Global Interactive Kiosk Market

Market Size in USD Billion

CAGR :

%

USD

29.56 Billion

USD

44.01 Billion

2024

2032

USD

29.56 Billion

USD

44.01 Billion

2024

2032

| 2025 –2032 | |

| USD 29.56 Billion | |

| USD 44.01 Billion | |

|

|

|

|

Interactive Kiosk Market Size

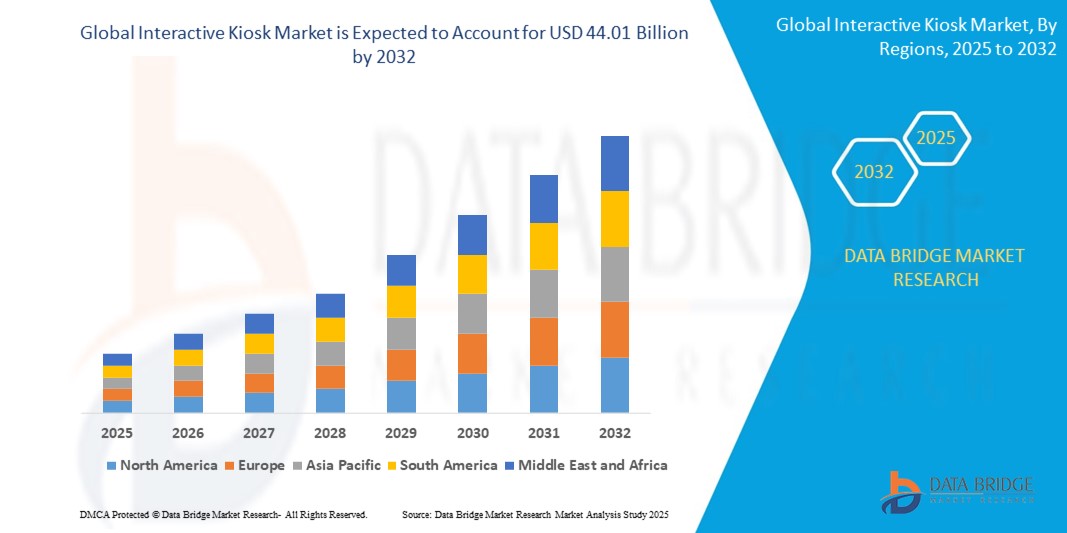

- The global interactive kiosk market size was valued at USD 29.56 billion in 2024 and is expected to reach USD 44.01 billion by 2032, at a CAGR of 5.1% during the forecast period

- This growth is driven by factors such as the increasing adoption of self-service technologies, rising demand for contactless solutions, and expanding applications across sectors like retail, healthcare, transportation, and banking

Interactive Kiosk Market Analysis

- Interactive kiosks are self-service terminals that provide users with access to digital information and services. They are widely used across industries such as retail, banking, healthcare, hospitality, transportation, and government for tasks including ticketing, check-ins, bill payments, and product browsing

- The demand for interactive kiosks is significantly driven by increasing consumer preference for contactless and convenient service experiences, particularly in urban and high-traffic environments

- North America is expected to dominate the global interactive kiosk market with largest market share of 44.5%, due to the early adoption of advanced technologies, robust infrastructure, and strong presence of key market players

- Asia-Pacific is expected to be the fastest growing region in the interactive kiosk market during the forecast period due to rapid urbanization, increasing retail expansion, and government initiatives for digital transformation

- Hardware segment is expected to dominate the market with a largest market share of 45.5% due to its foundational role in kiosk functionality. Key hardware components include displays, printers, card readers, scanners, enclosures, and motion sensors. These elements are essential for the physical operation of kiosks, enabling user interaction and transaction processing. The integration of these components with software solutions enhances the overall user experience, making hardware investments critical for businesses aiming to provide efficient and engaging self-service options

Report Scope and Interactive Kiosk Market Segmentation

|

Attributes |

Interactive Kiosk Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Interactive Kiosk Market Trends

“Technological Advancements & Personalization in Interactive Kiosks”

- One prominent trend in the evolution of interactive kiosks is the increasing integration of advanced technologies such as AI, touchless interfaces, and cloud-based analytics

- These innovations are reshaping user engagement by enabling personalized, real-time services and seamless multi-channel interactions across retail, banking, transportation, and healthcare sectors

- For instance, AI-powered kiosks can analyze user behavior to offer tailored product recommendations, while touchless interfaces using gesture or voice control improve hygiene and user convenience—especially valuable in post-pandemic service models

- These advancements are transforming self-service experiences, enhancing operational efficiency, and driving the adoption of intelligent kiosks across both developed and emerging markets

Interactive Kiosk Market Dynamics

Driver

“Growing Demand for Contactless and Self-Service Solutions”

- The rising demand for contactless and self-service technologies is a significant driver of growth in the global interactive kiosk market

- Consumers increasingly prefer autonomous and efficient service options in public spaces such as airports, retail stores, banks, and hospitals—particularly in the aftermath of the COVID-19 pandemic

- As hygiene and convenience remain top priorities, interactive kiosks provide a scalable solution for businesses to reduce human interaction while enhancing service speed and accuracy

For instance,

- Many retail chains and fast-food restaurants have deployed self-checkout kiosks and digital ordering systems to streamline operations and meet evolving customer expectations

- As a result, the widespread demand for touchless and user-friendly service delivery platforms is significantly increasing the deployment of interactive kiosks across sectors globally

Opportunity

“Enhancing User Experience Through AI and Data Integration”

- AI-powered interactive kiosks can personalize user experiences, optimize operations, and improve decision-making across various industries by leveraging real-time data and analytics

- These kiosks can collect and analyze user behavior, preferences, and service patterns, allowing businesses to tailor content, recommendations, and offers based on individual interactions—driving both customer satisfaction and revenue growth

- AI-enabled kiosks can perform predictive maintenance, reduce downtime, and automate customer service tasks such as answering queries, directing foot traffic, and guiding users through complex transactions.

For instance,

- In retail environments, AI-integrated kiosks can use computer vision and machine learning algorithms to recognize repeat customers, recommend products based on past purchases, and deliver dynamic promotions in real time—transforming the traditional shopping experience

- The integration of AI and data analytics into interactive kiosks represents a substantial market opportunity by enabling smarter, more adaptive systems that improve efficiency, customer engagement, and operational scalability across industries

Restraint/Challenge

“High Initial Investment and Maintenance Costs Limiting Adoption”

- The high initial cost of deploying interactive kiosks—encompassing hardware, software, and installation—poses a significant challenge, particularly for small and medium-sized enterprises (SMEs) and institutions with limited budgets

- Depending on the complexity, a single interactive kiosk can cost anywhere from several thousand to tens of thousands of dollars, excluding ongoing expenses such as software licensing, network connectivity, and routine maintenance

- These financial burdens can discourage adoption in developing markets or low-margin industries where capital expenditure is tightly controlled

For instance,

- In 2024, large retail chains and banks are rapidly adopting kiosk technologies, smaller businesses often cite high costs and uncertain ROI as barriers to implementation—delaying digital transformation at the grassroots level

- Consequently, the high cost of deployment and maintenance limits widespread penetration, particularly in cost-sensitive markets, potentially slowing the global growth trajectory of interactive kiosk adoption

Interactive Kiosk Market Scope

The market is segmented on the basis of component, type, end-use, location, and panel size.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Type |

|

|

By End-Use |

|

|

By Location |

|

|

By Panel Size |

|

In 2025, the hardware is projected to dominate the market with a largest share in component segment

The hardware segment is expected to dominate the interactive kiosk market with the largest share of 45.5% due to its foundational role in kiosk functionality. Key hardware components include displays, printers, card readers, scanners, enclosures, and motion sensors. These elements are essential for the physical operation of kiosks, enabling user interaction and transaction processing. The integration of these components with software solutions enhances the overall user experience, making hardware investments critical for businesses aiming to provide efficient and engaging self-service options

The automated teller machine is expected to account for the largest share during the forecast period in type segment

In 2025, the automated teller machine segment is expected to dominate the market with the largest market share of 50% due to the essential role ATMs play in providing convenient, 24/7 access to banking services, including cash withdrawals, deposits, and account inquiries. Their widespread deployment across various locations, such as bank branches, shopping centers, and transit hubs, ensures that consumers have reliable access to financial services at their convenience

Interactive Kiosk Market Regional Analysis

“North America Holds the Largest Share in the Interactive Kiosk Market”

- North America dominates the global interactive kiosk market with largest market share of 44.5%, driven by widespread technological adoption, robust digital infrastructure, and strong presence of key kiosk manufacturers and solution providers

- The United States holds a significant share of approximately 84%, due to the high penetration of self-service technologies across industries such as retail, banking, transportation, and healthcare

- The region’s early adoption of innovations like AI-powered kiosks, biometric authentication, and NFC-enabled transactions contributes to a mature and well-established market

- In addition, supportive regulatory frameworks, rising demand for contactless customer service solutions, and investments in public infrastructure—such as airports and smart cities—further fuel market growth in the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Interactive Kiosk Market”

- The Asia-Pacific region is expected to register the fastest growth rate in the global interactive kiosk market, driven by rapid urbanization, expanding middle-class populations, and increasing digital transformation initiatives

- Countries such as China, India, Japan, and South Korea are emerging as key growth hubs due to rising demand for self-service technologies across retail, banking, transportation, and government services

- Japan leads in the adoption of advanced, touchless, and AI-integrated kiosks, supported by a highly tech-savvy population and innovation-driven market environment

- Meanwhile, China and India are experiencing a surge in kiosk installations due to large-scale public sector deployments, growing retail ecosystems, and increasing investment in smart city infrastructure

- Government support, rising smartphone and internet penetration, and the presence of global and local kiosk providers further contribute to the rapid market expansion in the Asia-Pacific region

Interactive Kiosk Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Source Technologies LLC (U.S.)

- ADVANCED KIOSKS (U.S.)

- IER (France)

- REDYREF (U.S.)

- Meridian Kiosks (U.S.)

- Advanced Co. LTD. (South Korea)

- Diebold Nixdorf, Incorporated (U.S.)

- KIOSK Information Systems (U.S.)

- Zebra Technologies Corp. (U.S.)

- NEXCOM International Co. Ltd. (Taiwan)

- Olea Kiosks Inc. (U.S.)

- FrankMayer and Associates, INC. (U.S.)

- Lilitab, LLC (U.S.)

- Acante (U.K.)

- ZIVELO, Inc. (U.S.)

- Intuiface (France)

- Aila Technologies, Inc. (U.S.)

- DynaTouch (U.S.)

- Peerless-AV (U.S.)

Latest Developments in Global Interactive Kiosk Market

- In January 2021, Diebold Nixdorf introduced the DN Series EASY, a next-generation suite of self-service solutions specifically designed to meet the evolving operational and customer engagement needs of retailers. These solutions focus on streamlining in-store processes, enhancing the consumer shopping experience, and optimizing cost efficiency through automation and intelligent design. This launch underscores the increasing demand for technologically advanced, user-centric kiosk systems across the retail sector

- In January 2021, Magnit partnered with NCR Corporation to deploy advanced retail technologies in the Russian market, including self-service checkouts, interactive kiosks, self-scanning systems, and AI-driven video analytics. This initiative highlights the growing international adoption of intelligent self-service solutions. The integration of AI and automation into retail environments reflects a broader industry trend toward digital transformation, contributing to the global market’s expansion and reinforcing the role of interactive kiosks in enhancing customer engagement and streamlining retail operations

- In October 2020, Meridian launched a line of temperature screening kiosks designed to provide fast, contactless health checks. These kiosks enable individual users to scan by aligning their face within a designated frame, after which a thermal sensor measures and displays their body temperature on-screen with an accuracy of ±0.9°F. This development illustrates the rapid adaptation of kiosk technology in response to public health needs. The introduction of health-focused functionalities, such as thermal scanning, has expanded the role of interactive kiosks beyond traditional retail and service applications—accelerating their adoption in sectors like healthcare, transportation, and corporate environments, and contributing to the market's diversification and growth

- In December 2023, REDYREF announced the acquisition of Livewire Digital, a leading provider of interactive kiosk software and service solutions. This strategic move is intended to strengthen REDYREF’s capabilities in delivering end-to-end customer engagement technologies across a wide range of industries, including retail, hospitality, and transportation. This acquisition reflects the growing trend of consolidation among key players aiming to offer integrated hardware and software solutions

- In November 2023, Advantech unveiled a next-generation interactive kiosk platform equipped with integrated AI capabilities designed to deliver personalized customer engagement and data-driven targeted advertising. This solution leverages artificial intelligence to analyze user behavior in real time, enabling dynamic content delivery tailored to individual preferences. This innovation highlights the shift toward intelligent, customer-centric solutions that enhance user experience and marketing effectiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Interactive Kiosk Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Interactive Kiosk Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Interactive Kiosk Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.