Global Lactase In Food And Beverage Application Market

Market Size in USD Million

CAGR :

%

USD

604.79 Million

USD

866.68 Million

2024

2032

USD

604.79 Million

USD

866.68 Million

2024

2032

| 2025 –2032 | |

| USD 604.79 Million | |

| USD 866.68 Million | |

|

|

|

|

What is the Global Lactase in Food and Beverage Application Market Size and Growth Rate?

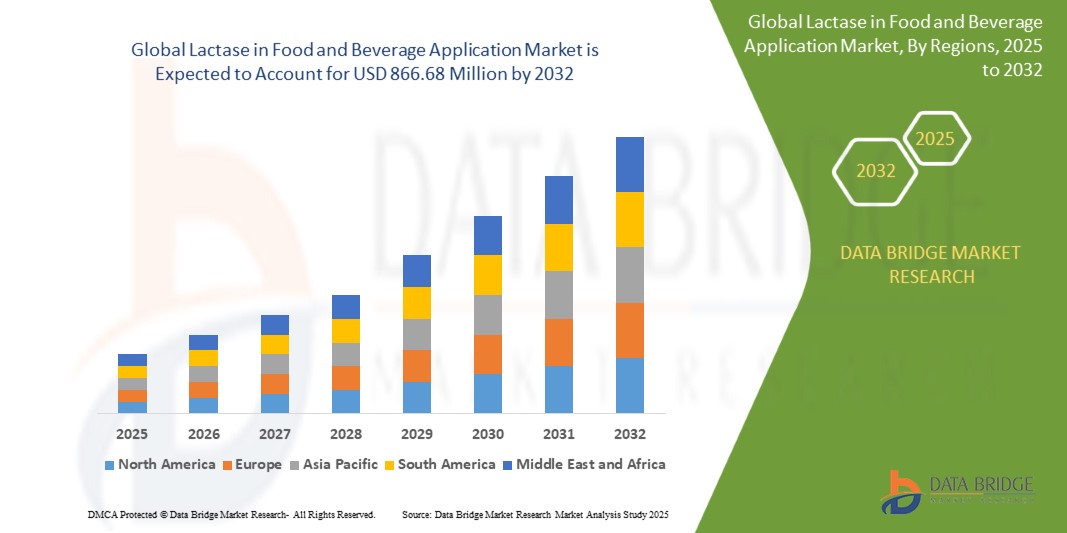

- The global lactase in food and beverage application market size was valued at USD 604.79 million in 2024 and is expected to reach USD 866.68 million by 2032, at a CAGR of 4.60% during the forecast period

- The lactase enzyme market in food and beverage applications is experiencing notable growth, driven by increasing consumer awareness and demand for lactose-free products. Lactose intolerance affects a significant portion of the global population, leading to a rising need for dairy alternatives and products with reduced lactose content

- As a result, lactase is becoming an essential ingredient in the dairy industry, enabling the production of lactose-free milk, cheese, yogurt, and other dairy products

What are the Major Takeaways of Lactase in Food and Beverage Application Market?

- The market is supported by the growing trend of health and wellness, as consumers seek products that align with their dietary restrictions and preferences. Advances in enzyme technology and increasing adoption of lactase in various food and beverage applications, such as baked goods and processed foods, are expanding the market's reach

- Europe dominated the lactase in food and beverage application market with the largest revenue share of 38.75% in 2024, driven by high dairy consumption, rising lactose intolerance awareness, and a strong focus on digestive health across the region

- Asia-Pacific lactase in food and beverage application market is expected to grow at the fastest CAGR of 12.9% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and growing dairy consumption in countries such as China, India, Japan, and Southeast Asia

- The Furniture segment dominated the lactase in food and beverage application market with the largest market revenue share of 28.4% in 2024, driven by the growing demand for functional, aesthetically appealing, and space-saving furniture solutions across urban households and commercial spaces

Report Scope and Lactase in Food and Beverage Application Market Segmentation

|

Attributes |

Lactase in Food and Beverage Application Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Lactase in Food and Beverage Application Market?

“Expansion of Clean-Label and High-Purity Lactase for Dairy-Free and Digestive Health Solutions”

- A major evolving trend in the global lactase in food and beverage application market is the growing demand for clean-label, high-purity lactase enzymes that cater to the increasing consumer preference for dairy-free, digestive health, and lactose-free food and beverage products

- For instance, companies such as DSM and Novozymes are introducing highly purified, non-GMO lactase enzymes designed for improved efficiency, minimal allergen risk, and clean-label formulations, addressing health-conscious consumer needs

- Advancements in biotechnology and enzyme purification are enabling the development of lactase products that offer superior stability, enhanced activity across a broad pH range, and compatibility with various dairy and non-dairy applications

- The rise of plant-based diets and the growing incidence of lactose intolerance globally are accelerating the adoption of lactase enzymes in dairy alternatives, protein supplements, and functional beverages

- Leading players are also exploring sustainable production methods and enzyme formulations free from chemical additives, aligning with environmental and health trends

- This trend is reshaping product development across the food and beverage sector, positioning high-performance lactase as a vital ingredient for both functional health products and clean-label dairy alternatives

What are the Key Drivers of Lactase in Food and Beverage Application Market?

- The rising prevalence of lactose intolerance, coupled with growing consumer awareness about digestive health, is significantly driving demand for lactase enzymes across food and beverage applications

- For instance, in February 2024, Chr. Hansen Holding A/S launched an advanced lactase solution optimized for lactose-free dairy products, offering improved enzyme stability and performance in both refrigerated and ambient conditions, supporting market expansion

- The surge in demand for dairy-free and low-lactose products, particularly in emerging markets, is creating opportunities for lactase use in milk, yogurt, ice cream, infant formulas, and plant-based beverages

- Increasing health consciousness and preference for digestive wellness products are boosting lactase adoption in sports nutrition, functional foods, and dietary supplements

- In addition, regulatory support for lactose-free labeling and favorable product positioning in retail channels are further accelerating market growth, as consumers seek convenient, gut-friendly, and allergen-free food solutions

Which Factor is challenging the Growth of the Lactase in Food and Beverage Application Market?

- The lactase in food and beverage application market faces challenges related to high production costs, stringent regulatory requirements, and technical limitations in certain food matrices

- For instance, maintaining enzyme stability and activity under varying temperature and pH conditions, especially in processed food applications, can be technically complex and cost-intensive, affecting market scalability

- The premium pricing of lactose-free and enzyme-fortified products can deter price-sensitive consumers, particularly in developing economies where affordability remains a key barrier

- Moreover, regulatory complexities around enzyme classification, labeling, and allergen claims differ across regions, creating compliance challenges for manufacturers

- Overcoming these barriers requires investment in advanced enzyme engineering, cost-efficient production methods, and clear consumer education to promote the benefits of lactase-enriched, digestive health-focused products

How is the Lactase in Food and Beverage Application Market Segmented?

The market is segmented on the basis of source, form, and application.

• By Source

On the basis of source, the lactase in food and beverage application market is segmented into Fungi, Yeast, and Bacteria. The Yeast segment dominated the Lactase in Food and Beverage Application market with the largest market revenue share of 49.2% in 2024, owing to its high efficiency in enzyme production, cost-effectiveness, and ability to operate across a wide pH and temperature range. Yeast-derived lactase enzymes are widely used in dairy processing due to their superior stability and compatibility with various food applications, making them the preferred choice for large-scale manufacturers.

The Bacteria segment is projected to witness the fastest growth rate of 24.6% from 2025 to 2032, driven by technological advancements in microbial fermentation and the growing demand for high-purity, GRAS (Generally Recognized As Safe) certified lactase enzymes. Bacterial sources are gaining traction for their ability to produce enzymes with enhanced stability, making them suitable for processed dairy products and functional food formulations.

• By Form

On the basis of form, the lactase in food and beverage application market is segmented into Powder and Liquid. The Powder segment held the largest market revenue share of 57.8% in 2024, attributed to its longer shelf life, ease of transportation, and flexibility in formulation across a wide range of dairy products including milk, yogurt, and protein powders. Powdered lactase is highly favored by manufacturers due to its superior storage stability and cost advantages in large-scale operations.

The Liquid segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by its high solubility, easy application in dairy processing, and rapid enzymatic activity. Liquid lactase is particularly popular for on-site applications in milk and yogurt production, where quick enzyme integration and immediate processing benefits are required.

• By Application

On the basis of application, the lactase in food and beverage application market is segmented into Milk, Cheese, Yogurt, and Others. The Milk segment dominated the lactase in food and beverage application market with the largest market revenue share of 61.5% in 2024, driven by the rising global demand for lactose-free milk among consumers with lactose intolerance or digestive sensitivity. The availability of convenient, lactose-free milk options, combined with growing health awareness, is significantly boosting lactase enzyme usage in milk processing.

The Yogurt segment is anticipated to grow at the fastest CAGR from 2025 to 2032, supported by the surging popularity of functional, probiotic-rich, and digestive health-focused dairy products. The increasing consumer preference for lactose-free yogurts that support gut health, along with product innovations in flavored and plant-based varieties, is fueling rapid growth in this segment.

Which Region Holds the Largest Share of the Lactase in Food and Beverage Application Market?

- Europe dominated the lactase in food and beverage application market with the largest revenue share of 38.75% in 2024, driven by high dairy consumption, rising lactose intolerance awareness, and a strong focus on digestive health across the region

- The region's well-established dairy industry, combined with increasing demand for lactose-free and functional dairy products, is fueling significant adoption of lactase enzymes in food and beverage applications

- European consumers are placing growing emphasis on health-conscious choices, clean-label products, and digestive wellness, positioning lactase as a key ingredient in milk, yogurt, and cheese production, with wide-scale acceptance across both retail and foodservice sectors

Germany Lactase in Food and Beverage Application Market Insight

Germany lactase in food and beverage application market captured the largest revenue share within Europe in 2024, supported by the country's advanced dairy processing industry, high prevalence of lactose intolerance, and strong demand for lactose-free alternatives. Germany’s health-conscious consumer base, coupled with innovation in dairy products and emphasis on sustainability, continues to drive market growth. The increasing popularity of functional foods and dairy-based nutritional products further supports demand for lactase enzymes in Germany.

France Lactase in Food and Beverage Application Market Insight

France lactase in food and beverage application market is experiencing steady expansion, fueled by the country's deep-rooted dairy culture and growing demand for lactose-free and digestive-friendly food and beverages. French manufacturers are increasingly incorporating lactase enzymes to develop innovative dairy products catering to health-focused consumers, with notable growth in yogurt, milk, and cheese segments. Rising health awareness and a preference for premium, clean-label dairy offerings are accelerating market growth in France.

U.K. Lactase in Food and Beverage Application Market Insight

U.K. lactase in food and beverage application market is projected to witness robust growth, driven by a combination of growing health concerns, increased lactose intolerance diagnoses, and rising demand for dairy alternatives. The expanding market for lactose-free milk, yogurt, and ready-to-drink products reflects the U.K.'s evolving dietary trends. Retailer emphasis on health and wellness, alongside strong marketing campaigns by dairy brands, continues to bolster lactase adoption in food and beverage applications across the U.K.

Which Region is the Fastest Growing Region in the Lactase in Food and Beverage Application Market?

Asia-Pacific lactase in food and beverage application market is expected to grow at the fastest CAGR of 12.9% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and growing dairy consumption in countries such as China, India, Japan, and Southeast Asia. Increasing consumer awareness of lactose intolerance, coupled with government initiatives promoting nutrition and dairy innovation, is expanding demand for lactase enzymes across the region. The rise of dairy product diversification and the development of affordable lactose-free options are further accelerating market growth in APAC.

China Lactase in Food and Beverage Application Market Insight

China lactase in food and beverage application market captured the largest revenue share within Asia-Pacific in 2024, fueled by rapid urban development, a growing middle-class population, and strong demand for functional and digestive health-focused dairy products. China's status as a key dairy manufacturing hub, combined with rising consumer preference for lactose-free milk and yogurt, continues to support substantial growth in lactase enzyme adoption.

India Lactase in Food and Beverage Application Market Insight

India lactase in food and beverage application market is witnessing rapid growth, supported by increasing dairy consumption, rising health awareness, and growing concerns over digestive health. Government initiatives promoting nutrition, coupled with expanding availability of lactose-free products, are driving market penetration. India's large lactose-intolerant population and rising disposable incomes further support lactase demand across milk, yogurt, and dairy alternative segments.

Japan Lactase in Food and Beverage Application Market Insight

Japan lactase in food and beverage application market is expanding steadily, driven by an aging population, heightened digestive health awareness, and strong demand for functional dairy offerings. Japan's innovative food processing industry and consumer focus on health and wellness are accelerating lactase adoption, particularly in milk, yogurt, and probiotic product categories. The integration of digestive health solutions into everyday diets continues to bolster lactase market growth across Japan.

Which are the Top Companies in Lactase in Food and Beverage Application Market?

The lactase in food and beverage application industry is primarily led by well-established companies, including:

- Chr. Hansen Holding A/S (Denmark)

- Kerry Inc. (Ireland)

- DSM (Netherlands)

- Novozymes (Denmark)

- Merck KGaA (Germany)

- DuPont (U.S.)

- Senson (China)

- Amano Enzyme Inc. (Japan)

- Advanced Enzyme Technologies (India)

- ENMEX (Mexico)

- Antozyme Biotech Pvt Ltd (India)

- Nature BioScience Pvt. L.T.D. (India)

- Aumgene Biosciences (India)

- Creative Enzymes (U.S.)

- Biolaxi Corporation (India)

- Novact Corporation (India)

- Enzyme Bioscience Private Limited (India)

- Infinita Biotech Private Limited (India)

- Rajvi Enterprise (India)

- Mitushi Biopharma (India)

What are the Recent Developments in Global Lactase in Food and Beverage Application Market?

- In May 2023, dsm-firmenich unveiled Maxilact Next, promoted as the fastest-acting pure lactase enzyme available in the market, designed to improve the production efficiency of lactose-free dairy products. This launch strengthens the company’s leadership in high-performance enzyme solutions catering to the growing lactose-free dairy demand

- In June 2022, Koninklijke DSM N.V. (Netherlands) announced its merger with Firmenich (Denmark), a global leader in fragrance and flavor innovation, aiming to enhance its market presence in nutrition, wellness, and beauty segments. This strategic merger, expected to be completed by 2023, positions the company to expand its capabilities across the lactase enzyme and broader ingredient markets

- In February 2022, Kerry Group plc. (Ireland) completed the acquisition of c-LEcta (Germany), a biotechnology innovator specializing in enzyme production through precision fermentation and bioprocessing. This acquisition is expected to accelerate Kerry’s entry and growth in the global lactase enzyme market

- In November 2021, Chr. Hansen Holding A/S (Denmark) introduced Sweety Y-3, a next-generation enzyme solution that reduces added sugar in yogurt while enhancing its natural sweetness without compromising product quality. This launch strengthens the company’s position in the lactase enzyme market and aligns with the growing demand for healthier dairy alternatives

- In June 2021, IFF rolled out an innovative lactase enzyme developed specifically for milk and neutral dairy products to help North American dairy manufacturers meet rising consumer demand for lactose-free offerings. This product launch reinforces IFF’s commitment to supporting the evolving needs of the dairy industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Lactase In Food And Beverage Application Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Lactase In Food And Beverage Application Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Lactase In Food And Beverage Application Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.