Global Intumescent Coatings Market

Market Size in USD Billion

CAGR :

%

USD

121.00 Billion

USD

1.75 Billion

2024

2032

USD

121.00 Billion

USD

1.75 Billion

2024

2032

| 2025 –2032 | |

| USD 121.00 Billion | |

| USD 1.75 Billion | |

|

|

|

|

Intumescent Coatings Market Size

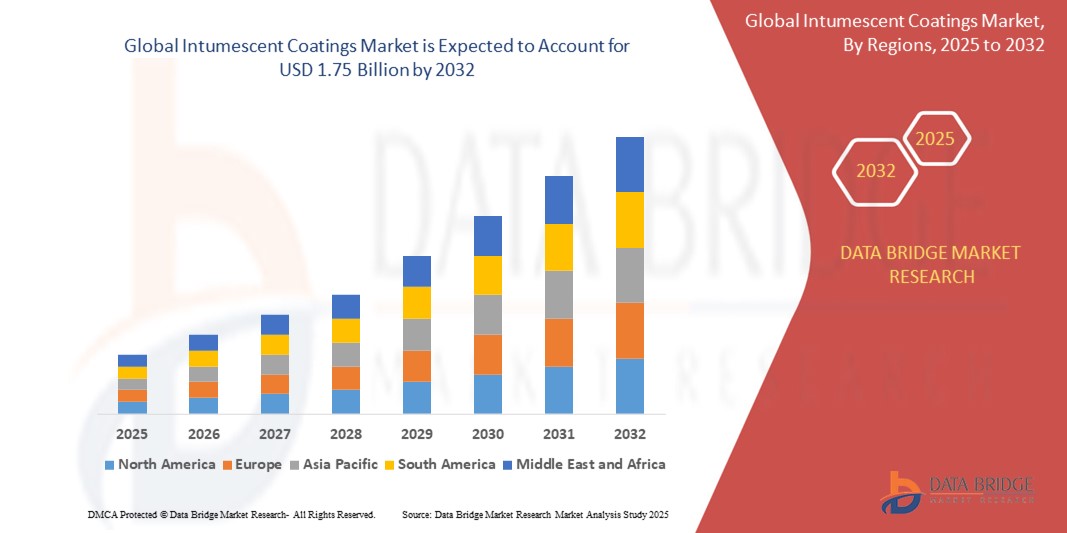

- The global Intumescent Coatings market size was valued at USD 1.21 billion in 2024 and is expected to reach USD 1.75 billion by 2032, at a CAGR of 4.7% during the forecast period

- This growth is driven by factors such as increasing demand for passive fire protection in buildings and industrial facilities, stringent fire safety regulations, and growing infrastructure development across emerging economies. Additionally, advancements in coating technologies and increased use of intumescent coatings in the oil & gas and construction sectors are further fueling market expansion.

Intumescent Coatings Market Analysis

- Intumescent coatings are critical fire protection materials used in construction, oil & gas, automotive, and industrial sectors. These coatings expand when exposed to high temperatures, forming an insulating char layer that protects structural elements such as steel and wood from fire damage.

- The demand for intumescent coatings is significantly driven by stringent building and fire safety regulations, increasing urbanization, and growing awareness regarding passive fire protection solutions. The rising focus on worker safety and asset protection in high-risk industries further contributes to market growth.

- North America is expected to dominate the global intumescent coatings market due to the presence of well-established construction and oil & gas sectors, along with strict enforcement of fire safety codes such as ASTM E119 and UL 263.

- Asia-Pacific is expected to be the fastest-growing region in the intumescent coatings market during the forecast period, owing to rapid infrastructure development, industrialization, and increasing government initiatives for building safety standards in countries like China, India, and Southeast Asian nations.

- The Thin-Film Intumescent Coatings segment is expected to dominate the market with a market share of 56.22% in 2025. Its widespread use in commercial and residential buildings, coupled with the growing adoption of steel structures, supports its segmental dominance. Advancements in water-based and low-VOC intumescent coatings are further enhancing their appeal in the construction sector.

Report Scope and Intumescent Coatings Market Segmentation

|

Attributes |

Intumescent Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Intumescent Coatings Market Trends

“Increasing Adoption of Environmentally Friendly and Water-Based Intumescent Coatings”

- One prominent trend in the intumescent coatings market is the shift toward eco-friendly, water-based formulations in response to stringent environmental regulations and rising sustainability goals.

- These coatings emit low or zero VOCs (Volatile Organic Compounds), making them safer for applicators and occupants, and suitable for green building certifications.

- For instance, several manufacturers are launching water-based intumescent coatings that comply with REACH and LEED standards, helping clients meet environmental targets without compromising on fire protection performance.

- This trend is transforming product development strategies, encouraging innovation in resin technologies and broadening application across residential, commercial, and industrial construction projects.

Intumescent Coatings Market Dynamics

Driver

“Stringent Fire Safety Regulations in the Construction Industry”

- Governments and regulatory bodies across the globe have implemented strict building codes mandating the use of fire-retardant materials in infrastructure projects.

- Intumescent coatings, which provide passive fire protection by expanding to form a char layer in case of fire, are increasingly used to protect structural steel and other load-bearing elements.

For instance,

- In in regions like North America and Europe, standards such as NFPA, BS 476, and EN 13381 mandate fireproofing in high-rise buildings, oil & gas facilities, and public infrastructure.

- As a result of the demand for intumescent coatings is expected to rise steadily as governments prioritize public safety and disaster resilience in construction practices.

Opportunity

“Infrastructure Boom in Emerging Economies”

- Rapid urbanization and increased infrastructure spending in Asia-Pacific, Middle East, and Africa create vast opportunities for the intumescent coatings market.

- New airports, metros, commercial complexes, and industrial zones in countries like India, UAE, and Vietnam require reliable fire protection, driving demand for these coatings.

For instance,

- governments in the GCC region are investing in megaprojects (e.g., NEOM in Saudi Arabia), which emphasize advanced building materials including fire-protection solutions.

- The trend allows manufacturers to expand market penetration through regional partnerships, local manufacturing, and customized product offerings.

Restraint/Challenge

“High Cost of Advanced Raw Materials and Application Processes”

- The production of high-performance intumescent coatings involves expensive ingredients like epoxy resins, flame retardants, and additives that ensure adhesion, durability, and fire resistance.

- Additionally, application of intumescent coatings requires skilled labor, surface preparation, and strict environmental conditions, increasing the overall project cost.

For instance,

- In the application process can be 2–3 times more expensive than standard paints due to labor, inspection, and certification requirements.

- Consequently, cost factors can deter adoption in price-sensitive markets, limiting penetration in small-scale or residential construction projects.

Intumescent Coatings Market Scope

The market is segmented on the basis Type, Substrate, Resin, Technology, Composition, and Application Technique.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Substrate |

|

|

By Resin |

|

|

By Technology

|

|

|

By Composition |

|

|

By Application Technique

|

|

In 2025, the Thin-Film Intumescent Coatings is projected to dominate the market with a largest share in Type segment

The Thin-Film Intumescent Coatings segment is expected to dominate the Intumescent Coatings market with the largest share of 56.22% in 2025 due to This dominance is attributed to their widespread use in commercial and residential buildings due to aesthetic appeal, ease of application, and efficient fire resistance for steel structures. The growing construction sector, especially in urban high-rise developments, and the rising need for passive fire protection are driving the adoption of thin-film coatings globally.

The Acrylic is expected to account for the largest share during the forecast period in Resin market

In 2025, the Acrylic segment is expected to dominate the market with the largest market share of 51.31% due to Acrylic-based coatings offer superior weather resistance, UV stability, and adhesion, making them ideal for both indoor and outdoor applications. Their low VOC emissions and compliance with green building standards also make them increasingly popular in environmentally regulated markets, contributing to their continued market leadership.

Intumescent Coatings Market Regional Analysis

“North America Holds the Largest Share in the Intumescent Coatings Market”

- North America dominates the global Intumescent Coatings market, supported by robust construction activity, stringent fire safety regulations, and increased adoption of passive fire protection solutions across commercial, residential, and industrial sectors.

- The United States holds a significant share due to its strict building codes, well-developed infrastructure, and the presence of major manufacturers actively investing in innovation and R&D.

- The region also benefits from increased investments in oil & gas, energy, and transportation sectors, where intumescent coatings play a critical safety role.

- Additionally, growing awareness regarding fire safety and insurance mandates for fireproofing structural steel elements continue to fuel market growth in North America.

“Asia-Pacific is Projected to Register the Highest CAGR in the Intumescent Coatings Market”

- The Asia-Pacific region is expected to record the highest growth rate in the intumescent coatings market during the forecast period, driven by rapid urbanization, expanding industrial base, and rising construction activities

- China, India, and Southeast Asian countries are witnessing strong infrastructure development, increased demand for commercial buildings, and stricter enforcement of fire safety norms, boosting the adoption of intumescent coatings.

- India and China, with their large populations and growing manufacturing sectors, are seeing increased government focus on fire safety in public and industrial buildings.

- Moreover, the influx of foreign direct investments (FDI) in construction and oil & gas, along with the local production of cost-effective coatings, is making Asia-Pacific a strategic hotspot for global market players.

Intumescent Coatings Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, Type dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Akzo Nobel N.V. (Netherlands)

- PPG Industries, Inc. (U.S.)

- Jotun (Norway)

- The Sherwin-Williams Company (U.S.)

- Hempel A/S (Denmark)

- Etex Group (Belgium)

- Kansai Paint Co., Ltd. (Japan)

- Teknos Group (Finland)

- 3M (U.S.)

- Carboline Company (U.S.)

- CPG EUROPE (Germany) (part of RPM International Inc., U.S.)

- BASF SE (Germany)

- Contego International Inc. (U.S.)

- Isolatek International (U.S.)

- GCP Applied Technologies Inc. (U.S.)

- Envirograf Passive Fire Products (U.K.)

- Albi Protective Coatings (U.S.) (a brand of StanChem Polymers)

- Arabian Vermiculite Industries (Saudi Arabia)

- No-Burn, Inc. (U.S.)

- Demilec (USA) Inc. (U.S.) (now part of Huntsman Corporation)

Latest Developments in Global Intumescent Coatings Market

- In March 2025, Akzo Nobel N.V. announced the launch of its next-generation water-based intumescent coating system, specifically designed for steel structures used in commercial and residential buildings. This product enhances fire resistance while offering low VOC emissions, aligning with green building standards and increasing sustainability in construction practices.

- In January 2025, PPG Industries, Inc. introduced a new range of epoxy-based intumescent coatings designed for the oil & gas and offshore industries. The coatings offer extended durability in harsh environments, improved corrosion resistance, and superior thermal protection, making them ideal for high-risk fire zones.

- In November 2024, Jotun expanded its production facility in the UAE to meet the rising regional demand for intumescent coatings. The expansion aims to support the growing infrastructure and energy sectors in the Middle East and Africa, while reducing delivery time and costs for local clients.

- In September 2024, Sherwin-Williams announced the development of a hybrid intumescent coating technology combining the benefits of solvent-based and water-based systems. The hybrid system ensures faster curing, improved workability, and high fire protection performance for structural steel in both commercial and industrial settings.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Intumescent Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Intumescent Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Intumescent Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.