Global Integrated Quantum Optical Circuits Market

Market Size in USD Billion

CAGR :

%

USD

1.08 Billion

USD

3.21 Billion

2024

2032

USD

1.08 Billion

USD

3.21 Billion

2024

2032

| 2025 –2032 | |

| USD 1.08 Billion | |

| USD 3.21 Billion | |

|

|

|

|

Integrated Quantum Optical Circuits Market Size

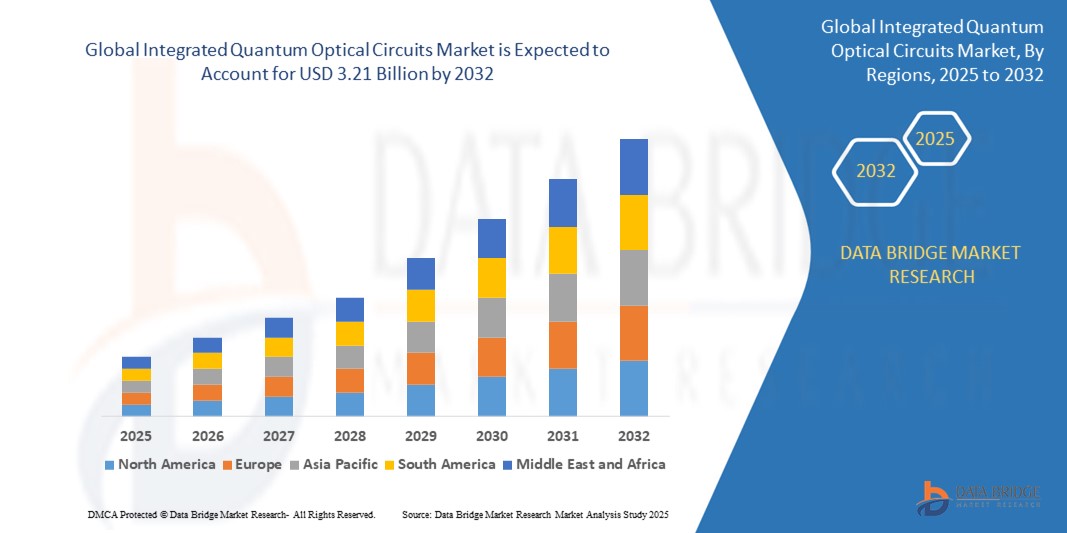

- The global integrated quantum optical circuits market size was valued at USD 1.08 billion in 2024 and is expected to reach USD 3.21 billion by 2032, at a CAGR of 14.6% during the forecast period

- The market growth is largely fueled by increasing investments in quantum technologies and rapid advancements in photonic integration, which are enabling scalable, compact, and efficient quantum systems for next-generation computing and communication

- Furthermore, the shift from bulky optical setups to miniaturized photonic circuits is driving demand across sectors such as telecommunications, defense, healthcare, and data centers. These converging trends are accelerating the development and deployment of integrated quantum optical circuits, thereby significantly boosting the industry's growth

Integrated Quantum Optical Circuits Market Analysis

- Integrated quantum optical circuits are miniaturized photonic devices that manipulate quantum states of light for applications in computing, communication, and sensing. These circuits leverage materials such as silicon photonics and lithium niobate to achieve scalability, energy efficiency, and high-fidelity signal transmission

- The growing demand is primarily driven by the need for high-speed, secure data transmission, advances in quantum computing architectures, and ongoing R&D initiatives by governments and tech firms to commercialize quantum technologies for real-world use cases

- North America dominated the integrated quantum optical circuits market with a share of over 35% in 2024, due to strong research investments in quantum technologies, the presence of major tech firms, and increasing collaborations between academic institutions and industry

- Asia-Pacific is expected to be the fastest growing region in the integrated quantum optical circuits market during the forecast period due to rising investments in quantum research, strong semiconductor infrastructure, and supportive government policies in countries such as China, Japan, and South Korea

- Quantum computing segment dominated the market with a market share of 39.6% in 2024, due to a surge in global investments and R&D initiatives aimed at developing scalable quantum processors. Integrated photonic circuits are being leveraged to generate, manipulate, and detect quantum states of light, providing the necessary scalability, noise resilience, and compactness required for building practical quantum computers

Report Scope and Integrated Quantum Optical Circuits Market Segmentation

|

Attributes |

Integrated Quantum Optical Circuits Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Integrated Quantum Optical Circuits Market Trends

“Rising Interest in Quantum Education”

- As quantum information science becomes increasingly vital to next-generation technologies, universities, research institutes, and private firms are ramping up educational investments to bridge the quantum talent gap. This surge in quantum education supports a pipeline of researchers and engineers, ultimately fueling the broader adoption and innovation of integrated quantum optical circuits

- For instance, global technology leaders such as Intel Corporation are collaborating with academic institutions to launch quantum education initiatives and university partnerships, aiming to develop a skilled workforce proficient in quantum photonics and integrated circuit design

- Governments and private organizations are funding quantum research centers and interdisciplinary programs, further embedding quantum photonics in academic curricula

- Massive open online courses (MOOCs), dedicated quantum engineering degree programs, and specialist workshops are making quantum optics knowledge accessible to a new generation of engineers and physicists

- The rise of university-affiliated spin-offs and startups brings youthful innovation to the market, accelerating the translation of academic research into practical quantum optical circuit solutions

- International collaboration networks, conferences, and consortia foster the exchange of expertise, ensuring that emerging talent is both global in perspective and industrially relevant

Integrated Quantum Optical Circuits Market Dynamics

Driver

“Advancements in Quantum Computing”

- Rapid breakthroughs in quantum computing are driving demand for integrated quantum optical circuits, which are essential for building scalable, stable, and efficient quantum systems for computation and communication

- For instance, Infinera Corporation and Ciena Corporation are leveraging advances in quantum photonics to develop integrated optical solutions for secure quantum communication networks and high-performance computing infrastructure

- The integration of photonic components—such as multiplexers, modulators, and lasers—on a single chip is enabling reduced energy loss, greater bandwidth, and higher processing speeds compared to traditional electronic circuits

- Ongoing miniaturization of quantum optical systems makes them more suitable for deployment across commercial sectors, including cryptography, data centers, and telecommunications

- Government initiatives in the U.S., Europe, and Asia are supporting large-scale R&D in quantum hardware, providing fiscal stimulus for corporate and academic partnerships with circuit manufacturers. Industry standards development and increased venture capital activity are accelerating the commercialization of integrated quantum optical circuits in both public and private sectors

Restraint/Challenge

“High Development Costs”

- Development of integrated quantum optical circuits poses considerable financial challenges, with high up-front R&D costs, complex fabrication processes, and the need for ultra-clean manufacturing environments

- For instance, leading manufacturers such as Aifotec AG and Finisar Corporation must invest substantial resources in specialized facilities, advanced lithography equipment, and experienced quantum photonics engineers, making cost recovery slow and scaling difficult for smaller firms

- The lack of standardized processes for fabricating quantum photonic components increases customization—and costs—especially for early-stage products or niche applications

- There is a continued reliance on rare materials (e.g., indium phosphide, gallium arsenide) and sophisticated integration methods, which add expense and limit accessibility for new entrants

- Market fragmentation and the absence of large-volume orders challenge economies of scale, further keeping unit costs elevated. Policy-driven funding is helping offset some development risks, but commercial viability will depend on further advances in manufacturing efficiency and demand-side growth

Integrated Quantum Optical Circuits Market Scope

The market is segmented on the basis of material type, component, and application.

- By Material Type

On the basis of material type, the integrated quantum optical circuits market is segmented into indium phosphide, silica glass, silicon photonics, lithium niobate, and gallium arsenide. The silicon photonics segment dominated the largest market revenue share in 2024, owing to its compatibility with existing CMOS fabrication techniques and its scalability for mass production. Silicon’s ability to integrate both photonic and electronic components on a single chip makes it highly attractive for cost-effective, high-volume applications in data centers and quantum computing setups. In addition, its proven performance in enabling compact, low-loss, and energy-efficient photonic circuits contributes to widespread adoption.

The lithium niobate segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its superior electro-optic properties and exceptional signal modulation capabilities. Lithium niobate-based platforms are gaining momentum in quantum photonic research and high-frequency applications, as they offer ultra-low optical losses, broader bandwidth, and enhanced phase stability critical for quantum coherence. The material's increasing use in next-generation modulators and interferometers is further accelerating its demand.

- By Component

On the basis of component, the market is segmented into waveguides, directional couplers, active components, light sources, and detectors. The waveguides segment held the largest revenue share in 2024, primarily due to their foundational role in routing and guiding light signals within photonic integrated circuits. Their precise fabrication and low propagation losses are crucial for ensuring minimal signal degradation in complex quantum systems. Growing adoption of waveguide-based architectures in both academic and commercial quantum technologies is driving this segment’s dominance.

The detectors segment is expected to register the fastest CAGR from 2025 to 2032, owing to the rising need for high-sensitivity photon detection in quantum communication and sensing applications. With advancements in superconducting nanowire and avalanche photodiode technologies, detectors are becoming increasingly accurate and efficient in capturing quantum states. Their role in enhancing system fidelity and enabling real-time quantum measurements positions them as a rapidly growing component segment.

- By Application

On the basis of application, the integrated quantum optical circuits market is segmented into optical fiber communication, optical sensors, biomedical, quantum computing, and others. The quantum computing segment accounted for the largest market revenue share of 39.6% in 2024, driven by a surge in global investments and R&D initiatives aimed at developing scalable quantum processors. Integrated photonic circuits are being leveraged to generate, manipulate, and detect quantum states of light, providing the necessary scalability, noise resilience, and compactness required for building practical quantum computers.

The optical sensors segment is projected to witness the fastest growth from 2025 to 2032, supported by increasing applications in environmental monitoring, medical diagnostics, and defense. Integrated optical sensors offer high sensitivity, low footprint, and enhanced data accuracy, making them ideal for detecting minute physical, chemical, or biological changes. The rising demand for compact and high-performance sensing technologies across diverse industries is accelerating the segment’s adoption.

Integrated Quantum Optical Circuits Market Regional Analysis

- North America dominated the integrated quantum optical circuits market with the largest revenue share of over 35% in 2024, driven by strong research investments in quantum technologies, the presence of major tech firms, and increasing collaborations between academic institutions and industry

- The region benefits from early adoption of quantum computing and photonics-based solutions across sectors such as defense, telecommunications, and data centers

- Continued funding from government agencies and private organizations, combined with a growing demand for advanced computing power, is reinforcing North America’s leadership in the integrated quantum photonics space

U.S. Integrated Quantum Optical Circuits Market Insight

The U.S. market captured the largest revenue share in 2024 within North America, supported by a robust R&D ecosystem and the dominance of quantum tech startups and university-led innovation hubs. Federal initiatives such as the National Quantum Initiative Act, and substantial investments by tech giants in scalable quantum computing infrastructure, are fostering commercial adoption. The convergence of silicon photonics with quantum platforms is accelerating demand across applications such as secure communication and high-performance computing.

Europe Integrated Quantum Optical Circuits Market Insight

The European market is projected to grow at a steady CAGR through the forecast period, underpinned by public-private partnerships, funding from programs such as Quantum Flagship, and strong institutional research backing. Countries across the EU are focusing on strengthening photonic integration capabilities to support secure data transmission and next-gen computing. The demand is rising across healthcare, automotive, and aerospace sectors, with applications in quantum sensing and secure networks gaining momentum.

U.K. Integrated Quantum Optical Circuits Market Insight

The U.K. market is anticipated to register notable growth, propelled by national initiatives such as the UK National Quantum Technologies Programme. The country’s focus on photonic quantum technologies in sectors such as defense, healthcare, and secure communications is creating favorable conditions for market expansion. The collaborative efforts among startups, universities, and industry players are advancing innovation and commercialization of integrated quantum circuits.

Germany Integrated Quantum Optical Circuits Market Insight

Germany is expected to see consistent growth in the market due to its strong emphasis on precision engineering, microelectronics, and photonics. Government-backed efforts such as the Quantum Futur program and involvement in EU quantum infrastructure initiatives are enhancing domestic capabilities. The country’s focus on high-performance industrial applications and data security is reinforcing demand for scalable quantum photonic platforms.

Asia-Pacific Integrated Quantum Optical Circuits Market Insight

The Asia-Pacific market is forecasted to grow at the fastest CAGR from 2025 to 2032, fueled by rising investments in quantum research, strong semiconductor infrastructure, and supportive government policies in countries such as China, Japan, and South Korea. Regional advancements in photonic chip manufacturing and integration are positioning APAC as both a demand and supply hub for integrated quantum technologies.

Japan Integrated Quantum Optical Circuits Market Insight

Japan’s market is expanding with momentum due to its leadership in semiconductor innovation, photonics research, and long-term government funding. The country’s efforts to advance quantum-safe communications and integrate photonic circuits in medical imaging, telecommunications, and automation are fostering steady demand. Collaboration between academia and large tech firms is enhancing commercialization potential.

China Integrated Quantum Optical Circuits Market Insight

China accounted for the largest market share in Asia Pacific in 2024, supported by large-scale investment in national quantum infrastructure and a fast-growing base of tech manufacturers. Government-led initiatives to develop secure communication networks and smart infrastructure are accelerating deployment. With a strong push for domestic chip production and integration of quantum technologies into military and industrial domains, China continues to lead APAC in market volume and innovation.

Integrated Quantum Optical Circuits Market Share

The integrated quantum optical circuits industry is primarily led by well-established companies, including:

- Ciena Corporation (U.S.)

- EMCORE Corporation (U.S.)

- NeoPhotonics Corporation (U.S.)

- Aifotec AG (Germany)

- Infinera Corporation (U.S.)

- Intel Corporation (U.S.)

- Broadcom (U.S.)

- Cisco (U.S.)

- Oclaro (now part of Lumentum) (U.S.)

- TE Connectivity (Switzerland)

- Hewlett-Packard Development Company, L.P. (U.S.)

- Corning Incorporated (U.S.)

- JDS Uniphase Corporation (now part of Lumentum) (U.S.)

- Lumentum Operations LLC (U.S.)

- Finisar Corporation (U.S.)

- Enablence Technologies, Inc. (Canada)

Latest Developments in Global Integrated Quantum Optical Circuits Market

- In November 2024, IonQ announced a collaboration with imec aimed at developing photonic integrated circuits and ion trap chip technology for quantum computing. This partnership marks a pivotal shift from bulky optical systems to compact, scalable photonic integration, with the goal of increasing qubit density and improving quantum system performance. The initiative is set to drive innovation in fabrication techniques, reduce hardware costs, and accelerate commercialization—factors that are poised to significantly advance the integrated quantum optical circuits market by making quantum hardware more accessible and efficient

- In February 2022, Intel Corporation announced the acquisition of Tower Semiconductor, a move that significantly strengthens Intel’s IDM 2.0 strategy by boosting global manufacturing capacity and diversifying its technological capabilities. Tower’s expertise in analog technologies such as RF, power management, SiGe, and industrial sensors—along with its strong presence in the U.S. and Asia—enhances Intel’s ability to meet the growing semiconductor demand. This acquisition is expected to positively impact the integrated quantum optical circuits market by improving access to advanced analog process technologies and supporting broader integration of quantum-compatible components at scale

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.