Global Led Driver Market

Market Size in USD Billion

CAGR :

%

USD

4.50 Billion

USD

11.00 Billion

2024

2032

USD

4.50 Billion

USD

11.00 Billion

2024

2032

| 2025 –2032 | |

| USD 4.50 Billion | |

| USD 11.00 Billion | |

|

|

|

|

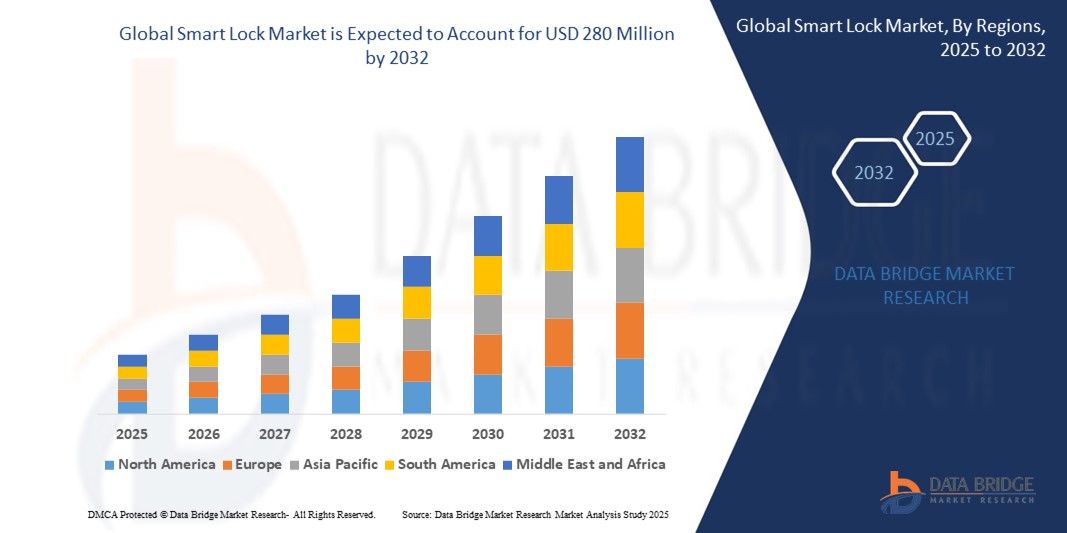

Smart Lock Market Size

- The Global Light-Emitting Diode (LED) Driver Market size was valued at USD 4.5 Billion in 2024 and is expected to reach USD 11 Billion by 2032, at a CAGR of 13.6% during the forecast period

- The growth of the Global Light-Emitting Diode (LED) Driver Market is fueled by rising LED adoption, energy efficiency demands, technological advancements, automotive lighting growth, and urban infrastructure development.

- The demand for selective soldering is driven by the need for Energy Efficiency Requirements, Government Incentives and Regulations, Growth in Automotive LED Lighting and Increasing use in Commercial and Industrial Applications.

Global Light-Emitting Diode (LED) Driver Market Analysis

- Asia Pacific dominates the market, driven by rapid urbanization, large-scale infrastructure projects, and a strong manufacturing base, with countries like China, India, Japan, and South Korea leading adoption, especially in residential and commercial sectors. The region also benefits from expanding smart city initiatives and supportive government policies promoting energy-efficient lighting solutions.

- In North America, the market exhibits steady growth driven by aggressive retrofit programs aimed at replacing traditional lighting with LED systems to meet stringent energy efficiency standards. The U.S. leads with substantial investments in commercial and industrial sectors where LED drivers are essential components. Additionally, the automotive industry’s increasing shift towards LED lighting for vehicles supports market demand. The region benefits from the presence of leading LED driver manufacturers, technological innovation, and growing integration of IoT-enabled smart lighting systems.

- Europe represents a mature and stable market characterized by strict environmental regulations such as the EU’s Ecodesign Directive and policies encouraging energy-saving lighting solutions. Countries like Germany, the UK, and France have seen widespread adoption of LED lighting in public infrastructure, commercial buildings, and homes. The focus on sustainability and carbon reduction targets, coupled with increasing investments in smart city projects and intelligent lighting control systems, further boost demand for advanced LED drivers.

- In Latin America, the LED driver market is emerging with gradual but promising growth. Urbanization and infrastructural modernization in countries like Brazil, Mexico, and Argentina have accelerated LED lighting adoption, particularly for street lighting and commercial applications. Although the market is still developing, growing awareness of energy efficiency and environmental concerns is encouraging governments and private sectors to invest in LED technologies.

- The Middle East & Africa region is witnessing steady expansion in LED driver demand, driven by large-scale infrastructure development, urbanization, and modernization of commercial and industrial facilities, especially in GCC countries such as the UAE, Saudi Arabia, and Qatar. Investments in smart city initiatives and increasing usage of LED lighting in commercial complexes, airports, and hospitality sectors also contribute to market growth. However, political instability and economic fluctuations in some African countries may pose challenges to consistent market expansion.

Report Scope and Global Light-Emitting Diode (LED) Driver Market Segmentation

|

Attributes |

Global Light-Emitting Diode (LED) Driver Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Light-Emitting Diode (LED) Driver Market Trends

“Smart Control, Energy Efficiency, and Integration Driving LED Driver Market Evolution”

- A major and accelerating trend in the global LED driver market is the integration of smart control systems, energy optimization features, and IoT connectivity, transforming how LED lighting is deployed across residential, commercial, and industrial environments. This evolution is aligning with global sustainability goals and digital transformation in building and infrastructure management.

- For instance, companies like Signify (Philips) and STMicroelectronics are developing intelligent LED drivers with embedded sensors and wireless connectivity (e.g., Zigbee, Bluetooth, DALI) that enable remote monitoring, automated dimming, and adaptive lighting control. These solutions are increasingly used in smart homes, office buildings, and municipal lighting systems to reduce energy consumption and improve user comfort.

- In industrial applications, digitally programmable LED drivers allow facility managers to configure lighting behavior based on occupancy, daylight availability, and process requirements. These drivers often come with diagnostic feedback, enhancing preventive maintenance and reducing operational downtime in factories, warehouses, and retail environments.

- Furthermore, AI and machine learning algorithms are being incorporated into advanced LED driver platforms to predict failure points, optimize light output for varying environmental conditions, and enable energy consumption analytics. This predictive capability is especially beneficial in high-performance sectors like healthcare, airports, and data centers.

- On the manufacturing side, modular and compact LED driver designs are enabling easier integration into complex lighting systems and form factors such as slim-profile panels, smart luminaires, and architectural fixtures. This flexibility allows for faster design iterations and customization based on project-specific needs.

- The digital retail experience is also improving, with interactive lighting configuration tools offered by some vendors for building planners and contractors. These platforms allow users to simulate lighting performance, choose driver settings, and calculate energy savings before procurement, leading to informed decision-making and reduced post-installation adjustments.

- As lighting systems become central to broader smart building strategies, the demand for multi-functional, energy-efficient, and connected LED drivers continues to grow. Companies investing in digital innovation, system integration, and intelligent lighting control are gaining a competitive edge in both developed and emerging markets.

Global Light-Emitting Diode (LED) Driver Market Dynamics

Driver

“Rising Demand Fueled by Energy Efficiency Goals, Smart Lighting Adoption, and Regulatory Push”

- The global push toward energy efficiency and sustainable infrastructure is a key driver accelerating the adoption of LED drivers, particularly in commercial, residential, and industrial sectors. As governments enforce stricter energy norms and phase out inefficient lighting technologies, LED drivers have become essential for ensuring optimal LED performance and regulatory compliance.

- For instance, regulatory initiatives like the EU Ecodesign Directive, U.S. DOE efficiency standards, and India’s UJALA program have mandated the use of high-efficiency lighting, boosting the demand for constant current and programmable LED drivers. These policies are directly influencing procurement patterns in smart cities, government facilities, and corporate buildings.

- The surge in smart building projects and IoT-enabled lighting systems is further driving demand for advanced LED drivers capable of dimming, remote control, and data communication. Companies like Signify, Tridonic, and Texas Instruments have launched smart drivers that support wireless protocols such as Zigbee, Bluetooth Mesh, and DALI-2, meeting the needs of modern lighting systems across sectors.

- In addition, the rising integration of LED lighting in electric vehicles (EVs) and premium automotive segments is creating new opportunities for compact, high-performance LED drivers. These drivers enable adaptive lighting features such as matrix beams, cornering lights, and ambient interior lighting, particularly in EV brands and luxury vehicles.

- The replacement of aging lighting infrastructure—especially in developed markets like North America, Europe, and parts of Asia—is increasing the demand for LED retrofit solutions. LED drivers play a critical role in these projects by ensuring compatibility with legacy fixtures and delivering long-term energy savings.

- The growing emphasis on aesthetic lighting and human-centric design in commercial and retail environments is also influencing demand. Dynamic LED drivers that allow tunable white, RGB control, and circadian rhythm lighting are now sought after by architects and lighting designers to enhance space functionality and user well-being.

- As industries and consumers increasingly value digital control, energy cost savings, and low-maintenance lighting systems, the demand for smart, reliable, and efficient LED drivers is expected to remain strong across both developed and emerging markets.

Restraint/Challenge

“Market Growth Hindered by High Integration Costs, Technical Complexity, and Standardization Gaps”

- A key restraint impacting the growth of the global LED driver market is the high initial cost and complexity associated with integrating advanced LED drivers, particularly in smart lighting and industrial applications. Sophisticated drivers with features like dimming, wireless control, or constant power output are significantly more expensive than basic analog models, limiting affordability for small-scale projects and cost-sensitive markets.

- For example, programmable or DALI-compatible LED drivers used in smart commercial buildings can cost 2–3 times more than traditional fixed-output drivers. This price disparity often discourages widespread adoption in residential and small enterprise segments, especially across developing economies in Africa, Southeast Asia, and Latin America.

- Technical complexity and compatibility challenges also pose a major hurdle. Differences in voltage requirements, form factors, thermal management, and LED configurations can make driver selection difficult, especially for retrofitting existing lighting systems. Incorrect driver matching can lead to flickering, reduced lifespan, or even system failure—deterring inexperienced installers and DIY users.

- The market is further challenged by a lack of global standardization, with varying performance benchmarks, compliance protocols (e.g., UL, CE, RoHS), and control protocols across regions. This creates operational inefficiencies for multinational manufacturers and confuses consumers trying to ensure safe and compliant installations.

- Additionally, product lifespan and reliability concerns remain for low-cost LED drivers, particularly in price-sensitive regions. Inconsistent quality among unbranded or counterfeit products available in grey markets can result in high failure rates, leading to poor end-user experiences and warranty issues that damage the market’s reputation.

- Regulatory complexities in sectors like automotive and aviation lighting also restrict adoption, as LED driver designs must meet stringent EMI/EMC, safety, and durability standards—raising development costs and extending time to market.

- Finally, volatility in raw material costs—including semiconductors, aluminum, and rare earth elements used in driver components—can disrupt production planning and affect profit margins for manufacturers, making long-term pricing strategies difficult to sustain.

Global Light-Emitting Diode (LED) Driver Market Scope

The market is segmented on the basis of Product Type, Type, Application and Technology.

- By Product Type

Constant current LED drivers are widely used in applications where consistent current delivery is crucial for performance and safety, such as in industrial lighting, commercial lighting, street lighting, and automotive lighting. These drivers support higher efficiency and better thermal management, making them the preferred choice for high-power and professional lighting systems. Their ability to provide precise control over LED output supports the growing demand for smart and adaptive lighting solutions.

Constant voltage LED drivers are primarily used in low-power lighting applications, including LED strips, signage, decorative lighting, and under-cabinet lighting. They are easier to install and typically more affordable, making them ideal for residential, retail, and hospitality environments. Their plug-and-play nature and compatibility with multiple LED modules make them popular in DIY and retrofit markets.

- By Type

Linear LED Drivers are ideal for low-power and cost-sensitive applications such as residential lighting, lamps, and compact indoor fixtures. They are simple in design, generate low EMI, but are less efficient in high-power scenarios due to heat loss.

Switching LED Drivers are Preferred for high-power and energy-efficient applications including street lighting, commercial lighting, automotive, and industrial setups. They offer superior efficiency, thermal management, and are widely used in smart and connected lighting systems.

- By Application

Automotive Lighting LED drivers are used in headlights, taillights, interior lighting, and adaptive systems in vehicles. Growing EV adoption and demand for advanced driver-assistance systems (ADAS) are boosting the need for compact, high-efficiency LED drivers in this segment.

Residential Lighting are widespread used in LED bulbs, downlights, and smart home systems. Demand is driven by energy efficiency, low maintenance, and increasing adoption of smart home technologies integrated with dimmable LED drivers.

Commercial Lighting are used in offices, retail stores, hospitals, and educational institutions, where smart and programmable drivers are gaining traction for automated control, daylight harvesting, and energy management.

Industrial Lighting are applied in factories, warehouses, and production facilities requiring robust, high-performance LED drivers capable of operating in harsh environments with features like surge protection and long lifecycle.

Street Lighting are crucial in urban infrastructure and smart city projects, LED drivers support high-efficiency outdoor lighting with capabilities like remote dimming, motion sensing, and energy monitoring to reduce municipal energy costs.

- By Technology

Analog LED drivers are widely used in basic lighting systems where dimming and control requirements are minimal. These drivers are cost-effective, simple to design, and highly reliable, making them ideal for residential lighting, standard commercial fixtures, and budget-conscious applications. However, they lack advanced control features, limiting their usage in smart or adaptive lighting systems.

Digital LED drivers offer advanced control capabilities, including dimming, color tuning, programmability, and remote operation. They are increasingly used in smart lighting, commercial buildings, automotive lighting, and architectural applications where integration with IoT platforms and lighting management systems is essential. As demand for connected lighting grows, digital drivers are gaining significant market traction.

Global Light-Emitting Diode (LED) Driver Market Regional Analysis

- North America holds a significant share in the LED driver market, driven by early adoption of advanced lighting technologies, stringent energy efficiency regulations, and widespread smart city initiatives. The U.S. and Canada lead in integrating smart lighting systems in commercial buildings, street lighting, and residential sectors. Growth in automotive LED applications, especially in electric and autonomous vehicles, further supports market expansion. Strong investments in R&D and presence of key manufacturers also boost regional demand.

- Europe is a prominent market for LED drivers due to rigorous environmental policies like the EU Ecodesign Directive and widespread adoption of sustainable infrastructure projects. Countries such as Germany, the UK, and France are investing heavily in smart lighting for public spaces and commercial properties. The region's focus on energy conservation and green building certifications (e.g., LEED, BREEAM) accelerates adoption of high-performance and programmable LED drivers.

- Asia Pacific is expected to witness the fastest growth in the LED driver market, fueled by rapid urbanization, industrialization, and government initiatives promoting energy-efficient lighting. China, India, Japan, and South Korea are key contributors, with large-scale infrastructure development and smart city projects driving demand. The region also benefits from a growing automotive sector and increasing consumer awareness of smart lighting solutions. Cost-competitive manufacturing and rising disposable incomes support widespread market penetration.

- Latin America shows moderate growth potential, led by countries like Brazil, Mexico, and Argentina. Increasing investments in infrastructure modernization and rising demand for energy-efficient commercial and residential lighting drive the market. However, slower regulatory enforcement and economic challenges may restrain growth compared to other regions. Expansion of e-commerce and digital lighting solutions could create new opportunities in this market.

- The Middle East and Africa region is gradually adopting LED driver technology, driven by growing urban infrastructure, government initiatives for energy savings, and investments in smart city projects. The demand is primarily concentrated in commercial buildings, public lighting, and industrial sectors. Countries like the UAE, Saudi Arabia, South Africa, and Egypt are leading market development, though economic and political instability in parts of the region may limit rapid growth.

North America Light-Emitting Diode (LED) Driver Market Insight

North America is a mature and technologically advanced market for LED drivers, characterized by early adoption of innovative lighting solutions and strong regulatory frameworks promoting energy efficiency. The U.S. is the largest contributor in this region, driven by federal and state-level initiatives such as the ENERGY STAR program and stringent lighting efficiency standards enforced by the Department of Energy (DOE).

Key demand sectors include commercial buildings, street lighting, industrial facilities, and residential smart lighting systems. Increasing investments in smart city projects across major metropolitan areas are accelerating the integration of digitally controlled and IoT-enabled LED drivers, enabling features like adaptive lighting, remote monitoring, and energy management.

The automotive sector in North America also contributes significantly to the LED driver market, propelled by the growing penetration of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) requiring sophisticated LED lighting solutions.

Europe Light-Emitting Diode (LED) Driver Market Insight

Europe stands as one of the most progressive regions in the global LED driver market, driven by strict regulatory frameworks and a strong emphasis on sustainability and energy efficiency. The European Union’s policies, such as the Ecodesign Directive and Energy Labeling Regulation, have been pivotal in accelerating the shift from conventional lighting to LED solutions equipped with advanced drivers.

Key markets include Germany, the UK, France, Italy, and the Nordic countries, where government incentives and green building certifications (like LEED and BREEAM) encourage the adoption of energy-efficient lighting technologies. The commercial sector dominates demand, with widespread deployment in offices, retail, healthcare, and educational institutions, increasingly leveraging digital and programmable LED drivers to enable smart lighting controls and energy management.

The region is also witnessing significant growth in street lighting upgrades under smart city initiatives, incorporating LED drivers with features such as remote dimming, motion sensors, and adaptive lighting to optimize municipal energy consumption.

Asia Pacific Light-Emitting Diode (LED) Driver Market Insight

The Asia Pacific region is the fastest-growing market for LED drivers globally, driven by rapid urbanization, expanding infrastructure projects, and increasing adoption of energy-efficient lighting solutions across residential, commercial, and industrial sectors. Countries like China, India, Japan, South Korea, and Australia are the key contributors to market growth.

Government initiatives promoting smart city development and sustainable energy use—such as China’s “Smart Lighting” programs and India’s energy conservation policies—are fueling demand for advanced LED drivers with features like digital control, dimming, and wireless connectivity.

The booming automotive industry in the region, including the rising production of electric vehicles (EVs), is further propelling the adoption of sophisticated LED drivers for vehicle lighting systems, enhancing safety and efficiency.Middle East and Africa Light-Emitting Diode (LED) Driver Market Insight

The Middle East and Africa Light-Emitting Diode (LED) Driver is expected to expand at a moderate CAGR during the forecast period, driven by the growing vehicle parc, rising interest in vehicle personalization, and increased usage of vehicles in off-road and rugged terrains. The region’s diverse economic landscape and gradual urban development are encouraging demand for replacement and custom wheels, especially in urban and semi-urban areas.

Well-developed automotive sectors in countries like South Africa, UAE, and Saudi Arabia, paired with expanding road infrastructure and rising disposable incomes, are promoting the adoption of alloy and performance wheels in both residential (individual consumers) and commercial (fleet and logistics) segments. Additionally, the integration of e-commerce platforms and digital service channels is simplifying access to aftermarket parts and boosting customer engagement.

Global Light-Emitting Diode (LED) Driver Market Share

The Global Light-Emitting Diode (LED) Driver industry is primarily led by well-established companies, including:

- Texas Instruments Incorporated

- Infineon Technologies AG

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- Analog Devices, Inc.

- Maxim Integrated Products, Inc. (now part of Analog Devices)

- Osram Licht AG

- Littelfuse, Inc.

- Inventronics Co., Ltd.

- Mean Well Enterprises Co., Ltd.

- Delta Electronics, Inc.

- Philips Lighting (Signify N.V.)

- Tridonic GmbH & Co KG

- Eaton Corporation plc

Latest Developments in Global Light-Emitting Diode (LED) Driver Market

- In April 2024, Texas Instruments, a major player in analog and embedded processing, introduced its next-generation AEC-Q100-qualified LED driver ICs for automotive applications. These drivers support adaptive front lighting and matrix beam control, addressing the growing demand for high-performance lighting in electric and autonomous vehicles.

- In March 2024, Signify (formerly Philips Lighting) launched a new range of UltraEfficient LED drivers designed for commercial and smart building lighting systems. These drivers feature DALI-2 and Zigbee compatibility, enabling seamless integration with intelligent lighting management platforms and reducing energy consumption by up to 50%.

- In February 2024, Inventronics, a global LED driver manufacturer, announced the release of its EAM series of programmable constant current LED drivers for high-bay and street lighting. The new series features thermal sensing, surge protection, and remote monitoring, catering to urban infrastructure and industrial applications in Asia and Europe.

- In January 2024, MEAN WELL unveiled its XLG-240 series, a compact LED driver line optimized for horticultural and industrial lighting. With features such as high surge immunity and wide output current range, the new series supports flexible deployment in both developed and emerging markets.

- In December 2023, Osram Opto Semiconductors partnered with a leading Asian smart home tech firm to co-develop digitally controlled LED drivers for next-generation residential and retail lighting. The collaboration focuses on color tuning, wireless control, and energy optimization, reflecting rising consumer demand for smart and ambient lighting solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Led Driver Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Led Driver Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Led Driver Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.