Global Label Printer Market

Market Size in USD Million

CAGR :

%

USD

558.72 Million

USD

1,101.10 Million

2024

2032

USD

558.72 Million

USD

1,101.10 Million

2024

2032

| 2025 –2032 | |

| USD 558.72 Million | |

| USD 1,101.10 Million | |

|

|

|

|

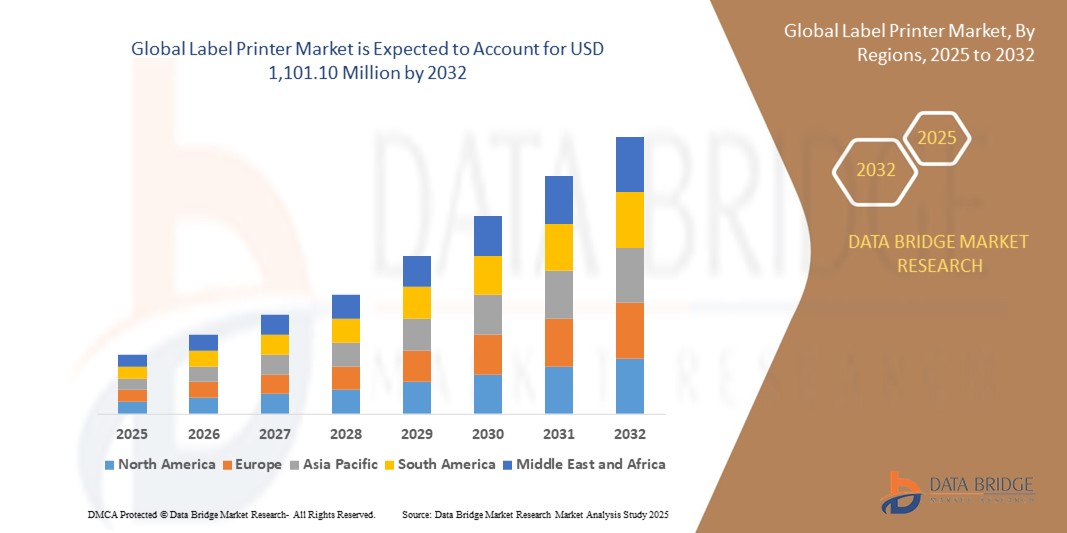

What is the Global Label Printer Market Size and Growth Rate?

- The global label printer market size was valued at USD 558.72 million in 2024 and is expected to reach USD 1,101.10 million by 2032, at a CAGR of 8.85% during the forecast period

- The label printer market is experiencing rapid advancement driven by the latest methods and technologies. Innovations such as RFID integration, mobile connectivity, and enhanced durability are reshaping industry standards

- This growth is fueled by increasing demand across retail, healthcare, and logistics sectors, where efficient labeling solutions play a critical role in operations and customer service.

What are the Major Takeaways of Label Printer Market?

- The label printer market is experiencing significant growth driven by the expanding e-commerce, retail, and logistics sectors. Businesses increasingly rely on efficient barcode labeling to streamline inventory management and shipment tracking processes

- For instance, e-commerce giants such as Amazon utilize advanced label printers to generate and apply unique barcodes swiftly, ensuring accurate tracking from warehouse shelves to customers' doorsteps. This demand surge underscores the critical role of label printers in supporting seamless operations and logistics efficiency

- North America dominated the Label Printer market with the largest revenue share of 33.25% in 2024, driven by robust demand across retail, manufacturing, and logistics sectors. The region’s emphasis on automation, compliance labeling, and efficient supply chain operations is propelling widespread use of Label Printers in various industrial and commercial applications

- Asia-Pacific Label Printer market is poised to grow at the fastest CAGR of 11.6% from 2025 to 2032, driven by increasing industrialization, infrastructure development, and digital transformation in emerging economies

- The Desktop Type segment dominated the Label Printer market with the largest market revenue share of 45.6% in 2024, driven by widespread adoption in small businesses, offices, and retail environments due to its compact size and cost-efficiency

Report Scope and Label Printer Market Segmentation

|

Attributes |

Label Printer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Label Printer Market?

“Enhanced Convenience through AI and Voice Integration”

- A key and accelerating trend in the global label printer market is the integration of artificial intelligence (AI) and voice assistant technologies such as Amazon Alexa, Google Assistant, and Apple Siri. These integrations offer users enhanced convenience, real-time customization, and remote accessibility for label printing tasks

- For instance, Brother’s Voice-Controlled Label Printers enable users to print labels using simple voice commands, boosting productivity in office and warehouse settings. Similarly, DYMO Connect allows users to design and print labels from their smartphone, integrating with voice assistant systems for added ease

- AI-powered label printers can analyze past usage patterns, suggest label templates, or even automate recurring tasks such as inventory tagging or barcode generation. This is especially valuable in commercial sectors, where intelligent automation can save time and reduce labeling errors

- These innovations align with broader smart workspace ecosystems, where label printers seamlessly interact with inventory systems, CRMs, and cloud platforms. Centralized control through voice commands enhances workflow in both homes and business environments

- Manufacturers such as Zebra Technologies are developing AI-enabled label printers that support predictive maintenance, real-time diagnostics, and seamless software integration, transforming traditional label printing into a fully smart and connected process

- This evolution is reshaping user expectations, driving demand for intelligent, connected, and voice-operable label printing solutions across retail, healthcare, logistics, and personal use

What are the Key Drivers of Label Printer Market?

- The expanding e-commerce and logistics sector, along with rising demand for efficient inventory and asset tracking, are primary growth drivers for the Label Printer market. Barcode and shipping label needs in warehouses and delivery operations have increased significantly post-pandemic

- In March 2024, Zebra Technologies launched a next-gen RFID label printer aimed at improving real-time tracking accuracy for supply chain environments, underlining the rising role of intelligent labeling in logistics

- In addition, the growing demand for product personalization and branding, especially among small businesses, is fueling demand for desktop and mobile label printers. Sectors such as food & beverage, cosmetics, and clothing heavily rely on attractive and customized labeling solutions

- The rise in regulatory requirements in industries such as pharmaceuticals and food packaging also drives adoption, where compliance-ready printers ensure accurate labeling, expiry tracking, and traceability

- Moreover, the trend toward compact, wireless, and mobile printers is broadening consumer reach. Small-scale entrepreneurs, home offices, and hobbyists are adopting label printers for DIY crafts, address labeling, and retail packaging

Which Factor is challenging the Growth of the Label Printer Market?

- One major challenge in the label printer market is the high cost of advanced label printers, especially those with thermal transfer, RFID capability, or cloud-based software integration. For small businesses and consumers, the upfront investment may be a deterrent compared to basic printing alternatives

- For instance, entry-level thermal printers are affordable, but industrial-grade RFID printers from brands such as Honeywell or TSC can be cost-prohibitive for budget-conscious users, limiting penetration in price-sensitive markets

- In addition, compatibility and software limitations can hinder user adoption. Many label printers require proprietary software or apps, which may not integrate well with third-party systems. This leads to frustration, especially for users managing multiple devices or platforms

- The environmental impact of label waste and the use of non-recyclable label materials also raise sustainability concerns. As global regulatory frameworks tighten, companies will need to invest in eco-friendly labels, recyclable cartridges, and energy-efficient printing technologies

- Addressing these hurdles through cost-effective models, open-source integrations, and sustainable innovations will be critical to unlocking the full growth potential of the global Label Printer market

How is the Label Printer Market Segmented?

The market is segmented on the basis of type, technology, application, and end-user.

• By Type

On the basis of type, the Label Printer market is segmented into Desktop Type, Industrial Type, and Portable/Mobile Type. The Desktop Type segment dominated the Label Printer market with the largest market revenue share of 45.6% in 2024, driven by widespread adoption in small businesses, offices, and retail environments due to its compact size and cost-efficiency. Desktop label printers are commonly used for shipping labels, product packaging, and barcoding, making them essential in day-to-day operations across various industries.

The Portable/Mobile Type segment is anticipated to witness the fastest growth rate of 20.4% from 2025 to 2032, fueled by increasing demand in field services, logistics, and warehousing. These printers enable on-the-go labeling with wireless connectivity, improving efficiency in fast-paced, decentralized operations.

• By Technology

On the basis of technology, the Label Printer market is segmented into Thermal, Direct Thermal, Inkjet, and Laser. The Thermal segment held the largest market revenue share in 2024, driven by its cost-effectiveness, durability, and suitability for high-volume printing needs, particularly in retail, logistics, and food packaging sectors. Thermal printers require minimal maintenance and are compatible with barcode systems, making them a preferred choice for industrial and commercial use.

The Inkjet segment is expected to witness the fastest CAGR from 2025 to 2032, owing to rising demand for high-resolution color printing in custom label production. Inkjet printers are widely adopted in food & beverage and cosmetics industries, where branding and visual appeal are essential.

• By Application

On the basis of application, the Label Printer market is segmented into Specialty, Organic and Gourmet Foods and Beverages, Wineries, Breweries and Distilleries, Cosmetics and Personal Care Products, Private Labelling, and Other. The Specialty, Organic and Gourmet Foods and Beverages segment accounted for the largest market revenue share in 2024, driven by the growing consumer preference for artisanal and health-focused products. Label printers help in branding and regulatory compliance through customized, attractive packaging.

The Wineries, Breweries and Distilleries segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the surge in craft beverage producers globally who require small-batch, high-quality labels with unique designs and traceability features.

• By End-User

On the basis of end-user, the Label Printer market is segmented into Construction Materials, Manufacturing, Warehousing, Retail, Transportation and Logistics, and Cement and Lime. The Transportation and Logistics segment dominated the market in 2024, holding the largest market revenue share of 37.1%, owing to the increasing need for real-time tracking, shipping labels, and inventory control across distribution channels.

The Warehousing segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rapid expansion of e-commerce and third-party logistics providers. Label printers play a critical role in improving warehouse efficiency, item tracking, and workflow automation.

Which Region Holds the Largest Share of the Label Printer Maret?

- North America dominated the Label Printer market with the largest revenue share of 33.25% in 2024, driven by robust demand across retail, manufacturing, and logistics sectors. The region’s emphasis on automation, compliance labeling, and efficient supply chain operations is propelling widespread use of Label Printers in various industrial and commercial applications

- Enterprises across the U.S. and Canada are increasingly adopting label printing solutions to meet the rising demand for customized packaging and inventory tracking, especially in e-commerce

- Technological advancements, such as mobile label printing and wireless connectivity, paired with high digital infrastructure and enterprise IT investments, continue to reinforce the region’s leading market position

U.S. Label Printer Market Insight

U.S. Label Printer market captured the largest revenue share in 2024 within North America, driven by the proliferation of smart logistics, e-commerce fulfillment centers, and warehousing operations. Businesses across sectors are turning to Label Printers for efficient barcode labeling, inventory management, and compliance with shipping regulations. In addition, the rise of private labeling and the demand for sustainable packaging in the food and beverage and retail industries are accelerating market growth.

Europe Label Printer Market Insight

Europe Label Printer market is projected to grow at a substantial CAGR over the forecast period, supported by strong industrial automation trends and the need for traceability and compliance across supply chains. Growing demand for high-resolution and eco-friendly label printing in the cosmetics, wine, and organic food sectors is further boosting adoption. European manufacturers and retailers are embracing innovative label printing technologies to enhance brand appeal and ensure transparency in product labeling.

U.K. Label Printer Market Insight

The U.K. Label Printer market is anticipated to grow at a notable CAGR, bolstered by increasing digitization of logistics and the growth of e-commerce. Businesses are prioritizing automation of labeling tasks to improve warehouse efficiency and ensure regulatory compliance. The rising use of label printers in the pharmaceutical and specialty food sectors, along with the growth of small-scale private labeling, continues to drive the market forward.

Germany Label Printer Market Insight

The Germany Label Printer market is expected to expand at a considerable CAGR, driven by the country's industrial strength and advanced manufacturing sector. German enterprises prioritize high-speed, durable, and precise labeling systems to support production and logistics. Sustainability is a key trend, prompting demand for eco-friendly inks and recyclable label materials, particularly in the packaging of consumer goods.

Which Region is the Fastest Growing Region in the Label Printer Market?

Asia-Pacific Label Printer market is poised to grow at the fastest CAGR of 11.6% from 2025 to 2032, driven by increasing industrialization, infrastructure development, and digital transformation in emerging economies. The rise of e-commerce, retail expansion, and government-led digital labeling regulations in countries such as China, India, and Southeast Asia are fueling market demand. In addition, the growing presence of label printer manufacturing facilities in the region is enhancing affordability and accessibility of products.

Japan Label Printer Market Insight

The Japan Label Printer market is gaining traction due to the country’s focus on smart factories and automation. High precision and compact label printing technologies are in strong demand in the electronics, healthcare, and automotive sectors. Japan’s aging workforce is also prompting industries to invest in efficient, easy-to-use labeling solutions, boosting adoption of both mobile and desktop printers.

China Label Printer Market Insight

The China Label Printer market held the largest market share in the Asia-Pacific region in 2024, driven by rapid urbanization, booming e-commerce, and advancements in smart manufacturing. Domestic producers are offering competitively priced label printers tailored for retail, logistics, and industrial applications. Government-backed smart city initiatives and investments in digital infrastructure are further accelerating the adoption of automated labeling systems in China.

Which are the Top Companies in Label Printer Market?

The label printer industry is primarily led by well-established companies, including:

- Afinia Label (U.S.)

- Primera Technology (U.S.)

- Epson India Pvt Ltd. (Japan)

- Allen Datagraph Systems, LLC (U.S.)

- VALLOY (South Korea)

- Electronics For Imaging, Inc. (U.S.)

- Domino Printing Sciences plc (U.K.)

- FUJIFILM Corporation (Japan)

- Gallus (Switzerland)

- HP Development Company, L.P. (U.S.)

- Honeywell International Inc. (U.S.)

- TSC Auto ID Technology Co., Ltd. (Taiwan)

What are the Recent Developments in Global Label Printer Market?

- In September 2024, DNP introduced two advanced thermal transfer ink ribbons globally, namely the R380, which enhances alcohol resistance for barcode and 2D code printing on tags and labels, and the V670, designed for high-quality printing on both plastic and paper food packaging, ideal for marking dates and production numbers. This product launch reinforces DNP’s focus on high-performance printing solutions for diverse labeling applications

- In April 2023, Barcodes, Inc. partnered with SVT Robotics to streamline the deployment of its autonomous mobile robot (AMR) portfolio across manufacturing and warehouse operations, aiming to accelerate automation integration and achieve faster return on investment (ROI). SVT’s low-code platform enables rapid and simplified connection of various robotic and automation systems. This collaboration enhances operational efficiency and supports the growing shift towards warehouse automation

- In January 2022, MUTOH America unveiled the XpertJet 1341SR Pro, a next-generation eco-solvent roll-to-roll printer featuring AccuFine print head, VerteLith RIP software, and i-screen technology. A standout feature includes a built-in media tracker that prints a barcode at the media's end, allowing the printer to identify remaining media on reload. This innovation promotes efficient media usage and reduces production downtime in large-scale printing operation

- In December 2021, FloBiz launched myBillBook, a comprehensive POS billing platform designed for retailers and franchises, integrating barcode generation and printing for individual sales. It also supports barcode scanning and facilitates contactless transactions, aligning with modern hygiene and safety standards. This launch reflects the growing need for secure, digitized, and touch-free transaction experiences in retail environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Label Printer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Label Printer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Label Printer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.