Global Life Science Software Market

Market Size in USD Billion

CAGR :

%

USD

20.80 Billion

USD

54.91 Billion

2024

2032

USD

20.80 Billion

USD

54.91 Billion

2024

2032

| 2025 –2032 | |

| USD 20.80 Billion | |

| USD 54.91 Billion | |

|

|

|

|

Life Science Software Market Size

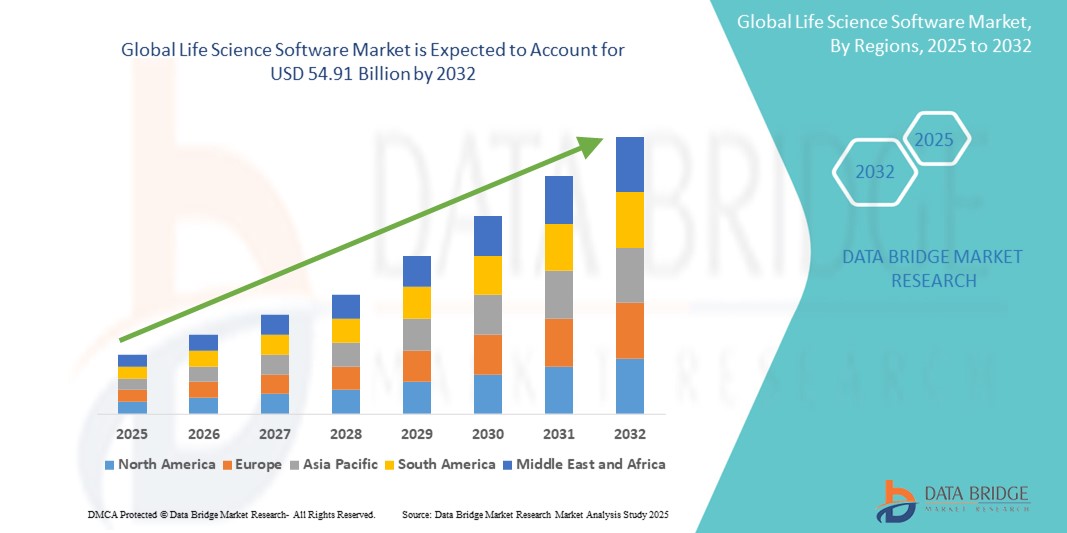

- The global Life Science Software market was valued at USD 20.80 billion in 2024 and is expected to reach USD 54.91 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 12.90%, primarily driven by the rising prevalence of chronic diseases

- This growth is driven by factors such as the aging population, growing demand for personalized medicine, and advance therapies

Life Science Software Market Analysis

- Life science software solutions are essential tools used across various sectors, including pharmaceuticals, biotechnology, medical devices, and healthcare. They support functions such as drug discovery, clinical trials management, laboratory data management, regulatory compliance, and patient data analysis. These solutions enable researchers and healthcare providers to streamline processes, ensure accuracy, and comply with stringent industry regulations

- The demand for life science software is primarily driven by the increasing complexity of scientific research, the need for efficient clinical trials management, and the growing focus on personalized medicine. As healthcare and biotech sectors evolve, there is a rising need for sophisticated software to process and analyze vast datasets, particularly in drug development, patient management, and clinical research

- North America stands as one of the dominant regions in the life science software market, largely due to its advanced healthcare infrastructure, the high adoption of new technologies, and the presence of numerous pharmaceutical, biotechnology, and research institutions. The United States in particular leads the market, owing to significant investments in healthcare technology, pharmaceuticals, and biotech innovations. The integration of AI, machine learning, and cloud computing is accelerating the demand for software solutions that can process complex biological and clinical data

- Globally, life science software solutions are considered crucial tools for industries such as pharmaceuticals, biotech, healthcare, and clinical research. The market includes solutions that optimize drug discovery processes, manage clinical trial data, streamline laboratory workflows, and ensure regulatory compliance. These tools are pivotal in enhancing the accuracy and efficiency of research, treatment planning, and decision-making

Report Scope and Life Science Software Market Segmentation

|

Attributes |

Life Science Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Life Science Software Market Trends

“Rising Adoption of AI, Cloud, and Integrated Platforms in Life Science Software Market”

- The life science software market is witnessing significant transformation driven by the integration of Artificial Intelligence (AI) and Machine Learning (ML). These technologies enhance drug discovery, diagnostic accuracy, and patient-specific treatment planning by enabling faster and more accurate data analysis from large-scale biological and clinical datasets

- Cloud-based software solutions are gaining traction as pharmaceutical and biotech companies seek scalable, cost-effective platforms that offer remote data access, collaboration, and real-time analytics. This trend supports the growing demand for flexible digital infrastructure in life sciences research and clinical development

- The increasing need for regulatory compliance and robust cybersecurity in managing sensitive patient and genomic data is driving investments in secure, compliant software platforms aligned with regulations such as HIPAA and GDPR

- Life science companies are also shifting toward integrated software platforms that combine various functionalities—including laboratory information management systems (LIMS), clinical trial management, and bioinformatics tools—into a single ecosystem to streamline operations and improve productivity

For instance,

- In December 2023, Thermo Fisher Scientific launched a new cloud-based life sciences software suite that supports real-time collaboration, secure data storage, and regulatory compliance for research and diagnostics, reflecting the growing shift toward digital research environments

- In March 2024, IBM Watson Health integrated AI and ML tools into its life science software to enable predictive modeling and accelerate precision drug discovery by analyzing genomic and patient response data

- The integration of AI, cloud computing, and unified digital platforms is revolutionizing the life science software market by enhancing research efficiency, data security, and personalized healthcare solutions

Life Science Software Market Dynamics

Driver

“Growing Need Due to Increased Demand for Healthcare Research and Precision Medicine”

- The increasing demand for precision medicine and personalized healthcare is a major driver for the life science software market. As the healthcare industry continues to shift towards tailored treatments based on individual patient data, the need for advanced software solutions that can analyze large datasets, such as genetic, clinical, and molecular data, is growing

- Advancements in genomics and proteomics are fueling the need for specialized software to handle, store, and process vast amounts of biological data. This includes tools for data analysis, predictive modeling, and simulation, all of which are critical for understanding disease mechanisms and developing customized therapies

- Furthermore, increased healthcare spending, especially in countries with aging populations, is contributing to the growth of the market. As more healthcare systems incorporate digital tools for improved patient care, the demand for software solutions that can optimize drug discovery, clinical trials, and diagnostics is expanding

For instance,

- In August 2022, according to a report from the National Institutes of Health (NIH), the growth of precision medicine is projected to impact over 130 million people in the U.S. alone by 2025, significantly driving the demand for software solutions in genomics and diagnostics

- The growing focus on precision medicine, fueled by advances in genomics and rising healthcare spending, is significantly driving the demand for life science software solutions worldwide

Opportunity

“Advancement in AI and Machine Learning for Drug Discovery and Healthcare Research”

- The integration of AI and machine learning (ML) in life science software is revolutionizing the drug discovery process. AI and ML algorithms can analyze biological data faster and more accurately than traditional methods, allowing researchers to predict drug efficacy, optimize clinical trial designs, and discover new therapeutic targets

- AI-powered software can automate tedious data analysis tasks, enabling researchers to focus on critical decision-making and hypothesis generation. In addition, ML models can identify patterns in complex datasets, offering insights that may otherwise be overlooked

- This technology is also making a profound impact in healthcare research, with AI-based software being used for everything from disease prediction and biomarker identification to drug repurposing and patient data management

For instance,

- In February 2023, a study published in Nature Medicine demonstrated the use of AI algorithms in analyzing vast amounts of genomic data, resulting in faster identification of genetic mutations related to rare diseases, highlighting the opportunity for AI in the life science software market

- In November 2023, according to the Journal of Medical Informatics, AI-based drug discovery platforms helped reduce time-to-market for cancer therapies, making them a highly sought-after solution in pharmaceutical R&D

- The integration of AI and ML in life science software is accelerating drug discovery and healthcare research by enabling faster, more accurate data analysis and decision-making

Restraint/Challenge

“High Implementation and Maintenance Costs”

- The high cost of implementation and maintenance for life science software solutions is a significant challenge, particularly for smaller research institutions and healthcare providers in developing regions. Advanced software solutions require not only a substantial initial investment but also ongoing costs for updates, training, and technical support

- For many small-to-medium-sized healthcare facilities and research labs, these costs can be prohibitive, limiting access to cutting-edge software tools that are necessary to drive innovation and maintain competitive advantages in precision medicine and drug discovery

- In addition, the complexity of integration with existing systems, such as electronic health records (EHRs) or laboratory information management systems (LIMS), can further increase costs and disrupt workflows, presenting a barrier for adoption

For instance,

- In July 2023, a report from the Global Health Organization highlighted that many public healthcare facilities in low- and middle-income countries struggle to afford or implement advanced life science software solutions, leading to limited access to the latest tools for diagnosis and treatment optimization

- The costs associated with training personnel to use these advanced systems also represent a barrier, as skilled labor is required to fully utilize the capabilities of AI-driven life science software

Life Science Software Market Scope

The market is segmented on the basis of type, application, component and solution

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By Component |

|

|

By Solutions |

|

Life Science Software Market Regional Analysis

“North America is the Dominant Region in the Life Science Software Market”

- North America leads the life science software market, driven by advanced healthcare infrastructure, widespread adoption of cutting-edge medical technologies, and the strong presence of key market players

- U.S. holds a significant market share, owing to the demand for innovative solutions in various sectors such as drug discovery, genomics, and clinical research, as well as the increasing need for precision medicine

- The region benefits from well-established reimbursement policies, substantial government and private sector investments in healthcare R&D, and the growing focus on personalized medicine, all of which strengthen the market

- In addition, the increasing number of clinical trials, advancements in data-driven research, and the high rate of adoption of AI and machine learning technologies are driving market growth across North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to register the highest growth rate in the life science software market, propelled by rapid healthcare infrastructure expansion, rising awareness of healthcare needs, and increasing investments in medical research and technology

- Countries such as China, India, and Japan are emerging as key markets, driven by the growing demand for advanced software solutions in genomics, drug discovery, and clinical data management

- Japan, with its leading position in medical technology and high demand for precision healthcare, remains a critical market for life science software. The country continues to advance in the adoption of AI-powered medical software for improving research accuracy and clinical outcomes

- China and India, with their large populations and rapidly rising healthcare needs, are witnessing significant investments in life science software solutions. The expanding presence of global medical technology firms, coupled with government-led initiatives to improve healthcare services and accessibility, further contribute to the market’s rapid growth

Life Science Software Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medical Information Technology, Inc. (U.S.)

- SAP SE (Germany)

- ELINEXT (U.S.)

- Epic Systems Corporation (U.S.)

- Infor (U.S.)

- Cognizant (U.S.)

- SAS Institute Inc. (U.S.)

- Veeva Systems (U.S.)

- AVEVA Group Limited (U.K.)

- Oracle (U.S.)

- JAG Product Inc (U.S.)

- Veradigm LLC and (U.S.)

- Optum Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- athenahealth, Inc. (U.S.)

- eClinicalWorks (U.S)

Latest Developments in Global Life Science Software Market

- In January 2025, Thermo Fisher Scientific announced the launch of GeneArt CRISPR Editing Software to streamline gene editing workflows for genetic research and therapeutic applications. The software includes cutting-edge tools that enhance precision and reduce the time required to design CRISPR experiments. The platform's AI-powered analytics and integration with other Thermo Fisher technologies are expected to accelerate drug discovery and genomic research

- In October 2024, Illumina unveiled updates to its BaseSpace Sequence Hub, a cloud-based platform that aids in genomic data analysis. The new updates enhance machine learning capabilities to support faster, more accurate interpretation of genomic data, enabling researchers to make quicker decisions in oncology and infectious disease research. This software is playing a crucial role in accelerating precision medicine initiatives

- In October 2024, Bio-Rad Laboratories launched a new version of its SDS-PAGE software tailored for clinical and pharmaceutical applications. This software update provides advanced features that improve protein analysis reproducibility, making it a key tool in drug discovery and therapeutic development in the Asia-Pacific region, especially in China

- In September 2024, PerkinElmer showcased new features for ChemDraw Software at the American Chemical Society (ACS) Meeting. The upgraded version of the software improves molecular modeling and simulation capabilities, allowing researchers to design more complex chemical structures and reactions with greater ease. This is a vital tool in drug discovery, biochemistry, and biotechnology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.