Global Internet of Things (IoT) Testing Market Segmentation, By Testing Type(Functional Testing, Performance Testing, Network Testing, Security Testing, Compatibility Testing, Usability Testing), Services (Professional Services, Managed Services), Application(Smart building And Home Automation, Capillary Networks Management, Smart Utilities, Vehicle Telematics, Smart Manufacturing, Smart Healthcare ) - Industry Trends and Forecast to 2032

Internet of Things (IoT) Testing Market Size

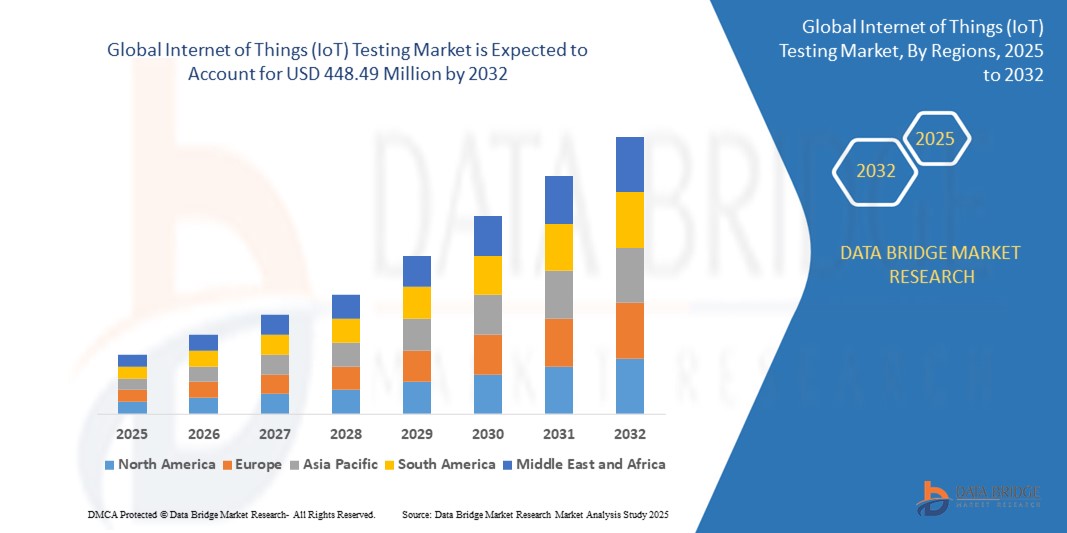

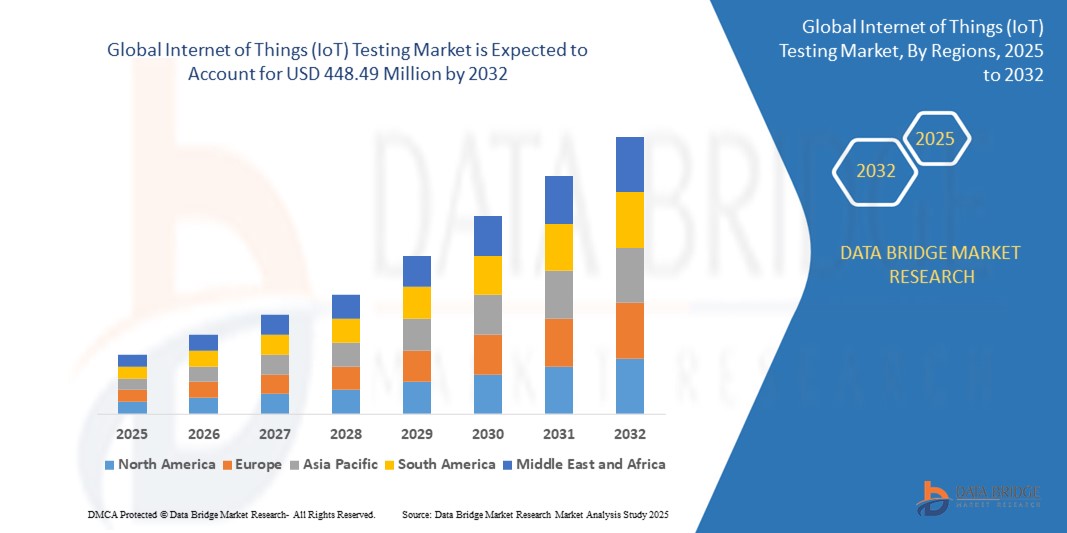

- The Global Internet of Things (IoT) Testing Market was valued at USD 43.74 Million in 2024 and is expected to reach USD 448.49 Million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 34.77%, primarily driven by the rise in the number of IoT testing service providers and the increasing adoption of IoT technology across various sectors.

- This growth is driven by factors such as the rapid adoption of IoT devices, the growing demand for efficient and secure IoT applications, and the increasing need for thorough testing of IoT networks, devices, and systems to ensure reliability, performance, and security.

Internet of Things (IoT) Testing Market Analysis

- IoT testing is crucial for ensuring the performance, security, and interoperability of connected devices, systems, and applications across a wide range of industries, including automotive, healthcare, manufacturing, and smart homes. These testing services are essential for verifying the reliability of the billions of devices connected to the internet, ensuring seamless communication between devices and applications.

- The demand for IoT testing services is largely driven by the increasing number of connected devices and the rise in adoption of IoT solutions across various sectors. The highest growth is seen in regions with advanced technological infrastructures, such as North America and Europe, where businesses and consumers are increasingly relying on IoT devices for smart homes, health monitoring, and industrial applications.

- The North America region remains a dominant market for IoT testing, driven by high technology adoption rates, robust infrastructure, and increasing investments in IoT projects. Moreover, the rise of new IoT applications in sectors like healthcare (e.g., smart medical devices), automotive (e.g., connected cars), and smart cities further accelerates the demand for IoT testing solutions in this region.

- For instance, in 2024, the IoT testing company, Keysight Technologies, partnered with a major automaker to test the connectivity and performance of IoT-enabled automotive systems in connected vehicles. This collaboration focused on ensuring seamless communication between various vehicle components, improving overall safety features, and ensuring compliance with emerging 5G connectivity standards.

- Additionally, in healthcare, a prominent IoT testing service provider worked with a medical device manufacturer to test the interoperability of IoT-connected devices like wearable health monitors and smart medical equipment. The aim was to ensure that these devices provide accurate real-time data for remote patient monitoring and that they comply with healthcare regulations such as HIPAA (Health Insurance Portability and Accountability Act) in the U.S.

- Globally, IoT testing services have become a critical component in the lifecycle of IoT devices, with testing services being integrated across product development, deployment, and maintenance phases to ensure smooth operation and compliance with security standards.

Report Scope and Internet of Things (IoT) Testing Market Segmentation

|

Attributes

|

Internet of Things (IoT) Testing Market Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players

|

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Internet of Things (IoT) Testing Market Trends

“Increased Adoption of Digital Twin Technology and Advanced Testing Automation”

- One of the prominent trends in the Global Internet of Things (IoT) Testing Market is the rising adoption of digital twin technology and advanced testing automation.

- These technologies enhance the precision, efficiency, and scalability of IoT testing by creating virtual replicas of physical devices and systems, allowing simulation and validation of real-world operations before actual deployment.

- For instance, digital twin models enable organizations to conduct comprehensive testing of IoT devices under different scenarios, helping to identify potential failures, optimize performance, and reduce development time and costs.

- Additionally, the integration of AI and machine learning within testing frameworks is improving the accuracy of automated testing processes, enabling faster detection of bugs, security vulnerabilities, and interoperability issues across large networks of IoT devices.

- This trend is transforming the traditional IoT testing environment by making it more predictive, proactive, and resilient, thus driving higher demand for sophisticated IoT testing solutions across industries such as smart manufacturing, smart healthcare, and automotive telematics.

Internet of Things (IoT) Testing Market Dynamics

Driver

“Advancing IoT Testing with Microservices and DevOps Integration”

- The integration of microservices and DevOps methodologies in IoT testing is enhancing the agility, scalability, and efficiency of testing processes, helping organizations to rapidly deploy and update IoT applications.

- Microservices enable faster development and testing of individual IoT application components, while DevOps ensures continuous testing and integration, resulting in faster delivery times and enhanced product quality.

- This approach is particularly beneficial for handling complex IoT networks, ensuring that all components function harmoniously and securely under various scenarios.

For instance,

- In 2023, companies like Tata Consultancy Services (TCS) and HCL Technologies leveraged microservices and DevOps to improve IoT application delivery and testing speeds, which significantly enhanced the market adoption of IoT solutions in industries like smart manufacturing and healthcare.

- In early 2024, a leading IoT testing service provider, RapidValue Solutions, utilized microservices to streamline the testing of its smart building solutions, cutting down the testing cycle by 20% and reducing errors.

- The seamless integration of microservices and DevOps will likely result in a more resilient and flexible IoT testing framework, boosting the speed of innovation and reducing operational risks.

Opportunity

“Adoption of AI-Driven Testing Tools”

- The growing adoption of artificial intelligence (AI) in IoT testing is opening new opportunities for predictive testing and automated analysis. AI-driven tools can identify vulnerabilities, optimize system performance, and predict potential failures in IoT networks, allowing for proactive solutions.

- AI tools can also assist in managing large data sets, which is crucial for analyzing the behavior and performance of complex IoT systems.

For instance,

- In 2024, a key player in the market, Keysight Technologies, introduced AI-powered test platforms that can simulate various IoT network behaviors, reducing the manual effort in testing and improving the overall testing efficiency.

- In 2025, SmartBear Software launched an AI-driven IoT testing suite that automates the testing process for IoT applications, speeding up time-to-market for IoT solutions.

- The rise in AI technology within IoT testing will continue to provide significant growth opportunities by enhancing accuracy, reducing testing time, and optimizing IoT performance in real-world conditions.

Restraint/Challenge

“Data Security and Privacy Risks in IoT Testing”

- One of the major challenges for the IoT testing market is ensuring the security and privacy of the vast amounts of data generated by interconnected devices. IoT systems often involve sensitive personal and organizational data, which makes them vulnerable to cyberattacks if not tested thoroughly for security vulnerabilities.

- Testing every potential input and variable to ensure the protection of private data is complex and costly, posing a significant challenge for service providers and testing firms.

For instance,

- In 2023, a report from the European Union Agency for Cybersecurity (ENISA) highlighted several data security breaches in IoT devices that had not been adequately tested for vulnerabilities before deployment, exposing consumers to potential data theft and privacy violations.

- In 2024, the rise of IoT botnets, which exploit unsecure IoT devices, underscored the necessity for robust security testing, which is still an ongoing challenge for the industry.

- The ongoing struggle to balance data privacy and security with the rapid deployment of IoT systems remains a critical concern, requiring more advanced and comprehensive testing methodologies to mitigate risks effectively.

Internet of Things (IoT) Testing Market Scope

The internet of things (IoT) testing market is segmented on the basis of testing types, services, and application.

|

Segmentation

|

Sub-Segmentation

|

|

By Testing Type

|

|

|

By Services

|

|

|

By Application

|

|

Internet of Things (IoT) Testing Market Regional Analysis

“North America is the Dominant Region in the Internet of Things (IoT) Testing Market”

- North America leads the Internet of Things (IoT) Testing Market, driven by rapid technological adoption, the presence of major service providers, and advanced infrastructure.

- The U.S. holds a significant market share, largely due to the increased adoption of IoT technologies across smart homes, automotive industries, and manufacturing, as well as a strong emphasis on innovation and research & development by key players like Tata Consultancy Services and HCL Technologies.

- With a robust ecosystem of IoT device manufacturers and service providers, North America is seeing widespread integration of IoT applications, including smart buildings, healthcare, and automotive telematics, which is fueling demand for IoT testing services.

- Moreover, the rise of smart home technology and significant investments in IoT network security contribute to a growing need for comprehensive IoT testing solutions in the region.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific (APAC) region is set to experience the highest growth rate in the IoT Testing Market, driven by expanding IoT infrastructure, technological advancements, and increasing government support in countries like China, India, and Japan.

- China and India are emerging as key players due to the massive demand for smart cities, smart manufacturing, and automotive telematics, which require robust testing services. With large populations and increasing IoT device deployments, the need for effective IoT testing solutions in these countries is growing rapidly.

- Japan remains a crucial market, leading the charge in the adoption of advanced IoT applications, including smart utilities and healthcare, as well as stringent regulations around network performance and security. The country is poised to continue its leadership in integrating IoT in various industrial sectors.

- APAC’s growing number of investors in IoT testing services and the increasing demand for efficient production systems is also fueling the market's rapid growth in the region.

Internet of Things (IoT) Testing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Praetorian Group, Inc.(United States)

- Trustwave Holdings, Inc.(United States)

- Novacoast, Inc. (United States)

- Apica(Sweden)

- SAKSOF(India)

- RapidValue Solutions(India)

- Happiest Minds(India)

- HCL Technologies Limited(India)

- Tata Consultancy Services Limited(India)

- SmartBear Software(United States)

- Rapid7 (United States)

- Capgemini(France)

- Infosys Limited (India)

- Cognizant(United States)

- Ixia(United States)

- Keysight Technologies(United States)

- AFour Technologies(India)

- Biz4Group(United States)

- HQSoftware(Estonia)

- IQ DIRECT INC. (United States)

Latest Developments in Global Internet of Things (IoT) Testing Market

- In January 2025, Service Virtualization became a key innovation in IoT testing, as IoT service providers integrated advanced simulation techniques to replicate various IoT device behaviors. This method ensures that complex IoT systems can be effectively tested before deployment, especially in smart building systems and vehicle telematics applications. This development helps overcome the challenge of testing in real-world environments, where physical devices might not always be available or practical to test. Virtual environments allow testing of IoT applications under various conditions, ensuring better scalability and performance.

- In October 2024, IoT security testing saw a significant leap forward with the introduction of next-gen penetration testing tools by companies like SmartBear Software and Rapid7. These tools help assess vulnerabilities in IoT devices connected to various smart utilities and smart healthcare applications.The adoption of security testing tools for IoT networks became crucial with the rising concerns over cyber threats and unauthorized access to sensitive data in applications such as smart homes and automotive telematics.

- In September 2024, testing solutions for IoT device compatibility and performance received a boost with enhanced API monitoring and network testing services offered by companies like Keysight Technologies and Tata Consultancy Services. This development aimed to optimize the connectivity and responsiveness of IoT applications in smart manufacturing and vehicle telematics sectors. As IoT devices become more interconnected, testing the interaction between devices from different manufacturers becomes increasingly important, ensuring seamless communication and optimal system performance.

SKU-