmetic brands, high per capita spending on personal care, and growing trends toward vegan and organic beauty products further reinforce the region's leadership in the lip gloss market

U.K. Lip Gloss Market Insight

U.K. lip gloss market captured the largest revenue share within Europe in 2024, fueled by a mature beauty sector, strong online retail penetration, and a fast-evolving consumer base focused on ethical beauty. Trends such as inclusivity in shades, preference for cruelty-free products, and rapid uptake of influencer-led brands continue to shape the market. The prominence of beauty subscription boxes and digital-first cosmetic launches has also significantly boosted product accessibility and trial among younger demographics.

Germany Lip Gloss Market Insight

Germany lip gloss market is projected to grow at a significant CAGR during the forecast period, driven by increasing consumer preference for dermatologically tested, fragrance-free, and functional lip glosses with skincare benefits. Germany’s emphasis on ingredient transparency and product safety aligns well with the rising popularity of organic and natural lip glosses. The country's strong retail infrastructure and trust in certified products position it as a key market for both domestic and international beauty brands.

North America Lip Gloss Market Insight

The North America lip gloss market is expected to register steady growth, supported by high consumer expenditure on beauty products and a constant influx of trend-driven product innovation. Demand is fueled by the popularity of social media beauty influencers and celebrity-endorsed brands, which significantly influence purchasing behavior across various age groups. The U.S. in particular leads in product personalization, gloss-lip hybrid formats, and the integration of skincare benefits such as SPF and hydration.

U.S. Lip Gloss Market Insight

The U.S. lip gloss market held the dominant share within North America in 2024, bolstered by a highly trend-responsive consumer base, the dominance of e-commerce platforms, and widespread adoption of clean beauty standards. The market is characterized by fast product turnover, seasonal limited editions, and a high focus on inclusive shade ranges. The strong presence of celebrity-led and indie beauty brands continues to disrupt traditional players and drive market dynamism.

Asia-Pacific Lip Gloss Market Insight

The Asia-Pacific lip gloss market is expected to witness the fastest CAGR from 2025 to 2032, fueled by a rapidly expanding middle class, rising interest in Western beauty standards, and increased influence of K-beauty and J-beauty trends. Markets such as China, Japan, South Korea, and India are seeing a surge in demand for multifunctional glosses that combine color with lip care. Digital channels, including livestreaming and mobile-first shopping, are playing a pivotal role in driving awareness and sales.

China Lip Gloss Market Insight

The China lip gloss market led the Asia-Pacific region in terms of revenue share in 2024, driven by the increasing purchasing power of Gen Z consumers, urbanization, and a booming e-commerce landscape. Demand is largely fueled by the influence of beauty influencers, rapid product releases, and the growing appeal of international brands. Government support for domestic cosmetic manufacturing and innovation also enhances the competitive environment.

Japan Lip Gloss Market Insight

The Japan lip gloss market continues to grow steadily, shaped by minimalistic beauty preferences, high demand for skin-nourishing formulations, and consumer trust in quality and safety. The popularity of lightweight, natural-finish glosses with added skincare benefits reflects the market's unique beauty philosophy. Japan's aging population and cultural focus on longevity and self-care are also fostering demand for lip gloss products that offer both aesthetic and health-related value.

Lip Gloss Market Share

The lip gloss industry is primarily led by well-established companies, including:

- L'Oréal S.A. (France)

- LVMH Moët Hennessy (France)

- Chanel (France)

- Procter & Gamble (U.S.)

- Revlon Group (U.S.)

- The Estée Lauder Companies Inc. (U.S.)

- Coty Inc. (U.S.)

- Shiseido Company (Japan)

- MAC Cosmetics (U.S.)

- ColourPop Cosmetics (U.S.)

- Kendo Holdings Inc. (U.S.)

- Oriflame Cosmetics Global SA (Sweden)

- Christian Dior SE (France)

- Amorepacific (South Korea)

- THE AVON COMPANY (U.S.)

- Tonymoly (South Korea)

- Giorgio Armani S.p.A. (Italy)

- Bourjois (France)

- NARS COSMETICS (U.S.)

- Burt's Bees (U.S.)

Latest Developments in Global Lip Gloss Market

- In July 2025, Rare Beauty by Selena Gomez made a strategic move to diversify its lip portfolio by launching its first-ever translucent gloss collection, the Positive Light Luminizing Lip Gloss. Released in six luminous shades—Dazzle, Beam, Flicker, Glimmer, Spark, and Blaze—each priced at $20, this innovation signals the brand's entry into a more experimental and high-shine segment. With a rebellious, youth-driven "Spring Breakers"-themed campaign, the launch is expected to strengthen Rare Beauty’s position in the premium lip gloss segment and attract Gen Z consumers seeking sheer, radiant finishes. It also reflects a broader industry trend toward multi-dimensional gloss textures and bold, expressive branding

- In September 2024, Kay Beauty introduced its lip plumping gloss collection in five shades, formulated with nourishing ingredients such as pomegranate and jojoba oil. This launch underscores the brand’s focus on combining skincare with color cosmetics, catering to the growing consumer demand for hybrid beauty products. The inclusion of natural actives aligns with the rising preference for clean beauty in the Indian market. This move enhances Kay Beauty's competitive edge in the mid-tier segment and is likely to attract skincare-conscious consumers looking for volume-enhancing yet gentle lip formulations

- In May 2022, Thread Beauty entered the multifunctional beauty category with its launch of “Gloss It,” a vegan lip gloss collection available in five versatile shades. Designed for application on lips, cheeks, and eyes, the product highlights the increasing consumer desire for value-driven, all-in-one cosmetics. The gloss offers a non-sticky, sheer finish with a touch of color and is enriched with nourishing ingredients. This launch reinforces Thread Beauty’s commitment to inclusivity and clean formulations and also resonates with minimalistic beauty routines, particularly among younger and budget-conscious demographics

- In July 2021, Lakmé Cosmetics expanded its lip color portfolio with the Matte Melt Liquid Lip Colour range, introducing a variety of shades from peach rose to vintage pink. With its focus on long-lasting wear and a velvety matte finish, the launch catered to consumers seeking bold color payoff with day-to-night durability. This addition bolstered Lakmé’s standing in the premium color cosmetics category in India and contributed to the growing shift toward matte lip formulations, particularly among urban professionals and fashion-forward consumers

- In May 2021, Summer Fridays enhanced its clean skincare line by launching new lip butter balms, now widely available on platforms such as Sephora and Revolve. These balms deliver rich hydration with a subtle tint, bridging the gap between skincare and lip cosmetics. The product’s luxurious texture and nourishing formula align with the increasing popularity of wellness-focused beauty routines. This release expanded Summer Fridays’ retail presence and also positioned the brand as a key player in the hybrid lip care segment, appealing to consumers who prioritize lip health along with aesthetic appeal

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.