Global Interventional X Ray Market

Market Size in USD Billion

CAGR :

%

USD

3.00 Billion

USD

4.56 Billion

2024

2032

USD

3.00 Billion

USD

4.56 Billion

2024

2032

| 2025 –2032 | |

| USD 3.00 Billion | |

| USD 4.56 Billion | |

|

|

|

|

Interventional X-ray Market Size

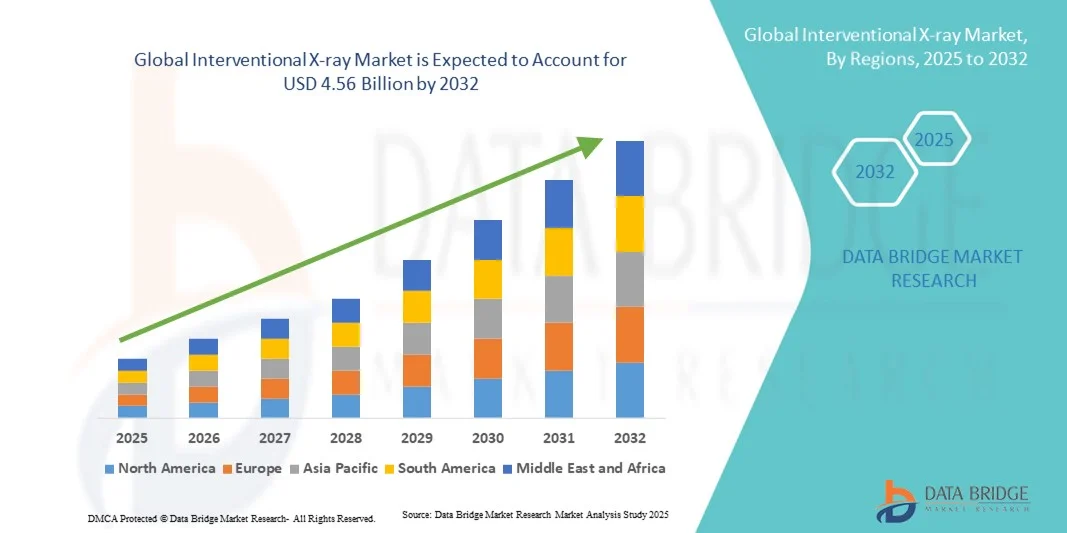

- The global interventional X-ray market size was valued at USD 3.00 billion in 2024 and is expected to reach USD 4.56 billion by 2032, at a CAGR of 5.4% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic diseases, rising demand for minimally invasive procedures, and continuous advancements in imaging technologies, leading to enhanced precision and safety in clinical interventions

- Furthermore, rising adoption of advanced imaging modalities such as fluoroscopy, CT, and MRI, along with increasing investments in healthcare infrastructure across regions such as North America and Asia-Pacific, is establishing interventional X-ray systems as essential tools in modern medical practice. These converging factors are accelerating the uptake of interventional X-ray solutions, thereby significantly boosting the industry's growth

Interventional X-ray Market Analysis

- Interventional X-ray systems, providing advanced imaging guidance for minimally invasive procedures, are increasingly vital components of modern healthcare facilities in both hospitals and specialized clinics due to their enhanced precision, real-time imaging capabilities, and integration with other diagnostic and therapeutic technologies

- The escalating demand for interventional X-ray systems is primarily fueled by the rising prevalence of chronic and cardiovascular diseases, growing preference for minimally invasive procedures, and continuous advancements in imaging technologies that improve procedural accuracy and patient safety

- North America dominated the interventional X-ray market with the largest revenue share of 41.7% in 2024, driven by high healthcare expenditure, advanced medical infrastructure, and a strong presence of key industry players, with the U.S. experiencing substantial growth in interventional procedures, particularly in radiology and oncology applications, supported by innovations from both established medical device companies and specialized startups

- Asia-Pacific is expected to be the fastest growing region in the interventional X-ray market during the forecast period due to increasing healthcare investments, rising adoption of minimally invasive procedures, and expanding hospital infrastructure

- Single-plane fixed interventional X-ray systems dominated the market in 2024 with a market share of 62.5%, driven by their widespread adoption in hospitals and diagnostic centers for a variety of applications including radiology, neurology, and oncology, offering high-quality imaging, operational efficiency, and cost-effectiveness compared to bi-plane systems

Report Scope and Interventional X-ray Market Segmentation

|

Attributes |

Interventional X-ray Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Interventional X-ray Market Trends

Advancements Through Hybrid ORs and AI-Enhanced Imaging

- A significant and accelerating trend in the global interventional X-ray market is the integration of advanced imaging technologies such as AI-assisted image reconstruction and hybrid operating rooms, improving procedural accuracy and efficiency

- For instance, Philips’ Azurion hybrid OR platform combines interventional X-ray with advanced surgical imaging, enabling real-time visualization and streamlined workflow for complex procedures

- AI integration in interventional X-ray systems enables features such as automated image enhancement, lesion detection, and predictive analytics for procedure planning, improving clinical outcomes and reducing procedure time

- The seamless integration of interventional X-ray systems with hospital PACS and surgical navigation platforms facilitates centralized control over imaging, patient data, and procedural guidance, enhancing operational efficiency

- This trend towards more intelligent, precise, and interconnected imaging systems is fundamentally reshaping expectations for minimally invasive procedures, with companies such as Siemens Healthineers developing AI-enabled imaging suites that offer predictive guidance and workflow optimization

- The demand for interventional X-ray systems with advanced imaging and AI integration is growing rapidly across hospitals, clinics, and diagnostic centers, as healthcare providers increasingly prioritize procedural accuracy, safety, and efficiency

Interventional X-ray Market Dynamics

Driver

Rising Adoption of Minimally Invasive Procedures and Cardiovascular Interventions

- The increasing prevalence of cardiovascular and oncological conditions, coupled with the growing adoption of minimally invasive procedures, is a significant driver for the heightened demand for interventional X-ray systems

- For instance, GE Healthcare reported a rise in demand for its Innova IGS 5 interventional X-ray systems in cardiovascular cath labs due to higher procedural volumes

- As hospitals and clinics seek to reduce patient recovery time and procedural risks, interventional X-ray systems offer real-time imaging guidance, enhancing the safety and success rate of procedures

- Furthermore, the expanding trend of outpatient and ambulatory surgical centers is boosting the need for compact and efficient interventional X-ray systems that support a wide range of diagnostic and therapeutic applications

- Increasing healthcare investments and rising government initiatives promoting minimally invasive procedures in developing countries are creating additional opportunities for interventional X-ray adoption

- The expansion of specialized cardiology, neurology, and oncology centers globally is driving the need for high-performance imaging systems, further boosting market growth

- The growing focus on early diagnosis, procedural precision, and integration with digital health platforms is propelling adoption in both established and emerging healthcare markets

Restraint/Challenge

High Capital Cost and Regulatory Compliance Hurdle

- The relatively high cost of interventional X-ray systems and associated infrastructure requirements pose a significant challenge to broader market adoption, particularly in developing regions

- For instance, installation of a bi-plane fixed interventional X-ray system can exceed several million USD, limiting accessibility for smaller hospitals or clinics

- Compliance with stringent regulatory standards such as FDA, CE, and local radiation safety norms adds complexity and delays to product launch timelines, affecting market expansion

- In addition, maintenance and operational costs, including software upgrades and specialized training for clinical staff, contribute to higher total cost of ownership and adoption hesitation

- Addressing these challenges through cost optimization, financing solutions, and regulatory guidance will be crucial for expanding the global interventional X-ray market in the forecast period

- Limited availability of skilled radiologists and technicians capable of operating advanced interventional X-ray systems can hinder market growth, particularly in emerging markets

- Interoperability challenges with existing hospital IT and imaging infrastructure may slow down adoption, as integration requires additional investment and time

Interventional X-ray Market Scope

The market is segmented on the basis of fixed interventional X-ray, surgical C-arm, application, and end user.

- By Fixed Interventional X-ray

On the basis of fixed interventional X-ray, the interventional X-ray market is segmented into single-plane and bi-plane systems. The single-plane segment dominated the market with the largest revenue share of 62.5% in 2024, driven by its widespread adoption in hospitals and diagnostic centers. Single-plane systems offer high-quality imaging suitable for a wide range of procedures including radiology, neurology, and oncology, providing precise visualization while maintaining cost-effectiveness. Hospitals often prefer single-plane systems due to their lower installation and maintenance costs compared to bi-plane setups, allowing broader deployment across departments. In addition, single-plane systems are compatible with existing imaging workflows, simplifying integration and staff training. The flexibility and efficiency of single-plane systems make them particularly suitable for routine interventional procedures, further cementing their market dominance. The availability of advanced features such as dose reduction technology and real-time imaging enhances their clinical appeal, reinforcing adoption across mature and emerging markets.

The bi-plane segment is anticipated to witness the fastest growth from 2025 to 2032 due to its superior imaging capabilities, particularly for complex cardiovascular and neurovascular interventions. Bi-plane systems allow simultaneous imaging from two angles, reducing procedure time and contrast usage while improving procedural accuracy. Hospitals and specialized centers increasingly adopt bi-plane systems to perform intricate interventions such as stent placements, cerebral aneurysm treatments, and complex angiographies. The demand for bi-plane systems is further driven by growing investments in advanced cardiac and neurological care infrastructure, particularly in developed regions. In addition, bi-plane technology supports integration with AI-assisted imaging tools, enhancing precision and workflow efficiency. Rising awareness among clinicians of the clinical benefits and patient safety improvements offered by bi-plane systems is expected to fuel market growth over the forecast period.

- By Surgical C-Arm

On the basis of surgical C-arm, the interventional X-ray market is segmented into mobile and mini C-arm systems. The mobile C-arm segment dominated the market in 2024 due to its versatility and widespread use in orthopedic, cardiovascular, and general surgical procedures. Mobile systems allow hospitals to perform imaging in multiple operating rooms without the need for dedicated installation, making them cost-effective and operationally flexible. The portability and high-quality fluoroscopic imaging offered by mobile C-arms are critical for intraoperative guidance, enhancing procedural accuracy and reducing complications. Hospitals and ambulatory surgical centers prefer mobile C-arms for their adaptability, allowing rapid deployment across different departments. Technological advancements such as improved detector resolution, dose reduction features, and wireless connectivity further strengthen the appeal of mobile C-arms. The growing adoption of minimally invasive surgeries globally is also contributing to the sustained demand for mobile C-arm systems.

The mini C-arm segment is expected to witness the fastest growth from 2025 to 2032, primarily due to its increasing adoption in orthopedic clinics and outpatient settings. Mini C-arms provide compact, targeted imaging for extremities such as hands, wrists, and feet, making them ideal for focused procedures without occupying large space. Their lower cost, ease of maneuverability, and reduced radiation exposure make them attractive for smaller healthcare facilities and specialized practices. The miniaturization trend in imaging systems and the rising prevalence of outpatient orthopedic procedures are key factors driving adoption. In addition, integration with digital storage systems and compatibility with telemedicine platforms enhances their utility in modern clinical workflows. Growing awareness among surgeons about the operational efficiency and patient safety benefits of mini C-arms is expected to fuel market growth.

- By Application

On the basis of application, the interventional X-ray market is segmented into radiology, neurology, oncology, and pediatric cardiology. Radiology applications dominated the interventional X-ray market in 2024 due to the high volume of imaging procedures performed for diagnostic and interventional purposes. Hospitals and diagnostic centers rely on X-ray systems for procedures such as angiography, biopsy guidance, and image-guided interventions. Radiology departments prefer systems with high image resolution, dose reduction features, and real-time visualization capabilities. The growing prevalence of chronic diseases and an increasing number of imaging procedures in routine patient care drive the dominance of the radiology segment. Integration with PACS and AI-based diagnostic tools further enhances workflow efficiency and diagnostic accuracy, strengthening its market position.

Neurology applications are expected to witness the fastest growth from 2025 to 2032 due to rising demand for image-guided neurovascular interventions, such as aneurysm coiling, stroke management, and intracranial stenting. Advanced interventional X-ray systems enable high-resolution imaging required for delicate neurological procedures, reducing risk and improving outcomes. The increasing incidence of neurological disorders, coupled with growing investments in specialized neurology centers, fuels market adoption. Integration with AI-assisted navigation systems and hybrid OR setups further enhances the segment’s growth potential. In addition, expanding healthcare infrastructure in emerging economies is driving the demand for advanced neuro-interventional imaging systems.

- By End User

On the basis of end user, the interventional X-ray market is segmented into hospitals, clinics, ambulatory surgical centers, research institutes, and diagnostic centers. Hospitals dominated the market in 2024 due to their high procedural volume, availability of capital for advanced imaging systems, and presence of multidisciplinary intervention units. Hospitals require fixed and mobile interventional X-ray systems to perform cardiovascular, neurological, and oncology procedures. The ability to integrate imaging systems with hospital IT infrastructure, PACS, and surgical navigation systems enhances workflow efficiency and patient care quality. Hospitals also prefer systems with advanced safety and dose reduction features, ensuring compliance with regulatory standards. The high adoption rate of minimally invasive procedures and hybrid OR setups in hospitals strengthens their position as the dominant end user.

Ambulatory surgical centers are expected to witness the fastest growth from 2025 to 2032 due to the increasing trend of outpatient procedures and cost-effective surgical care. ASCs benefit from mobile and mini C-arm systems that provide high-quality imaging without the need for large installation space. The rising preference for minimally invasive surgeries, faster patient turnover, and reduced hospital stays drive adoption in ASCs. Integration with digital health platforms and streamlined imaging workflows enhances procedural efficiency, making ASCs an attractive end-user segment for interventional X-ray systems. The growing number of ASCs in emerging economies further supports market growth for this segment.

Interventional X-ray Market Regional Analysis

- North America dominated the interventional X-ray market with the largest revenue share of 41.7% in 2024, driven by high healthcare expenditure, advanced medical infrastructure, and a strong presence of key industry players

- Hospitals and diagnostic centers in the region prioritize precision, safety, and efficiency in interventional procedures, leading to widespread adoption of both fixed and mobile interventional X-ray systems for applications such as radiology, oncology, and neurology

- This dominance is further supported by well-established healthcare systems, early adoption of minimally invasive procedures, and a skilled medical workforce, establishing interventional X-ray systems as essential tools in modern clinical practice

U.S. Interventional X-ray Market Insight

The U.S. interventional X-ray market captured the largest revenue share of 43% in 2024 within North America, fueled by the rapid adoption of minimally invasive procedures and advanced imaging systems. Hospitals and specialized clinics are increasingly prioritizing precision, safety, and efficiency in cardiovascular, oncology, and neurological interventions. The growing demand for hybrid operating rooms and AI-assisted imaging technologies further propels the interventional X-ray industry. Moreover, integration with hospital IT infrastructure, PACS, and surgical navigation platforms is significantly contributing to the market's expansion.

Europe Interventional X-ray Market Insight

The Europe interventional X-ray market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing prevalence of chronic diseases and rising demand for minimally invasive procedures. Investments in advanced hospital infrastructure and the adoption of digital imaging technologies are fostering market growth. European healthcare providers are also focusing on patient safety and procedural efficiency, supporting the adoption of interventional X-ray systems. The region is experiencing significant growth across hospitals, diagnostic centers, and specialty clinics, with these systems being incorporated into both new and upgraded medical facilities.

U.K. Interventional X-ray Market Insight

The U.K. interventional X-ray market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing focus on high-precision interventions and healthcare digitalization. In addition, the rising incidence of cardiovascular and oncological conditions is encouraging hospitals and clinics to adopt advanced imaging solutions. The U.K.’s strong healthcare infrastructure, coupled with supportive government policies for modern medical technologies, is expected to continue stimulating market growth. Furthermore, integration with AI-assisted guidance and minimally invasive procedural workflows enhances clinical outcomes and operational efficiency.

Germany Interventional X-ray Market Insight

The Germany interventional X-ray market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s focus on technologically advanced healthcare solutions and patient-centric care. Germany’s well-established medical infrastructure and emphasis on innovation promote adoption of interventional X-ray systems in hospitals and diagnostic centers. The integration of these systems with hybrid ORs, AI-based imaging, and dose reduction technologies is becoming increasingly prevalent. In addition, increasing awareness of minimally invasive procedures and rising demand for high-quality cardiovascular and neurovascular interventions support market growth.

Asia-Pacific Interventional X-ray Market Insight

The Asia-Pacific interventional X-ray market is poised to grow at the fastest CAGR during the forecast period, driven by rising healthcare investments, urbanization, and growing adoption of minimally invasive procedures in countries such as China, Japan, and India. The region’s expanding hospital infrastructure and increasing number of specialty centers are driving the demand for fixed and mobile interventional X-ray systems. Furthermore, improving affordability and accessibility of advanced imaging technologies, coupled with government initiatives to strengthen healthcare services, are significantly contributing to market growth across the region.

Japan Interventional X-ray Market Insight

The Japan interventional X-ray market is gaining momentum due to the country’s focus on advanced healthcare technologies, high procedural standards, and demand for precision imaging. Japanese hospitals emphasize minimally invasive interventions, which require sophisticated X-ray systems for cardiovascular, neurological, and oncological procedures. Integration with AI-assisted image processing and hybrid OR setups is fueling growth. Moreover, Japan’s aging population and rising prevalence of chronic diseases are such asly to spur demand for interventional X-ray systems in both hospitals and specialized clinics.

India Interventional X-ray Market Insight

The India interventional X-ray market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, expanding hospital infrastructure, and increasing adoption of minimally invasive procedures. India is emerging as a key market for cardiovascular, neurological, and oncology interventions, driving demand for both fixed and mobile X-ray systems. The push towards advanced healthcare facilities, availability of cost-effective imaging solutions, and growing awareness among medical professionals are key factors propelling market growth. Moreover, government initiatives to improve healthcare accessibility and investments in specialty clinics are significantly supporting the adoption of interventional X-ray systems.

Interventional X-ray Market Share

The Interventional X-ray industry is primarily led by well-established companies, including:

- Shanghai United Imaging Healthcare Co., LTD (China)

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- Canon Medical Systems Corporation (Japan)

- Koninklijke Philips N.V., (Netherlands)

- FUJIFILM Corporation (Japan)

- Shimadzu Corporation (Japan)

- Hologic, Inc. (U.S.)

- Samsung Medison Co., Ltd. (South Korea)

- Boston Scientific Corporation (U.S.)

- Medtronic (Ireland)

- Cook (U.S.)

- Terumo Corporation (Japan)

- Abbott (U.S.)

- Stryker (U.S.)

- Penumbra, Inc. (U.S.)

- AngioDynamics, Inc. (U.S.)

- Merit Medical Systems, Inc. (U.S.)

- Cardinal Health. (U.S.)

- Teleflex Incorporated (U.S.)

What are the Recent Developments in Global Interventional X-ray Market?

- In September 2025, Canon Medical Systems Europe is set to inaugurate a new imaging suite featuring the Alphenix 4D CT system in combination with the Aquilion ONE / INSIGHT Edition. This integration aims to provide comprehensive imaging solutions for complex interventional procedures, enhancing diagnostic capabilities and treatment planning.

- In June 2025, Philips announced a collaboration with Methodist Hospitals in Northwest Indiana to install four new interventional labs. These labs are equipped with advanced imaging technologies to support complex procedures in neurovascular, cardiology, and interventional radiology, reflecting a commitment to enhancing patient care through state-of-the-art facilities

- In May 2025, United Imaging received FDA clearance for its uAngio AVIVA interventional X-ray system, marking a significant advancement in the field. This system is the first to offer intelligent voice assistance, enabling hands-free image review and movement, thereby enhancing procedural workflows and reducing the need for manual adjustments during procedures

- In May 2025, GE HealthCare introduced CleaRecon DL, an AI-based 3D reconstruction platform designed for interventional suites. This technology aims to improve procedural accuracy and efficiency by providing real-time, high-quality 3D imaging, thereby assisting clinicians in complex procedures

- In December 2024, The Bowelbabe Fund, established in memory of Dame Deborah James, donated GBP 1 million to the Royal Marsden Hospital for the installation of a state-of-the-art interventional radiology X-ray scanner. This donation supports the adoption of advanced imaging techniques for minimally invasive cancer treatments, continuing Dame Deborah's legacy in improving cancer care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.