Global Large-Joint Reconstructive Implants Market Segmentation, By Joint (Knee Replacement, Hip Replacement, Shoulder Replacement Product, and Ankle Replacement Product) – Industry Trends and Forecast to 2032

Large-Joint Reconstructive Implants Market Analysis

Large-joint reconstructive implants are critical devices used to replace or repair damaged joints, typically in the knee, hip, shoulder, and ankle. These implants are designed to restore mobility and alleviate pain caused by conditions such as arthritis, trauma, or degenerative diseases. With the aging global population and increasing rates of joint-related disorders, the demand for large-joint reconstructive implants has grown significantly. Technological advancements have greatly enhanced the design and performance of these implants, leading to better outcomes and faster recovery times for patients. Recent innovations in large-joint reconstructive implants include the development of materials such as titanium and cobalt-chromium alloys, which offer improved strength, durability, and biocompatibility. Additionally, custom implants tailored to individual patients, using 3D imaging and printing technologies, are becoming more common. These personalized implants help ensure a better fit and alignment, which can enhance the longevity and functionality of the implant. Minimally invasive surgical techniques are also improving, reducing recovery time and the risk of complications. The market for large-joint reconstructive implants is expanding as healthcare providers increasingly adopt these advanced technologies, and as the global prevalence of joint disorders continues to rise.

Large-Joint Reconstructive Implants Market Size

The global large-joint reconstructive implants market size was valued at USD 6.31 billion in 2024 and is projected to reach USD 17.02 billion by 2032, with a CAGR of 13.20% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Large-Joint Reconstructive Implants Market Trends

“Increasing Use of Customized Implants”

One significant trend in the large-joint reconstructive implants market is the increasing use of customized implants driven by 3D printing and advanced imaging technologies. These innovations allow for the creation of implants tailored to an individual’s unique anatomy, leading to better fit, enhanced functionality, and longer-lasting outcomes. For instance, companies such as Stryker and Zimmer Biomet are leveraging 3D printing to produce personalized knee and hip replacements that are more precisely aligned with the patient’s joint structure, improving post-surgical mobility and reducing complications. Additionally, robot-assisted surgeries are becoming more prevalent, with systems such as MAKO by Stryker enabling surgeons to perform highly precise procedures, ensuring optimal implant placement. This trend improves surgical outcomes and shortens recovery times, reducing healthcare costs. As the demand for joint replacement surgeries rises, particularly among the aging population, these technological advancements are driving growth in the large-joint reconstructive implants market, offering more effective and patient-specific solutions.

Report Scope and Large-Joint Reconstructive Implants Market Segmentation

|

Attributes

|

Large-Joint Reconstructive Implants Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

Smith+Nephew (U.K.), Enovis Corporation (U.S.), Medical Devices Business Services, Inc. (U.S.), Aesculap, Inc. (Germany), Stryker (U.S.), Zimmer Biomet (U.S.), Medtronic (Ireland), NuVasive, Inc. (U.S.), Wright Medical Group N.V. (Netherlands), FHOrtho (France), Gruppo Bioimpianti s.r.l. (Italy), Exactech, Inc. (U.S.), Limacorporate S.p.A. (Italy), Colfax Corporation (U.S.), and Samo S.p.a. (Italy)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Large-Joint Reconstructive Implants Market Definition

Large-joint reconstructive implants are medical devices used to replace or repair damaged or diseased joints, typically in the knee, hip, shoulder, or ankle. These implants are designed to restore function, alleviate pain, and improve mobility in patients suffering from conditions such as osteoarthritis, rheumatoid arthritis, trauma, or degenerative joint diseases. The surgical procedure, known as joint replacement, involves removing the damaged joint and replacing it with an artificial prosthesis, tailored to the patient's specific needs. Large-joint reconstructive implants are essential for enhancing the quality of life in individuals with severe joint issues, particularly in the aging population.

Large-Joint Reconstructive Implants Market Dynamics

Drivers

- Rising Prevalence of Joint Disorders

The rising prevalence of joint disorders, particularly degenerative diseases such as osteoarthritis, is a significant driver for the large-joint reconstructive implants market. According to the World Health Organization (WHO), osteoarthritis affects more than 300 million people worldwide, with the condition primarily impacting the knee, hip, and shoulder joints. Contributing factors such as increasing obesity rates, sedentary lifestyles, and genetic predispositions are exacerbating the condition. For instance, a study published by the Centers for Disease Control and Prevention (CDC) states that obesity is a key risk factor, with nearly one in four adults in the U.S. suffering from osteoarthritis. As these joint disorders become more prevalent, there is a greater need for joint replacement surgeries to restore function and alleviate pain. The growing burden of joint-related diseases, coupled with an aging population, is driving the demand for advanced large-joint reconstructive implants, making this a pivotal market driver.

- Growing Aging Global

The aging global population is a key driver for the large-joint reconstructive implants market, as older individuals are more prone to joint-related diseases such as osteoarthritis and rheumatoid arthritis. According to the United Nations, by 2030, the number of people aged 60 and older will surpass 1.4 billion, with those aged 80 and above being the fastest-growing age group. As people age, the cartilage in joints deteriorates, leading to conditions that often require joint replacement surgery. For instance, the American Academy of Orthopaedic Surgeons (AAOS) reports that more than 700,000 knee replacement surgeries are performed annually in the U.S. alone, with the majority of these patients being over the age of 65. This demographic shift, combined with the increasing life expectancy, directly drives the demand for knee, hip, and shoulder replacements, positioning the aging population as a significant market driver for large-joint reconstructive implants.

Opportunities

- Growing Advancements in Implant Technology

Advancements in implant technology, particularly through innovations such as 3D printing and improved biomaterials, present a significant market opportunity for large-joint reconstructive implants. 3D printing allows for the creation of customized implants, tailored to the patient's specific anatomy, improving implant fit, alignment, and overall outcomes. Companies such as Zimmer Biomet have embraced this technology, offering personalized joint replacement implants that reduce complications and enhance recovery times. Additionally, the development of more durable biomaterials, such as titanium alloys and polyethylene, has led to implants that last longer and are more resistant to wear, particularly in high-stress areas such as the knee and hip. These innovations, along with robotic-assisted surgeries such as Stryker’s MAKO, enable more precise and minimally invasive procedures, ultimately improving surgical results and patient satisfaction. As the demand for joint replacements continues to rise, these technological advancements open up new opportunities for market expansion, making joint replacement procedures more efficient, affordable, and patient-friendly.

- Rising Healthcare Expenditure

Rising healthcare expenditure, particularly in developed regions, is creating a significant market opportunity for large-joint reconstructive implants by making joint replacement surgeries more accessible and affordable. For instance, in the U.S., healthcare spending is projected to reach $6.2 trillion by 2028, with a substantial portion allocated to orthopedic care and joint replacements. Countries such as Germany and Japan are also increasing healthcare investments, enabling better access to advanced treatments and technologies for joint diseases. This growing financial commitment has led to the expansion of joint replacement procedures, particularly in regions with aging populations. For instance, the National Health Service (NHS) in the U.K. has been actively funding hip and knee replacement surgeries, addressing the rising demand for these procedures. As healthcare budgets continue to increase, particularly for aging populations, more patients will have access to joint replacement surgeries, driving the demand for large-joint reconstructive implants and presenting opportunities for market growth across the globe.

Restraints/Challenges

- High Cost of Large-Joint Reconstructive Implants

The high cost of large-joint reconstructive implants presents a significant market challenge, particularly for advanced, high-quality models designed to offer better longevity and performance. For instance, a total hip or knee replacement implant can cost thousands of dollars, which is a substantial financial burden for patients in low- and middle-income countries where access to affordable healthcare is limited. In many cases, patients without adequate insurance or financial resources may be unable to afford these procedures, leading to disparities in access to necessary treatments. Additionally, the cost burden is not limited to patients alone, healthcare providers and hospitals are also impacted by the high price of implants, as they must allocate substantial resources to procure and maintain these devices. This financial strain can limit the availability of implants, particularly in smaller healthcare settings or developing regions, where alternatives may not be as readily available. As a result, the cost challenge restricts market growth by reducing the accessibility of joint reconstruction procedures, especially for underserved populations who are most in need of these interventions.

- Risk of Complications

The risk of complications associated with large-joint reconstructive procedures presents a significant challenge to the market, as it can deter patients from opting for surgery. While joint replacement surgeries, such as knee or hip replacements, are generally considered safe, complications such as infections, implant failure, or poor healing are always potential risks. For instance, infections following surgery can lead to extended hospital stays, additional treatments, and sometimes the need for further surgeries to replace the implant, all of which increase healthcare costs significantly. Moreover, complications can result in prolonged recovery times, leading to dissatisfaction among patients and a reluctance to undergo surgery in the first place. For instance, a patient may experience implant loosening or wear after several years, requiring a costly revision surgery. Such complications drive up healthcare expenses and impact the overall success rates of joint reconstruction procedures, making potential patients hesitant to undergo the surgery. This uncertainty surrounding the risks of complications can limit the demand for joint reconstruction implants and affect the market's growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Large-Joint Reconstructive Implants Market Scope

The market is segmented on the basis of joint. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Joint

- Knee Replacement

- Hip Replacement

- Shoulder Replacement Product

- Ankle Replacement Product

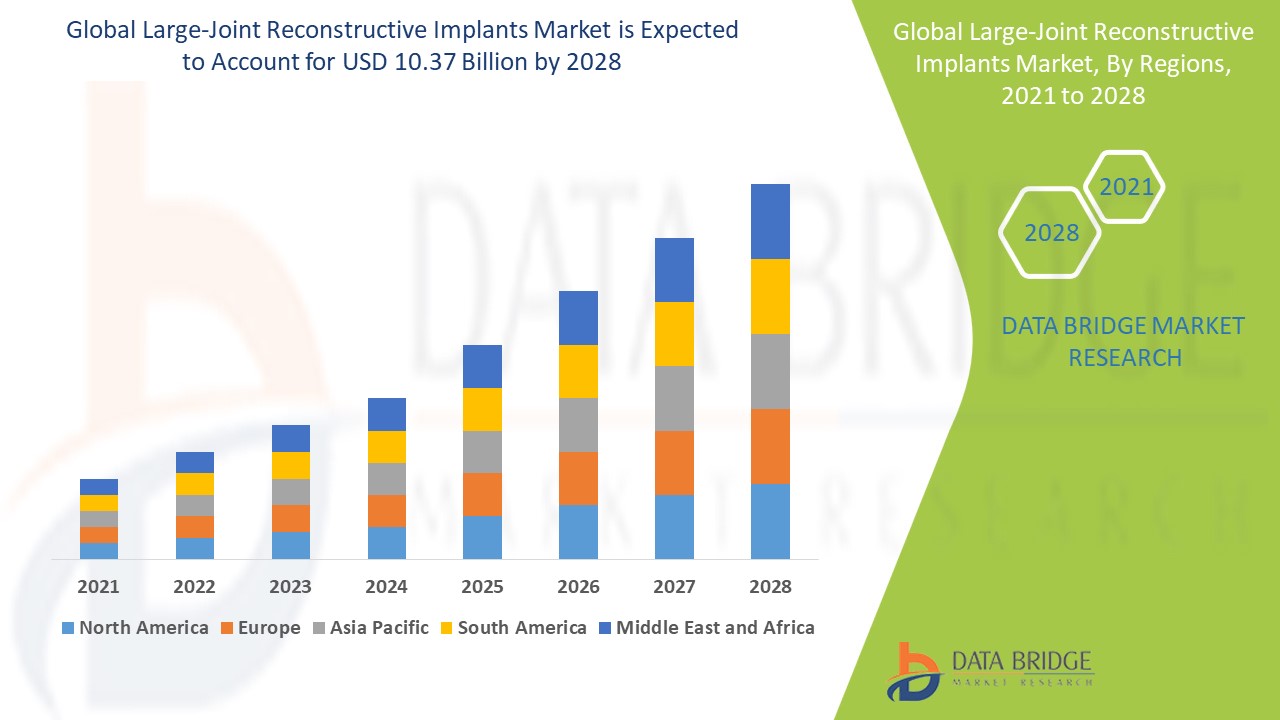

Large-Joint Reconstructive Implants Market Regional Analysis

The market is analysed and market size insights and trends are provided by country and joint as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America leads the large-joint reconstructive implants market, driven by a high prevalence of orthopedic conditions, such as arthritis, and an aging population that demands joint replacement procedures. The region benefits from advanced healthcare infrastructure, widespread adoption of innovative implant technologies, and strong reimbursement policies. Additionally, the presence of key market players and ongoing research and development contribute to the growth of this market. These factors collectively position North America as the dominant player in the global large-joint reconstructive implants market.

Asia-Pacific market for large-joint reconstructive implants is witnessing rapid growth, fueled by an aging population, a rising incidence of joint disorders, and increased healthcare spending. Advancements in medical technology and greater awareness of joint health further support market expansion, making reconstructive implants more accessible and appealing. As more individuals seek effective solutions for joint pain and mobility challenges, demand for joint reconstruction devices continues to climb across the region, driving robust market development.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Large-Joint Reconstructive Implants Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Large-Joint Reconstructive Implants Market Leaders Operating in the Market Are:

- Smith+Nephew (U.K.)

- Enovis Corporation (U.S.)

- Medical Devices Business Services, Inc. (U.S.)

- Aesculap, Inc. (Germany)

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Medtronic (Ireland)

- NuVasive, Inc. (U.S.)

- Wright Medical Group N.V. (Netherlands)

- FHOrtho (France)

- Gruppo Bioimpianti s.r.l. (Italy)

- Exactech, Inc. (U.S.)

- Limacorporate S.p.A. (Italy)

- Colfax Corporation (U.S.)

- Samo S.p.a. (Italy)

Latest Developments in Large-Joint Reconstructive Implants Market

- In February 2024, Smith+Nephew, a leading global medical technology company, launched its AETOS Shoulder System for full commercial availability in the U.S. The system also received 510(k) clearance for integration with 3D Planning Software for total shoulder arthroplasty

- In February 2024, AddUp, a global OEM specializing in metal additive manufacturing, partnered with Anatomic Implants to submit a 510(k) joint type for the world's first 3D-printed toe joint replacement

- In February 2024, THINK Surgical, Inc. announced a new partnership with Waldemar Link of Germany, renowned for its joint replacement solutions. This collaboration will integrate the LinkSymphoKnee System into THINK Surgical's ID-HUB platform

- In December 2023, Stryker acquired Serf Sas, a joint replacement business, a move expected to strengthen Stryker's European presence and complement its existing joint replacement portfolio

- In July 2022, an innovation-driven medical technology company launched ARVIS (Augmented Reality Visualization and Information System), an FDA-cleared, real-time, hands-free augmented reality (AR) technology. Over 200 successful cases were completed in the U.S., aiding orthopedic surgeons with precision guidance for hip and knee surgeries

SKU-