Global Label Adhesive Market

Market Size in USD Billion

CAGR :

%

USD

53.20 Billion

USD

75.94 Billion

2024

2032

USD

53.20 Billion

USD

75.94 Billion

2024

2032

| 2025 –2032 | |

| USD 53.20 Billion | |

| USD 75.94 Billion | |

|

|

|

|

Label Adhesive Market Size

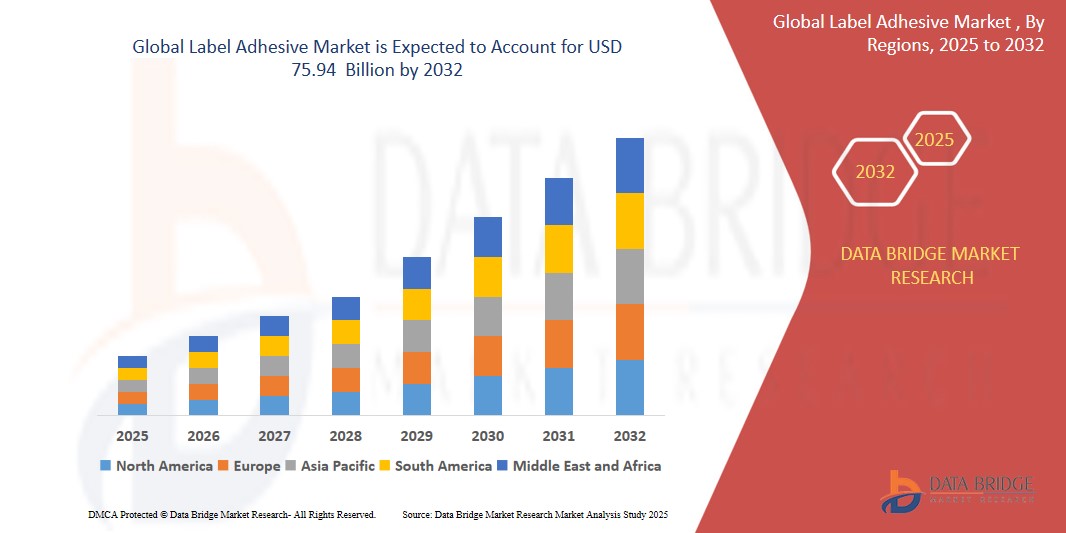

- The global Label Adhesive market was valued at USD 53.20 billion in 2024 and is expected to reach USD 75.94 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.60%, primarily driven by the Rise in the technological advancements

- This growth is driven by factors such as the usage of permanent label adhesives, increase in the shift in preference to hot melt adhesives encouraging small players, increase in the government regulations pertaining to food safety

Label Adhesive Market Analysis

- Label Adhesives are vital bonding agents used in a wide array of industries such as packaging, food & beverages, pharmaceuticals, logistics, and personal care. These adhesives ensure secure label attachment on diverse surfaces including plastics, glass, metal, and paper, enabling traceability, branding, and regulatory compliance.

- The demand for label adhesives is significantly driven by the rapid growth in e-commerce, increasing urban consumption of packaged goods, and stringent labeling requirements in food and healthcare sectors. Nearly 60% of the global label adhesive demand is attributed to pressure-sensitive adhesives used in packaging and shipping labels, especially in fast-moving consumer goods (FMCG).

- The Asia-Pacific region stands out as the dominant region for Label Adhesives, fueled by the booming manufacturing sector, rising middle-class consumption, and expanding pharmaceutical and logistics networks

- For instance, China and India have witnessed a surge in both domestic and export-driven packaging needs. Coupled with government support for industrial expansion and sustainability initiatives, Asia-Pacific not only consumes the highest volume of label adhesives but is also becoming a hub for adhesive technology innovation and production

- Globally, label adhesives are considered one of the top three essential consumables in the packaging and labeling value chain, following label materials and printing inks. They play a pivotal role in ensuring product integrity, brand identity, and regulatory compliance across diverse end-use industries.

Report Scope and Label Adhesive Market Segmentation

|

Attributes |

Label Adhesive Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Label Adhesive Market Trends

“Increased Adoption of Smart Labeling and Digital Integration”

- One prominent trend in the global Label Adhesive market is the growing adoption of smart labeling technologies and digital integration throughout packaging and supply chains.

- These innovations enhance traceability, authentication, and real-time tracking, especially in industries like pharmaceuticals, food & beverage, and logistics. Smart labels often require adhesives that can withstand a range of environmental conditions and still function flawlessly with RFID, NFC, and QR technologies.

- For instance, RFID-integrated labels used in cold chain logistics or pharma packaging need specialized adhesives that perform under fluctuating temperatures and moisture levels without affecting signal integrity.

- Digital integration also enables brands to collect and analyze consumer behavior, manage inventory better, and improve logistics efficiency—all of which drive demand for more precise, functional adhesive solutions.

- This trend is transforming the role of label adhesives from simple bonding agents to crucial enablers of intelligent packaging, opening new avenues for product differentiation and operational excellence.

Label Adhesive Market Dynamics

Driver

“Growing Demand Driven by E-commerce and FMCG Growth”

- The surge in e-commerce, along with the expansion of fast-moving consumer goods (FMCG) and retail sectors, is significantly driving the demand for label adhesives globally.

- As more products require packaging and labeling for identification, branding, and traceability, the use of label adhesives in logistics, food and beverage, healthcare, and cosmetics has risen substantially.

- Pressure-sensitive adhesives (PSAs) are the most widely used due to their ease of application and strong bonding properties across various substrates.

- In addition, regulations mandating product labeling for safety, traceability, and consumer information have further fueled the need for reliable adhesive technologies.

For instance,

- In 2025, exponential growth in global parcel shipments — estimated to surpass 200 billion annually by 2025 — reflects the critical role of adhesives in logistics and labeling operations. This demand is particularly strong in Asia-Pacific and North America, where e-commerce penetration is highest

Opportunity

“Rising Demand for Sustainable and Bio-Based Adhesives”

- Environmental sustainability is emerging as a major focus across the packaging and labeling industry. As companies and governments work to reduce carbon footprints and plastic waste, there is growing demand for bio-based, compostable, and recyclable label adhesives.

- Adhesive manufacturers now have the opportunity to lead innovation in this space by developing formulations that meet green packaging standards without compromising performance.

- Additionally, water-based and solvent-free adhesives are gaining traction due to lower VOC emissions and regulatory compliance.

For instance,

- In January 2025, major players like UPM Raflatac and Avery Dennison have launched eco-friendly adhesive technologies that support circular economy initiatives. Such innovations create an opportunity for suppliers to align with the sustainability goals of large FMCG and pharmaceutical brands.

Restraint/Challenge

“Volatility in Raw Material Prices and Supply Chain Disruptions”

- One of the key challenges in the label adhesive market is the volatile pricing and limited availability of key raw materials, such as acrylates, rubber-based resins, and solvents.

- These materials are subject to fluctuations due to factors like crude oil prices, geopolitical tensions, and regulatory constraints, which can directly impact manufacturing costs and profit margins.

- The situation is exacerbated by global supply chain disruptions and logistical delays, which can hinder timely product availability and strain supplier-client relationships.

For instance,

- In November 2023, many adhesive manufacturers faced delays and cost surges due to shortages of ethylene-vinyl acetate (EVA) and acrylics — core components of label adhesives. These issues have compelled companies to reassess sourcing strategies and consider localizing production to enhance resilience.

Label Adhesive Market Scope

The market is segmented on the basis Technology, Substrate Type, Process, Application,

|

Segmentation |

Sub-Segmentation |

|

By Technology |

|

|

By Substrate Type |

|

|

By Process |

|

|

By Application

|

|

Label Adhesive Market Regional Analysis

“North America is the Dominant Region in the Label Adhesive Market”

-

North America leads the global label adhesive market, driven by strong demand from packaging, pharmaceuticals, food & beverages, and logistics sectors.

- The U.S. holds a substantial share due to its advanced manufacturing capabilities, strong regulatory frameworks for labeling, and high adoption of smart and sustainable packaging technologies.

- The region is also home to major label and adhesive manufacturers such as Avery Dennison and CCL Industries, which continue to invest in product innovation and eco-friendly adhesive technologies.

- Additionally, the rapid rise in e-commerce and retail logistics, especially post-pandemic, has driven higher consumption of pressure-sensitive and removable label adhesives used in inventory tracking and parcel shipping.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

-

The Asia-Pacific region is poised for the fastest growth in the label adhesive market, attributed to rapid industrialization, booming e-commerce, and expanding packaging sectors.

- Countries like China, India, and Southeast Asian nations are experiencing a surge in demand for label adhesives across food, pharmaceuticals, automotive, and logistics.

- China dominates in terms of volume, with its large-scale manufacturing and export-oriented packaging industry, while India is rapidly adopting sustainable and smart labeling technologies.

- Japan, on the other hand, focuses on technologically advanced adhesives used in high-performance electronics and premium consumer goods.

Label Adhesive Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, Technology dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- AVERY DENNISON CORPORATION (U.S.)

- CCL Industries (Canada)

- Multi-Color Corporation (U.S.)

- UPM-Kymmene (Finaland)

- Coveris Holdings S.A. (Austria)

- Torraspapel Adestor (Part of Lecta Group) (Spain)

- Fuji Seal International (Japan)

- Lintec (Japan)

- Americk Packaging Group (Ireland)

- Inland Label and Marketing Services (U.S.)

- C S Labels (U.K.)

- Secura Labels (U.K.)

- Hansol Paper Co (South Korea)

- Terragene (Argentina)

- BSP Labels (U.K.)

- Label Craft (Canada)

- Etiquette Labels (U.K.)

- Reflex Labels (U.K.)

- Muroll (Austria)

- SVS Spol S R.O. (Slovakia)

- Royston Labels (U.K.)

- Aztec Label (U.K.)

- Etis Slovakia, A.S. (Slovakia)

Latest Developments in Global Label Adhesive Market

- In March 2025, Avery Dennison Corporation announced the launch of its new bio-based hot melt adhesives under the CleanFlake™ technology platform, designed to improve recyclability in PET packaging. These adhesives enable clean label separation during the recycling process, helping brands meet global sustainability mandates.

- In February 2025, UPM Raflatac opened a new labelstock slitting and distribution terminal in India to strengthen its supply capabilities in South Asia. This move enhances local access to high-performance pressure-sensitive adhesives used in logistics, pharmaceuticals, and food packaging.

- In January 2025, CCL Industries acquired a specialty label adhesive manufacturer in Germany to expand its footprint in high-performance and sustainable adhesives across European markets. The acquisition supports its strategy to provide innovative, low-VOC adhesive solutions aligned with EU sustainability directives.

- In December 2024, Lintec Corporation announced the development of a new ultra-low migration label adhesive for pharmaceutical and medical packaging applications. The product meets stringent safety standards for drug labeling, minimizing the risk of adhesive migration into sensitive pharmaceutical substances.

- In November 2024, Multi-Color Corporation (MCC) partnered with SABIC to co-develop recyclable label adhesives using certified circular polymers. The partnership focuses on reducing the environmental footprint of packaging and improving the recyclability of multi-layer label structures.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Label Adhesive Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Label Adhesive Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Label Adhesive Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.