Global Ink Resins Market

Market Size in USD Billion

CAGR :

%

USD

5.48 Billion

USD

9.37 Billion

2024

2032

USD

5.48 Billion

USD

9.37 Billion

2024

2032

| 2025 –2032 | |

| USD 5.48 Billion | |

| USD 9.37 Billion | |

|

|

|

|

Ink Resins Market Size

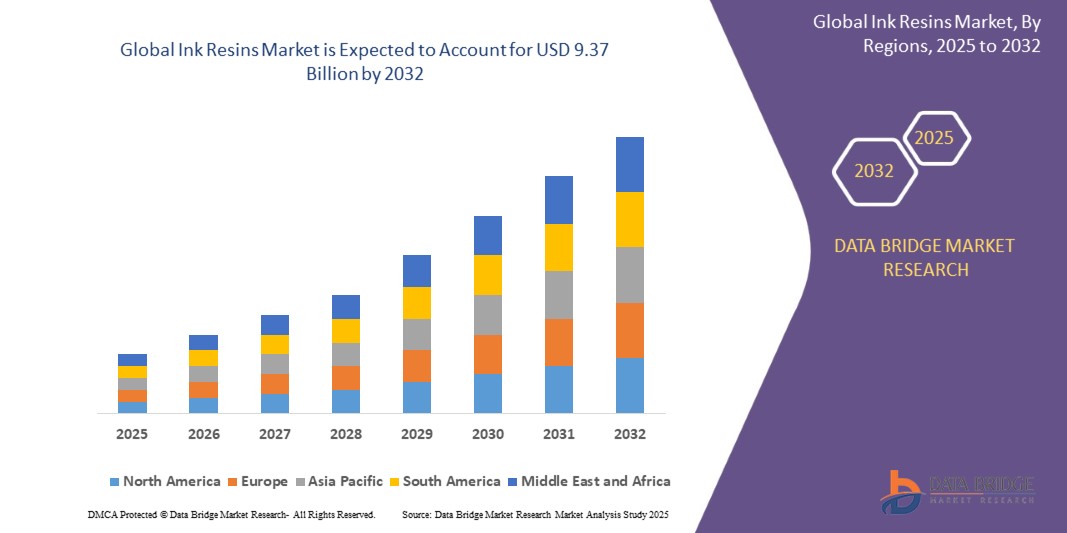

- The global Ink Resins market size was valued at USD 5.48 billion in 2024 and is expected to reach USD 9.37 billion by 2032, at a CAGR of 7.1% during the forecast period

- Market growth is driven by increasing demand for high-quality, durable printed packaging across food, beverage, and e-commerce sectors.

- Rising adoption of sustainable, bio-based, water-based, and UV-curable resins plays a key role in product innovation, responding to environmental regulations and consumer preferences.

- Expansion of digital and flexible printing technologies, as well as growth in emerging markets, fuels demand for advanced ink resin formulations.

Ink Resins Market Analysis

- Ink resins are key components that bind pigments and colorants in printing inks, imparting adhesion, gloss, durability, and resistance to chemicals and environmental factors. The global market reflects evolving consumer and industrial needs for better print quality, faster drying times, and eco-friendly materials.

- Acrylic resins dominate due to their superior weather resistance, flexibility, and gloss. Hydrocarbon and polyester resins are widely used for their strong adhesion and versatility.

- Applications in flexible packaging, including plastics and films, grow rapidly due to e-commerce expansion and the need for visually appealing, protective packaging solutions.

- Digital printing’s rapid expansion creates demand for specialized resin systems compatible with inkjet and laser technologies.

- Regulatory pressures encourage development of low-VOC and environmentally friendly resins, supporting growth in sustainable packaging.

- Industry players focus on R&D to optimize resin properties for specific substrates and applications while enhancing sustainability credentials.

Report Scope and Ink Resins Market Segmentation

|

Attributes |

Ink Resins Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ink Resins Market Trends

Transition to Sustainable, High-Performance, and Specialty Resin Solutions

- A defining trend in the global ink resins market is the accelerated shift toward eco-friendly and bio-based resin formulations. Manufacturers are investing in water-based, vegetable-derived, and low-VOC resin chemistries to meet stricter environmental regulations and growing consumer demand for sustainable packaging and printed materials.

- The proliferation of digital and flexible printing technologies is driving innovation in resin design, with increased emphasis on resins that offer rapid curing, excellent adhesion to diverse substrates, and superior image quality. UV-curable and radiation-curable resins are gaining ground for their quick drying times, durability, and lower energy consumption.

- Functional and specialty resin solutions—such as antimicrobial, scratch-resistant, and weatherproof formulations—are being developed to serve high-value applications in food packaging, pharmaceuticals, and outdoor advertising. These advanced chemistries support both enhanced performance and compliance with safety standards for food contact and sensitive applications.

- Major ink producers and packaging converters are collaborating to design packaging inks and coatings that can be easily recycled and are compatible with circular economy initiatives. This includes innovation in resins that allow for easy removal during recycling or minimize contamination of recycled materials.

- As companies increase their corporate sustainability commitments, investment in renewable raw materials, green chemistry, and lifecycle analysis of ink resin products is rising. Brands that offer traceable, low-environmental-impact resin systems are gaining competitive differentiation and regulatory favor in key markets.

- With rising global e-commerce and demand for premium packaging finishes, resins providing better gloss, fade resistance, and tactile effects are attracting attention across commercial printing, labels, and specialty graphics sectors.

Ink Resins Market Dynamics

Driver

Surging Demand for Sustainable, High-Performance Packaging and Commercial Printing

- The ongoing shift to eco-friendly packaging is a major driver for the global ink resins market. Brands and converters are prioritizing inks made from sustainable, low-VOC, and bio-based resins in response to stricter regulations and heightened consumer environmental awareness.

- The robust growth of e-commerce and online retail is fueling demand for attractive, durable, and flexible packaging—requiring resins that deliver superior print quality, rapid drying, strong adhesion, and resistance to fading, chemicals, and moisture.

- Innovations in digital, UV, and flexographic printing methods continue to propel the need for specialized resin systems compatible with new substrates, formats, and speed requirements.

- In addition, increasing demand for food-safe and migration-compliant ink formulations is driving the adoption of functional resin technologies in food and pharmaceutical packaging where regulatory standards are highest.

Restraint/Challenge

Raw Material Volatility, Regulatory Complexity, and Technical Hurdles

- Volatility in petrochemical feedstock prices—such as those for styrene, acrylics, or polyesters—can impact production costs, margins, and price stability for ink resins, especially in times of geopolitical or supply chain disruptions.

- Growing regulatory scrutiny on VOC emissions, heavy metals, and hazardous ingredients in inks places pressure on manufacturers to reformulate products, adhere to complex regional standards, and invest in R&D for safer, compliant alternatives.

- Technical challenges include balancing low VOC content with maintaining print performance, gloss, durability, and compatibility across diverse printing technologies and substrates.

- Competition from alternative materials, rapid changes in packaging formats, and evolving customer requirements demand continual innovation and collaboration between resin suppliers, ink formulators, and printer OEMs.

- Educating end-users on the benefits, limitations, and safe handling of advanced ink resins remains crucial for broad market adoption, particularly as sustainability considerations reshape procurement and production practices globally.

Ink Resins Market Scope

The market is segmented on the basis of resin type, printing technology, and end-use application.

- By Resin Type

On the basis of resin type, the global ink resins market is segmented into acrylic resins, hydrocarbon resins, polyester resins, epoxy resins, polyurethane resins, and others. The acrylic resins segment dominates the largest market revenue share in 2024, due to its superior adhesion, weather resistance, gloss, and flexibility, making it highly popular for packaging, commercial, and label printing applications. Hydrocarbon resins are widely used for their excellent solubility and compatibility with multiple ink systems, especially in offset and flexographic printing. Bio-based and water-based resin types are expected to witness the fastest growth rate from 2025 to 2032, driven by increasing regulatory pressure for sustainable, low-VOC inks and rising demand for eco-friendly packaging solutions.

- By Printing Technology

On the basis of printing technology, the market is segmented into lithographic (offset) printing, flexographic printing, gravure printing, digital printing, and others. Lithographic printing holds the largest market revenue share in 2024, attributed to its extensive use across packaging, magazines, and commercial print runs due to cost-effectiveness and efficiency. Digital printing is projected to register the fastest CAGR through 2032, supported by the growth of on-demand printing, specialty graphics, and innovative packaging formats requiring unique resin formulations.

- By End-Use Application

The market is segmented by end-use into packaging, commercial printing, label printing, textile printing, and others. Packaging is the leading application segment, driven by surging demand in food, beverage, e-commerce, and consumer goods sectors. Label printing and textile printing are showing notable growth, supported by increasing requirements for durability, specialty finishes, and compliance with sustainability initiatives.

Ink Resins Market Regional Analysis

- Asia-Pacific dominates the global ink resins market with an estimated revenue share of 38% to 42% in 2024. This strong position is driven by rapid expansion in packaging, commercial printing, and e-commerce across major countries like China, India, Japan, and South Korea.

- The region benefits from a flourishing manufacturing ecosystem, rising consumer spending, and vigorous demand for high-quality, sustainable printed materials in urban centers.

- Consumers and industrial buyers in Asia-Pacific are increasingly utilizing advanced ink resin formulations—particularly acrylic, hydrocarbon, and bio-based types—for applications ranging from flexible packaging to specialty graphics, in response to regulatory requirements and the sustainability movement.

- Government policies supporting environmental protection and the development of recycling-friendly inks further catalyze growth, as does the abundance of cost-effective labor and raw materials.

- Asia-Pacific’s export-oriented printing and packaging industry, as well as ongoing R&D investment in eco-friendly resin technologies, ensure the region’s continued leadership and fastest growth rate within the global ink resins market

U.S. Ink Resins Market Insight

The U.S. dominates the North American ink resins market in 2024, supported by advanced packaging, commercial printing, and labeling industries. High demand for sustainable and low-VOC resin formulations stems from strict regulatory standards and a consumer focus on environmentally safe products. Innovation is strong among major producers, who continually launch water-based, UV-curable, and bio-based resins for food, pharmaceuticals, and e-commerce packaging. The rise in digital printing and customized graphics also accelerates the adoption of specialty resin solutions across U.S. printing segments.

Europe Ink Resins Market Insight

Europe’s ink resins market is set for robust growth, driven by stringent VOC regulations, rising demand for eco-friendly inks, and significant government and EU-funded R&D initiatives. Applications are expanding into high-end packaging, commercial print, and specialty labels in countries like Germany, France, and the U.K. European manufacturers are pioneering sustainable resin chemistries and circular packaging designs, responding to corporate sustainability targets and consumer demand for recyclable, low-impact products.

U.K. Ink Resins Market Insight

The U.K. ink resins market is expected to register healthy growth, fueled by demand for premium packaging, specialty commercial printing, and regulatory pressures to adopt sustainable materials. Local converters and printers increasingly source advanced acrylic, polyurethane, and water-based resins, prioritizing reduced environmental footprint and compliance with evolving standards.

Germany Ink Resins Market Insight

Germany’s ink resins market benefits from its leadership in engineering, manufacturing, and environmental policy. The strong industrial sector drives demand for technically advanced and sustainable resin systems, particularly for automotive, food, pharmaceutical, and specialty packaging. German companies focus on developing low-VOC, bio-based, and high-performance resins, and leverage extensive R&D collaborations between private firms and research institutions.

Asia-Pacific Ink Resins Market Insight

Asia-Pacific accounts for the largest revenue share in 2024, propelled by rapid growth in packaging, flexible printing, and e-commerce industries across China, India, Japan, and South Korea. Robust production infrastructure, affordable labor, and abundant raw materials support market strength, while rising regulatory requirements and exports of packaged goods further stimulate demand for quality, sustainable resin solutions.

India Ink Resins Market Insight

India’s ink resins market is projected to experience the highest CAGR through 2032. Strong expansion in packaged food, beverage, and pharmaceutical sectors—combined with “Make in India” initiatives and rising middle-class consumption—drives demand for affordable, eco-friendly, and high-performance ink resins in packaging and printing.

China Ink Resins Market Insight

China leads Asia-Pacific by revenue share, underpinned by its massive packaging, commercial printing, and industrial manufacturing base. Rapid innovation in water-based, specialty, and bio-resins is supported by domestic demand and a push for technological leadership in print chemistry. Growing exports, urbanization, and consumer health priorities accelerate adoption of advanced ink resin formulations in China’s booming market.

Ink Resins Market Share

The Ink Resins industry is primarily led by well-established companies, including:

- Eastman Chemical Company (U.S.)

- BASF (Germany)

- Evonik Industries (Germany)

- Allnex (Germany)

- Dow (U.S.)

- Hexion Inc. (U.S.)

- Synthomer plc (U.K.)

- Lubrizol Corporation (U.S.)

- Wacker Chemie AG (Germany)

- Arkema (France)

- Royal DSM (Netherlands)

- DIC Corporation (Japan)

- Lawter (U.S.)

- Mitsubishi Chemical Group Corporation (Japan)

- Hydrite Chemical Co. (U.S.)

- Indulor Chemie GmbH (Germany)

- Arakawa Chemical Industries, Ltd. (Japan)

Latest Developments in Global Ink Resins Market

- In June 2025 Eastman Chemical launched a new line of bio-based acrylic resin formulations for flexible packaging inks.

- In February 2025 BASF SE expanded production capacity for water-based resins responding to growing sustainable packaging demand.

- In November 2024 Evonik introduced UV-curable resins optimized for fast printing and durability in digital applications.

- In August 2024 Arkema invested in R&D for low-VOC polyurethane resins targeting high-end label printing markets.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.