Global Insulin Infusion Pumps Market

Market Size in USD Billion

CAGR :

%

USD

8.46 Billion

USD

18.40 Billion

2024

2032

USD

8.46 Billion

USD

18.40 Billion

2024

2032

| 2025 –2032 | |

| USD 8.46 Billion | |

| USD 18.40 Billion | |

|

|

|

|

Insulin Infusion Pumps Market Size

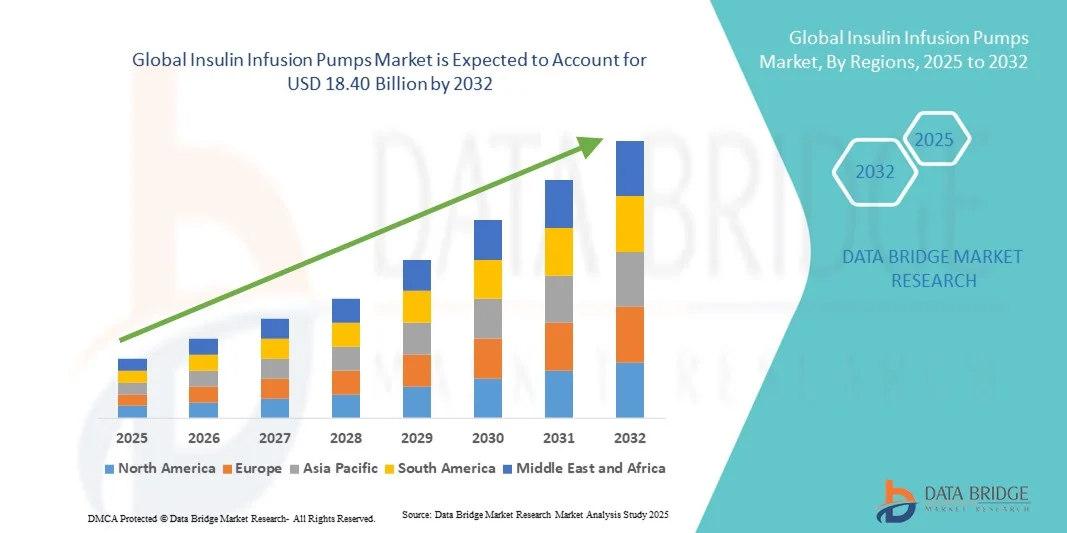

- The global insulin infusion pumps market size was valued at USD 8.46 billion in 2024 and is expected to reach USD 18.40 billion by 2032, at a CAGR of 10.20% during the forecast period

- The market growth is largely fueled by the growing prevalence of diabetes worldwide and the increasing adoption of advanced insulin delivery systems that offer greater accuracy, convenience, and flexibility compared to traditional methods

- Furthermore, rising patient awareness regarding continuous glucose monitoring (CGM) integration, along with technological advancements such as smart and tubeless insulin pumps, are accelerating the uptake of insulin infusion pump solutions, thereby significantly boosting the industry's growth

Insulin Infusion Pumps Market Analysis

- Insulin infusion pumps, offering continuous and precise insulin delivery, are becoming increasingly vital components of modern diabetes management systems due to their ability to maintain optimal glucose control and enhance patient convenience

- The escalating demand for insulin infusion pumps is primarily fueled by the growing prevalence of diabetes, rising awareness of advanced insulin delivery technologies, and the increasing preference for wearable, automated solutions that reduce the need for multiple daily injections

- North America dominated the insulin infusion pumps market with the largest revenue share of 45.3% in 2024, characterized by a high prevalence of diabetes, favorable reimbursement policies, and strong technological advancements. The U.S. experienced substantial growth in insulin infusion pump adoption, driven by the rising integration of continuous glucose monitoring (CGM) systems, patient preference for hybrid closed-loop systems, and active innovation by leading medical device manufacturers

- Asia-Pacific is expected to be the fastest-growing region in the Insulin Infusion Pumps market during the forecast period, expanding at a CAGR from 2025 to 2032, due to increasing healthcare expenditure, a surge in diabetes cases, and greater access to advanced treatment options across countries such as China, India, and Japan

- The Type I Diabetes segment dominated the market in 2024 with a revenue share of 69.7%, primarily because patients with Type I diabetes require lifelong insulin administration for glycemic control

Report Scope and Insulin Infusion Pumps Market Segmentation

|

Attributes |

Insulin Infusion Pumps Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Insulin Infusion Pumps Market Trends

Technological Advancements and Integration of Artificial Intelligence (AI) in Insulin Delivery

- A significant and accelerating trend in the global insulin infusion pumps market is the integration of advanced technologies such as artificial intelligence (AI), automation, and data analytics into insulin delivery systems. These innovations are transforming diabetes management by improving precision, minimizing user error, and enabling real-time adjustments to insulin dosage

- For instance, several leading manufacturers, including Medtronic and Insulet Corporation, have developed AI-enabled insulin pumps that automatically adjust insulin delivery based on continuous glucose monitoring (CGM) data. Such closed-loop or “artificial pancreas” systems significantly reduce hypoglycemia risks and provide better glycemic control

- The integration of wireless communication technologies such as Bluetooth and cloud-based platforms allows patients and healthcare providers to monitor insulin dosage remotely and track glucose levels in real time. This digital connectivity enhances treatment personalization and supports telemedicine-based diabetes management

- AI algorithms in insulin infusion pumps analyze glucose fluctuations and predict upcoming changes in blood sugar levels, ensuring timely insulin administration. These predictive models have revolutionized patient safety and comfort, especially for those requiring intensive insulin therapy

- In addition, advancements in microfluidics and sensor technology are driving the miniaturization of insulin pumps, making them more discreet and comfortable for everyday use. Wearable and tubeless insulin pumps are gaining traction among younger and tech-savvy diabetic populations seeking flexibility and convenience

- This trend toward smart, automated, and AI-integrated insulin infusion systems is fundamentally reshaping diabetes management. As digital healthcare adoption grows, companies such as Tandem Diabetes Care and Ypsomed are emphasizing innovation through AI-driven insulin delivery algorithms and advanced connectivity with continuous glucose monitors, enhancing the efficiency and personalization of treatment

Insulin Infusion Pumps Market Dynamics

Driver

Rising Diabetes Prevalence and Growing Adoption of Automated Insulin Delivery Systems

- The global surge in diabetes prevalence, particularly type 1 and type 2 diabetes, is a major driver fueling demand for insulin infusion pumps. According to the International Diabetes Federation (IDF), over 540 million adults are living with diabetes globally, and the number is projected to exceed 640 million by 2030

- The growing preference for advanced insulin delivery technologies over conventional insulin injections is accelerating market growth. Patients are increasingly opting for infusion pumps due to their ability to deliver continuous, precise, and adjustable insulin doses, improving glucose control and quality of life

- For instance, in February 2024, Medtronic plc launched its MiniMed 780G advanced hybrid closed-loop system in new international markets, providing automatic basal insulin adjustments and correction boluses every five minutes. This innovation reflects how automation is revolutionizing insulin therapy and expanding adoption among patients worldwide

- Furthermore, the rise in government initiatives to support diabetes management and the growing awareness of the benefits of insulin pump therapy are contributing to market expansion. Several reimbursement programs across North America and Europe are also encouraging patients to shift from multiple daily injections (MDI) to pump-based therapy

- The convenience of continuous subcutaneous insulin infusion (CSII), along with integration with CGM systems, has made insulin infusion pumps a critical component of modern diabetes management. The increasing number of young diabetic patients preferring wearable solutions is expected to further propel market growth

- These combined factors—technological innovation, healthcare awareness, and patient-centric advancements—are projected to drive the insulin infusion pumps market significantly during the forecast period

Restraint/Challenge

High Cost, Maintenance Challenges, and Data Security Concerns

- Despite the promising outlook, the insulin infusion pumps market faces challenges due to the high cost of devices and ongoing maintenance expenses. Advanced insulin pumps, especially those integrated with CGM and AI-driven algorithms, are considerably more expensive than conventional insulin pens, limiting accessibility among patients in low- and middle-income regions

- For instance, the average cost of an insulin pump device ranges between USD 4,000–7,000, excluding consumables such as infusion sets and sensors. This significant financial burden discourages adoption, particularly in countries with inadequate reimbursement policies

- Technical issues such as pump blockages, calibration errors, and software malfunctions also pose operational risks, potentially leading to improper insulin dosing. These mechanical and software-related limitations highlight the need for robust design validation and regular device monitoring

- Furthermore, the integration of wireless and cloud-based data transmission introduces data security and privacy concerns. There have been instances where cybersecurity researchers identified vulnerabilities in connected medical devices, including insulin pumps, that could allow unauthorized access or tampering. Such risks have made healthcare regulators emphasize stricter cybersecurity protocols

- The dependence on continuous technical support and periodic software updates increases the operational complexity for both patients and healthcare providers. In addition, the learning curve associated with using advanced insulin infusion systems can be intimidating for elderly patients

- To overcome these restraints, manufacturers are focusing on affordability through modular pump designs, improving cybersecurity features, and enhancing patient education. Addressing these challenges will be critical for achieving sustained market penetration and user trust in the long term

Insulin Infusion Pumps Market Scope

The market is segmented on the basis of product, application, and end user.

- By Product

On the basis of product, the Insulin Infusion Pumps market is segmented into insulin pumps, infusion sets, and reservoirs. The insulin pumps segment dominated the market in 2024 with a revenue share of 58.4%, owing to their critical role in delivering precise and continuous insulin doses for diabetes management. The growing prevalence of diabetes, increasing awareness regarding continuous subcutaneous insulin infusion (CSII) therapy, and technological advancements such as smart pumps integrated with continuous glucose monitoring (CGM) systems are key factors driving dominance. In addition, major manufacturers are introducing compact, wireless, and tubeless pump models to enhance patient comfort and compliance, which further strengthens the market leadership of this segment. Enhanced accuracy, programmable delivery options, and connectivity with mobile apps have made insulin pumps the preferred choice among Type 1 diabetes patients worldwide.

The infusion sets segment is projected to witness the fastest growth from 2025 to 2032, registering a CAGR of 15.9%, driven by the rising use of advanced, easy-to-insert sets that improve comfort and reduce site infections. Innovations such as cannula design optimization, auto-insertion mechanisms, and extended wear durations are fueling adoption. Moreover, as patients increasingly shift towards home-based diabetes care, demand for disposable and user-friendly infusion sets continues to surge. Strategic collaborations between device makers and healthcare providers to enhance insulin delivery systems are expected to further accelerate growth during the forecast period.

- By Application

On the basis of application, the Insulin Infusion Pumps market is segmented into Type I Diabetes and Type II Diabetes. The Type I Diabetes segment dominated the market in 2024 with a revenue share of 69.7%, primarily because patients with Type I diabetes require lifelong insulin administration for glycemic control. Continuous infusion pumps provide better glucose stability, flexibility in meal timing, and improved quality of life compared to multiple daily injections (MDI). The segment’s dominance is further supported by strong clinical recommendations favoring insulin pump therapy for Type I diabetes and reimbursement availability in many developed economies. In addition, pediatric and adolescent diabetic populations increasingly prefer wearable, compact pump systems due to convenience and safety.

The Type II Diabetes segment is projected to exhibit the fastest CAGR of 14.6% from 2025 to 2032, as clinicians are increasingly recommending insulin pump therapy for Type II diabetes patients with severe insulin resistance or poor glucose control. Rising obesity rates, growing geriatric populations, and increased acceptance of technology-driven insulin management solutions are fueling adoption. Furthermore, recent clinical studies showing improved glycemic outcomes in Type II patients using pumps have led to broader acceptance. Manufacturers are also developing cost-effective and simplified pump models tailored for Type II users, further stimulating demand during the forecast period.

- By End User

On the basis of end user, the Insulin Infusion Pumps market is segmented into hospitals and clinics, home care, and laboratories. The hospitals and clinics segment dominated the market in 2024 with a revenue share of 52.3%, owing to the concentration of skilled professionals and availability of advanced insulin delivery devices in clinical settings. Hospitals play a crucial role in initiating insulin pump therapy, providing patient education, and managing insulin adjustments under supervision. The presence of multidisciplinary diabetes care teams, government support for medical technology adoption, and the use of pumps in acute care and gestational diabetes management contribute to segment leadership.

The home care segment is expected to witness the fastest CAGR of 16.4% from 2025 to 2032, driven by the growing trend toward self-management of chronic conditions and the availability of compact, user-friendly, and wireless insulin pumps. The convenience of real-time glucose monitoring, remote healthcare consultations, and integration of pump data with mobile applications support the adoption of pumps at home. In addition, rising healthcare costs and the desire to minimize hospital visits are pushing patients toward home-based therapy options. Manufacturers are also focusing on developing affordable, wearable, and connected devices specifically designed for home use, which is expected to boost the segment significantly over the forecast period.

Insulin Infusion Pumps Market Regional Analysis

- North America dominated the insulin infusion pumps market with the largest revenue share of 45.3% in 2024, characterized by a high prevalence of diabetes, favorable reimbursement policies, and strong technological advancements

- The market experienced substantial growth in insulin infusion pump adoption, driven by the rising integration of continuous glucose monitoring (CGM) systems, patient preference for hybrid closed-loop systems, and active innovation by leading medical device manufacturers

- This dominance is further supported by growing awareness of advanced diabetes management technologies, supportive government initiatives, and the increasing adoption of wearable medical devices. Together, these factors have positioned North America as a leader in insulin delivery innovation

U.S. Insulin Infusion Pumps Market Insight

The U.S. insulin infusion pumps market captured the largest revenue share in 2024 within North America, driven by the strong presence of major players such as Medtronic, Tandem Diabetes Care, and Insulet Corporation. The adoption of next-generation insulin pumps is accelerating, supported by integration with CGM systems, user-friendly interfaces, and advanced data management capabilities. Furthermore, the growing number of diabetes patients transitioning from multiple daily injections (MDI) to automated insulin delivery systems is further propelling market growth.

Europe Insulin Infusion Pumps Market Insight

The Europe insulin infusion pumps market is projected to expand at a significant CAGR during the forecast period, fueled by increasing awareness of diabetes management technologies and supportive healthcare policies promoting advanced insulin delivery systems. Countries such as Germany, France, and the U.K. are witnessing growing adoption due to the presence of well-established healthcare infrastructure and favorable reimbursement frameworks. In addition, rising demand for personalized diabetes management solutions is contributing to market expansion across the region.

U.K. Insulin Infusion Pumps Market Insight

The U.K. insulin infusion pumps market is anticipated to grow at a notable CAGR, supported by strong government focus on diabetes care, growing investments in digital health technologies, and partnerships between hospitals and medtech companies. The country’s emphasis on improving patient outcomes through connected health solutions is driving adoption of advanced insulin delivery systems integrated with CGM and smartphone applications.

Germany Insulin Infusion Pumps Market Insight

The Germany insulin infusion pumps market is expected to expand considerably during the forecast period, owing to its well-developed healthcare infrastructure, robust clinical research environment, and widespread availability of technologically advanced diabetes devices. Increasing acceptance of hybrid closed-loop systems and patient preference for automated insulin delivery solutions are key factors fueling market growth in the country.

Asia-Pacific Insulin Infusion Pumps Market Insight

The Asia-Pacific insulin infusion pumps market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing healthcare expenditure, rising diabetes prevalence, and expanding access to advanced insulin delivery systems. Countries such as China, Japan, and India are seeing strong adoption trends, supported by growing awareness of diabetes management and favorable government healthcare initiatives. In addition, the availability of affordable and compact insulin pumps is expanding access for middle-income populations.

Japan Insulin Infusion Pumps Market Insight

The Japan insulin infusion pumps market is gaining significant traction due to the country’s focus on high-quality healthcare, technological innovation, and growing geriatric population. The integration of insulin pumps with digital monitoring systems and AI-based insulin dosing algorithms is enhancing patient adherence and outcomes. Increasing collaborations between healthcare providers and technology developers are also fostering rapid market growth.

China Insulin Infusion Pumps Market Insight

The China insulin infusion pumps market accounted for the largest revenue share in Asia-Pacific in 2024, driven by a sharp rise in diabetes cases, expanding healthcare infrastructure, and increased accessibility to insulin pump therapy. The country’s local medtech companies are actively innovating to offer cost-effective solutions tailored to domestic demand, while government initiatives promoting chronic disease management are further accelerating adoption across hospitals and home care settings.

Insulin Infusion Pumps Market Share

The Insulin Infusion Pumps industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Insulet Corporation (U.S.)

- Roche Diabetes Care (Switzerland)

- Tandem Diabetes Care, Inc. (U.S.)

- Ypsomed AG (Switzerland)

- SOEHNI Health Care GmbH (Germany)

- Eoflow Co., Ltd. (South Korea)

- Diabeloop SA (France)

- Valeritas, Inc. (U.S.)

- Medtrum Technologies, Inc. (China)

- CeQur SA (Switzerland)

- B. Braun SE (Germany)

- Dana Diabecare (South Korea)

- Amrita Therapeutics (India)

- Pancreum, Inc. (U.S.)

- Spring Health Solutions Ltd. (U.K.)

Latest Developments in Global Insulin Infusion Pumps Market

- In July 2023, Tandem Diabetes Care received FDA clearance for its Mobi insulin pump, the world’s smallest durable automated insulin delivery system. This compact device integrates with continuous glucose monitors (CGMs) to automatically adjust insulin delivery based on glucose readings. Its launch marked a major step forward in wearable diabetes technology, emphasizing portability, comfort, and personalized insulin management for both adult and pediatric users

- In November 2022, Medtronic plc introduced an extended-wear infusion set in the United States, compatible with its insulin pump systems. Designed to last up to seven days—twice as long as standard sets—this innovation reduces the frequency of site changes, minimizes skin irritation, and improves user convenience. The product was developed in response to growing patient demand for more comfortable and cost-effective insulin delivery options

- In May 2023, Ypsomed AG announced a collaboration with Abbott Laboratories to integrate its mylife YpsoPump with the FreeStyle Libre 3 continuous glucose monitoring system. This partnership enabled seamless data connectivity between insulin pumps and glucose sensors, creating an interoperable ecosystem for automated insulin adjustments and enhancing user experience in real-time diabetes management

- In March 2024, Insulet Corporation expanded the reach of its Omnipod 5 automated insulin delivery system to several global markets. The system’s enhanced algorithm improved glucose control precision and adaptability to individual users’ daily patterns. This expansion reflected the rising global adoption of hybrid closed-loop technologies and Insulet’s growing influence in the wearable diabetes device segment

- In April 2024, Beta Bionics advanced clinical trials for its iLet Bionic Pancreas, a fully automated insulin delivery system designed to mimic pancreatic function. Using adaptive algorithms that continuously learn from patient glucose data, the iLet aims to reduce manual inputs and simplify diabetes management. The development represents a major milestone toward fully closed-loop insulin delivery and personalized therapy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.