Global Iot Sensors Market

Market Size in USD Billion

CAGR :

%

USD

13.64 Billion

USD

72.49 Billion

2024

2032

USD

13.64 Billion

USD

72.49 Billion

2024

2032

| 2025 –2032 | |

| USD 13.64 Billion | |

| USD 72.49 Billion | |

|

|

|

|

Internet of Things (IoT) Sensor Market Size

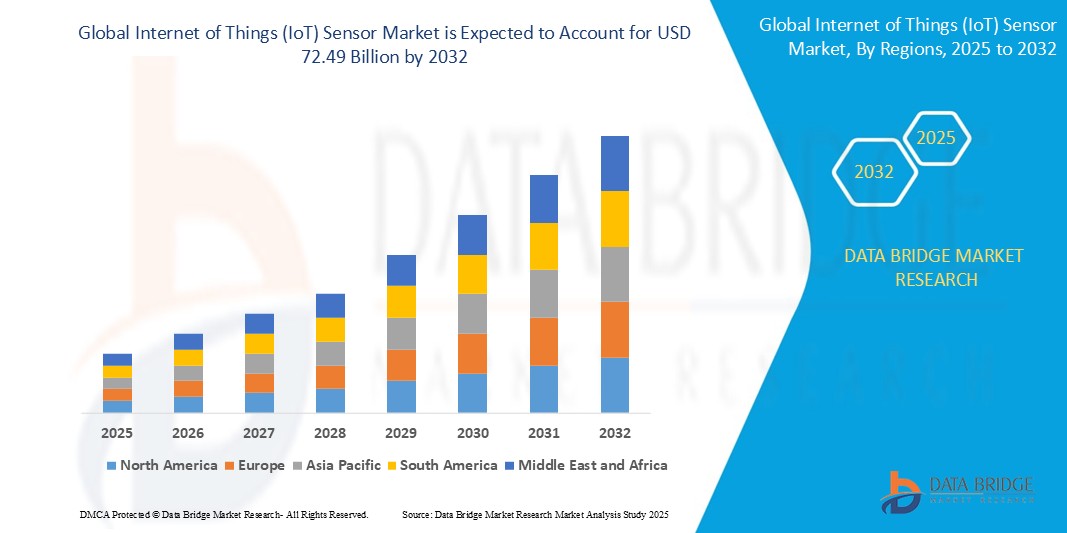

- The global internet of things (IoT) sensor market size was valued at USD 13.64 billion in 2024 and is expected to reach USD 72.49 billion by 2032, at a CAGR of 23.22 % during the forecast period

- The market growth is largely fuelled by the increasing adoption of smart devices, advancements in wireless communication technologies, and the rising demand for real-time data across industries such as manufacturing, healthcare, transportation, and smart cities

- In addition, the expansion of 5G networks, proliferation of edge computing, and increasing government initiatives to support smart infrastructure are contributing to the rapid deployment of IoT sensors.

Internet of Things (IoT) Sensor Market Analysis

- The internet of things sensor market is experiencing consistent growth due to rising demand across various connected applications. This expansion reflects increasing integration of sensor technologies in diverse digital ecosystems

- The market is seeing rapid development in sensor design and functionality to support evolving connectivity needs. Enhanced performance and adaptability of sensors are contributing to the rising value of this sector

- North America dominates the internet of things (IoT) sensor market with the largest revenue share of 40.5%, driven by high adoption of advanced technologies, strong digital infrastructure, and widespread use of connected devices across industries such as healthcare, manufacturing, and transportation. The presence of major market players and continuous innovation further reinforce the region’s leadership in IoT sensor deployment.

- Asia-Pacific is expected to be the fastest growing region in the internet of things (IoT) sensor market during the forecast period due to rapid industrial growth, smart infrastructure investments, and increasing IoT adoption across sectors

- The motion sensors segment holds the largest market revenue share due to its essential role in a wide range of internet of things applications across industries. These sensors are commonly used in smart lighting, surveillance systems, healthcare monitoring, and industrial automation to detect and respond to movement. Their reliability, energy efficiency, and adaptability make them a preferred choice in both consumer and commercial settings. Motion sensors also play a crucial part in automotive systems for safety and navigation features. With growing demand for automation and real-time responsiveness, this segment is expected to maintain strong momentum.

Report Scope and Internet of Things (IoT) Sensor Market Segmentation

|

Attributes |

Internet of Things (IoT) Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Internet of Things (IoT) Sensor Market Trends

“Integration of Artificial Intelligence in Internet of Things Sensor Technology”

- Artificial intelligence is being integrated into internet of things sensor systems to enable faster and more accurate data analysis at the device level

- For instance, AI algorithms in home security sensors can instantly detect unusual movements and send alerts without cloud processing

- Sensors with embedded intelligence improve decision-making by processing data at the source rather than relying on external systems

- This trend supports automation across industries such as smart manufacturing and precision agriculture by enhancing system responsiveness

- The use of AI in sensors reduces dependence on centralized computing, leading to more efficient bandwidth usage and lower energy consumption

- The growing demand for context-aware and self-learning sensors is encouraging innovation in intelligent sensor design and deployment

Internet of Things (IoT) Sensor Market Dynamics

Driver

“Growing Adoption of Smart and Connected Devices”

- The growing use of smart and connected devices across various sectors is significantly increasing the need for sensors that can monitor and respond in real time

- For instance, connected vehicles use sensors to detect obstacles and alert drivers, while wearable fitness devices track heart rate and activity levels

- Consumers and businesses are adopting smart technologies for improved convenience, automation, and energy efficiency, driving demand for advanced sensors

- Industrial sectors are leveraging sensors for predictive maintenance and automated monitoring to reduce downtime and enhance productivity

- The increasing availability of affordable sensor technologies and widespread wireless connectivity is accelerating internet of things deployment

- The rise of smart city initiatives and cloud-edge integration is enabling real-time analytics and automation using diverse sensor types

Restraint/Challenge

“Security and Privacy Concerns”

- Security and privacy concerns are limiting the growth of internet of things sensors due to the large volume of sensitive data they handle

- For instance, compromised sensors in smart healthcare systems can expose patient records or interfere with critical monitoring devices

- Sensors are often targeted in cyberattacks as they can serve as entry points into broader networks, risking data theft and operational disruption

- Many sensors operate on low-power networks and lack strong encryption, making them more vulnerable to cyber threats and unauthorized access

- The decentralized nature of internet of things ecosystems creates complex challenges for managing and securing every connected node

- Integrating strong cybersecurity measures adds to implementation costs and technical complexity, deterring some users from adoption

Internet of Things (IoT) Sensor Market Scope

The global IoT sensor market is segmented based on sensor type, component, vertical, technology, and end user.

- By Sensor Type

On the basis of sensor type, the internet of things (IoT) sensor market is segmented into temperature sensors, pressure sensors, humidity sensors, flow sensors, accelerometers, magnetometers, gyroscopes, inertial sensors, image sensors, touch sensors, proximity sensors, acoustic sensors, motion sensors, occupancy sensors, CO2 sensors, light sensors, and radar sensors. The motion sensors segment holds the largest market revenue share due to its essential role in a wide range of internet of things applications across industries. These sensors are commonly used in smart lighting, surveillance systems, healthcare monitoring, and industrial automation to detect and respond to movement. Their reliability, energy efficiency, and adaptability make them a preferred choice in both consumer and commercial settings. Motion sensors also play a crucial part in automotive systems for safety and navigation features. With growing demand for automation and real-time responsiveness, this segment is expected to maintain strong momentum.

The acoustic sensor segment is expected to witness the fastest growth from 2025 to 2032, driven by its increasing use in smart homes, voice recognition systems, and predictive maintenance. These sensors enable voice commands in virtual assistants, detect unusual sounds in industrial equipment, and support advanced home security solutions. Acoustic sensors are also gaining traction in healthcare for monitoring respiratory and sleep patterns. As voice-driven interfaces and sound analytics become more prevalent, the demand for intelligent and sensitive acoustic sensors continues to rise rapidly.

- By Component

On the basis of component, the internet of things (IoT) sensor market is segmented into hardware, software/platform, connectivity, and services. The hardware segment held the largest market revenue share due to the essential role sensor devices play in collecting data across internet of things ecosystems. Hardware components such as sensors, microcontrollers, and communication modules form the physical backbone of any connected system. These elements are critical for real-time monitoring, control, and communication between devices in applications ranging from industrial automation to smart homes. As more sectors deploy connected devices for operational efficiency, the demand for reliable and scalable hardware solutions continues to grow. The consistent need for physical devices ensures the hardware segment remains central to market expansion.

The software and platform segment is projected to witness the fastest compound annual growth rate from 2025 to 2032, driven by the increasing need for advanced analytics, device interoperability, and centralized management. Software platforms are crucial for processing vast amounts of data collected by sensors, enabling actionable insights and predictive analytics. They also facilitate seamless device integration, remote monitoring, and real-time decision-making across complex networks. With the rise of edge computing and artificial intelligence, the demand for intelligent platforms that can manage large-scale deployments is accelerating. This segment’s rapid growth reflects the shift from hardware-centric solutions to value-added services and data-driven strategies in internet of things applications.

- By Vertical

On the basis of vertical, the internet of things (IoT) sensor market is segmented into consumer, commercial, and industrial verticals. The industrial segment accounted for the largest market revenue share due to the widespread use of internet of things sensors in enhancing operational efficiency, automation, and safety. These sensors are deeply integrated into manufacturing systems for real-time monitoring, equipment diagnostics, and predictive maintenance, reducing downtime and improving productivity. Industries such as oil and gas, automotive, and energy rely on sensors for tracking environmental conditions, machine performance, and supply chain logistics. With the rise of Industry 4.0 and smart factories, the demand for robust and scalable sensor networks in industrial environments continues to expand. The focus on cost savings and data-driven operations makes this segment a key contributor to market growth.

The commercial segment is anticipated to experience the fastest compound annual growth rate from 2025 to 2032, supported by growing implementation of internet of things technologies in retail, hospitality, smart offices, and connected healthcare. In smart buildings, sensors help manage lighting, HVAC, and security systems for energy efficiency and occupant comfort. Retailers use sensors for foot traffic analysis, shelf monitoring, and personalized marketing strategies. In the healthcare space, connected medical devices and facility management systems increasingly depend on sensor data for improved patient care and operational oversight. As digital transformation accelerates in commercial spaces, the demand for intelligent and interoperable sensor solutions is rising rapidly, positioning this segment for significant growth in the coming years.

- By Technology

On the basis of technology, the internet of things (IoT) sensor market is segmented into wireless and wired. The wireless technology segment held the dominant market revenue share due to its adaptability, ease of installation, and ability to support large-scale deployments across various internet of things applications. Wireless communication enables devices to connect seamlessly without the limitations of physical infrastructure, making it ideal for dynamic environments such as smart homes, agriculture, and logistics. Technologies such as Wi-Fi, Bluetooth, and cellular networks allow for real-time data exchange and remote monitoring. As the number of connected devices continues to grow, wireless solutions offer the flexibility and scalability needed to support complex networks. This makes them a preferred choice in both consumer and industrial internet of things ecosystems.

The wired technology segment is expected to witness steady growth, particularly in scenarios where data transmission security, speed, and reliability are critical. Applications in manufacturing plants, utility systems, and healthcare facilities often favor wired connections to ensure uninterrupted performance and resistance to interference. Ethernet and other wired protocols provide consistent bandwidth and minimal latency, which are essential for time-sensitive operations and secure environments. In settings where signal loss or unauthorized access could compromise safety or data integrity, wired infrastructure remains the trusted solution. While not as flexible as wireless options, the dependability of wired connections continues to sustain their relevance in select high-stakes internet of things deployments.

- By End User

On the basis offend user, the internet of things (IoT) sensor market is segmented into consumer electronics, automotive, industrial, healthcare, food & beverages, aerospace & defense, transportation, agriculture, and others. The consumer electronics segment generated the largest market revenue share due to the widespread integration of internet of things sensors in everyday devices such as smartphones, smartwatches, and home automation systems. These sensors enable features such as motion detection, environmental monitoring, and user interaction, enhancing functionality and user experience. The popularity of smart home devices, including thermostats, lighting systems, and voice assistants, continues to fuel this segment’s growth. In addition, increasing consumer demand for connected and intuitive gadgets supports rapid innovation and mass adoption. As smart living becomes more mainstream, sensor-driven consumer electronics remain a key revenue contributor.

The healthcare end-user segment is projected to register the fastest compound annual growth rate from 2025 to 2032, fueled by growing reliance on internet of things sensors for patient care and medical efficiency. Remote patient monitoring systems use sensors to track vital signs and transmit data to healthcare providers in real time, improving chronic disease management. Wearable health devices such as fitness trackers and biosensors are gaining popularity for both wellness tracking and clinical use. Smart hospital systems also utilize sensors for asset tracking, temperature control, and patient movement monitoring. As healthcare shifts toward personalized, data-driven care, the adoption of internet of things technologies continues to rise sharply, positioning this segment for rapid expansion.

Internet of Things (IoT) Sensor Market Regional Analysis

- North America led the global internet of things sensor market with the highest revenue share of 40.5% due to substantial investments in advanced technology and infrastructure

- The region benefits from a strong industrial base and early adoption of internet of things solutions in sectors such as healthcare, manufacturing, and smart cities

- Consumers and businesses actively utilize sensor technologies to drive automation, increase operational efficiency, and enable real-time monitoring

- A high concentration of leading internet of things companies and sensor manufacturers supports innovation and rapid product development

- Government support and favorable regulatory environments also contribute to widespread deployment of connected sensor networks across the region

U.S. Internet of Things (IoT) Sensor Market Insight

The U.S. internet of things sensor market accounted for the largest share of 78.5% within North America in 2025, driven by the widespread adoption of connected devices and strong demand for data-driven technologies across sectors. A well-established technology infrastructure and the presence of major tech companies support ongoing innovation and market leadership. Rapid advancements in wireless connectivity, especially 5G, are further enhancing sensor functionality and deployment. The country's proactive approach to smart infrastructure and cybersecurity standards encourages widespread implementation. High consumer awareness and a dynamic startup ecosystem also contribute to the development of advanced sensor applications. As industries continue to embrace automation and real-time analytics, the U.S. remains a key force in shaping the future of the internet of things sensor market.

Europe Internet of Things (IoT) Sensor Market Insight

The European internet of things sensor market is expected to witness strong growth during the forecast period, supported by strict environmental policies and a growing push for industrial automation. Government-led digital transformation programs are encouraging the integration of smart technologies across public and private sectors. The region’s commitment to sustainability drives the use of sensors in applications such as energy efficiency, waste management, and air quality monitoring. Ongoing smart city projects across major European cities are also creating demand for connected systems in transportation, utilities, and infrastructure. In addition, a focus on enhancing operational efficiency and reducing environmental impact supports sensor deployment in manufacturing and logistics. With increasing investments in digital infrastructure and regulatory backing, Europe is emerging as a key player in the global internet of things sensor landscape.

U.K. Internet of Things (IoT) Sensor Market Insight

The U.K. internet of things sensor market is expected to grow at a significant pace, driven by the rising popularity of smart home devices and connected living solutions. Government and private sector investments in smart infrastructure, including transportation, energy, and public safety, are supporting broader adoption of sensor technologies. Businesses across sectors such as retail, manufacturing, and healthcare are leveraging internet of things solutions to enhance efficiency, reduce costs, and improve customer experiences. Public awareness around the advantages of real-time data monitoring and automation is also growing steadily. The expansion of high-speed connectivity and edge computing further enables seamless sensor integration. As digital transformation gains momentum, the U.K. is positioned as a dynamic and evolving market for internet of things sensor innovations.

Germany Internet of Things (IoT) Sensor Market Insight

The Germany internet of things sensor market is set to grow steadily, supported by the country’s advanced industrial base and leadership in engineering and automation. With a strong emphasis on Industry 4.0, German manufacturers are increasingly deploying sensors to enable predictive maintenance, quality control, and real-time monitoring. The country’s well-established infrastructure and commitment to digital transformation make it a favorable environment for large-scale internet of things implementations. Smart building initiatives and energy-efficient solutions are also contributing to the rising demand for sensor technologies. Government policies encouraging innovation and sustainability further boost adoption across sectors. As Germany continues to prioritize productivity and digitalization, the market for internet of things sensors is expected to see consistent and sustained growth.

Asia-Pacific Internet of Things (IoT) Sensor Market Insight

The Asia-Pacific internet of things sensor market is expected to grow at the fastest pace, supported by rapid industrial growth and accelerating urban development across key economies such as China, Japan, and India. Government-led initiatives promoting smart cities and digital infrastructure are creating strong demand for connected technologies. Rising consumer incomes and increased adoption of smart devices in homes, healthcare, and transportation are fueling the need for advanced sensor solutions. The region’s strength in electronics manufacturing also makes sensor technologies more accessible and cost-effective. As industries modernize and embrace automation, Asia-Pacific continues to strengthen its position as a major growth engine for the global internet of things sensor market.

Japan Internet of Things (IoT) Sensor Market Insight

The Japan internet of things sensor market is experiencing steady growth, supported by the country’s advanced technology landscape and commitment to innovation in manufacturing and automation. Precision-driven industries in Japan are rapidly integrating sensor-based systems to enhance quality control, reduce downtime, and improve productivity. In healthcare, the growing aging population is creating strong demand for remote monitoring devices and assistive technologies powered by sensors. Smart agriculture is also expanding, with sensors being used to monitor soil conditions, crop health, and weather patterns to increase yields. The emphasis on efficiency, safety, and sustainability aligns well with internet of things applications. As digital transformation deepens across sectors, Japan continues to emerge as a key market for internet of things sensor adoption.

China Internet of Things (IoT) Sensor Market Insight

The China internet of things sensor market held the largest revenue share in Asia Pacific in 2025, driven by its dominant role in global manufacturing and the swift expansion of urban infrastructure. Government policies strongly promote digital transformation, encouraging widespread adoption of smart technologies in sectors such as transportation, utilities, and industrial automation. The country's focus on smart factories and intelligent supply chains is fueling demand for high-performance sensor solutions. In addition, domestic manufacturers offer cost-effective sensors at scale, improving accessibility for businesses across various verticals. As China continues to lead in smart city initiatives and advanced manufacturing, its internet of things sensor market is expected to maintain robust growth.

Internet of Things (IoT) Sensor Market Share

The Internet of Things (IoT) Sensor industry is primarily led by well-established companies, including:

- Sierra Wireless, Inc. (Canada)

- Moxa Inc. (Taiwan)

- General Electric Company (U.S.)

- Skyworks Solution Inc. (U.S.)

- Infineon Technologies AG (Germany)

- Honeywell International Inc. (U.S.)

- Texas Instruments Incorporated (U.S.)

- Siemens (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- NXP Semiconductors (Netherlands)

- STMicroelectronics (Switzerland)

- IBM (U.S.)

- Sensata Technologies, Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- TE Connectivity (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

Latest Developments in Global Internet of Things (IoT) Sensor Market

- In April 2023, Texas Instruments introduced the SimpleLink series of Wi-Fi 6 companion integrated circuits as a product development initiative. These ICs are designed to enable robust, secure, and cost-effective Wi-Fi connectivity in challenging environments, including those with high device density and temperatures up to 105°C. This advancement supports efficient IoT deployment in industrial and commercial settings, enhancing connectivity performance and reliability. The launch is expected to strengthen Texas Instruments’ position in the IoT sensor market by meeting the growing demand for durable and scalable wireless solutions

- In February 2023, Qualcomm announced a service expansion through the launch of Qualcomm Aware, aimed at accelerating IoT adoption across industries. This platform offers advanced asset management capabilities by leveraging cutting-edge silicon, an extensive developer-friendly cloud infrastructure, and a network of hardware and software partners. It is expected to improve decision-making accuracy for mission-critical applications, significantly impacting the IoT landscape by enabling smarter, more responsive operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Iot Sensors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Iot Sensors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Iot Sensors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.