Global Inline Metrology Market

Market Size in USD Million

CAGR :

%

USD

848.11 Million

USD

2,594.40 Million

2025

2033

USD

848.11 Million

USD

2,594.40 Million

2025

2033

| 2026 –2033 | |

| USD 848.11 Million | |

| USD 2,594.40 Million | |

|

|

|

|

Inline Metrology Market Size

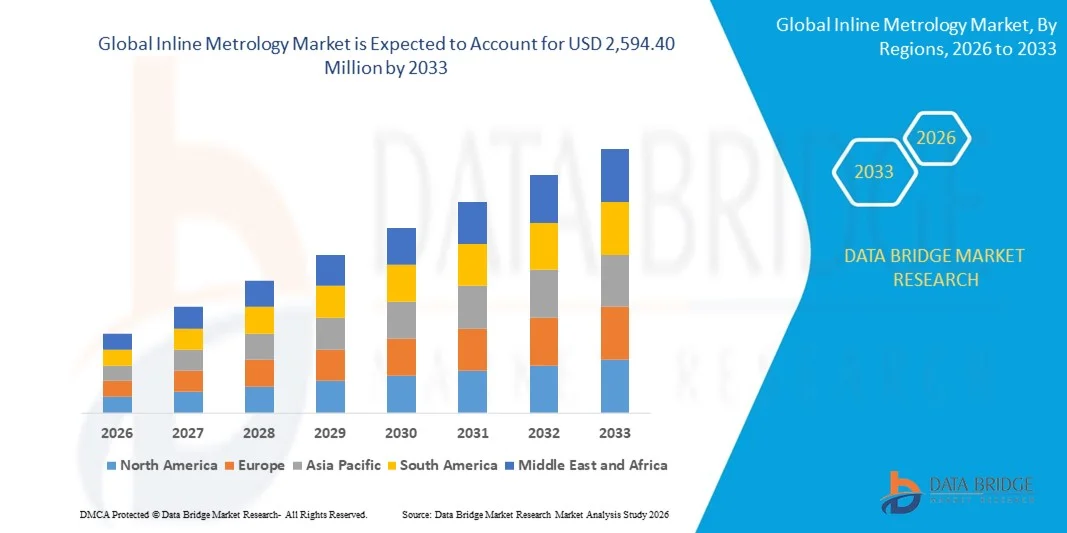

- The global inline metrology market size was valued at USD 848.11 million in 2025 and is expected to reach USD 2,594.40 million by 2033, at a CAGR of 15.00% during the forecast period

- The market growth is largely fuelled by the increasing adoption of automation and smart manufacturing across automotive, semiconductor, and electronics industries

- Rising demand for real-time quality inspection and process optimization in high-volume manufacturing environments is further supporting market expansion

Inline Metrology Market Analysis

- Inline metrology systems are gaining strong traction as manufacturers shift toward zero-defect production, reduced scrap rates, and improved production efficiency

- Technological advancements in sensors, machine vision, and AI-enabled measurement solutions are enhancing accuracy, speed, and integration with Industry 4.0 frameworks

- North America dominated the inline metrology market with the largest revenue share in 2025, driven by the strong presence of advanced manufacturing facilities, early adoption of automation technologies, and high investments in Industry 4.0 initiatives

- Asia-Pacific region is expected to witness the highest growth rate in the global inline metrology market, driven by expanding manufacturing bases, rising demand for high-precision production, and government initiatives supporting industrial automation and smart factories

- The hardware segment held the largest market revenue share in 2025, driven by the widespread deployment of inline measurement equipment such as sensors, scanners, and inspection devices directly integrated into production lines. Hardware solutions enable real-time data capture, high measurement accuracy, and continuous monitoring, making them essential for high-volume and precision-driven manufacturing environments

Report Scope and Inline Metrology Market Segmentation

|

Attributes |

Inline Metrology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Inline Metrology Market Trends

Rising Adoption Of Real-Time Measurement And Automation

- The increasing emphasis on real-time quality control and process optimization is significantly shaping the global inline metrology market, as manufacturers seek faster and more accurate measurement solutions integrated directly into production lines. Inline metrology systems enable continuous monitoring, reduce rework, and minimize production downtime, strengthening their adoption across automotive, semiconductor, electronics, and aerospace industries

- Growing adoption of automation, robotics, and smart manufacturing practices is accelerating demand for inline metrology solutions in high-volume and precision-driven manufacturing environments. Manufacturers are increasingly integrating inline metrology with automated inspection systems to improve yield rates, ensure dimensional accuracy, and maintain consistent product quality across large-scale operations

- Industry 4.0 and digital manufacturing trends are influencing purchasing decisions, with companies prioritizing advanced sensing, data analytics, and closed-loop feedback systems. Inline metrology solutions support data-driven manufacturing by enabling real-time adjustments, predictive maintenance, and enhanced process control, helping manufacturers improve operational efficiency and reduce scrap rates

- For instance, in 2024, leading automotive and semiconductor manufacturers in Germany, Japan, and the U.S. expanded the deployment of inline optical and laser-based metrology systems to support high-precision component production. These implementations were aimed at improving throughput, meeting tighter tolerances, and complying with stringent quality standards across global supply chains

- While demand for inline metrology is growing, sustained market expansion depends on continuous technological innovation, system integration capabilities, and cost-effective deployment. Manufacturers are focusing on improving measurement speed, accuracy, and software compatibility to support diverse production environments and enable broader adoption

Inline Metrology Market Dynamics

Driver

Growing Need For High-Precision And Real-Time Quality Control

- Rising demand for high-precision components in industries such as automotive, electronics, aerospace, and semiconductor manufacturing is a major driver for the inline metrology market. Inline measurement systems help detect defects early in the production process, reduce waste, and ensure compliance with strict quality requirements

- Expanding use of automation and advanced manufacturing techniques is further driving market growth. Inline metrology enables seamless integration with robotic systems and production equipment, allowing manufacturers to achieve faster inspection cycles and improved consistency without interrupting operations

- Manufacturers are increasingly investing in inline metrology solutions to support zero-defect manufacturing and continuous improvement initiatives. These systems provide real-time data and analytics, enabling faster decision-making and improved process optimization across complex production lines

- For instance, in 2023, semiconductor manufacturers in Taiwan and South Korea increased investments in inline metrology tools to support advanced node production and improve yield management. These deployments were driven by the need for tighter process control and higher throughput in next-generation chip manufacturing

- Although demand for precision measurement is rising, long-term growth will depend on advancements in sensor technology, software intelligence, and system interoperability. Continued investment in R&D and digital integration will be critical to address evolving manufacturing requirements

Restraint/Challenge

High Implementation Cost And Integration Complexity

- The relatively high cost of inline metrology systems remains a key challenge, particularly for small and medium-sized manufacturers. Advanced sensors, software platforms, and customization requirements contribute to higher upfront investment, limiting adoption in cost-sensitive environments

- Integration complexity with existing production lines and legacy equipment also restricts market growth. Inline metrology systems often require specialized installation, calibration, and skilled personnel, increasing operational complexity and deployment timelines

- Data management and interoperability challenges further impact adoption, as manufacturers must ensure seamless integration with manufacturing execution systems and quality management platforms. Inconsistent data standards and compatibility issues can reduce the effectiveness of inline measurement solutions

- For instance, in 2024, manufacturers in emerging markets such as India and Southeast Asia reported slower adoption of inline metrology due to high system costs and limited technical expertise. These challenges affected deployment across automotive component and electronics assembly plants

- Addressing these challenges will require cost optimization, modular system design, and improved ease of integration. Collaboration between metrology providers, automation vendors, and manufacturers will be essential to enhance accessibility, reduce complexity, and unlock the full growth potential of the global inline metrology market

Inline Metrology Market Scope

The market is segmented on the basis of offering, product, application, and industry vertical.

- By Offering

On the basis of offering, the global inline metrology market is segmented into hardware, software, and services. The hardware segment held the largest market revenue share in 2025, driven by the widespread deployment of inline measurement equipment such as sensors, scanners, and inspection devices directly integrated into production lines. Hardware solutions enable real-time data capture, high measurement accuracy, and continuous monitoring, making them essential for high-volume and precision-driven manufacturing environments.

The software and services segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing need for data analytics, system integration, and predictive insights. Advanced software platforms support real-time process control, visualization, and closed-loop feedback, while services such as calibration, maintenance, and customization enhance system performance and long-term operational efficiency.

- By Product

On the basis of product, the market is segmented into coordinate measuring machines (CMM), machine vision systems, multi-sensor measuring systems, optical scanners, laser trackers, and others. The machine vision systems segment accounted for the largest market share in 2025, supported by their ability to deliver high-speed, non-contact inspection and seamless integration with automated production lines. These systems are widely used for dimensional inspection, defect detection, and surface analysis across multiple industries.

The multi-sensor measuring systems segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand for flexible and versatile measurement solutions. These systems combine optical, tactile, and laser-based technologies, enabling comprehensive inspection of complex components and supporting advanced manufacturing requirements.

- By Application

On the basis of application, the inline metrology market is segmented into quality control and inspection, reverse engineering, and others. The quality control and inspection segment dominated the market in 2025, owing to the increasing emphasis on zero-defect manufacturing and real-time process validation. Inline metrology solutions help manufacturers detect deviations early, reduce scrap, and maintain consistent product quality.

The reverse engineering segment is expected to register strong growth from 2026 to 2033, driven by rising demand for rapid product development, component replication, and design optimization. Inline metrology supports accurate data capture and digital modeling, enabling faster innovation cycles and reduced time-to-market.

- By Industry Vertical

On the basis of industry vertical, the market is segmented into automotive, aerospace, semiconductors, energy and power, and others. The automotive segment held the largest revenue share in 2025, driven by high production volumes, stringent quality standards, and increasing adoption of automation across vehicle manufacturing and component assembly processes.

The semiconductors segment is expected to register strong growth from 2026 to 2033, supported by the need for ultra-precision measurement, tighter tolerances, and advanced process control. Growing investments in semiconductor fabrication facilities and next-generation chip manufacturing are further accelerating the adoption of inline metrology solutions.

Inline Metrology Market Regional Analysis

- North America dominated the inline metrology market with the largest revenue share in 2025, driven by the strong presence of advanced manufacturing facilities, early adoption of automation technologies, and high investments in Industry 4.0 initiatives

- Manufacturers in the region place significant emphasis on real-time quality inspection, production efficiency, and precision measurement, accelerating the deployment of inline metrology solutions across production lines

- This widespread adoption is further supported by robust R&D activities, high capital expenditure capabilities, and the growing need to minimize production errors and downtime, positioning inline metrology as a critical component in modern manufacturing environments

U.S. Inline Metrology Market Insight

The U.S. inline metrology market captured the largest revenue share in 2025 within North America, supported by the rapid adoption of smart manufacturing and advanced automation systems. Manufacturers are increasingly integrating inline metrology solutions to enable real-time inspection and data-driven decision-making. The strong demand from automotive, aerospace, and semiconductor industries, combined with continuous technological advancements in machine vision and optical measurement systems, continues to drive market growth. In addition, the emphasis on reducing scrap rates and improving operational efficiency is further accelerating adoption across large-scale manufacturing facilities.

Europe Inline Metrology Market Insight

The Europe inline metrology market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent quality standards and regulatory requirements across key industries. The region’s strong focus on precision engineering, coupled with increasing automation in manufacturing processes, is fostering the adoption of inline metrology systems. European manufacturers are increasingly incorporating these solutions into both new and upgraded production lines to enhance product consistency and reduce inspection time, supporting sustained market expansion.

U.K. Inline Metrology Market Insight

The U.K. inline metrology market is expected to witness the fastest growth rate from 2026 to 2033, supported by the growing adoption of advanced manufacturing technologies and the increasing need for high-precision inspection solutions. The presence of established automotive and aerospace sectors, along with rising investments in smart factories, is encouraging the deployment of inline metrology systems. In addition, the focus on improving manufacturing efficiency and maintaining compliance with quality standards continues to support market growth in the country.

Germany Inline Metrology Market Insight

The Germany inline metrology market is expected to witness the fastest growth rate from 2026 to 2033, driven by the country’s strong industrial base and leadership in precision manufacturing. Germany’s emphasis on automation, digital manufacturing, and high-quality production standards is significantly boosting the adoption of inline metrology solutions. The integration of inline measurement systems within automated production environments is becoming increasingly common, particularly in automotive and industrial machinery manufacturing, reinforcing market growth.

Asia-Pacific Inline Metrology Market Insight

The Asia-Pacific inline metrology market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid industrialization, expanding manufacturing capacities, and increasing adoption of automation technologies. Countries such as China, Japan, and India are witnessing rising demand for real-time quality inspection solutions to support high-volume production. Government initiatives promoting advanced manufacturing and the growing presence of global manufacturers in the region are further accelerating the adoption of inline metrology systems.

Japan Inline Metrology Market Insight

The Japan inline metrology market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s strong focus on precision engineering, automation, and technological innovation. Japanese manufacturers emphasize high accuracy and consistency in production, driving the integration of inline metrology solutions across electronics, automotive, and semiconductor industries. The increasing deployment of smart factories and connected manufacturing systems is further supporting market expansion in the country.

China Inline Metrology Market Insight

The China inline metrology market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid industrial expansion, large-scale manufacturing operations, and rising adoption of smart manufacturing technologies. China’s strong focus on improving product quality and manufacturing efficiency, along with substantial investments in automation and digital inspection systems, is driving demand for inline metrology solutions. The presence of a large manufacturing base and increasing implementation of Industry 4.0 practices continue to position China as a key growth market for inline metrology systems.

Inline Metrology Market Share

The Inline Metrology industry is primarily led by well-established companies, including:

- Hexagon AB (Sweden)

- FARO (U.S.)

- Nikon Metrology NV (Japan)

- ZEISS (Germany)

- KLA Corporation (U.S.)

- JENOPTIK AG (Germany)

- Renishaw plc (U.K.)

- Mitutoyo Corporation (Japan)

- AMETEK Inc. (U.S.)

- Perceptron Inc. (U.S.)

- • COGNEX CORPORATION (U.S.)

- • LMI TECHNOLOGIES INC. (Canada)

- QIS Metrologies AB (Sweden)

- SYNERGX Technologies Inc. (U.S.)

- WENZEL Group (Germany)

- KUKA AG (Germany)

- Fraunhofer-Gesellschaft (Germany)

- Metrologic Group (France)

- DWFritz Automation Inc. (U.S.)

- ABB (Switzerland)

Latest Developments in Global Inline Metrology Market

- In November 2025, KLA Corporation (US) entered into a strategic partnership with a leading semiconductor manufacturer to develop advanced inline metrology solutions. This collaboration aims to enhance KLA’s product portfolio while delivering high-precision and reliable measurement capabilities tailored for semiconductor production. The initiative is expected to drive innovation, strengthen KLA’s market presence, and meet the growing demand for accurate and efficient manufacturing solutions in the semiconductor industry

- In October 2025, Nikon Metrology (JP) launched a new series of laser scanning systems for high-speed inline measurement applications. The launch focuses on providing rapid and precise data collection for manufacturing processes, catering to industries that require efficiency and accuracy. This development is poised to reinforce Nikon’s market position and address the increasing need for automated, high-performance measurement technologies

- In September 2025, Faro Technologies (US) expanded its global operations by opening a new manufacturing facility in Europe. The expansion is designed to enhance production capabilities, reduce lead times, and better serve European customers. This strategic move strengthens Faro’s supply chain, improves operational responsiveness, and supports the company’s competitiveness in a market that values speed, efficiency, and localized solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Inline Metrology Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Inline Metrology Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Inline Metrology Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.