Global Leak Detection Market

Market Size in USD Billion

CAGR :

%

USD

2.92 Billion

USD

5.65 Billion

2024

2032

USD

2.92 Billion

USD

5.65 Billion

2024

2032

| 2025 –2032 | |

| USD 2.92 Billion | |

| USD 5.65 Billion | |

|

|

|

|

Leak Detection Market Size

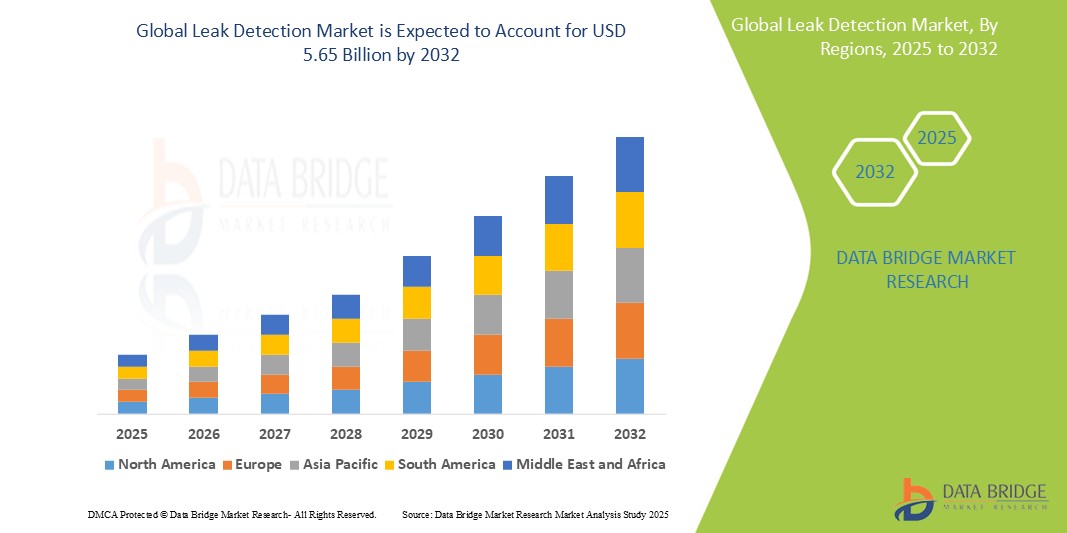

- The global leak detection market size was valued at USD 2.92 billion in 2024 and is expected to reach USD 5.65 billion by 2032, at a CAGR of 8.60% during the forecast period

- This growth is driven by factors such as the increasing emphasis on safety regulations, rising pipeline and oil & gas infrastructure investments, and growing environmental concerns regarding leak-related hazards

Leak Detection Market Analysis

- Leak detection systems are vital for identifying and addressing leaks in pipelines, tanks, and industrial systems, helping to prevent environmental contamination and reduce product loss. They are widely used across oil & gas, water treatment, chemical, and power generation industries

- The demand for leak detection technologies is driven by stringent environmental regulations, aging pipeline infrastructure, and the need for early detection to avoid costly damages

- North America is expected to dominate the leak detections market with a market share of 43.5%, due to stringent environmental regulations, robust pipeline infrastructure, and the widespread implementation of advanced monitoring technologies

- Asia-Pacific is expected to be the fastest growing region in the leak detection market with a market share of 23.5 %, during the forecast period due to rapid industrialization, urbanization, and infrastructure development

- Upstream segment is expected to dominate the market with a market share of 65.5% due to its critical role in oil and gas exploration and production

Report Scope and Leak Detection Market Segmentation

|

Attributes |

Leak Detection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Leak Detection Market Trends

“Integration of Smart Sensing Technologies & AI-Driven Monitoring Systems”

- One prominent trend in the global leak detection market is the growing adoption of smart sensing technologies and AI-driven monitoring systems across various industries such as oil & gas, water treatment, and chemicals

- These technologies enable real-time leak identification, predictive maintenance, and automated response mechanisms, reducing downtime and enhancing operational safety

- For instance, AI-powered systems analyze vast sensor data to detect anomalies and predict potential leak points before they occur, significantly minimizing environmental damage and operational losses

- These innovations are reshaping the leak detection landscape, making monitoring systems more intelligent, proactive, and reliable, and accelerating the transition toward fully automated, safety-focused infrastructures

Leak Detection Market Dynamics

Driver

“Rising Environmental and Regulatory Pressure for Pipeline Safety”

- The increasing emphasis on environmental safety and the enforcement of stringent regulations are major factors driving demand for leak detection systems, particularly in the oil & gas, chemical, and water management sectors

- As pipeline infrastructure ages and environmental concerns intensify, governments and industry regulators are mandating the implementation of advanced leak detection technologies to prevent hazardous leaks and reduce ecological damage

- These regulations require operators to adopt real-time monitoring systems that ensure immediate detection and rapid response to leaks, thus minimizing operational risks and legal liabilities

For instance,

- In June 2021, the U.S. Pipeline and Hazardous Materials Safety Administration (PHMSA) finalized new rules requiring stricter leak detection and repair (LDAR) protocols for over 400,000 miles of onshore gas transmission lines. These rules are part of broader efforts to reduce methane emissions and enhance pipeline safety

- As a result of these growing regulatory pressures and environmental concerns, industries are increasingly investing in innovative leak detection solutions, significantly boosting market growth

Opportunity

“Adoption of AI and IoT for Predictive Leak Detection and Smart Infrastructure”

- The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) in leak detection systems presents a significant opportunity for market growth, enabling smarter, more predictive monitoring of infrastructure

- AI-powered analytics can process real-time data from sensors embedded in pipelines or industrial systems, detecting anomalies and predicting potential leak events before they occur

- IoT-enabled devices facilitate remote monitoring, automated alerts, and integration with cloud-based platforms, providing operators with enhanced visibility and control over vast pipeline networks and facilities

For instance,

- In March 2024, Sensirion and a consortium of industrial tech firms announced the deployment of AI-integrated IoT sensors across municipal water systems in Europe, resulting in a 30% improvement in early leak detection and a significant reduction in water loss. These systems use machine learning to identify patterns associated with minor leaks, preventing them from escalating into major failure

- By leveraging these technologies, companies can reduce maintenance costs, improve environmental compliance, and enhance system reliability—paving the way for a shift toward smart infrastructure and data-driven pipeline management

Restraint/Challenge

“High Installation and Maintenance Costs Limiting Widespread Adoption”

- The high initial investment and ongoing maintenance costs associated with advanced leak detection systems present a significant barrier to market penetration, especially for small and mid-sized operators in emerging economies

- Technologies such as fiber optic sensing, acoustic monitoring, and real-time data analytics require sophisticated hardware, skilled personnel, and regular calibration—leading to substantial operational expenditures

- These financial constraints often lead companies to delay or limit the deployment of modern leak detection systems, particularly in older pipeline networks that would require extensive retrofitting

For instance,

- In October 2023, according to a report by the International Energy Agency (IEA), many oil and gas companies in low- and middle-income countries struggle to meet the capital requirements for deploying real-time leak detection technologies. As a result, they continue to rely on manual or less effective methods, increasing the risk of undetected leaks and environmental damage

- This cost-related limitation affects the scalability of smart leak detection solutions, potentially delaying the global transition toward safer, automated, and environmentally responsible infrastructure management

Leak Detection Market Scope

The market is segmented on the basis of type, product type, technology, and end user

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Product Type |

|

|

By Technology |

|

|

By End User |

|

In 2025, upstream is projected to dominate the market with a largest share in type segment

The upstream segment is expected to dominate the leak detection market with the largest share of 65.5% in 2025 due to its critical role in oil and gas exploration and production. As upstream operations involve drilling, extraction, and transportation of raw materials, the need for advanced leak detection solutions is vital to prevent environmental hazards, ensure safety, and comply with regulatory standards. The high value of preventing operational disruptions and maintaining the integrity of exploration assets further boosts the demand for leak detection technologies in this segment

The handheld gas detectors is expected to account for the largest share during the forecast period in product type market

In 2025, the handheld gas detectors segment is expected to dominate the market with the largest market share of 50.5% due to its portability, ease of use, and ability to provide real-time detection of gas leaks in various environments. These devices are widely adopted across industries such as oil and gas, manufacturing, and construction due to their cost-effectiveness and immediate on-site diagnostics. Their versatility in detecting a wide range of gases further contributes to their significant market share

Leak Detection Market Regional Analysis

“North America Holds the Largest Share in the Leak Detection Market”

- North America dominates the leak detection market with a market share of estimated 43.5%, driven, by stringent environmental regulations, robust pipeline infrastructure, and the widespread implementation of advanced monitoring technologies

- U.S. holds a market share of 70.5%, due to active regulatory bodies such as PHMSA (Pipeline and Hazardous Materials Safety Administration) and significant investments in oil & gas and utility infrastructure

- The strong presence of major industry players and increased focus on minimizing methane emissions have further accelerated the adoption of automated leak detection systems

- In addition, the rising number of pipeline expansions and maintenance projects, along with government initiatives to ensure operational safety, contribute to market growth in the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Leak Detection Market”

- Asia-Pacific is expected to witness the highest growth rate in the leak detection market with a market share of 23.5%, driven by rapid industrialization, urbanization, and infrastructure development

- Countries such as China, India, and Australia are key contributors due to expanding pipeline networks, increasing energy demand, and growing concerns about water and gas leakage in urban areas

- China is investing heavily in smart city initiatives and utility infrastructure, which includes advanced leak detection technologies for water conservation and pipeline safety

- India is projected to register the highest CAGR of 6.9% in the leak detection market, driven by its rising awareness of environmental sustainability and ongoing investments in oil & gas infrastructure

Leak Detection Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Teledyne FLIR LLC (U.S.)

- ABB (Sweden)

- Honeywell International Inc. (U.S.)

- Siemens Energy (Germany)

- Pentair (U.S.)

- ClampOn AS (Norway)

- Schneider Electric (France)

- Atmos International (U.K.)

- Xylem (U.S.)

- Emerson Electric Co. (U.S.)

- KROHNE Messtechnik GmbH (Germany)

- PERMA-PIPE International Holdings, Inc. (U.S.)

- TTK (India)

- PSI Software SE (Germany)

- HIMA (India)

- AVEVA Group Limited (U.K.)

- Yokogawa Electric Corporation (Japan)

- INFICON (Switzerland)

- MAGNUM Pirex AG / MAGNUM LEO-Pipe GmbH (Germany)

- Hawk Measurement Systems (Australia)

- OptaSense Ltd. (U.K.)

Latest Developments in Global Leak Detection Market

- In May 2025, Xylem, a global water technology company, has introduced AI-powered leak detection systems through its 2025 Partnerships Accelerator. These innovations aim to enhance water security by enabling real-time leak detection and rapid response, addressing challenges such as aging infrastructure and water scarcity

- In March 2025, ChampionX has received approval from the U.S. Environmental Protection Agency (EPA) for its Aerial Optical Gas Imaging (AOGI) platform. This technology combines high-definition optical gas imaging with an advanced gimbal system to detect, locate, and visualize methane leaks with pinpoint accuracy. It is particularly effective for expansive areas such as the Permian Basin, enabling technicians to identify leaks at the component level and streamline repair processes

- In November 2024, TotalEnergies announced plans to install real-time methane leak detection equipment on all its upstream assets by the end of 2025. This initiative aims to reduce methane emissions and supports the company's goal of achieving near-zero methane emissions by 2030. The move underscores the industry's commitment to environmental sustainability and regulatory compliance

- In October 2024, Airtech has partnered with Distran to integrate advanced leak detection technology into composite manufacturing processes. The collaboration combines Distran's ultrasonic leak detection systems with Airtech's expertise in vacuum bagging, aiming to enhance quality control and reduce defects in composite materials

- In June 2024, Moen has entered into a strategic agreement with Amica Insurance to promote the adoption of leak detection technology in residential settings. The partnership encourages homeowners to install water leak detection devices, aiming to minimize water damage and reduce insurance claims related to leaks

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.