Global Latex Examination Glove Market

Market Size in USD Billion

CAGR :

%

USD

1.35 Billion

USD

2.27 Billion

2024

2032

USD

1.35 Billion

USD

2.27 Billion

2024

2032

| 2025 –2032 | |

| USD 1.35 Billion | |

| USD 2.27 Billion | |

|

|

|

|

Latex Examination Glove Market Size

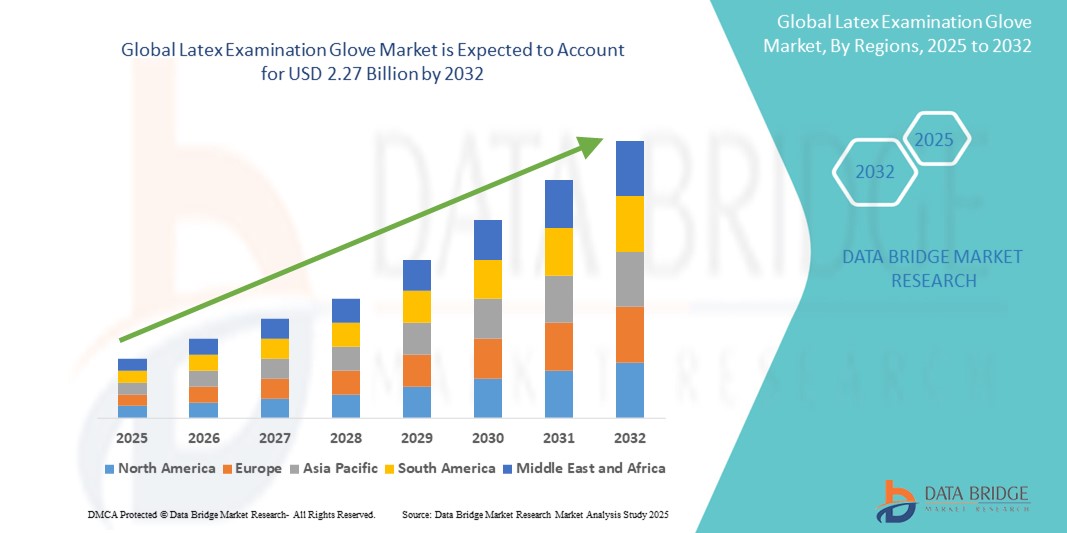

- The global latex examination glove market size was valued at USD 1.35 billion in 2024 and is expected to reach USD 2.27 billion by 2032, at a CAGR of 6.71% during the forecast period

- The market growth is primarily driven by the increasing demand for medical-grade protective equipment across healthcare settings, propelled by heightened awareness regarding infection control and hygiene standards

- In addition, rising healthcare expenditures, an expanding global patient pool, and the continued prevalence of infectious diseases are contributing to the adoption of latex examination gloves as essential diagnostic and procedural tools. These cumulative trends are reinforcing the market's expansion trajectory, firmly establishing latex gloves as a cornerstone in medical safety protocols

Latex Examination Glove Market Analysis

- Latex examination gloves, widely used for medical and diagnostic purposes, serve as critical protective barriers in healthcare and laboratory environments due to their superior tactile sensitivity, elasticity, and cost-effectiveness

- The growing demand for latex examination gloves is driven by heightened global awareness of infection prevention, increasing surgical and diagnostic procedures, and strict regulatory standards promoting hygiene and safety in medical practices

- North America dominated the latex examination glove market with the largest revenue share of 39.29% in 2024, supported by stringent health regulations, a mature healthcare sector, and high demand for personal protective equipment (PPE), especially in hospitals, outpatient settings, and diagnostic labs

- Asia-Pacific is expected to be the fastest growing region in the latex examination glove market during the forecast period, driven by increasing healthcare investments, rising medical tourism, and expanding manufacturing capabilities in countries such as Malaysia and Thailand

- The powdered latex glove segment dominated the latex examination glove market with a market share of 47% in 2024, favored in specific clinical settings for ease of donning, although rising concerns over allergies are prompting a gradual shift toward powder-free alternatives

Report Scope and Latex Examination Glove Market Segmentation

|

Attributes |

Latex Examination Glove Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Latex Examination Glove Market Trends

“Rising Demand for Powder-Free and Hypoallergenic Variants”

- A significant and accelerating trend in the global latex examination glove market is the shift toward powder-free and hypoallergenic gloves, driven by increasing awareness of latex-related allergies among healthcare professionals and patients. This trend is reshaping product development and procurement standards across medical institutions.

- For instance, companies such as Ansell Limited and Cardinal Health have expanded their powder-free product portfolios, incorporating chlorination and polymer coatings to reduce protein content and minimize allergic reactions

- Powder-free latex gloves are preferred for their reduced risk of airborne allergens and skin irritation, aligning with global safety protocols in healthcare environments. Regulatory actions, such as the FDA's ban on powdered gloves in the U.S., have further propelled the adoption of safer alternatives

- These gloves maintain key benefits such as high tactile sensitivity, flexibility, and comfort while addressing user safety concerns. In addition, innovations in glove design such as improved fit and thinner yet durable materials are enhancing usability and acceptance

- The rising demand for latex gloves with advanced safety and ergonomic features is also supported by growing infection control requirements and sustainability efforts within healthcare systems. Manufacturers are adopting eco-friendly production practices to meet global environmental standards

- This trend toward safer, user-friendly, and environmentally conscious glove options is transforming the landscape of examination glove usage, particularly in hospitals, laboratories, and outpatient facilities, where user comfort and protection are paramount

Latex Examination Glove Market Dynamics

Driver

“Increased Usage Due to Growing Infection Control Awareness and Healthcare Expansion”

- The growing emphasis on hygiene and infection control in medical environments, especially in the aftermath of global pandemics, is a major driver of the latex examination glove market. These gloves are now considered essential components of personal protective equipment (PPE) across clinical and laboratory settings

- For instance, hospitals and diagnostic centers worldwide are increasing procurement of disposable gloves to meet stricter sanitation guidelines and minimize cross-contamination risks during examinations and minor procedures

- Healthcare infrastructure expansion in emerging economies, coupled with government initiatives to strengthen public health systems, is further fueling demand for latex gloves. As more facilities are built and services are scaled, glove usage becomes integral to daily operations

- Latex examination gloves are valued for their superior tactile sensitivity and snug fit, enabling precise diagnostics and comfort during prolonged use. Their cost-effectiveness and widespread availability make them a practical choice for bulk use in both public and private healthcare sectors

- The convergence of healthcare development, stringent infection control standards, and rising disease awareness is expected to sustain robust demand for latex examination gloves across global markets

Restraint/Challenge

“Allergic Reactions and Regulatory Bans on Powdered Gloves”

- One of the key challenges facing the latex examination glove market is the risk of allergic reactions caused by proteins in natural rubber latex. These reactions can range from mild skin irritation to severe anaphylaxis, leading to limitations in glove usage among sensitive populations

- For instance, regulatory agencies such as the U.S. Food and Drug Administration (FDA) have banned powdered latex gloves in medical settings due to their heightened allergenic potential and health risks associated with airborne particles

- As a result, healthcare providers are increasingly turning to alternative materials or low-protein latex variants, but the transition often involves higher production costs, which can affect pricing and accessibility, particularly in cost-sensitive markets

- In addition, the global supply of natural rubber—concentrated in regions such as Southeast Asia—is subject to fluctuations due to environmental and geopolitical factors, potentially impacting glove availability and cost

- To overcome these challenges, manufacturers are investing in allergy-reducing technologies, developing synthetic alternatives, and improving supply chain resilience. Consumer education and regulatory compliance will also be crucial in ensuring the continued growth of the market

Latex Examination Glove Market Scope

The market is segmented on the basis of product, form, and end user.

- By Product

On the basis of product, the latex examination glove market is segmented into sterile and non-sterile gloves. The non-sterile segment dominated the market with the largest market revenue share in 2024, primarily due to its widespread usage in routine examinations, diagnostics, and general medical procedures. Non-sterile gloves are cost-effective, readily available, and suitable for high-volume applications in outpatient departments, laboratories, and primary healthcare facilities. Their extensive utility across both developed and emerging healthcare systems positions them as the preferred choice in general clinical settings.

The sterile segment, is expected to grow at the fastest rate during the forecast period, due to increasing procedural volumes and the rising demand for high-precision infection control in hospital environments. This is critical in specific applications such as minor surgical interventions, wound care, and procedures requiring a sterile field.

- By Form

On the basis of form, the latex examination glove market is segmented into powdered and powder-free gloves. The powdered segment dominated the market with the largest market revenue share of 47% in 2024, due to its widespread use in regions with less stringent regulatory oversight and among healthcare providers who favor ease of donning and lower cost. Powdered gloves continue to be a preferred choice in many developing countries where affordability and ease of handling take precedence.

However, the powder-free segment is expected to grow at the fastest rate during the forecast period, driven by increasing regulatory restrictions in major markets such as the U.S. and Europe and rising awareness of allergic reactions associated with glove powder. Powder-free gloves, treated through chlorination or polymer coatings, are becoming the standard in modern healthcare settings with strict infection control protocols.

- By End User

On the basis of end user, the latex examination glove market is segmented into hospitals, clinics, ambulatory surgery centers, diagnostic imaging centers, rehabilitation centers, and others. The hospital segment dominated the market with the largest revenue share in 2024, driven by high patient volumes, procedural intensity, and stringent hygiene requirements across departments such as emergency, inpatient, and surgical care.

Clinics and ambulatory surgery centers are expected to exhibit notable growth during forecast period, supported by increasing outpatient care demand and the expansion of minor procedure facilities. These settings require continuous glove use for diagnostics, examinations, and aseptic interventions.

Latex Examination Glove Market Regional Analysis

- North America dominated the latex examination glove market with the largest revenue share of 39.29% in 2024, supported by stringent health regulations, a mature healthcare sector, and high demand for personal protective equipment (PPE), especially in hospitals, outpatient settings, and diagnostic labs

- The region’s healthcare infrastructure emphasizes the routine use of examination gloves in hospitals, clinics, and outpatient centers, with growing awareness of hygiene and occupational safety further propelling demand

- This widespread adoption is reinforced by well-established distribution networks, a focus on patient safety, and continuous advancements in glove manufacturing, making latex examination gloves a critical component of standard medical and diagnostic procedures across North America

U.S. Latex Examination Glove Market Insight

The U.S. latex examination glove market captured the largest revenue share of 78% in 2024 within North America, driven by stringent healthcare regulations, a high frequency of medical procedures, and strong demand for infection control products. Hospitals and clinics prioritize high-quality disposable gloves to meet occupational safety standards. The shift toward powder-free and hypoallergenic gloves, combined with robust domestic distribution and procurement frameworks, continues to propel the U.S. market forward. In addition, heightened preparedness for pandemic response and stockpiling practices contribute to sustained market demand.

Europe Latex Examination Glove Market Insight

The Europe latex examination glove market is projected to grow at a steady CAGR during the forecast period, supported by rigorous hygiene standards and increasing awareness regarding healthcare-associated infections (HAIs). The rise in surgical volumes, an aging population, and the expansion of primary healthcare services are all contributing to glove usage across hospitals and outpatient facilities. European countries are also shifting toward environmentally friendly and powder-free glove options, reflecting both regulatory and consumer preferences for sustainable and safe medical products.

U.K. Latex Examination Glove Market Insight

The U.K. latex examination glove market is anticipated to expand at a moderate CAGR during the forecast period, driven by robust healthcare infrastructure and the widespread implementation of infection prevention protocols across the NHS and private healthcare providers. Ongoing investments in medical equipment and a rise in point-of-care diagnostics are fueling demand for disposable gloves. Furthermore, the focus on minimizing latex allergies through powder-free and low-protein alternatives is shaping procurement decisions in clinical environments.

Germany Latex Examination Glove Market Insight

The Germany latex examination glove market is expected to grow consistently through the forecast period, supported by a technologically advanced healthcare system and strong government emphasis on occupational health and hygiene. Hospitals and laboratories in Germany maintain high glove usage due to standardized procedural requirements. Moreover, the country’s preference for certified, eco-friendly, and skin-safe medical products is encouraging adoption of premium latex glove variants with reduced allergen content.

Asia-Pacific Latex Examination Glove Market Insight

The Asia-Pacific latex examination glove market is poised to grow at the fastest CAGR of 23.2% during the forecast period of 2025 to 2032, driven by the region’s expanding healthcare infrastructure, increasing public health investments, and high medical glove manufacturing capacity. Countries such as Malaysia, Thailand, and Indonesia are key production hubs, supplying both domestic and global markets. Meanwhile, growing healthcare awareness and the rise in hospital admissions across China, India, and Southeast Asia are fueling demand for disposable examination gloves.

Japan Latex Examination Glove Market Insight

The Japan latex examination glove market is growing steadily due to a mature healthcare system, a rising geriatric population, and a strong emphasis on infection prevention in medical and eldercare facilities. Japan’s demand for high-quality, hypoallergenic gloves aligns with its safety-conscious medical culture. In addition, the integration of latex gloves into home healthcare and rehabilitation services is expanding glove usage beyond traditional hospital settings.

India Latex Examination Glove Market Insight

The India latex examination glove market accounted for the largest market revenue share in Asia-Pacific in 2024, fueled by rapid urbanization, growing healthcare access, and rising awareness of hygiene and infection control. The government's focus on improving public healthcare delivery, increasing surgical procedures, and initiatives such as "Digital Health Mission" are accelerating glove usage. With a strong domestic manufacturing base and the availability of cost-effective glove options, India continues to be a key driver of regional market growth.

Latex Examination Glove Market Share

The latex examination glove industry is primarily led by well-established companies, including:

- Top Glove Corporation Bhd (Malaysia)

- Hartalega Holdings Berhad (Malaysia)

- Supermax Corporation Berhad (Malaysia)

- Kossan Rubber Industries Bhd (Malaysia)

- Sri Trang Gloves (Thailand) PCL (Thailand)

- Ansell Limited (Australia)

- Semperit AG Holding (Austria)

- Medline Industries, LP (U.S.)

- Cardinal Health, Inc. (U.S.)

- McKesson Corporation (U.S.)

- Dynarex Corporation (U.S.)

- B. Braun SE (Germany)

- Owens & Minor, Inc. (U.S.)

- Unigloves (UK) Limited (U.K.)

- Gloveon Co. Ltd. (Malaysia)

- Rubberex Corporation (M) Berhad (Malaysia)

- RFB Latex Limited (India)

- Shandong Yuyuan Latex Gloves Co., Ltd. (China)

- Zhushi Pharmaceutical Group Co., Ltd. (China)

- Kanam Latex Industries Pvt. Ltd. (India)

What are the Recent Developments in Global Latex Examination Glove Market?

- In April 2023, Top Glove Corporation Bhd, one of the world’s largest manufacturers of latex gloves, announced the launch of its new eco-friendly latex examination gloves. These gloves are designed using biodegradable materials without compromising on safety and performance, aligning with the company’s long-term sustainability goals. This development reflects Top Glove's commitment to environmental responsibility and innovation, as global demand shifts toward greener healthcare solutions

- In March 2023, Ansell Limited introduced its next-generation powder-free latex examination gloves with advanced allergy-reduction technology. The new gloves feature an ultra-low protein content and enhanced polymer coating, aiming to minimize the risk of allergic reactions while maintaining tactile sensitivity. This move underscores Ansell’s focus on user safety and its response to growing concerns over latex allergies in medical environments

- In March 2023, Hartalega Holdings Berhad expanded its glove production capacity in Malaysia through the commissioning of new high-speed, energy-efficient manufacturing lines. This expansion aims to meet the rising global demand for examination gloves, particularly in emerging markets. The initiative reflects Hartalega’s strategic focus on innovation, efficiency, and meeting increasing healthcare needs globally

- In February 2023, Medline Industries, LP announced the opening of a new distribution center in the U.S. to improve logistics and availability of medical gloves and other PPE. This move supports the timely distribution of latex examination gloves to hospitals and clinics across North America, ensuring uninterrupted supply chains and reinforcing the company’s commitment to healthcare preparedness and responsiveness

- In January 2023, Sri Trang Gloves (Thailand) Public Company Limited unveiled its new range of latex examination gloves certified with enhanced international quality standards including ISO 13485:2016 and EN455. These gloves are tailored for high-performance environments such as surgical wards and laboratories, highlighting Sri Trang’s ongoing investment in quality, compliance, and meeting the evolving demands of global healthcare markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.