Global L Citrulline Market

Market Size in USD Billion

CAGR :

%

USD

1.69 Billion

USD

2.54 Billion

2024

2032

USD

1.69 Billion

USD

2.54 Billion

2024

2032

| 2025 –2032 | |

| USD 1.69 Billion | |

| USD 2.54 Billion | |

|

|

|

|

L-citrulline market Size

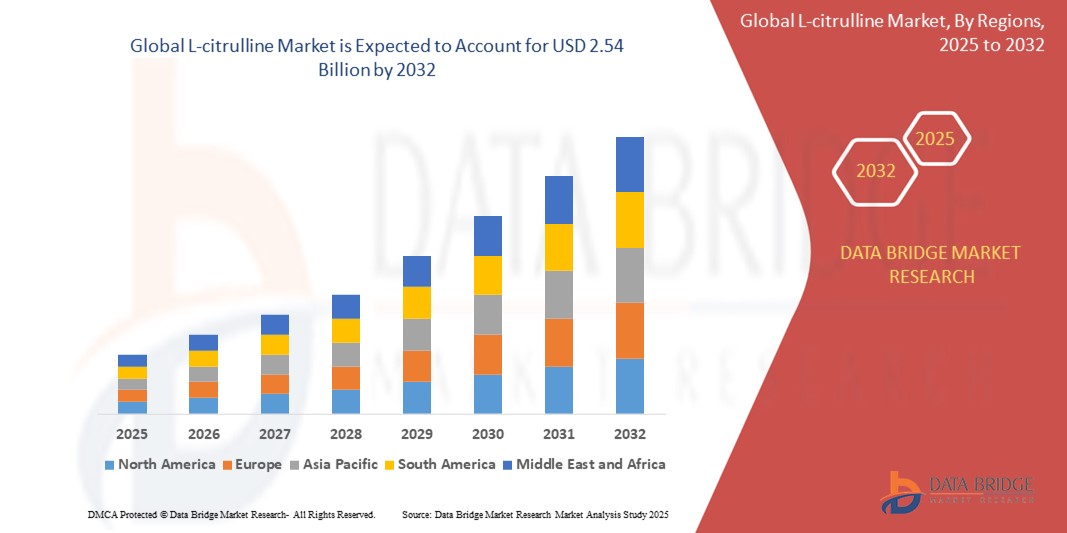

- The Global l-citrulline market size was valued at USD 1.69581 Billion in 2024 and is expected to reach USD 2.54 Billion by 2032, at a CAGR of 5.2% during the forecast period

- The market growth is primarily driven by the increasing consumer focus on physical fitness, muscle recovery, and enhanced athletic performance, which is fueling demand for L-citrulline supplements across sports nutrition and health & wellness sectors

- Moreover, the growing popularity of pre-workout formulations, combined with rising awareness of L-citrulline’s role in nitric oxide production and improved blood flow, is encouraging product development and functional innovation. These dynamics are accelerating the expansion of the L-citrulline market, particularly within the nutraceutical and dietary supplement industries

L-citrulline market Analysis

- L-citrulline, a non-essential amino acid known for enhancing nitric oxide production and promoting better blood flow, is gaining significant traction across sports nutrition, bodybuilding, and wellness sectors due to its benefits in improving exercise performance and reducing muscle fatigue

- The escalating demand for L-citrulline is primarily driven by growing health consciousness, increasing participation in endurance and high-intensity training activities, and rising preference for performance-enhancing supplements among athletes, fitness enthusiasts, and aging populations

- North America dominates the L-citrulline market with the largest revenue share of 40.01% in 2024, supported by a strong sports supplement industry, high consumer awareness regarding workout recovery aids, and a robust distribution network of health and wellness retailers. The U.S. leads the market, driven by increasing demand for nitric oxide boosters and pre-workout formulations

- Asia-Pacific is projected to be the fastest-growing region in the L-citrulline market during the forecast period, fueled by increasing disposable incomes, urban fitness trends, expanding gym culture, and a surge in e-commerce platforms offering nutritional supplements

- The powder segment dominates the L-citrulline market with a market share of 43.2% in 2024, owing to its flexibility in dosage customization, faster absorption rates, and widespread use in pre-workout blends favored by both amateur and professional athletes

Report Scope and L-citrulline market Segmentation

|

Attributes |

L-citrulline Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

L-citrulline market Trends

“Formulation Innovation and Bioavailability Enhancement”

- A significant and accelerating trend in the global L-citrulline market is the growing focus on formulation innovation and enhancement of bioavailability to maximize performance outcomes and consumer benefits. Manufacturers are increasingly investing in advanced delivery systems and synergistic ingredient blends to differentiate their products and meet the evolving expectations of health-conscious consumers.

- For example, leading supplement brands are combining L-citrulline with malate (L-citrulline malate) to improve endurance and reduce muscle fatigue, while also exploring encapsulation technologies and sustained-release formats to improve absorption and prolong nitric oxide production. These innovations are especially appealing in the pre-workout and endurance training segments.

- Enhanced bioavailability solutions, including micronized powders and liposomal delivery systems, are being developed to improve the efficiency of L-citrulline uptake in the body. Such innovations are crucial for athletes and fitness enthusiasts seeking fast-acting and long-lasting effects for peak performance and recovery.

- In parallel, clean-label and vegan-friendly formulations are gaining momentum, with manufacturers increasingly utilizing plant-based capsules and avoiding artificial additives to align with rising consumer preferences for transparency and natural ingredients.

- Sustainability is also becoming a growing consideration, with companies seeking eco-conscious sourcing of raw materials and recyclable packaging to meet environmental goals and consumer values.

- This shift toward performance-optimized, bioavailable, and ethically formulated products is reshaping the competitive dynamics of the market. Brands that embrace advanced formulation technologies and sustainable practices are positioned to capture expanding opportunities across sports nutrition, wellness, and therapeutic supplement categories

L-citrulline market Dynamics

Driver

“Rising Demand Driven by Athletic Performance, Muscle Recovery, and Pre-Workout Supplementation”

- The increasing emphasis on physical fitness, sports performance, and active lifestyles is a major driver of the growing demand for L-citrulline across global consumer health and sports nutrition markets. Athletes, bodybuilders, and fitness enthusiasts are turning to L-citrulline to enhance endurance, improve blood flow, and accelerate muscle recovery.

- For instance, in January 2024, Kaged Muscle expanded its portfolio with a new pre-workout formulation featuring clinical doses of L-citrulline malate, aiming to meet the needs of competitive athletes seeking improved vascularity and reduced exercise fatigue. Such innovations reflect the market’s responsiveness to performance-focused supplementation.

- L-citrulline’s role as a precursor to L-arginine and nitric oxide production makes it essential in promoting better oxygen delivery to muscles during high-intensity exercise, reinforcing its adoption in pre- and intra-workout supplements.

- The growing popularity of evidence-backed, amino acid-based supplements among both recreational and professional users is contributing to a surge in demand, particularly for clean-label and high-potency formulations that deliver noticeable performance outcomes.

- Moreover, consumers are increasingly seeking natural alternatives to synthetic enhancers, positioning L-citrulline as a preferred choice in formulating plant-based and stimulant-free performance products.

- This trend is further supported by the rise of gym culture, personal training, and wellness influencers promoting functional ingredients for strength, stamina, and recovery, solidifying L-citrulline’s status as a core ingredient in next-generation sports supplements

Restraint/Challenge

“High Ingredient Costs and Intense Competition in Established Markets”

- The relatively high cost of producing high-purity L-citrulline, especially pharmaceutical- and nutraceutical-grade variants, presents a significant barrier to wider adoption in price-sensitive markets. Advanced extraction, purification, and formulation processes drive up production expenses, which are ultimately reflected in the retail pricing of supplements.

- For instance, premium L-citrulline-based pre-workout products from brands such as NutraBio and Kaged Muscle often retail at a higher price point due to clinical dosing, clean-label standards, and third-party testing—factors that can limit affordability for entry-level consumers or price-sensitive demographics.

- In mature regions such as North America and Western Europe, the L-citrulline market faces saturation due to a high concentration of established brands, widespread product availability, and a well-informed customer base. This saturation leads to intensified competition, margin pressures, and slower growth in new customer acquisition.

- Furthermore, many consumers remain unaware of the differences between L-citrulline and other amino acids like L-arginine or citrulline malate, leading to confusion and diluted brand differentiation. This lack of consumer education hinders demand growth in mass-market segments.

- Overcoming these challenges requires not only competitive pricing strategies and differentiated product positioning, but also increased investment in marketing, consumer education, and innovative formulations that clearly communicate the unique benefits and superior bioavailability of L-citrulline

L-citrulline market Scope

The market is segmented on the basis of type, price range, and classification.

- Application

On the basis of application, the L-citrulline market is segmented into Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Agriculture/Animal Feed, and Others

The Pharmaceuticals segment dominates the market with the largest revenue share of 38.2% in 2024, driven by increasing demand for L-citrulline in clinical nutrition, cardiovascular health supplements, and sports medicine formulations. L-citrulline’s proven benefits in enhancing nitric oxide production and improving blood circulation are contributing to its widespread use in therapeutic applications targeting hypertension, erectile dysfunction, and muscle fatigue

- By Price Range

On the basis of type, the L-citrulline market is segmented into Powder and Crystal

The Powder segment dominates the market with the largest revenue share of 56.4% in 2024, driven by its widespread use in sports nutrition and fitness supplements. Powdered L-citrulline is favored for its ease of mixing, fast absorption, and customizable dosing, making it a preferred choice for athletes, bodybuilders, and health-conscious consumers seeking performance-enhancing and recovery-focused formulations. Leading brands such as NutraBio, BulkSupplements, and Kaged Muscle offer high-purity L-citrulline powders that are often incorporated into pre-workout blends and endurance support products

- By Classification

On the basis of classification, the L-citrulline market is segmented into Food Grade and Medical Grade

The Medical Grade segment held the largest market revenue share in 2024, driven by its extensive use in clinical and therapeutic applications, including cardiovascular health, erectile dysfunction treatment, and recovery supplements for athletes and post-surgical patients. Medical grade L-citrulline is subject to stringent purity standards and regulatory compliance, making it suitable for pharmaceutical formulations and evidence-based nutraceuticals

L-citrulline market Regional Analysis

- North America dominates the L-citrulline market with the largest revenue share of 33.0% in 2024, driven by growing demand for dietary supplements, functional foods, and sports nutrition products. The region benefits from a strong fitness culture, high consumer awareness, and well-developed healthcare and e-commerce infrastructures

- Consumers in North America prioritize scientifically backed health ingredients like L-citrulline, known for its role in improving blood flow, reducing fatigue, and enhancing physical performance. Widespread availability of premium nutraceuticals and strong presence of major market players further contribute to regional growth

U.S. L-citrulline market Insight

The U.S. L-citrulline market captured the largest revenue share of 80% within North America in 2024, fueled by the expanding sports and wellness industry, growing gym memberships, and increased prevalence of cardiovascular conditions. Heightened focus on performance nutrition and recovery supplements among athletes and aging adults drives demand. Moreover, the proliferation of e-commerce and specialty supplement retailers enhances product accessibility and customer engagement

Europe L-citrulline market Insight

The Europe L-citrulline market is projected to expand at a substantial CAGR of over 5.2% through 2032, driven by increasing health awareness, an aging population, and rising adoption of amino acid supplements in functional food and pharmaceuticals.

European consumers increasingly seek clean-label, vegan, and clinically validated ingredients, making L-citrulline a favorable choice. Key markets such as Germany, France, and the UK are leading the way in regulatory innovation and consumer education in the nutraceutical space

U.K. L-citrulline market Insight

The U.K. L-citrulline market is anticipated to grow at a noteworthy CAGR, supported by rising trends in active lifestyles, dietary supplementation, and preventive healthcare. Demand is particularly strong among fitness-focused millennials and the aging population seeking natural support for energy, circulation, and cardiovascular health. The U.K.'s robust online retail infrastructure and established supplement brands are facilitating steady expansion

Germany L-citrulline market Insight

The Germany L-citrulline market is expected to expand at a considerable CAGR, driven by growing consumer interest in clean-label and performance-enhancing products. Germany’s strong pharmaceutical and nutraceutical manufacturing base, combined with high regulatory standards and sustainability-driven innovation, positions the country as a key contributor to regional growth

Asia-Pacific L-citrulline market Insight

The Asia-Pacific L-citrulline market is poised to grow at the fastest CAGR of 5.7% from 2024 to 2032, driven by rapid urbanization, rising disposable incomes, and growing awareness of preventive health. The region’s expanding middle-class population is fueling demand for sports supplements, functional foods, and therapeutic amino acids across China, Japan, India, South Korea, and Australia.

Government initiatives promoting wellness and domestic nutraceutical production are improving market accessibility and affordability. Local players are also expanding product lines tailored to traditional preferences and emerging trends

Japan L-citrulline market Insight

The Japan L-citrulline market accounts for 40% of the Asia-Pacific market share in 2024, driven by the country’s aging population and strong demand for health supplements that support cardiovascular function, muscle health, and energy levels. The integration of L-citrulline in functional beverages and anti-fatigue formulations is on the rise, supported by Japan’s advanced pharmaceutical and food science sectors

China L-citrulline market Insight

The China L-citrulline market captured 30% of the Asia-Pacific market in 2024, fueled by growing consumer interest in sports nutrition, wellness, and functional ingredients. Increasing disposable incomes, improved healthcare access, and favorable government policies are supporting the growth of L-citrulline in both over-the-counter supplements and food applications. Domestic manufacturers are capitalizing on cost-effective production and growing regional exports to capture a broader customer base

L-citrulline market Share

The smart lock industry is primarily led by well-established companies, including:

- NutraBio Labs, Inc. (U.S.)

- Now Foods (U.S.)

- NutraBolt (U.S.)

- Swanson Health Products (U.S.)

- BulkSupplements.com (U.S.)

- Hikari Seiyaku Co., Ltd. (Japan)

- Glanbia plc (Ireland)

- Kaged Muscle (U.S.)

- Jarrow Formulas, Inc. (U.S.)

- Nutrabolt (U.S.)

- Evlution Nutrition (U.S.)

- Horny Goat Weed Inc. (U.S.)

- PrimaForce (U.S.)

- True Nutrition (U.S.)

- NutraKey (U.S.)

- GNC Holdings, LLC (U.S.)

- Allmax Nutrition Inc. (Canada)

- MyProtein (U.K.)

- Infinite Labs (U.S.)

Latest Developments in Global l-citrulline market

- In April 2025, Kyowa Hakko Bio Co., Ltd., a global leader in amino acid production, launched a new pharmaceutical-grade L-citrulline ingredient for clinical and therapeutic use. This highly purified formulation is tailored for cardiovascular and metabolic health applications, supporting the company’s expansion into regulated medical markets. The development reinforces Kyowa Hakko’s commitment to innovation and its leadership in the amino acid segment

- In March 2025, NutraBio Labs introduced a new vegan-certified, non-GMO L-citrulline powder under its sports nutrition portfolio. Designed for pre-workout and endurance formulations, the product offers a clean-label alternative for fitness enthusiasts seeking stimulant-free nitric oxide boosters. This launch addresses increasing consumer demand for transparency, plant-based supplements, and functional performance products

- In February 2025, NOW Foods, a prominent U.S.-based dietary supplement brand, expanded its L-citrulline product line with dual-layer tablets that offer extended-release benefits. The innovation aims to enhance sustained nitric oxide levels throughout physical activity, appealing to athletes and older adults alike. This strategic product enhancement positions NOW Foods to capitalize on the longevity and active aging trends in the nutraceutical industry

- In January 2025, Glanbia Nutritionals announced a strategic partnership with a leading South Korean distributor to expand the availability of its branded L-citrulline ingredients across the Asia-Pacific region. This collaboration enables localized market penetration and supports Glanbia’s growth strategy in emerging markets with rising interest in performance nutrition and clinical-grade amino acids

- In January 2025, PureBulk, Inc., an online bulk supplement provider, introduced a subscription-based direct-to-consumer model for its L-citrulline products. This move reflects evolving consumer preferences for convenience, cost-effectiveness, and personalized supplementation. The subscription service includes customizable dosages, educational resources, and loyalty incentives aimed at enhancing customer retention and engagement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global L Citrulline Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global L Citrulline Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global L Citrulline Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.