Global Laminated Tubes Market

Market Size in USD Million

CAGR :

%

USD

566.16 Million

USD

1,570.26 Million

2021

2029

USD

566.16 Million

USD

1,570.26 Million

2021

2029

| 2022 –2029 | |

| USD 566.16 Million | |

| USD 1,570.26 Million | |

|

|

|

|

Market Analysis and Size

Since the past few years, laminated tubes have become more popular because they combine the advantages of plastic and metal. High-volume items such as toothpaste were typically packaged in laminated tubes. However, these tubes are currently used in various industries, from cosmetic and pharmaceutical goods to acrylic oil paints and adhesives. As a result, with these aforementioned determinants, the market is anticipated to witness huge growth across the globe.

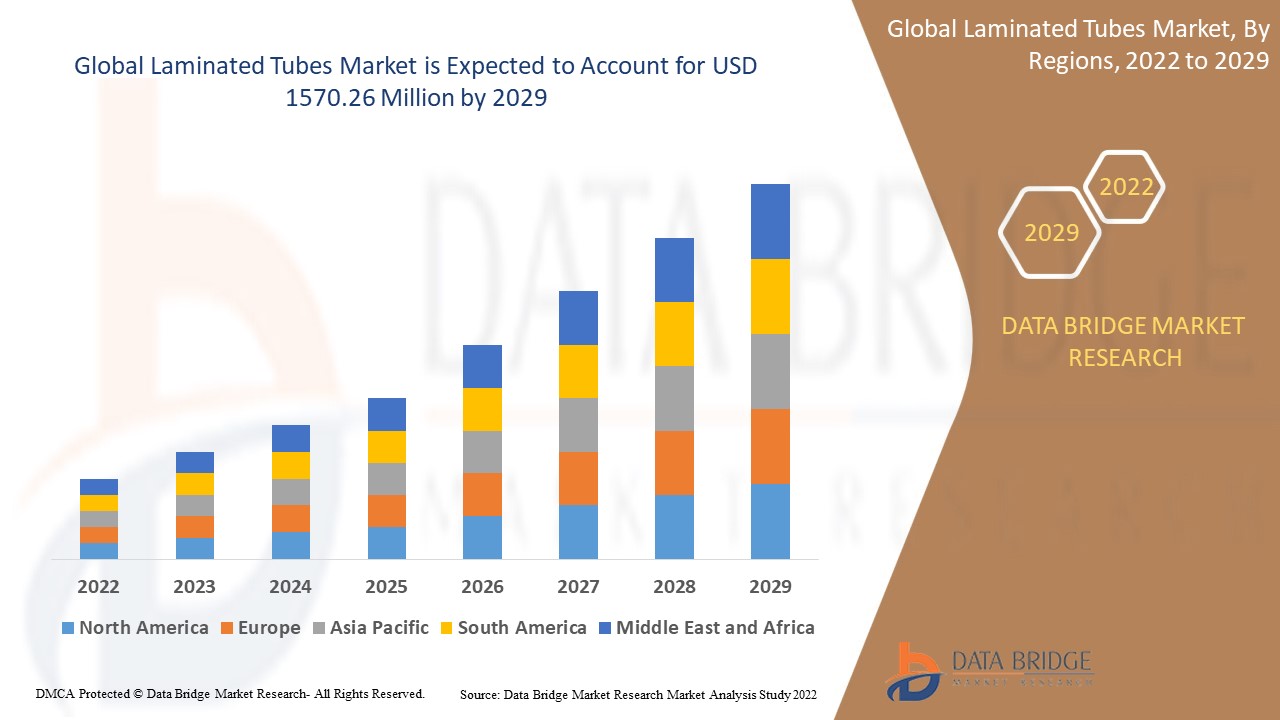

Global Laminated Tubes Market was valued at USD 566.16 million in 2021 and is expected to reach USD 1570.26 million by 2029, registering a CAGR of 13.60% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and technological advancements.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Plastic Barrier Laminate (PBL) Tubes, Aluminum Barrier Laminate (ABL) Tubes), Capacity (Less than 50ml, 50 ml to 100 ml, 101 ml to 150 ml, Above 150 ml), End-Use (Cosmetics, Oral Care, Commercial, Pharmaceuticals, Home and Other Personal Care, Food, Others), Cap Type (Stand-up Cap, Nozzle Cap, Fez Cap, Flip Top Cap, Other Caps) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia- Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, UAE, Egypt, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

EPL Limited (India), ALBEA (France), Berry Global Inc. (U.S.), CCL Industries. (Canada), MONTEBELLO PACKAGING (Canada), TUBOPRESS ITALIA S.R.L. (Italy), LINHARDT GmbH & Co. KG (Germany), Hoffmann Neopac AG (Switzerland), Recision Concepts International (U.S.), Huhtamaki (Finland), Lajovic Tuba (Slovenia), TUBAPACK, (Slovakia), Pirlo Holding GmbH (Austria), Bergen Plastics (Norway) and Burhani Group of Industries (Pakistan) |

|

Market Opportunities |

|

Market Definition

Laminated tubes (PFPE) is a low-molecular-weight fluorinated synthetic fluid. Laminated tubes is non-toxic and nonflammable in their natural state. It is utilized in severe temperatures ranging from 80°C to 200°C. PFPE's molecular structure might be linear, branched, or a combination of both, depending on the application. Temperature resistance, lubricity, wear resistance, and fluid volatility are all provided by PFPE.

Laminated Tubes Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Laminated Tubes Possess Beneficial Features

Laminated tubes' expanding range of uses can be due to their formidable barrier resistance. The barrier strength of the plastic material employed in the laminated tubes is comparable to that of alumina. Laminated tubes prevent air, moisture, and intense light from coming into contact with the product being stored, which could cause it to lose its quality and become unusable. As a result, the demand for laminated tubes is anticipated to increase globally by a factor of two over the forecast period.

The increasing awareness about the advantage of using lubricant-based products due to their corrosion resistant, nonflammable, and nontoxic properties will further propel the growth rate of laminated tubes market. Additionally, the growth in trade by air transportation will also drive market value growth. The expansion of the automotive industry and the increase in defense budgets are other market growth determinants projected to bolster the market's growth.

Opportunities

- Increased High-Quality Product Demand and Surging Investments

Furthermore, increased consumers' demands for products of high quality and perceived value extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Additionally, the growing investments by the key players for the product development and material level innovations to maintain their lead will further expand the future growth of the laminated tubes market.

Restraints/Challenges

- Stringent Regulations

The stringent regulations regarding the usages of plastic will create hindrances for the growth of the laminated tubes market.

- Supply Chain Disruptions

With the rising number of restrictions around the globe due to pandemic, there has been a hit in the demand and supply. Also, the fluctuations in the prices of raw materials will prove to be a demerit for the laminated tubes market. Therefore, this will challenge the laminated tubes market growth rate.

This laminated tubes market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the laminated tubes market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Laminated Tubes Market

The recent outbreak of coronavirus had a significant impact on the laminated tubes market. Consumers have been seen to be increasingly concerned with safety and upholding proper hygiene practices. The preference for safe, secure, dependable, and hygienic pharmaceutical packaging has grown as a result of the COVID-19 outbreak. During the pandemic, makers of laminated tubes created new laminated tube hand sanitizers to meet the rising demand for hand sanitizers and sprays. For instance, Cleansing hand gel, as well as laminated tubes for hand sanitizer, lotions, and hand soap, were introduced in April 2020 by Albea S.A., the manufacturer of laminated tubes.

Additionally, the people are now more concerned about their health, hygiene, and cleanliness as a result of the pandemic. As a result, there is now a greater need for antiseptic creams, gels, and ointments packaged in laminated tubes, which presents prospects for market growth. Additionally, increased awareness of oral hygiene is anticipated that the market for oral care laminating tubes will continue to rise steadily.

Recent Development

- In December 2020, EPL Limited won acclaim on a global scale for their Platina Tube with an HDPE closure. The Platina is the first totally sustainable and recyclable tube, cap, and shoulder included.

- In June 2021, To establish sustainability in the oral care market, EPL Limited has teamed with Uniliver. According to Unilever APR, the EPL Ltd. will provide the toothpaste category Platina Tubes, which have been fully sustainable and entirely recyclable. Platina Tube, a brand of EPL Ltd. enterprises, is a 100% sustainable and recyclable tube (The Association of Plastic Recyclers)

Global Laminated Tubes Market Scope

The laminated tubes market is segmented on the basis of product type, capacity, end-use and cap type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Plastic Barrier Laminate (PBL) Tubes

- Aluminum Barrier Laminate (ABL) Tubes

Capacity

- Less than 50ml

- 50 ml to 100 ml

- 101 ml to 150 ml

- Above 150 ml

End-Use

- Cosmetics

- Oral Care

- Commercial

- Pharmaceuticals

- Home and Other Personal Care

- Food

- Others

Cap Type

- Stand-up Cap

- Nozzle Cap

- Fez Cap

- Flip Top Cap

- Other Caps

Laminated Tubes Market Regional Analysis/Insights

The laminated tubes market is analyzed and market size insights and trends are provided by country, product type, capacity, end-use and cap type as referenced above.

The countries covered in the laminated tubes market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period of 2022-2029. The market growth over this region is attributed to the growth of the cosmetics industry within the region.

Asia-Pacific, on the other hand, is estimated to show lucrative growth over the forecast period of 2022-2029, due to the rising demand of sustainable and innovative packaging in India, and China in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Laminated Tubes Market Share Analysis

The laminated tubes market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to laminated tubes market.

Some of the major players operating in the laminated tubes market are

- EPL Limited (India)

- ALBEA (France)

- Berry Global Inc. (U.S.)

- CCL Industries. (Canada)

- MONTEBELLO PACKAGING (Canada)

- TUBOPRESS ITALIA S.R.L. (Italy)

- LINHARDT GmbH & Co. KG (Germany)

- Hoffmann Neopac AG (Switzerland)

- Recision Concepts International (U.S.)

- Huhtamaki (Finland)

- Lajovic Tuba (Slovenia)

- TUBAPACK, (Slovakia)

- Pirlo Holding GmbH (Austria)

- Bergen Plastics (Norway)

- Burhani Group of Industries (Pakistan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL LAMINATED TUBES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL LAMINATED TUBES MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL LAMINATED TUBES MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 PORTER’S FIVE FORCES

5.4 VENDOR SELECTION CRITERIA

5.5 PESTEL ANALYSIS

5.6 REGULATION COVERAGE

5.6.1 PRODUCT CODES

5.6.2 CERTIFIED STANDARDS

5.6.3 SAFETY STANDARDS

5.6.3.1. MATERIAL HANDLING & STORAGE

5.6.3.2. TRANSPORT & PRECAUTIONS

5.6.3.3. HARAD IDENTIFICATION

6 PRICING ANALYSIS

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

10 GLOBAL LAMINATED TUBES MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION) (UNITS)

(ASP, VALUE AND VOLUME WILL BE PROVIDED FOR ALL THE SEGMENTS)

10.1 OVERVIEW

10.2 PLASTIC BARRIER LAMINATED (PBL) TUBES

10.2.1 PLASTIC BARRIER LAMINATED (PBL) TUBES, BY TYPE

10.2.1.1. ETHYLENE VINYL ALCOHOL (EVOH)

10.2.1.2. POLYAMIDE (PA)

10.2.1.3. POLYESTER (PET)

10.2.1.4. OTHERS

10.2.2 PLASTIC BARRIER LAMINATED (PBL) TUBES, BY CAPACITY

10.2.2.1. LESS THAN 50 ML

10.2.2.2. 51-100 ML

10.2.2.3. 101-150 ML

10.2.2.4. MORE THAN 150 ML

10.2.3 PLASTIC BARRIER LAMINATED (PBL) TUBES, BY CLOSURE TYPE

10.2.3.1. STAND-UP CAP

10.2.3.2. NOZZLE CAP

10.2.3.3. FEZ CAP

10.2.3.4. FLIP TOP CAP

10.2.3.5. SCREW ON CAP

10.2.3.6. DISPENSING

10.2.3.7. CAPLESS

10.2.3.8. OTHERS

10.3 ALUMINUM BARRIER LAMINATED (ABL) TUBES

10.3.1 ALUMINUM BARRIER LAMINATED (ABL) TUBES, BY CAPACITY

10.3.1.1. LESS THAN 50 ML

10.3.1.2. 51-100 ML

10.3.1.3. 101-150 ML

10.3.1.4. MORE THAN 150 ML

10.3.2 ALUMINUM BARRIER LAMINATED (ABL) TUBES, BY CLOSURE TYPE

10.3.2.1. STAND-UP CAP

10.3.2.2. NOZZLE CAP

10.3.2.3. FEZ CAP

10.3.2.4. FLIP TOP CAP

10.3.2.5. SCREW ON CAP

10.3.2.6. DISPENSING

10.3.2.7. CAPLESS

10.3.2.8. OTHERS

11 GLOBAL LAMINATED TUBES MARKET, BY CAPACITY, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 LESS THAN 50 ML

11.3 51-100 ML

11.4 101-150 ML

11.5 MORE THAN 150 ML

12 GLOBAL LAMINATED TUBES MARKET, BY CLOSURE TYPE, 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 STAND-UP CAP

12.3 NOZZLE CAP

12.4 FEZ CAP

12.5 FLIP TOP CAP

12.6 SCREW ON CAP

12.7 DISPENSING

12.8 CAPLESS

12.9 OTHERS

13 GLOBAL LAMINATED TUBES MARKET, BY LAYER, 2022-2031 (USD MILLION)

13.1 OVERVIEW

13.2 2-LAYER

13.3 3-LAYER

13.4 5-LAYER

14 GLOBAL LAMINATED TUBES MARKET, BY END USE, 2022-2031 (USD MILLION)

14.1 OVERVIEW

14.2 COSMETICS AND PERSONAL CARE

14.2.1 COSMETICS AND PERSONAL CARE, BY TYPE

14.2.1.1. HAIR CARE

14.2.1.2. SKIN CARE

14.2.1.3. NAIL CARE

14.2.1.4. NAIL POLISH

14.2.1.5. OTHERS

14.2.2 COSMETICS AND PERSONAL CARE, BY PRODUCT TYPE

14.2.2.1. PLASTIC BARRIER LAMINATED (PBL) TUBES

14.2.2.1.1. PLASTIC BARRIER LAMINATED (PBL) TUBES, BY MATERIAL

14.2.2.1.1.1 ETHYLENE VINYL ALCOHOL (EVOH)

14.2.2.1.1.2 POLYAMIDE (PA)

14.2.2.1.1.3 POLYESTER (PET)

14.2.2.1.1.4 OTHERS

14.2.2.2. ALUMINUM BARRIER LAMINATED (ABL) TUBES

14.3 ORAL CARE

14.3.1 ORAL CARE, BY PRODUCT TYPE

14.3.1.1. PLASTIC BARRIER LAMINATED (PBL) TUBES

14.3.1.1.1. PLASTIC BARRIER LAMINATED (PBL) TUBES, BY MATERIAL

14.3.1.1.1.1 ETHYLENE VINYL ALCOHOL (EVOH)

14.3.1.1.1.2 POLYAMIDE (PA)

14.3.1.1.1.3 POLYESTER (PET)

14.3.1.1.1.4 OTHERS

14.3.1.2. ALUMINUM BARRIER LAMINATED (ABL) TUBES

14.4 COMMERCIAL

14.4.1 COMMERCIAL, BY CATEGORY

14.4.1.1. SEALANTS AD ADHESIVES

14.4.1.2. LUBRICANTS

14.4.1.3. SPECIALTY GREASE

14.4.1.4. OTHERS

14.4.2 COMMERCIAL, BY PRODUCT TYPE

14.4.2.1. PLASTIC BARRIER LAMINATED (PBL) TUBES

14.4.2.1.1. PLASTIC BARRIER LAMINATED (PBL) TUBES, BY MATERIAL

14.4.2.1.1.1 ETHYLENE VINYL ALCOHOL (EVOH)

14.4.2.1.1.2 POLYAMIDE (PA)

14.4.2.1.1.3 POLYESTER (PET)

14.4.2.1.1.4 OTHERS

14.4.2.2. ALUMINUM BARRIER LAMINATED (ABL) TUBES

14.5 PHARMACEUTICALS

14.5.1 PHARMACEUTICALS, BY PRODUCT TYPE

14.5.1.1. PLASTIC BARRIER LAMINATED (PBL) TUBES

14.5.1.1.1. PLASTIC BARRIER LAMINATED (PBL) TUBES, BY MATERIAL

14.5.1.1.1.1 ETHYLENE VINYL ALCOHOL (EVOH)

14.5.1.1.1.2 POLYAMIDE (PA)

14.5.1.1.1.3 POLYESTER (PET)

14.5.1.1.1.4 OTHERS

14.5.1.2. ALUMINUM BARRIER LAMINATED (ABL) TUBES

14.6 HOME CARE

14.6.1 HOME CARE, BY TYPE

14.6.1.1. LAUNDRY GEL

14.6.1.2. TOILETRIES

14.6.1.3. HAND WASH GELS

14.6.1.4. OTHERS

14.6.2 HOME CARE, BY PRODUCT TYPE

14.6.2.1. PLASTIC BARRIER LAMINATED (PBL) TUBES

14.6.2.1.1. PLASTIC BARRIER LAMINATED (PBL) TUBES, BY MATERIAL

14.6.2.1.1.1 ETHYLENE VINYL ALCOHOL (EVOH)

14.6.2.1.1.2 POLYAMIDE (PA)

14.6.2.1.1.3 POLYESTER (PET)

14.6.2.1.1.4 OTHERS

14.6.2.2. ALUMINUM BARRIER LAMINATED (ABL) TUBES

14.7 FOOD

14.7.1 FOOD, BY PRODUCT TYPE

14.7.1.1. PLASTIC BARRIER LAMINATED (PBL) TUBES

14.7.1.1.1. PLASTIC BARRIER LAMINATED (PBL) TUBES, BY MATERIAL

14.7.1.1.1.1 ETHYLENE VINYL ALCOHOL (EVOH)

14.7.1.1.1.2 POLYAMIDE (PA)

14.7.1.1.1.3 POLYESTER (PET)

14.7.1.1.1.4 OTHERS

14.7.1.2. ALUMINUM BARRIER LAMINATED (ABL) TUBES

14.8 PAINTS

14.8.1 PAINTS, BY PRODUCT TYPE

14.8.1.1. PLASTIC BARRIER LAMINATED (PBL) TUBES

14.8.1.1.1. PLASTIC BARRIER LAMINATED (PBL) TUBES, BY MATERIAL

14.8.1.1.1.1 ETHYLENE VINYL ALCOHOL (EVOH)

14.8.1.1.1.2 POLYAMIDE (PA)

14.8.1.1.1.3 POLYESTER (PET)

14.8.1.1.1.4 OTHERS

14.8.1.2. ALUMINUM BARRIER LAMINATED (ABL) TUBES

14.9 SHOE POLISH

14.9.1 SHOE POLISH, BY PRODUCT TYPE

14.9.1.1. PLASTIC BARRIER LAMINATED (PBL) TUBES

14.9.1.1.1. PLASTIC BARRIER LAMINATED (PBL) TUBES, BY MATERIAL

14.9.1.1.1.1 ETHYLENE VINYL ALCOHOL (EVOH)

14.9.1.1.1.2 POLYAMIDE (PA)

14.9.1.1.1.3 POLYESTER (PET)

14.9.1.1.1.4 OTHERS

14.9.1.2. ALUMINUM BARRIER LAMINATED (ABL) TUBES

14.1 OTHERS

15 GLOBAL LAMINATED TUBES MARKET, BY REGION, 2022-2031 (USD MILLION) (UNITS)

GLOBAL LAMINATED TUBES MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

15.2 EUROPE

15.2.1 GERMANY

15.2.2 U.K.

15.2.3 ITALY

15.2.4 FRANCE

15.2.5 SPAIN

15.2.6 RUSSIA

15.2.7 SWITZERLAND

15.2.8 TURKEY

15.2.9 BELGIUM

15.2.10 NETHERLANDS

15.2.11 REST OF EUROPE

15.3 ASIA-PACIFIC

15.3.1 JAPAN

15.3.2 CHINA

15.3.3 SOUTH KOREA

15.3.4 INDIA

15.3.5 SINGAPORE

15.3.6 THAILAND

15.3.7 INDONESIA

15.3.8 MALAYSIA

15.3.9 PHILIPPINES

15.3.10 AUSTRALIA

15.3.11 NEW ZEALAND

15.3.12 REST OF ASIA-PACIFIC

15.4 SOUTH AMERICA

15.4.1 BRAZIL

15.4.2 ARGENTINA

15.4.3 REST OF SOUTH AMERICA

15.5 MIDDLE EAST AND AFRICA

15.5.1 SOUTH AFRICA

15.5.2 EGYPT

15.5.3 SAUDI ARABIA

15.5.4 UNITED ARAB EMIRATES

15.5.5 ISRAEL

15.5.6 REST OF MIDDLE EAST AND AFRICA

16 GLOBAL LAMINATED TUBES MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS AND ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

16.7 EXPANSIONS

16.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 SWOT ANALYSIS AND DATA BRIDGE MARKET RESEARCH ANALYSIS

18 GLOBAL LAMINATED TUBES MARKET - COMPANY PROFILE

18.1 BERRY GLOBAL INC.

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT UPDATES

18.2 ALBEA GROUP

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT UPDATES

18.3 HUHTAMAKI

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT UPDATES

18.4 CTL PACK (ACQUIRED BY SHAW KWEI & PARTNERS)

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT UPDATES

18.5 HOFFMANN NEOPAC AG

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT UPDATES

18.6 CCL INDUSTRIES

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT UPDATES

18.7 PRECISION CONCEPTS INTERNATIONAL (ACQUIRED BY ONCAP)

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT UPDATES

18.8 TUBOPRESS ITALIA S.R.L.

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT UPDATES

18.9 MONTEBELLO PACKAGING INC.

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT UPDATES

18.1 TUBETTIFICIO PERFEKTUP

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT UPDATES

18.11 ALLTUB

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT UPDATES

18.12 LAJOVIC TUBA

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT UPDATES

18.13 TUBAPACK, A.S.

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT UPDATES

18.14 PIRLO HOLDING GMBH

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT UPDATES

18.15 NORWAY PACK

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT UPDATES

18.16 EPL LIMITED (FORMERLY KNOWN AS ESSEL PROPACK LIMITED)

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT UPDATES

18.17 BURHANI PACKAGING SOLUTIONS LLC

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT UPDATES

18.18 ANTILLA, INC.

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT UPDATES

18.19 GUANGZHOU REGO PACKING INDUSTRY CO., LTD

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT UPDATES

18.2 AUBER PACKAGING

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT UPDATES

18.21 PREMIER PLUS CO., LTD.

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT UPDATES

18.22 NEUUV PACK (M) SDN BHD

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT UPDATES

18.23 ABDOS LAMITUBES

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT UPDATES

18.24 KIM PAI LAMITUBE

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT UPDATES

18.25 TUBECON INDIA LLP

18.25.1 COMPANY SNAPSHOT

18.25.2 REVENUE ANALYSIS

18.25.3 PRODUCT PORTFOLIO

18.25.4 RECENT UPDATES

19 QUESTIONNAIRE

20 CONCLUSION

21 RELATED REPORTS

22 ABOUT DATA BRIDGE MARKET RESEARCH

Global Laminated Tubes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Laminated Tubes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Laminated Tubes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.