Global Kickboxing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

2.00 Billion

USD

2.85 Billion

2024

2032

USD

2.00 Billion

USD

2.85 Billion

2024

2032

| 2025 –2032 | |

| USD 2.00 Billion | |

| USD 2.85 Billion | |

|

|

|

|

Kickboxing Equipment Market Size

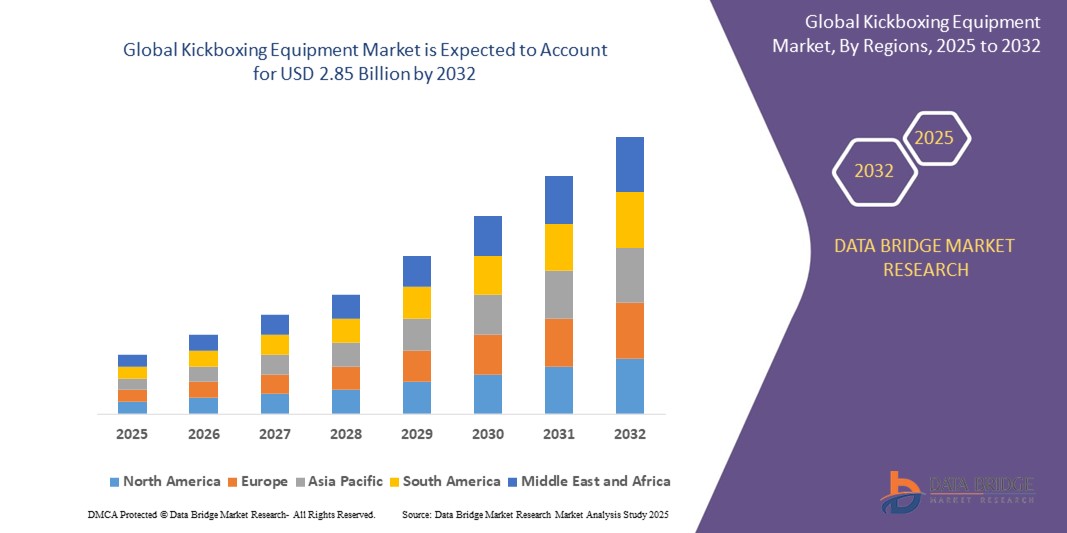

- The global kickboxing equipment market size was valued at USD 2.00 billion in 2024 and is expected to reach USD 2.85 billion by 2032, at a CAGR of 4.50% during the forecast period

- Market growth is primarily driven by increased fitness awareness, the rising popularity of combat sports, and growing participation in kickboxing as a fitness and competitive activity across both developed and emerging regions

- Furthermore, a surge in demand for high-quality, durable, and ergonomically designed gear for both amateur and professional athletes is significantly accelerating the adoption of advanced kickboxing equipment, positively impacting overall market expansion

Kickboxing Equipment Market Analysis

- Kickboxing Equipment, including gloves, protective gear, pads, and training accessories, plays a critical role in training, injury prevention, and performance enhancement, making it indispensable for fitness enthusiasts and athletes alike

- The growing inclination toward home fitness routines, expansion of combat sports training centers, and the influence of celebrity endorsements and fitness influencers are key factors contributing to the increased demand for kickboxing equipment

- In addition, advancements in material technology and the availability of customized, lightweight, and breathable gear are elevating user experience, further propelling market demand across individual, commercial, and institutional applications

- Asia-Pacific dominates the kickboxing equipment market with the largest revenue share of 41.3% in 2024, driven by a surge in fitness consciousness, rising disposable income, and increasing urbanization across countries such as China, Japan, and India.

- Asia-Pacific is expected to be the fastest growing region in the kickboxing equipment market during the forecast period driven by its cultural affinity for martial arts and growing awareness of the importance of fitness. This cultural backdrop fosters a robust demand for kickboxing gear, driving market dominance in the region

- The Gloves segment dominates the market with the largest revenue share of 43.7% in 2024, attributed to their fundamental role in both training and professional matches. Gloves are essential for protecting athletes' hands and preventing injuries, making them a non-negotiable purchase for all kickboxing participants

Report Scope and Kickboxing Equipment Market Segmentation

|

Attributes |

Kickboxing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Kickboxing Equipment Market Trends

“Increased Demand for High-Performance, Ergonomic, and Sustainable Gear”

- A key emerging trend in the global kickboxing equipment market is the growing demand for ergonomic, high-performance, and eco-friendly gear that enhances training efficiency and user comfort. Athletes and fitness enthusiasts are increasingly seeking equipment that offers superior protection, durability, and functionality, especially as kickboxing becomes more mainstream for fitness and competition

- For instance, Adidas AG’s December 2022 launch of technologically advanced kickboxing gloves and protective gear reflects the industry shift toward performance-boosting equipment designed with cutting-edge materials

- Sustainability is also gaining traction, with manufacturers exploring recyclable materials, non-toxic padding, and environmentally responsible production processes to meet consumer expectations

- In parallel, the focus on ergonomics and injury prevention has led to the development of gear with improved padding, wrist support, and moisture control, optimizing training comfort and safety

- Leading companies such as Fairtex and Combat Sports International are investing in R&D and athlete collaborations to design products that meet the evolving needs of both professional fighters and casual fitness users

- This trend toward high-performance, eco-conscious, and user-friendly gear is reshaping the competitive landscape, encouraging continuous innovation and expanding the global consumer base

Kickboxing Equipment Market Dynamics

Driver

“Rising Fitness Consciousness and Combat Sports Popularity”

- The increasing global focus on health, fitness, and self-defense is a major growth driver for the kickboxing equipment market. As more individuals turn to kickboxing for physical conditioning, stress relief, and personal empowerment, the demand for professional-grade training equipment is accelerating

- For instance, in April 2022, Fairtex partnered with the Muay Thai Grand Prix to launch co-branded equipment, aiming to boost the sport's visibility and attract a larger audience

- The expansion of fitness centers, martial arts academies, and online training platforms has further elevated kickboxing as a preferred discipline, fostering demand for high-quality gloves, protective gear, punching bags, and apparel

- In addition, endorsements from professional athletes, fitness influencers, and social media campaigns are driving awareness and inspiring consumer interest in kickboxing, fueling equipment sales across both developed and emerging markets

- As participation grows among women, youth, and recreational users, the market is seeing a surge in product customization, including gear designed for different body types and skill levels, reinforcing long-term growth potential

Restraint/Challenge

“Inconsistent Quality Standards and Price Sensitivity in Developing Markets”

- One of the key challenges in the kickboxing equipment market is the lack of universal quality and safety standards, which can lead to consumer confusion and varying levels of trust in product performance and durability

- In markets where regulatory oversight is limited, the influx of low-cost, substandard gear raises concerns about injury risks and product longevity, negatively affecting user experience and brand reputation

- For instance, consumer reviews frequently highlight issues such as poor stitching, inadequate padding, or inconsistent sizing in budget-oriented brands, which can deter repeat purchases

- In addition, price sensitivity, especially in developing countries, presents a barrier to premium product adoption. While top-tier brands offer technologically advanced and safe gear, their higher price points often place them out of reach for casual users or low-income customers

- Brands such as RDX Sports and Hayabusa Fightwear have responded by introducing affordable entry-level options without compromising essential quality, yet achieving a balance between cost and performance remains a challenge

- Addressing this issue will require better regulation, consumer education, and flexible pricing strategies to ensure broader access to safe and reliable kickboxing equipment worldwide

Kickboxing Equipment Market Scope

The market is segmented on the basis of product type, distribution channel, and application.

• By Product Type

On the basis of product type, the kickboxing equipment market is segmented into Gloves, Protective Gear, Hand Wraps, Punching Bags, Boxing Pads, Athletic Tapes, Clothing, Ankle/Knee/Elbow Wraps, Shin Guards, Mouth Guards, Hand Gear, Kettle Bell, and Others. The Gloves segment dominates the market with the largest revenue share of 43.7% in 2024, attributed to their fundamental role in both training and professional matches. Gloves are essential for protecting athletes' hands and preventing injuries, making them a non-negotiable purchase for all kickboxing participants. Their continuous demand is also supported by product innovations such as moisture-wicking materials, ergonomic padding, and smart sensor integration.

The Protective Gear segment is expected to witness the fastest CAGR of 6.4% from 2025 to 2032, driven by increasing safety awareness among athletes and regulatory emphasis on injury prevention. Products such as head guards, groin protectors, and body shields are seeing strong demand from training academies and sports institutions due to rising enrollment in kickboxing as a fitness and self-defense activity.

• By Distribution Channel

On the basis of distribution channel, the kickboxing equipment market is segmented into Sports Outlets, E-Commerce, and Other. The E-Commerce segment held the largest market revenue share of 47.5% in 2024, fueled by the convenience of online shopping, broader product availability, and the rise of fitness influencers and brand collaborations on digital platforms. Online channels offer consumers access to international brands and customer reviews, which significantly influence purchase decisions.

The Sports Outlets segment is anticipated to witness the fastest growth rate of 16.9% from 2025 to 2032, supported by in-store trials, brand promotions, and personalized product recommendations. Sports stores continue to attract customers looking for hands-on evaluation, expert advice, and immediate product availability.

• By Application

On the basis of application, the kickboxing equipment market is segmented into Individual, Commercial, and Institutional. The Individual segment accounted for the largest market revenue share of 51.3% in 2024, driven by growing consumer interest in personal fitness, home workouts, and self-defense training. Increased awareness about health, coupled with the proliferation of online training programs and home gym setups, has significantly boosted individual purchases.

The Commercial segment is projected to experience the fastest CAGR of 20.2% from 2025 to 2032, driven by the expansion of kickboxing studios, fitness chains, and professional training centers. The demand for durable and high-performance equipment tailored for multiple users and intense sessions is propelling commercial segment growth.

Kickboxing Equipment Market Regional Analysis

- Asia-Pacific dominates the kickboxing equipment market with the largest revenue share of 41.3% in 2024, driven by a surge in fitness consciousness, rising disposable income, and increasing urbanization across countries such as China, Japan, and India

- Asia-Pacific is expected to be the fastest growing region in the kickboxing equipment market during the forecast period driven by its cultural affinity for martial arts and growing awareness of the importance of fitness

- The region's strong performance is bolstered by growing participation in combat sports, a rising number of fitness centers, and the popularity of kickboxing as both a competitive sport and a fitness regime

- In addition, local manufacturing capabilities, aggressive marketing strategies, and government initiatives to promote physical health contribute to Asia-Pacific’s leading position and rapid market expansion

China Kickboxing Equipment Market Insight

The China kickboxing equipment market captured the largest revenue share in Asia-Pacific in 2024, fueled by a rapidly expanding middle class and increasing awareness of fitness and martial arts. The country’s dominance is supported by a strong domestic manufacturing base, aggressive retail penetration, and a growing fitness culture in urban areas. As smart fitness solutions and combat sports gain popularity, demand for a full range of Kickboxing Equipment—from gloves to protective gear—continues to grow, particularly among youth and gym-goers in metropolitan regions.

Japan Kickboxing Equipment Market Insight

The Japan kickboxing equipment market is experiencing steady growth, driven by a tech-savvy population and a deep-rooted martial arts culture. The rising preference for kickboxing in wellness routines, combined with high living standards and consumer spending on premium fitness gear, is propelling market growth. Moreover, Japan’s aging population contributes to demand for lighter, ergonomic equipment designed for safe usage, while commercial gyms and fitness chains continue to expand offerings that incorporate kickboxing into group training and rehabilitation programs.

India Kickboxing Equipment Market Insight

The India kickboxing equipment market is witnessing one of the fastest growth rates in the region, fueled by rising health awareness, increasing gym memberships, and the influence of social media fitness trends. Urban consumers are embracing kickboxing as a high-intensity workout alternative, leading to increased sales of gloves, hand wraps, and punching bags through both online and offline retail channels. The government’s push for fitness through initiatives such as “Fit India Movement” and the rise of MMA training centers further support growth.

North America Kickboxing Equipment Market Insight

The North America kickboxing equipment market held the second-largest revenue share in 2024, accounting for 24.6%, driven by a well-established sports culture and high consumer spending on fitness gear. Consumers in the region are increasingly drawn to kickboxing for its fitness and self-defense benefits, with sales supported by celebrity endorsements, reality sports programming, and growing demand for home workout setups. The U.S. remains the key market due to the popularity of combat sports and the presence of numerous specialized sporting goods retailers.

U.S. Kickboxing Equipment Market Insight

The U.S. market dominated North America's total revenue in 2024. Strong demand is driven by growing health consciousness, the rise of boutique fitness studios, and increasing participation in amateur and professional kickboxing. E-commerce platforms and gym chains offering personalized training plans and virtual coaching are further accelerating equipment sales across categories.

Europe Kickboxing Equipment Market Insight

The Europe kickboxing equipment market is projected to grow at a moderate pace, led by an increasing focus on personal fitness and a renewed interest in combat sports. Countries such as the U.K., Germany, and France are seeing rising kickboxing participation among both youth and adults. Premium gym chains, organized sports leagues, and government-backed fitness campaigns are helping promote the adoption of kickboxing training and related gear.

U.K. Kickboxing Equipment Market Insight

The U.K. market is witnessing consistent growth, supported by an expanding network of fitness clubs and martial arts academies. The popularity of kickboxing as a hybrid cardio-sport and self-defense technique is attracting new demographics, including women and younger audiences. The country’s well-established e-commerce infrastructure and brand endorsements contribute to increased online sales of gloves, pads, and performance wear.

Germany Kickboxing Equipment Market Insight

The Germany market is growing steadily, with consumers increasingly investing in high-quality protective gear and training accessories. The preference for structured fitness regimes and sustainable product materials aligns with Germany’s market trends. Gyms and training academies across urban centers are integrating kickboxing into their offerings, especially as a group fitness option.

Kickboxing Equipment Market Share

The kickboxing equipment industry is primarily led by well-established companies, including:

- Everlast Worldwide, Inc. (U.S.)

- Venum (France)

- RDX Sports (U.K.)

- Century LLC (U.S.)

- Budoland (Germany)

- Combat Brands, LLC (U.S.)

- Fairtex (Thailand)

- Fujian Weizhixing Sports Goods Co., Ltd (China)

- Hayabusa Fightwear Inc. (Canada)

- Paffen Sport GmbH & Co. KG (Germany)

- Revgear (U.S.)

- Rival Boxing Gear USA (U.S.)

- ADVANTEST CORPORATION (Japan)

- SMAI USA (Australia)

- TWIN SPECIAL (Thailand)

Latest Developments in Global Kickboxing Equipment Market

- In December 2022, Adidas AG launched its latest range of kickboxing equipment, including gloves, headgear, shin guards, and other protective gear, all designed with cutting-edge technology and advanced materials to maximize user comfort and safety. This launch further reinforces Adidas’ commitment to innovation and excellence in the combat sports segment

- In July 2022, Combat Sports International introduced a new collection of kickboxing pads and bags, featuring durable construction and ergonomic design tailored to enhance training performance and athlete protection. This release strengthens the brand’s presence in the premium kickboxing gear category

- In April 2022, Fairtex, a globally recognized combat sports brand, entered a multi-year partnership with the Muay Thai Grand Prix to develop co-branded equipment and merchandise aimed at boosting global recognition of the sport. This strategic alliance highlights Fairtex’s efforts to expand its market influence through event-based collaborations

- In July 2021, Fairtex partnered with Cage Warriors to supply gloves and other gear for the organization, enhancing the brand’s visibility and credibility across the combat sports landscape. This move supports Fairtex’s strategic expansion into professional fighting circuits

- In April 2021, Everlast Worldwide, Inc. introduced its latest line of kickboxing gloves featuring enhanced padding and ergonomic design for superior comfort and safety during both training and competition. This innovation underscores Everlast’s continued leadership in high-performance combat gear

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.