Global Inorganic Corrosion Inhibitors Market

Market Size in USD Billion

CAGR :

%

USD

6.52 Billion

USD

9.07 Billion

2025

2033

USD

6.52 Billion

USD

9.07 Billion

2025

2033

| 2026 –2033 | |

| USD 6.52 Billion | |

| USD 9.07 Billion | |

|

|

|

|

What is the Global Inorganic Corrosion Inhibitors Market Size and Growth Rate?

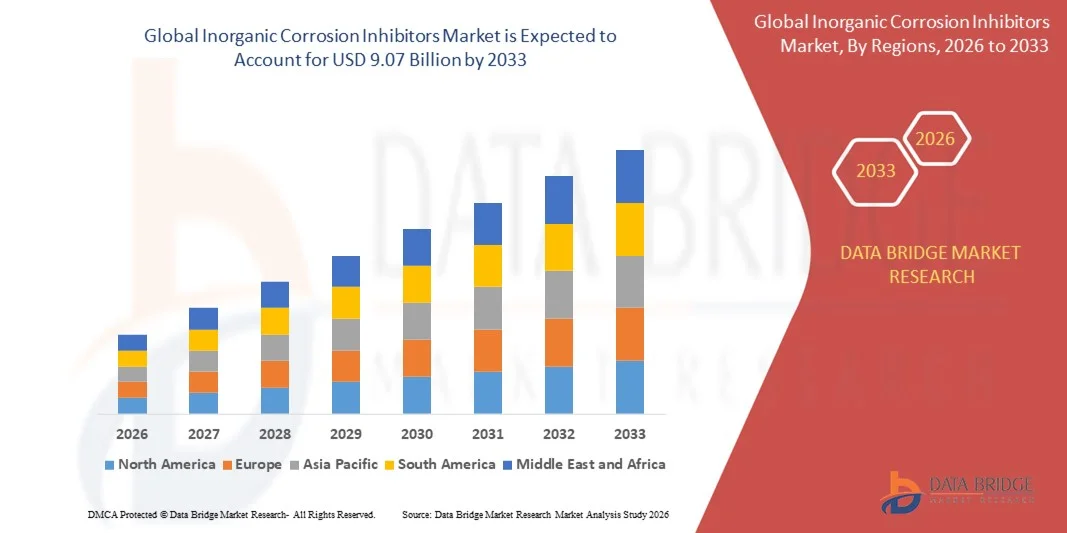

- The global inorganic corrosion inhibitors market size was valued at USD 6.52 billion in 2025 and is expected to reach USD 9.07 billion by 2033, at a CAGR of4.20% during the forecast period

- The factors such as surging industrialization in emerging economies are the root cause fueling up the inorganic corrosion inhibitors market growth rate

- Additionally, high usage of these inhibitors in wastewater treatment and piping of oil and gas fuels will also directly and positively impact the growth rate of the inorganic corrosion inhibitors market

What are the Major Takeaways of Inorganic Corrosion Inhibitors Market?

- The increasing use of plastics and ceramics instead of steel in the piping system derail growth of the inorganic corrosion inhibitors market

- The ongoing research for development of chromium and lead free inhibitors generate various opportunities for the market. The complications of inorganic corrosion inhibitors such as they are reactive as well as highly water soluble leading to leakage problem pose as challenge for the market’s growth

- North America dominated the inorganic corrosion inhibitors market with a 38.7% revenue share in 2025, driven by strong demand from the oil & gas sector, power generation facilities, chemical processing plants, and water treatment infrastructure across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.10% from 2026 to 2033, driven by rapid industrialization, expanding oil refining capacity, infrastructure development, and increasing investments in water treatment facilities across China, India, Japan, South Korea, and Southeast Asia

- The Anodic Inhibitors segment dominated the market with a 44.6% share in 2025, as these inhibitors are widely used to form protective oxide layers on metal surfaces, preventing metal dissolution and extending asset life

Report Scope and Inorganic Corrosion Inhibitors Market Segmentation

|

Attributes |

Inorganic Corrosion Inhibitors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Inorganic Corrosion Inhibitors Market?

Increasing Shift Toward Environmentally Sustainable and High-Performance Inorganic Corrosion Inhibitors

- The inorganic corrosion inhibitors market is witnessing strong adoption of advanced, low-toxicity, and environmentally compliant formulations designed for industrial water treatment, oil & gas pipelines, metal processing, and infrastructure protection

- Manufacturers are introducing multi-functional inhibitor blends based on phosphates, molybdates, silicates, and nitrites that offer enhanced passivation, long-term durability, and compatibility with diverse metal substrates

- Growing demand for cost-efficient, thermally stable, and high-performance corrosion protection solutions is driving deployment across power plants, refineries, marine systems, automotive cooling systems, and construction sectors

- For instance, companies such as BASF SE, Ecolab, Dow Inc., and Akzo Nobel N.V. are expanding their inorganic corrosion inhibitor portfolios with eco-friendly and high-efficiency solutions for industrial and municipal application

- Increasing regulatory pressure to reduce hazardous chromate-based inhibitors is accelerating the shift toward safer inorganic alternatives with improved environmental profile

- As industrial infrastructure expands and asset longevity becomes critical, Inorganic Corrosion Inhibitors will remain essential for extending equipment life, reducing maintenance costs, and ensuring operational reliability

What are the Key Drivers of Inorganic Corrosion Inhibitors Market?

- Rising demand for durable metal protection solutions across oil & gas, power generation, marine, automotive, and construction industries to minimize corrosion-related losses

- For instance, in 2024–2025, leading companies such as BASF SE, Henkel AG, and Ecolab strengthened their water treatment and industrial protection portfolios with enhanced inorganic inhibitor technologies

- Growing investments in infrastructure development, desalination plants, HVAC systems, and industrial water recycling projects are boosting demand globally across the U.S., Europe, and Asia-Pacific

- Advancements in formulation chemistry, improved solubility profiles, and synergistic inhibitor combinations have enhanced corrosion resistance efficiency and long-term system stability

- Rising awareness regarding asset integrity management and lifecycle cost optimization is creating sustained demand for high-performance inorganic inhibitor solutions

- Supported by expanding industrialization, stricter environmental regulations, and increased maintenance spending, the Inorganic Corrosion Inhibitors market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Inorganic Corrosion Inhibitors Market?

- Stringent environmental regulations restricting the use of certain traditional inorganic compounds such as chromates and heavy-metal-based inhibitors limit product adoption

- For instance, during 2023–2025, tightening environmental compliance standards in Europe and North America increased reformulation costs and regulatory testing requirements for manufacturers

- Volatility in raw material prices, including phosphates and specialty inorganic salts, increases production costs and impacts profit margins

- Competition from organic corrosion inhibitors and hybrid formulations offering comparable protection with lower environmental impact creates substitution pressure

- Technical limitations in highly aggressive environments may require complex multi-component systems, increasing operational complexity and cost

- To address these challenges, companies are focusing on sustainable chemistries, regulatory-compliant formulations, and advanced performance optimization to strengthen global adoption of Inorganic Corrosion Inhibitors

How is the Inorganic Corrosion Inhibitors Market Segmented?

The market is segmented on the basis of type, product, and application.

- By Type

On the basis of type, the inorganic corrosion inhibitors market is segmented into Anodic Inhibitors, Cathodic Inhibitors, and Others. The Anodic Inhibitors segment dominated the market with a 44.6% share in 2025, as these inhibitors are widely used to form protective oxide layers on metal surfaces, preventing metal dissolution and extending asset life. Compounds such as phosphates, nitrites, molybdates, and silicates are extensively applied across cooling systems, boilers, pipelines, and industrial water circuits. Their strong passivation efficiency and cost-effectiveness make them suitable for large-scale industrial operations.

The Cathodic Inhibitors segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption in aggressive environments such as marine systems, offshore platforms, and chemical processing plants. Rising demand for enhanced corrosion resistance, environmental compliance, and long-term infrastructure durability is accelerating growth in this segment.

- By Product

On the basis of product, the market is segmented into Sprays and Coatings. The Coatings segment dominated the market with a 58.2% share in 2025, owing to its extensive use in industrial equipment, storage tanks, pipelines, structural steel, and marine components. Inorganic corrosion-inhibiting coatings provide long-term surface protection, improved adhesion, and resistance against moisture, chemicals, and temperature variations. Their application in infrastructure development, oil & gas facilities, and power plants significantly contributes to segment dominance.

The Sprays segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for easy-to-apply, maintenance-focused corrosion protection solutions. Spray-based inhibitors are increasingly used for temporary protection, field repairs, automotive components, and equipment storage due to their convenience and lower application cost. Growing industrial maintenance activities and asset preservation initiatives further support segment expansion.

- By Application

On the basis of application, the inorganic corrosion inhibitors market is segmented into Oil and Gas Industry and Water Treatment Plants. The Oil and Gas Industry segment dominated the market with a 61.4% share in 2025, driven by extensive usage in pipelines, refineries, offshore platforms, drilling equipment, and storage facilities. Harsh operational environments, exposure to saline water, high pressure, and corrosive chemicals significantly increase corrosion risks, making inhibitors essential for asset integrity management and operational safety.

The Water Treatment Plants segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing investments in municipal water systems, desalination plants, cooling towers, and industrial wastewater treatment facilities. Rising focus on infrastructure modernization, regulatory compliance, and prevention of scaling and corrosion in water distribution systems is accelerating demand in this segment.

Which Region Holds the Largest Share of the Inorganic Corrosion Inhibitors Market?

- North America dominated the inorganic corrosion inhibitors market with a 38.7% revenue share in 2025, driven by strong demand from the oil & gas sector, power generation facilities, chemical processing plants, and water treatment infrastructure across the U.S. and Canada. Extensive pipeline networks, offshore exploration activities, and aging industrial assets continue to fuel the need for advanced corrosion protection solutions

- Leading manufacturers in North America are introducing environmentally compliant, high-performance inorganic formulations such as phosphates, molybdates, and silicates to enhance asset durability and regulatory adherence. Continuous investments in infrastructure modernization and industrial maintenance programs further strengthen regional market growth

- Strong regulatory frameworks, advanced industrial operations, and high awareness regarding asset integrity management reinforce North America’s leadership position in the global market

U.S. Inorganic Corrosion Inhibitors Market Insight

The U.S. is the largest contributor in North America, supported by extensive oil & gas pipelines, refinery operations, desalination units, and industrial water treatment systems. Increasing investments in shale exploration, petrochemical expansion, and power plant upgrades drive consistent demand for corrosion inhibitors. Strict environmental standards and focus on operational efficiency further accelerate adoption across industrial sectors.

Canada Inorganic Corrosion Inhibitors Market Insight

Canada contributes significantly due to strong presence of oil sands projects, mining operations, and power generation facilities. Harsh climatic conditions and exposure to corrosive environments increase the need for durable corrosion protection systems. Government-backed infrastructure upgrades and growing industrial water treatment requirements continue to support market expansion.

Asia-Pacific Inorganic Corrosion Inhibitors Market

Asia-Pacific is projected to register the fastest CAGR of 9.10% from 2026 to 2033, driven by rapid industrialization, expanding oil refining capacity, infrastructure development, and increasing investments in water treatment facilities across China, India, Japan, South Korea, and Southeast Asia. Growth in manufacturing, petrochemicals, marine industries, and energy generation significantly increases demand for inorganic corrosion inhibitors to extend equipment lifespan and reduce maintenance costs. Rising urbanization, desalination projects, and government-supported industrial expansion programs are accelerating adoption across the region.

China Inorganic Corrosion Inhibitors Market Insight

China is the largest contributor in Asia-Pacific due to massive industrial production, expanding petrochemical complexes, and large-scale infrastructure development. Strong investments in power plants, chemical manufacturing, and municipal water treatment facilities drive consistent demand for corrosion protection solutions.

Japan Inorganic Corrosion Inhibitors Market Insight

Japan shows steady growth supported by advanced manufacturing, marine engineering, and energy infrastructure modernization. Strong focus on high-quality materials, industrial safety, and long-term asset durability supports sustained adoption of inorganic corrosion inhibitors.

India Inorganic Corrosion Inhibitors Market Insight

India is emerging as a high-growth market, driven by expanding refinery capacity, rapid urban infrastructure development, and increasing investments in wastewater treatment plants. Government initiatives in industrial corridors and smart city projects further accelerate market penetration.

South Korea Inorganic Corrosion Inhibitors Market Insight

South Korea contributes significantly due to strong shipbuilding, petrochemical, and power generation industries. Growing focus on corrosion-resistant infrastructure, offshore energy projects, and industrial efficiency improvements supports long-term market growth.

Which are the Top Companies in Inorganic Corrosion Inhibitors Market?

The inorganic corrosion Inhibitors industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Dai-ichi India Pvt Ltd (India)

- Akzo Nobel N.V. (Netherlands)

- Cortec Corporation (U.S.)

- Ashland (U.S.)

- Henkel Adhesives Technologies India Private Limited (India)

- Dow Inc. (U.S.)

- W. R. Grace & Co.-Conn (U.S.)

- Daubert Cromwell Inc (U.S.)

- Ecolab (U.S.)

- Crystal Industrial Syndicate Pvt. Ltd (India)

- ChemTreat, Inc (U.S.)

What are the Recent Developments in Global Inorganic Corrosion Inhibitors Market?

- In August 2024, PPG introduced its advanced powder primer, PPG PRIMERON Optimal, formulated with optimized zinc technology to deliver superior corrosion resistance and long-lasting surface protection. The primer enhances adhesion, durability, and coating performance, making it highly suitable for demanding industrial environments. By integrating effective inorganic corrosion inhibitors, the product significantly improves the lifespan of coated substrates under harsh operating conditions. This development strengthens PPG’s position in the protective coatings segment and highlights its continued focus on high-performance corrosion control solutions

- In March 2023, Cortec launched VpCI-649 HP, a high-performance corrosion inhibitor certified under ANSI/NSF Standard 61 for hydro-testing applications in drinking water systems. The formulation provides reliable corrosion protection during hydrostatic testing of pipelines and vessels while maintaining low dosage requirements and minimal chloride impact. Its approval for potable water systems expands safe application possibilities and enhances compliance with industry regulations. This launch reinforces Cortec’s innovation capabilities and supports the advancement of safer and more efficient corrosion prevention technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Inorganic Corrosion Inhibitors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Inorganic Corrosion Inhibitors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Inorganic Corrosion Inhibitors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.