Intercom Devices Market Analysis and Insights

The global intercom devices market is the collective and worldwide industry encompassing the production, distribution, and utilization of communication systems designed to facilitate two-way voice and often, video communication between individuals across different locations within buildings, facilities, or confined spaces. This market includes a diverse range of intercom solutions, both traditional and technologically advanced, utilized across residential, commercial, industrial, institutional, and public sectors. The market involves the development of hardware, software, and integrated systems that contribute to enhancing communication efficiency, security, and convenience, thereby addressing a variety of needs and applications across various global industries and settings.

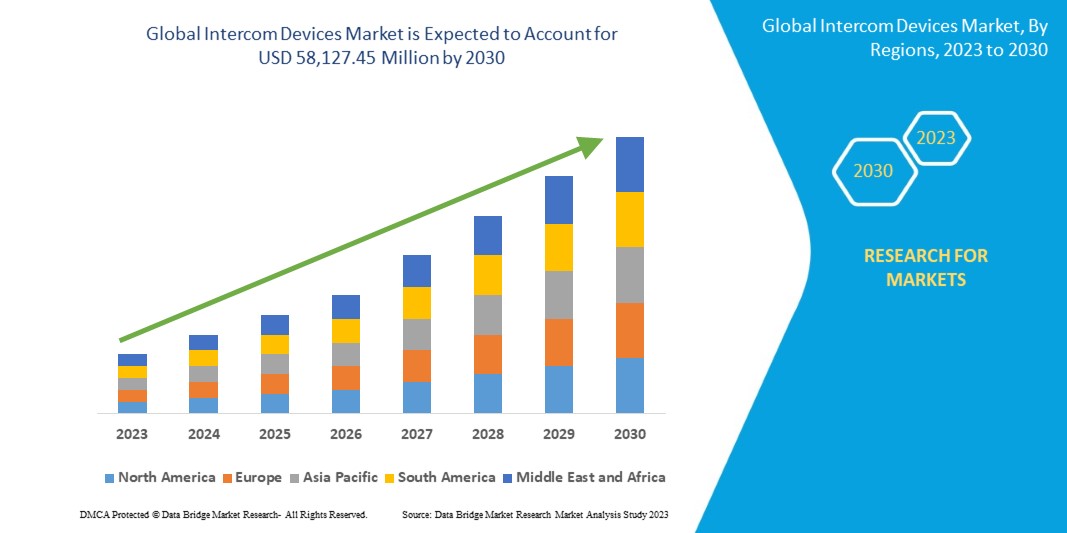

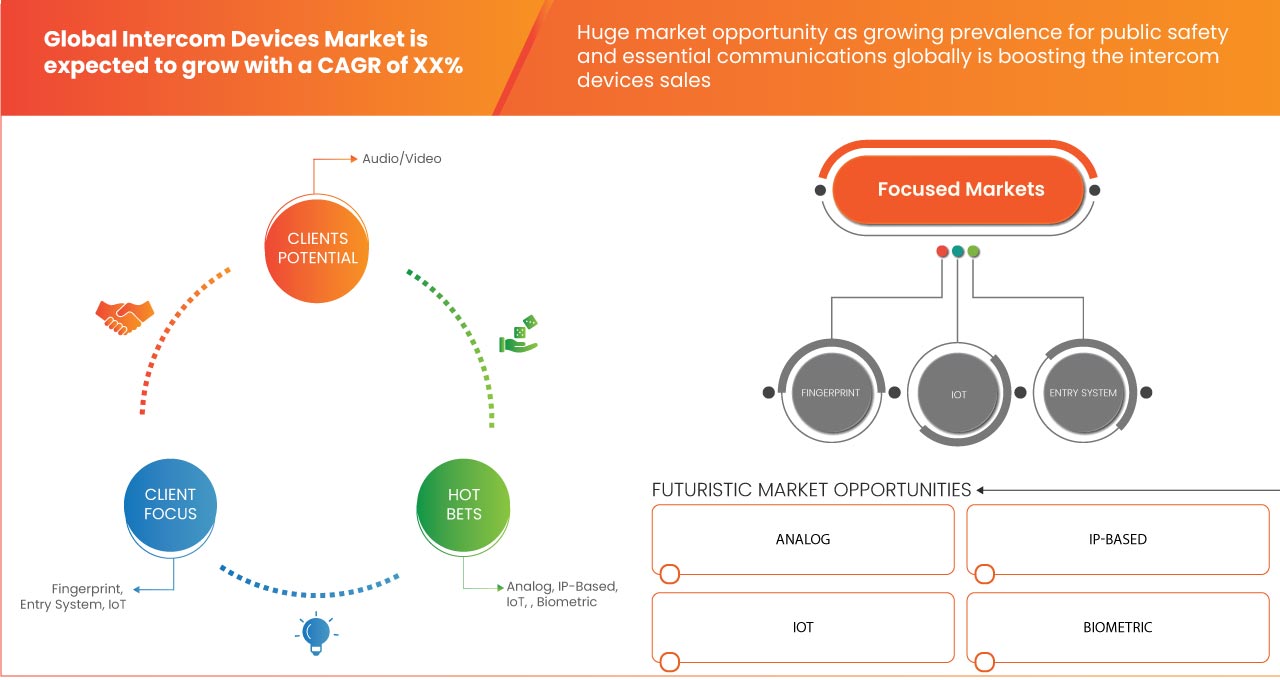

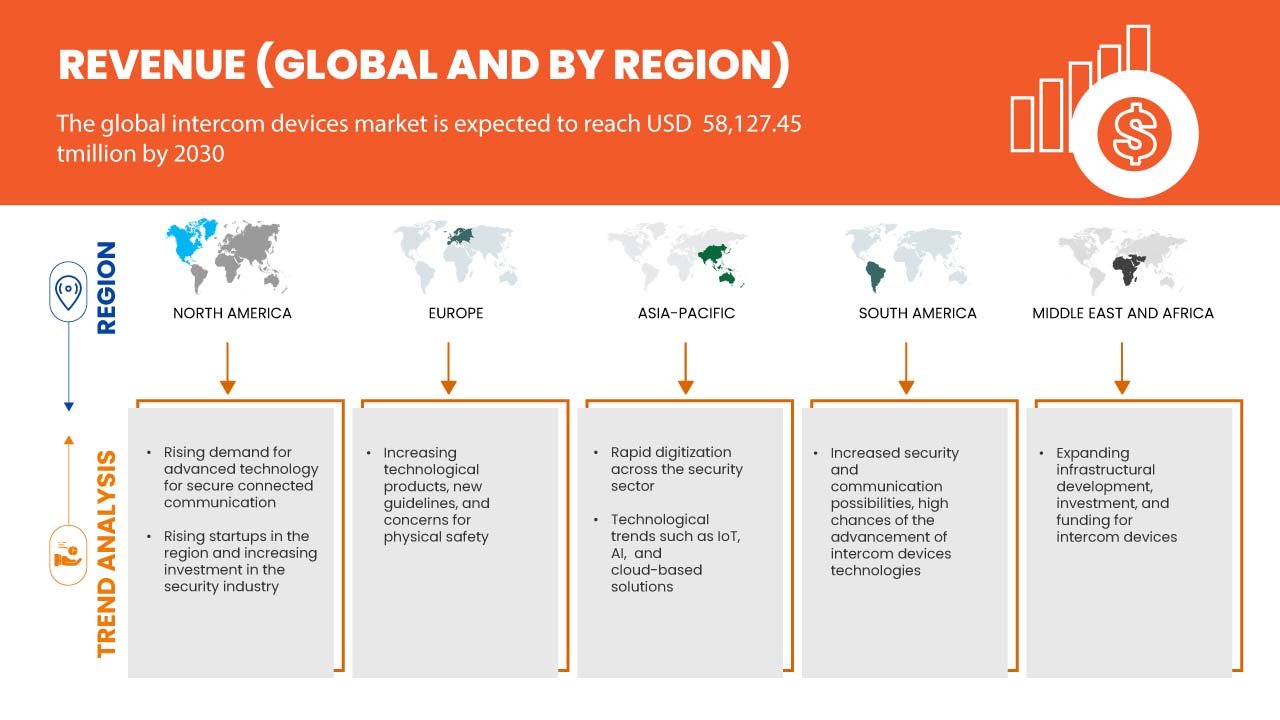

Data Bridge Market Research analyzes that the global intercom devices market is expected to reach a value of USD 58,127.45 million by 2030, growing with a CAGR of 12.7 % during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

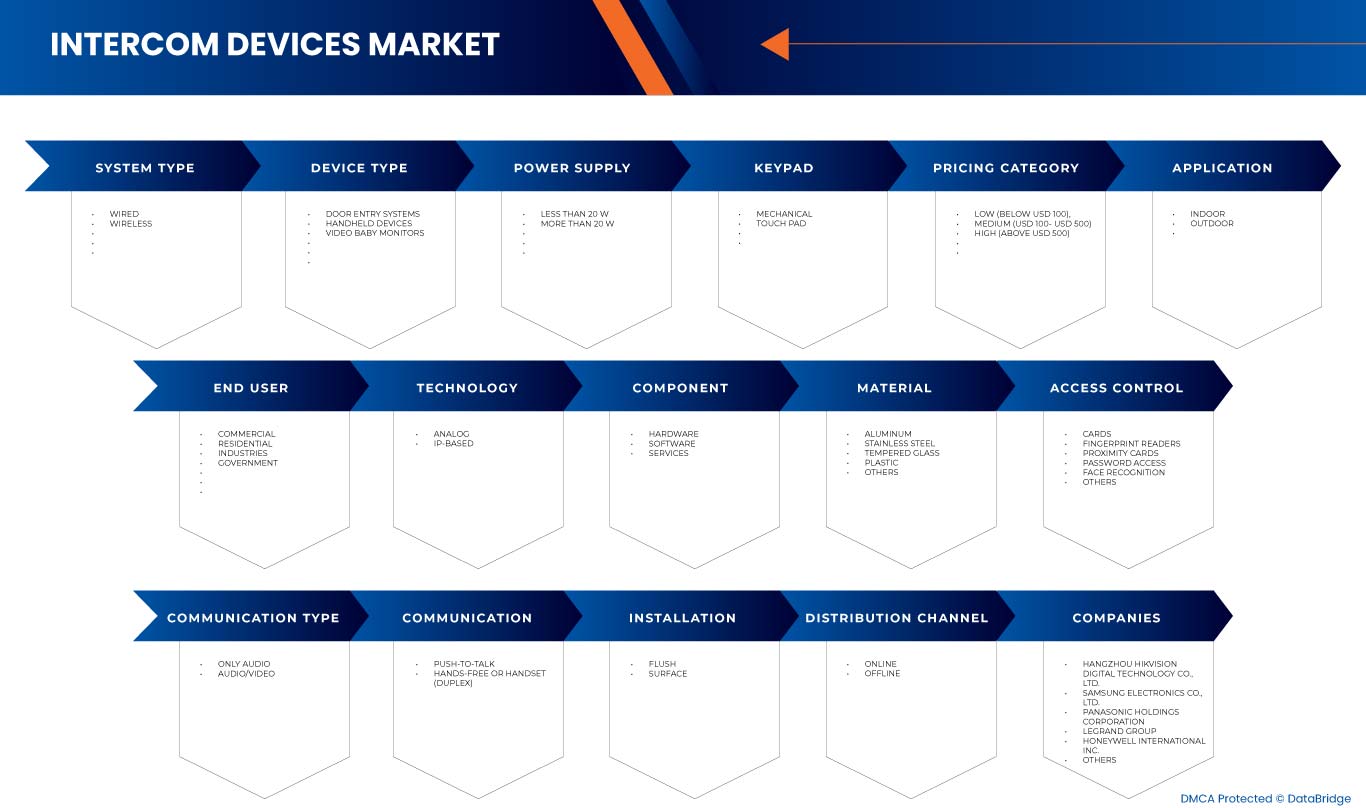

System Type (Wired and Wireless), Component (Hardware, Software, and Services), Device Type (Door Entry Systems, Handheld Devices, and Video Baby Monitors), Material (Aluminum, Stainless Steel, Tempered Glass, Plastic, and Others), Power Supply (Less Than 20 W and More Than 20 W), Access Control (Cards, Fingerprint Readers, Proximity Cards, Password Access, Face Recognition, and Others), Technology (Analog and IP-Based), Keypad (Mechanical Button and Touch Pad), Communication Type (Audio/Video and Only Audio)), Price Category (Low (Below USD 100), Medium (USD 100- USD 500), and High (Above USD 500)), Communication (Push-To-Talk and Hands-Free Or Handset (Duplex)), Application (Outdoor and Indoor), Installation (Flush and Surface), End User (Commercial, Residential, Industries, and Government), Distribution Channel (Offline and Online) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, U.K., France, Spain, Italy, Netherlands, Russia, Switzerland, Denmark, Sweden, Poland, Belgium, Turkey, Norway, Finland, Rest of Europe, China, Japan, South Korea, India, Malaysia, Taiwan, Australia & Zealand, Singapore, Indonesia, Thailand, Philippines, Vietnam, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, U.A.E., Kuwait, Qatar, Egypt, Israel, and Rest of Middle East and Africa |

|

Market Players Covered |

Hangzhou Hikvision Digital Technology Co., Ltd, SAMSUNG ELECTRONICS CO., LTD., Panasonic Holdings Corporation, Schneider Intercom GmbH (A Subsidiary of TKH GROUP), Siedle, URMET S.p.A., Zicom, ABB, Aiphone Corporation, Godrej & Boyce Manufacturing Company Limited, Axis Communications AB (A Subsidiary of Canon Group), Gira, Zenitel, The Akuvox Company, Hager Group, GUANGDONG ANJUBAO DIGITAL TECHNOLOGY CO.,LTD, Schneider Electric, Alpha Communications, COMELIT S.p.A., FERMAX ELECTRÓNICA, S.A.U., TCS TürControlSysteme AG, TOA Corporation, Honeywell International Inc., Dahua Technology Co., Ltd, Legrand Group, Xiamen Leelen Technology Co.,Ltd., and COMMAX among others |

Market Definition

Intercom devices facilitate real-time communication and are widely adopted in residential, commercial, and industrial settings. In homes, intercoms provide enhanced security and convenient internal communication. Industrial applications involve intercoms for secure access control. The market is driven by the growing demand for security equipment and technological advancements, including wireless and IP-based solutions, which improve communication range. However, challenges such as privacy concerns and integration complexities could restrain market growth. One significant market opportunity lies in the integration of intercom devices with smart home ecosystems. Moreover, the ongoing technological advancements in video and audio quality, and the integration of AI and cloud services, further elevate the market's potential.

Global Intercom Devices Market Dynamics

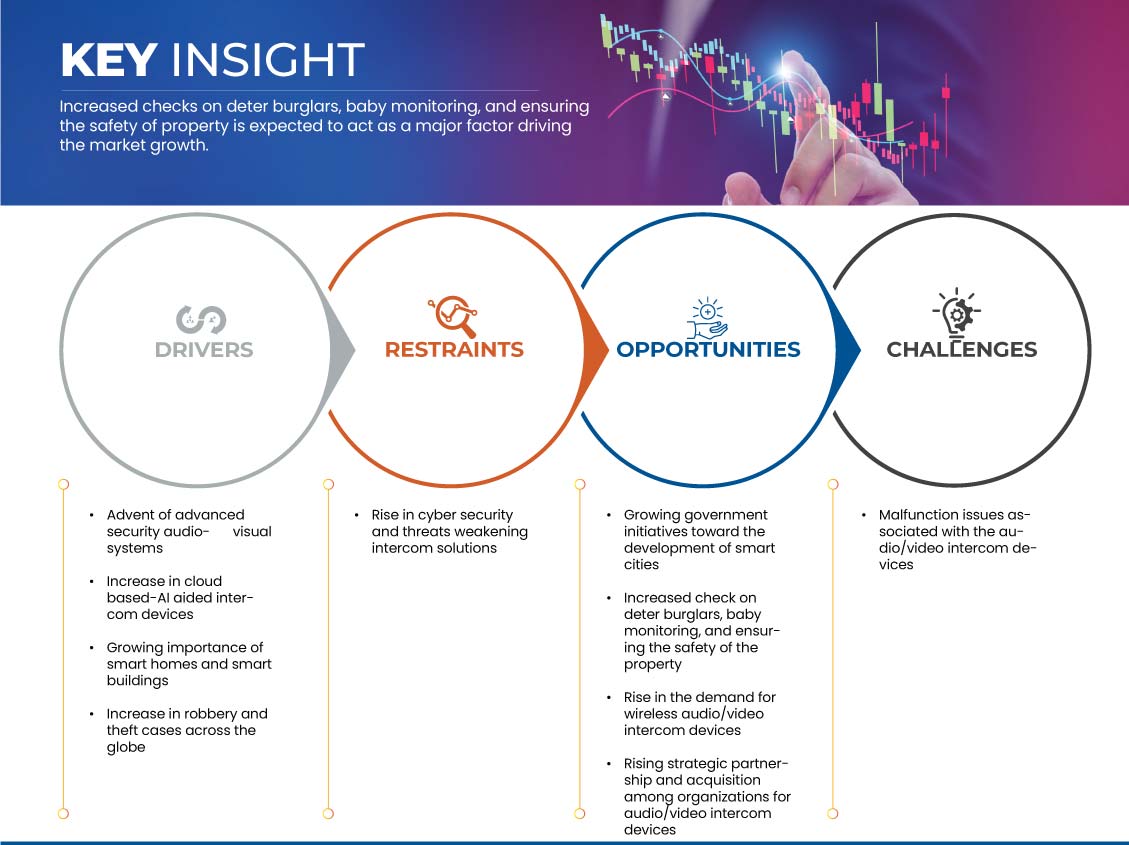

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Driver

- Advent of Advanced Security Audio-Visual Systems

The advent of advanced security audio-visual systems has significantly transformed the landscape of the market, ushering in a new era of enhanced communication, surveillance, and security capabilities. This technological evolution has spurred remarkable innovations in intercom devices, driving their demand across diverse industries and regions. Traditional intercom systems primarily focused on audio communication. However, the integration of advanced security audio-visual systems has brought about a revolutionary shift by combining both audio and video elements. This convergence has empowered users with the ability to not only hear but also see the individuals they are communicating with. In security contexts, this translates to improved verification processes, as personnel can visually confirm the identity of visitors before granting access. This heightened level of verification augments security protocols, making intercom devices an integral component of modern access control and surveillance systems, which is expected to drive market growth.

Restraint

- Rise in Cyber Security and Threats Weakening Intercom Solutions

Cybercrime/hacking and cybersecurity issues have increased by 600% during the pandemic across all sectors. Flaws in network or software security are a weakness that hackers exploit to perform unauthorized actions within a system. According to Purple Sec LLC, in 2018 mobile malware variants for mobile have increased by 54% 2018, out of which 98% of mobile malware target Android devices. 25% of businesses are estimated to have been victims of crypto-jacking, including the security industry. For instance, Rambus Company stated that about 80% of IoT devices are prone to cyber-attacks. The hack could be identification theft by hacking the information from unprotected smart home appliances and internet-connected devices such as smart locks, smart video door locks, biometrics devices, and others. Smart security can also malfunction if there is no protective firewall and strong cyber security application.

Opportunity

- Growing Government Initiatives Toward the Development of Smart Cities

The initiatives taken by the government in smart cities and communities are done by two governance bodies that are a high-level group advising the European Commission (EC) made up of senior representatives from industries, cities, and civil society, and the smart cities stakeholder platform. The platform focuses on identifying the solutions and needs of various developers. Smart cities are urban areas that leverage technology and data-driven solutions to enhance the quality of life for residents, improve sustainability, and streamline urban management. Intercom devices, with their communication, security, and integration capabilities, play a pivotal role in shaping the communication infrastructure of these smart cities, which is expected to provide opportunities for market growth.

Challenge

- Malfunction Issues Associated with the Intercom Devices

While intercom devices offer numerous benefits in communication, security, and convenience, technical glitches and malfunctions can undermine their effectiveness and erode customer trust. These issues can impact various aspects of the market and create obstacles that manufacturers and providers need to address. Intercom devices are relied upon for communication, security, and access control purposes. Malfunctions such as dropped calls, poor audio quality, or video lag can lead to concerns about the reliability of the devices. Users may become hesitant to depend on intercom systems for critical functions, eroding trust and potentially leading them to seek alternative solutions.

Malfunctioning intercom devices can lead to a subpar user experience, frustrating users, and diminishing overall satisfaction. Difficulties in initiating communication, delayed responses, or unclear audio can lead to user dissatisfaction and negative perceptions of the technology. Unhappy customers may be less likely to recommend intercom devices to others, impacting word-of-mouth referrals and potential growth.

Recent Developments

- In September 2022, Hangzhou Hikvision Digital Technology Co., Ltd. introduced its MinMoe Iris Recognition Terminal, setting new standards in access control security. Leveraging the unique and stable iris patterns of individuals, this innovative terminal ensures precise identification and differentiation within just one second, even at a distance of up to 70 cm. Its incorporation of color imaging and video anti-counterfeiting further guarantees accuracy. The terminal's multi-method authentication, including iris recognition, face recognition, fingerprint, and cards, enhances flexibility and security for access control solutions.

- In June 2022, ABB continued to elevate the global intercom devices market with its cutting-edge Welcome IP portfolio, redefining door entry control from single dwellings to Multi-Dwelling Units (MDUs). This innovative range encompasses a spectrum of features, including audio/video transmission, intercom, access control, and IP camera integration. The flexible IP infrastructure facilitates easy planning, high scalability, and robust cyber security. Notably, the flagship Welcome IP station boasts a 5-inch touch display, ensuring intuitive user interaction. The IP Touch internal touchscreen and ABB Welcome app seamlessly integrate with the external unit, offering a unified design. ABB's Welcome IP range embodies modernity, versatility, and enhanced functionality, catering to diverse residential and commercial needs.

Global Intercom Devices Market Scope

The global intercom devices market is segmented into fifteen notable segments based on system type, component, device type, material, power supply, access control, technology, keypad, communication type, price category, communication, application, installation, end user, and distribution channel.

System Type

- Wired

- Wireless

On the basis of system type, the market is segmented into wired and wireless.

Component

- Hardware

- Software

- Services

On the basis of component, the market is segmented into hardware, software, and services.

Device Type

- Door Entry Systems

- Handheld Devices

- Video Baby Monitors

On the basis of device type, the market is segmented into door entry systems, handheld devices, and video baby monitors.

Material

- Aluminium

- Stainless Steel

- Tempered Glass

- Plastic

- Others

On the basis of material, the market is segmented into aluminum, stainless steel, tempered glass, plastic, and others.

Power Supply

- Less than 20 W

- More than 20 W

On the basis of power supply, the market is segmented into less than 20 W and more than 20 W.

Access Control

- Cards

- Fingerprint Readers

- Proximity Cards

- Password Access

- Face Recognition

- Others

On the basis of access control, the market is segmented into cards, fingerprint readers, proximity cards, password access, face recognition, and others.

Technology

- Analog

- IP Based

On the basis of technology, the market is segmented into analog and IP-based.

Keypad

- Mechanical Button

- Touch Pad

On the basis of keypad, the market is segmented into mechanical button and touch pad.

Communication Type

- Only Audio

- Audio/Video

On the basis of communication type, the market is segmented into audio/video and only audio.

Pricing Category

- Low (Below USD 100)

- Medium (USD 100- USD 500)

- High (Above USD 500)

On the basis of price category, the market is segmented into low (below USD 100), medium (USD 100- USD 500), and high (above USD 500).

Communication

- Push-To-Talk

- Hands-Free Or Handset (Duplex)

On the basis of communication, the market is segmented into push-to-talk and hands-free or handset (duplex).

Application

- Indoor

- Outdoor

On the basis of application, the market is segmented into outdoor and indoor.

Installation

- Flush

- Surface

On the basis of installation, the market is segmented into flush and surface.

End User

- Commercial

- Residential

- Industries

- Government

On the basis of end user, the market is segmented into commercial, residential, industries, and government.

Distribution Channel

- Offline

- Online

On the basis of distribution channel, the market is segmented into offline and online.

Global Intercom Devices MarketRegional Analysis/Insights

The global intercom devices market is segmented into fifteen notable segments based on system type, component, device type, material, power supply, access control, technology, keypad, communication type, price category, communication, application, installation, end user, and distribution channel.

The countries covered in this market report are U.S., Canada, Mexico, Germany, U.K., France, Spain, Italy, Netherlands, Russia, Switzerland, Denmark, Sweden, Poland, Belgium, Turkey, Norway, Finland, Rest of Europe, China, Japan, South Korea, India, Malaysia, Taiwan, Australia & Zealand, Singapore, Indonesia, Thailand, Philippines, Vietnam, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, U.A.E., Kuwait, Qatar, Egypt, Israel, and Rest of Middle East and Africa.

North America is expected to dominate the market due to the presence of key market players in the largest consumer market with a high GDP. The U.S. is expected to dominate the North America region due to the strong presence of key players. Germany is expected to dominate the Europe region due to the increasing demand from emerging markets and expansion. China is expected to dominate the Asia-Pacific region due to increasing customer inclinations toward recording devices.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from global brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Intercom Devices Market Share Analysis

The global intercom devices market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, product width and breadth, application dominance, and product type lifeline curve. The above data points provided are only related to the company’s focus on the market.

Some of the major players operating in the global intercom devices market are Hangzhou Hikvision Digital Technology Co., Ltd, SAMSUNG ELECTRONICS CO., LTD., Panasonic Holdings Corporation, Schneider Intercom GmbH (A Subsidiary of TKH GROUP), Siedle, URMET S.p.A., Zicom, ABB, Aiphone Corporation, Godrej & Boyce Manufacturing Company Limited, Axis Communications AB (A Subsidiary of Canon Group), Gira, Zenitel, The Akuvox Company, Hager Group, GUANGDONG ANJUBAO DIGITAL TECHNOLOGY CO.,LTD, Schneider Electric, Alpha Communications, COMELIT S.p.A., FERMAX ELECTRÓNICA, S.A.U., TCS TürControlSysteme AG, TOA Corporation, Honeywell International Inc., Dahua Technology Co., Ltd, Legrand Group, Xiamen Leelen Technology Co.,Ltd., and COMMAX among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL INTERCOM DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 SYSTEM TYPE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ADVENT OF ADVANCED SECURITY AUDIO-VISUAL SYSTEMS

5.1.2 INCREASE IN ROBBERY, BURGLARY, AND THIEF CASES ACROSS THE GLOBE

5.1.3 INCREASE IN CLOUD BASED-AI AIDED INTERCOM DEVICES

5.1.4 GROWING IMPORTANCE OF SMART HOMES AND SMART BUILDINGS

5.2 RESTRAINT

5.2.1 RISE IN CYBER SECURITY AND THREATS WEAKENING INTERCOM SOLUTIONS

5.3 OPPORTUNITIES

5.3.1 GROWING GOVERNMENT INITIATIVES TOWARD THE DEVELOPMENT OF SMART CITIES

5.3.2 INCREASED CHECKS ON DETER BURGLARS, BABY MONITORING, AND ENSURING THE SAFETY OF PROPERTY

5.3.3 RISE IN DEMAND FOR WIRELESS INTERCOM DEVICES

5.3.4 RISING STRATEGIC PARTNERSHIP AND ACQUISITION AMONG ORGANIZATIONS FOR INTERCOM DEVICES

5.4 CHALLENGE

5.4.1 MALFUNCTION ISSUES ASSOCIATED WITH THE INTERCOM DEVICES

6 GLOBAL INTERCOM DEVICES MARKET, BY ACCESS CONTROL

6.1 OVERVIEW

6.2 CARDS

6.3 FINGERPRINT READERS

6.4 PROXIMITY CARDS

6.5 PASSWORD ACCESS

6.6 FACE RECOGNITION

6.7 OTHERS

7 GLOBAL INTERCOM DEVICES MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 ANALOG

7.3 IP-BASED

8 GLOBAL INTERCOM DEVICES MARKET, BY KEYPAD

8.1 OVERVIEW

8.2 MECHANICAL BUTTON

8.3 TOUCH PAD

9 GLOBAL INTERCOM DEVICES MARKET, BY DEVICE TYPE

9.1 OVERVIEW

9.2 DOOR ENTRY SYSTEMS

9.3 HANDHELD DEVICES

9.4 VIDEO BABY MONITORS

10 GLOBAL INTERCOM DEVICES MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 ALUMINUM

10.3 STAINLESS STEEL

10.4 TEMPERED GLASS

10.5 PLASTIC

10.6 OTHERS

11 GLOBAL INTERCOM DEVICES MARKET, BY POWER SUPPLY

11.1 OVERVIEW

11.2 LESS THAN 20 W

11.3 MORE THAN 20 W

12 GLOBAL INTERCOM DEVICES MARKET, BY PRICE CATEGORY

12.1 OVERVIEW

12.2 LOW (BELOW USD 100)

12.3 MEDIUM (USD 100- USD 500)

12.4 HIGH (ABOVE USD 500)

13 GLOBAL INTERCOM DEVICES MARKET, BY COMMUNICATION

13.1 OVERVIEW

13.2 PUSH-TO-TALK

13.3 HANDS-FREE OR HANDSET (DUPLEX)

14 GLOBAL INTERCOM DEVICES MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 OUTDOOR

14.3 INDOOR

15 GLOBAL INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE

15.1 OVERVIEW

15.2 AUDIO/VIDEO

15.2.1 ON THE BASIS OF SCREEN SIZE

15.2.1.1 BELOW 3 INCHES

15.2.1.2 2-5 INCHES

15.2.1.3 5-7 INCHES

15.2.1.4 ABOVE 7 INCHES

15.3 ONLY AUDIO

16 GLOBAL INTERCOM DEVICES MARKET, BY END USER

16.1 OVERVIEW

16.2 COMMERCIAL

16.2.1 COMMERCIAL, TYPE

16.2.1.1 HOTEL

16.2.1.2 AIRPORT

16.2.1.3 BANKS AND FINANCIAL INSTITUTION

16.2.1.4 PRISONS AND POLICE STATION

16.2.1.5 OFFICES

16.2.1.6 HEALTCARE

16.2.1.7 SCHOOL AND UNIVERSITIES

16.2.1.8 PARKING GARAGE

16.2.1.9 OTHERS

16.2.2 DEVICE TYPE

16.2.2.1 DOOR ENTRY SYSTEMS

16.2.2.2 HANDHELD DEVICES

16.2.2.3 VIDEO BABY MONITORS

16.3 RESIDENTIAL

16.3.1 TYPE

16.3.1.1 APARTMENTS

16.3.1.2 SINGLE OR MULTI-FAMILY HOMES

16.3.1.3 HOSTEL

16.3.1.4 CONDOMINIUMS

16.3.1.5 OTHERS

16.3.2 DEVICE TYPE

16.3.2.1 DOOR ENTRY SYSTEMS

16.3.2.2 HANDHELD DEVICES

16.3.2.3 VIDEO BABY MONITORS

16.4 INDUSTRIES

16.4.1 DEVICE TYPE

16.4.1.1 DOOR ENTRY SYSTEMS

16.4.1.2 HANDHELD DEVICES

16.4.1.3 VIDEO BABY MONITORS

16.5 GOVERNMENT

16.5.1 DEVICE TYPE

16.5.1.1 DOOR ENTRY SYSTEMS

16.5.1.2 HANDHELD DEVICES

16.5.1.3 VIDEO BABY MONITORS

17 GLOBAL INTERCOM DEVICES MARKET, BY INSTALLATION

17.1 OVERVIEW

17.2 FLUSH

17.3 SURFACE

18 GLOBAL INTERCOM DEVICES MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 OFFLINE

18.2.1 SPECIALITY STORES

18.2.2 SUPERMARKET/HYPERMARKET

18.2.3 WHOLESALER

18.2.4 OTHERS

18.3 ONLINE

18.3.1 E-COMMERCE

18.3.2 COMPANY WEBSITE

19 GLOBAL INTERCOM DEVICES MARKET, BY SYSTEM TYPE

19.1 OVERVIEW

19.2 WIRED

19.2.1 2-WIRE SYSTEM

19.2.2 CAT-5 SYSTEM

19.2.3 4-WIRE SYSTEM

19.2.4 OTHERS

19.3 WIRELESS

19.3.1 WIFI

19.3.2 RADIO FREQUENCY

19.3.3 OTHERS

20 GLOBAL INTERCOM DEVICES MARKET, BY COMPONENT

20.1 OVERVIEW

20.2 HARDWARE

20.2.1 CAMERAS

20.2.1.1 LESS THAN 2 MM

20.2.1.2 2 MM-3 MM

20.2.1.3 MORE THAN 3 MM

20.2.2 LCD SCREEN

20.2.2.1 CAPACITIVE

20.2.2.2 RESISTIVE

20.2.3 READER

20.2.4 SENSOR

20.2.4.1 IMAGE SENSOR

20.2.4.2 PROXIMITY SENSOR

20.2.4.3 OTHERS

20.2.5 SWITCHES

20.2.6 ACCESSORIES

20.2.7 OTHERS

20.3 SOFTWARE

20.4 SERVICES

20.4.1 INSTALLATION

20.4.2 SUPPORT AND MAINTENANCE

20.4.3 TESTING

21 GLOBAL INTERCOM DEVICES MARKET, BY REGION

21.1 OVERVIEW

21.2 NORTH AMERICA

21.2.1 U.S.

21.2.2 CANADA

21.2.3 MEXICO

21.3 EUROPE

21.3.1 U.K.

21.3.2 GERMANY

21.3.3 FRANCE

21.3.4 ITALY

21.3.5 SPAIN

21.3.6 RUSSIA

21.3.7 NETHERLANDS

21.3.8 SWITZERLAND

21.3.9 TURKEY

21.3.10 BELGIUM

21.3.11 DENMARK

21.3.12 SWEDEN

21.3.13 POLAND

21.3.14 NORWAY

21.3.15 FINLAND

21.3.16 REST OF EUROPE

21.4 ASIA-PACIFIC

21.4.1 CHINA

21.4.2 JAPAN

21.4.3 SOUTH KOREA

21.4.4 INDIA

21.4.5 MALAYSIA

21.4.6 AUSTRALIA & NEW ZEALAND

21.4.7 TAIWAN

21.4.8 SINGAPORE

21.4.9 INDONESIA

21.4.10 THAILAND

21.4.11 PHILIPPINES

21.4.12 VIETNAM

21.4.13 REST OF ASIA-PACIFIC

21.5 MIDDLE EAST AND AFRICA

21.5.1 U.A.E.

21.5.2 SAUDI ARABIA

21.5.3 SOUTH AFRICA

21.5.4 EGYPT

21.5.5 ISRAEL

21.5.6 QATAR

21.5.7 KUWAIT

21.5.8 REST OF MIDDLE EAST AND AFRICA

21.6 SOUTH AMERICA

21.6.1 BRAZIL

21.6.2 ARGENTINA

21.6.3 REST OF SOUTH AMERICA

22 GLOBAL INTERCOM DEVICES MARKET: COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: GLOBAL

22.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

22.3 COMPANY SHARE ANALYSIS: EUROPE

22.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

23 SWOT ANALYSIS

24 COMPANY PROFILINGS

24.1 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD

24.1.1 COMPANY SNAPSHOT

24.1.2 REVENUE ANALYSIS

24.1.3 COMPANY SHARE ANALYSIS

24.1.4 PRODUCT PORTFOLIO

24.1.5 RECENT DEVELOPMENTS

24.2 SAMSUNG ELECTRONICS CO., LTD.

24.2.1 COMPANY PROFILE

24.2.2 REVENUE ANALYSIS

24.2.3 COMPANY SHARE ANALYSIS

24.2.4 PRODUCT PORTFOLIO

24.2.5 RECENT DEVELOPMENTS

24.3 PANASONIC HOLDINGS CORPORATION

24.3.1 COMPANY SNAPSHOT

24.3.2 REVENUE ANALYSIS

24.3.3 COMPANY SHARE ANALYSIS

24.3.4 PRODUCTS PORTFOLIO

24.3.5 RECENT DEVELOPMENTS

24.4 LEGRAND GROUP

24.4.1 COMPANY SNAPSHOT

24.4.2 REVENUE ANALYSIS

24.4.3 PRODUCTS PORTFOLIO

24.4.4 RECENT DEVELOPMENT

24.5 HONEYWELL INTERNATIONAL INC.

24.5.1 COMPANY SNAPSHOT

24.5.2 REVENUE ANALYSIS

24.5.3 PRODUCTS PORTFOLIO

24.5.4 RECENT DEVELOPMENT

24.6 ABB

24.6.1 COMPANY PROFILE

24.6.2 REVENUE ANALYSIS

24.6.3 PRODUCTS PORTFOLIO

24.6.4 RECENT DEVELOPMENTS

24.7 AIPHONE CORPORATION

24.7.1 COMPANY SNAPSHOT

24.7.2 REVENUE ANALYSIS

24.7.3 PRODUCTS PORTFOLIO

24.7.4 RECENT DEVELOPMENTS

24.8 ALPHA COMMUNICATIONS

24.8.1 COMPANY SNAPSHOT

24.8.2 PRODUCT PORTFOLIO

24.8.3 RECENT DEVELOPMENT

24.9 AXIS COMMUNICATIONS AB (A SUBSIDIARY OF CANON GROUP)

24.9.1 COMPANY SNAPSHOT

24.9.2 REVENUE ANALYSIS

24.9.3 PRODUCTS PORTFOLIO

24.9.4 RECENT DEVELOPMENTS

24.1 COMELIT GROUP S.P.A.

24.10.1 COMPANY SNAPSHOT

24.10.2 PRODUCTS PORTFOLIO

24.10.3 RECENT DEVELOPMENTS

24.11 COMMAX

24.11.1 COMPANY SNAPSHOT

24.11.2 PRODUCTS PORTFOLIO

24.11.3 RECENT DEVELOPMENT

24.12 DAHUA TECHNOLOGY CO., LTD

24.12.1 COMPANY SNAPSHOT

24.12.2 REVENUE ANALYSIS

24.12.3 PRODUCTS PORTFOLIO

24.12.4 RECENT DEVELOPMENTS

24.13 FERMAX ELECTRÓNICA, S.A.U.

24.13.1 COMPANY SNAPSHOT

24.13.2 PRODUCTS PORTFOLIO

24.13.3 RECENT DEVELOPMENTS

24.14 FUJIAN AURINE TECHNOLOGY CO., LTD.

24.14.1 COMPANY SNAPSHOT

24.14.2 PRODUCTS PORTFOLIO

24.14.3 RECENT DEVELOPMENT

24.15 GIRA

24.15.1 COMPANY SNAPSHOT

24.15.2 PRODUCTS PORTFOLIO

24.15.3 RECENT DEVELOPMENTS

24.16 GODREJ & BOYCE MANUFACTURING COMPANY LIMITED

24.16.1 COMPANY SNAPSHOT

24.16.2 REVENUE ANALYSIS

24.16.3 PRODUCT PORTFOLIO

24.16.4 RECENT DEVELOPMENT

24.17 GUANGDONG ANJUBAO DIGITAL TECHNOLOGY CO.,LTD

24.17.1 COMPANY SNAPSHOT

24.17.2 REVENUE ANALYSIS

24.17.3 PRODUCT PORTFOLIO

24.17.4 RECENT DEVELOPMENTS

24.18 HAGER GROUP

24.18.1 COMPANY SNAPSHOT

24.18.2 PRODUCTS PORTFOLIO

24.18.3 RECENT DEVELOPMENT

24.19 SCHNEIDER ELECTRIC

24.19.1 COMPANY SNAPSHOT

24.19.2 REVENUE ANALYSIS

24.19.3 PRODUCTS PORTFOLIO

24.19.4 RECENT DEVELOPMENTS

24.2 SCHNEIDER INTERCOM GMBH

24.20.1 COMPANY SNAPSHOT

24.20.2 PRODUCTS PORTFOLIO

24.20.3 RECENT DEVELOPMENTS

24.21 SIEDLE

24.21.1 COMPANY SNAPSHOT

24.21.2 PRODUCTS PORTFOLIO

24.21.3 RECENT DEVELOPMENT

24.22 TCS TÜRCONTROLSYSTEME AG

24.22.1 COMPANY SNAPSHOT

24.22.2 PRODUCTS PORTFOLIO

24.22.3 RECENT DEVELOPMENT

24.23 THE AKUVOX COMPANY

24.23.1 COMPANY SNAPSHOT

24.23.2 PRODUCTS PORTFOLIO

24.23.3 RECENT DEVELOPMENTS

24.24 TOA CORPORATION

24.24.1 COMPANY SNAPSHOT

24.24.2 REVENUE ANALYSIS

24.24.3 PRODUCT PORTFOLIO

24.24.4 RECENT DEVELOPMENTS

24.25 URMET S.P.A.

24.25.1 COMPANY SNAPSHOT

24.25.2 PRODUCTS PORTFOLIO

24.25.3 RECENT DEVELOPMENT

24.26 XIAMEN LEELEN TECHNOLOGY CO., LTD.

24.26.1 COMPANY SNAPSHOT

24.26.2 PRODUCTS PORTFOLIO

24.26.3 RECENT DEVELOPMENTS

24.27 ZENITEL

24.27.1 COMPANY SNAPSHOT

24.27.2 PRODUCTS PORTFOLIO

24.27.3 RECENT DEVELOPMENT

24.28 ZICOM

24.28.1 COMPANY SNAPSHOT

24.28.2 PRODUCT PORTFOLIO

24.28.3 RECENT DEVELOPMENTS

25 QUESTIONNAIRE

26 RELATED REPORTS

List of Table

TABLE 1 GLOBAL INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2021-2030 (USD MILLION)

TABLE 2 GLOBAL CARDS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 GLOBAL FINGERPRINT READERS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 GLOBAL PROXIMITY CARDS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 GLOBAL PASSWORD ACCESS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 GLOBAL FACE RECOGNITION IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 GLOBAL OTHERS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 GLOBAL INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 9 GLOBAL ANALOG IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 GLOBAL IP-BASED IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 GLOBAL INTERCOM DEVICES MARKET, BY KEYPAD, 2021-2030 (USD MILLION)

TABLE 12 GLOBAL MECHANICAL BUTTON IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 GLOBAL TOUCH PAD IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 GLOBAL INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 15 GLOBAL DOOR ENTRY SYSTEMS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 GLOBAL HANDHELD DEVICES IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 GLOBAL INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 GLOBAL INTERCOM DEVICES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 19 GLOBAL ALUMINUM IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 GLOBAL STAINLESS STEEL IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 GLOBAL TEMPERED GLASS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 GLOBAL INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 GLOBAL OTHERS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 GLOBAL INTERCOM DEVICES MARKET, BY POWER SUPPLY, 2021-2030 (USD MILLION)

TABLE 25 GLOBAL LESS THAN 20 W IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 GLOBAL MORE THAN 20 W IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 GLOBAL INTERCOM DEVICES MARKET, BY PRICE CATEGORY, 2021-2030 (USD MILLION)

TABLE 28 GLOBAL LOW (BELOW USD 100) IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 GLOBAL MEDIUM (USD 100- USD 500) IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 GLOBAL HIGH (ABOVE USD 500) IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 GLOBAL INTERCOM DEVICES MARKET, BY COMMUNICATION, 2021-2030 (USD MILLION)

TABLE 32 GLOBAL PUSH-TO-TALK IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 GLOBAL HANDS-FREE OR HANDSET (DUPLEX) IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 GLOBAL INTERCOM DEVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 GLOBAL OUTDOOR IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 GLOBAL INDOOR IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 GLOBAL INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2021-2030 (USD MILLION)

TABLE 38 GLOBAL AUDIO/VIDEO IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 GLOBAL AUDIO/VIDEO IN INTERCOM DEVICES MARKET, BY SCREEN SIZE, 2021-2030 (USD MILLION)

TABLE 40 GLOBAL ONLY AUDIO IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 GLOBAL INTERCOM DEVICES MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 42 GLOBAL COMMERCIAL IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 GLOBAL COMMERCIAL IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 GLOBAL COMMERCIAL IN INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 45 GLOBAL RESIDENTIAL IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 GLOBAL RESIDENTIAL IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 GLOBAL RESIDENTIAL IN INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 48 GLOBAL INDUSTRIES IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 GLOBAL INDUSTRIES IN INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 50 GLOBAL GOVERNMENT IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 GLOBAL GOVERNMENT IN INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 52 GLOBAL INTERCOM DEVICES MARKET, BY INSTALLATION, 2021-2030 (USD MILLION)

TABLE 53 GLOBAL FLUSH IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 GLOBAL SURFACE IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 55 GLOBAL INTERCOM DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 56 GLOBAL OFFLINE IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 57 GLOBAL OFFLINE IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 GLOBAL ONLINE IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 59 GLOBAL ONLINE IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 GLOBAL INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 GLOBAL WIRED IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 62 GLOBAL WIRED IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 GLOBAL WIRELESS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 64 GLOBAL WIRELESS IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 GLOBAL INTERCOM DEVICES MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 66 GLOBAL HARDWARE IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 67 GLOBAL HARDWARE IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 GLOBAL CAMERAS IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 GLOBAL LCD SCREEN IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 GLOBAL SENSOR IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 GLOBAL SOFTWARE IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 72 GLOBAL GROUND IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 73 GLOBAL SERVICES IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 GLOBAL INTERCOM DEVICES MARKET: SEGMENTATION

FIGURE 2 GLOBAL INTERCOM DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL INTERCOM DEVICES MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL INTERCOM DEVICES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL INTERCOM DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL INTERCOM DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL INTERCOM DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL INTERCOM DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL INTERCOM DEVICES MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 GLOBAL INTERCOM DEVICES MARKET: MULTIVARIATE MODELLING

FIGURE 11 GLOBAL INTERCOM DEVICES MARKET: SYSTEM TYPE

FIGURE 12 GLOBAL INTERCOM DEVICES MARKET: SEGMENTATION

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE GLOBAL INTERCOM DEVICES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR GLOBAL INTERCOM DEVICES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 ADVENT OF ADVANCED SECURITY AUDIO-VISUAL SYSTEMS IS EXPECTED TO BE A KEY DRIVER FOR THE GLOBAL INTERCOM DEVICES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 16 WIRED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL INTERCOM DEVICES MARKET IN THE FORECAST PERIOD 2023 TO 2030

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GLOBAL INTERCOM DEVICES MARKET

FIGURE 18 VIDEO SYSTEMS

FIGURE 19 STATS RELATED TO ROBBERY AND BURGLARY

FIGURE 20 TECHNOLOGY AMALGAMATION IN SMART HOME/ BUILDINGS

FIGURE 21 IMPACT OF CYBER SECURITY THREAT

FIGURE 22 GLOBAL INTERCOM DEVICES MARKET: BY ACCESS CONTROL, 2022

FIGURE 23 GLOBAL INTERCOM DEVICES MARKET: BY TECHNOLOGY, 2022

FIGURE 24 GLOBAL INTERCOM DEVICES MARKET: BY KEYPAD, 2022

FIGURE 25 GLOBAL INTERCOM DEVICES MARKET: BY DEVICE TYPE, 2022

FIGURE 26 GLOBAL INTERCOM DEVICES MARKET: BY MATERIAL, 2022

FIGURE 27 GLOBAL INTERCOM DEVICES MARKET: BY POWER SUPPLY, 2022

FIGURE 28 GLOBAL INTERCOM DEVICES MARKET: BY PRICE CATEGORY, 2022

FIGURE 29 GLOBAL INTERCOM DEVICES MARKET: BY COMMUNICATION, 2022

FIGURE 30 GLOBAL INTERCOM DEVICES MARKET: BY APPLICATION, 2022

FIGURE 31 GLOBAL INTERCOM DEVICES MARKET: BY COMMUNICATION TYPE, 2022

FIGURE 32 GLOBAL INTERCOM DEVICES MARKET: BY END USER, 2022

FIGURE 33 GLOBAL INTERCOM DEVICES MARKET: BY INSTALLATION, 2022

FIGURE 34 GLOBAL INTERCOM DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 35 GLOBAL INTERCOM DEVICES MARKET: BY SYSTEM TYPE, 2022

FIGURE 36 GLOBAL INTERCOM DEVICES MARKET: BY COMPONENT, 2022

FIGURE 37 GLOBAL INTERCOM DEVICES MARKET: SNAPSHOT (2022)

FIGURE 38 GLOBAL INTERCOM DEVICES MARKET: COMPANY SHARE 2022 (%)

FIGURE 39 NORTH AMERICA INTERCOM DEVICES MARKET: COMPANY SHARE 2022 (%)

FIGURE 40 EUROPE INTERCOM DEVICES MARKET: COMPANY SHARE 2022 (%)

FIGURE 41 ASIA-PACIFIC INTERCOM DEVICES MARKET: COMPANY SHARE 2022 (%)

Global Intercom Devices Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Intercom Devices Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Intercom Devices Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.