Global Infrared Spectroscopy Market

Market Size in USD Billion

CAGR :

%

USD

1.14 Billion

USD

1.63 Billion

2024

2032

USD

1.14 Billion

USD

1.63 Billion

2024

2032

| 2025 –2032 | |

| USD 1.14 Billion | |

| USD 1.63 Billion | |

|

|

|

|

Infrared Spectroscopy Market Size

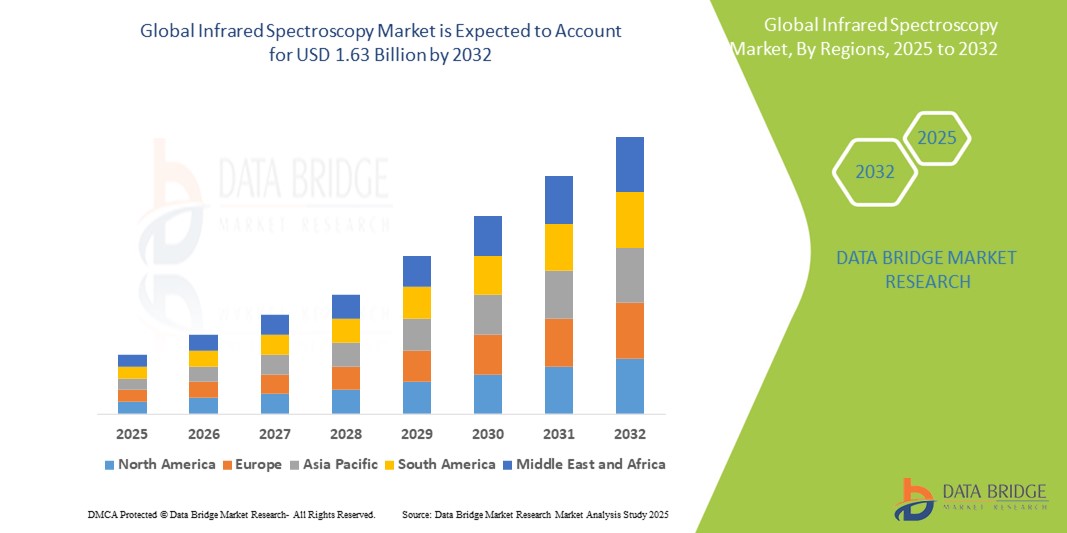

- The global infrared spectroscopy market size was valued at USD 1.14 billion in 2024 and is expected to reach USD 1.63 billion by 2032, at a CAGR of 4.60% during the forecast period

- The market growth is primarily fueled by the increasing adoption of IR spectroscopy across diverse industries such as pharmaceuticals, food and beverage, environmental testing, and chemical processing

- Furthermore, technological advancements, including the miniaturization and portability of IR spectrometers, are significantly broadening their usability, enabling on-site and real-time analysis in various fields and driving the industry's expansion

Infrared Spectroscopy Market Analysis

- Infrared spectroscopy (IR) which analyzes the interaction of infrared radiation with matter to identify and characterize molecular structures, is an increasingly crucial analytical technique across a broad range of industries, including pharmaceuticals, chemicals, food and beverage, and environmental monitoring

- The escalating demand for IR spectroscopy is primarily fueled by stringent regulations in various industries, growing concerns over environmental pollution, and continuous technological advancements leading to more portable and user-friendly devices

- North America dominates the infrared spectroscopy market with the largest revenue share of 35.5% in 2024, characterized by the region's robust pharmaceutical and healthcare sectors, advanced research infrastructure, and substantial investments in R&D, particularly in the U.S.

- Asia-Pacific is expected to be the fastest growing region in the infrared spectroscopy market during the forecast period due to rapid industrialization, increasing investments in R&D, and rising emphasis on quality control and regulatory compliance in emerging economies

- Fourier transform infrared (FTIR) spectroscopy segment dominates the infrared spectroscopy market with a market share of 30.5% in 2024, driven by its ability to provide detailed molecular analysis by simultaneously capturing a broad spectrum of infrared light, making it highly efficient for various applications

Report Scope and Infrared Spectroscopy Market Segmentation

|

Attributes |

Infrared Spectroscopy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Infrared Spectroscopy Market Trends

“Advancements in Data Analysis and Automation through AI and Machine Learning”

- A significant and accelerating trend in the global infrared spectroscopy market is the deepening integration with artificial intelligence (AI) and machine learning (ML). This fusion of technologies is significantly enhancing data analysis, interpretation, and automation capabilities, transforming the efficiency and accuracy of spectroscopic applications

- For instance, AI algorithms are being applied to analyze complex IR spectra, enabling more precise identification of molecular structures and components. This is particularly beneficial in fields such as pharmaceuticals for drug characterization and quality control, and in environmental monitoring for identifying pollutants

- AI and ML integration in IR spectroscopy enables features such as automated data cleaning and transformation, identifying patterns and anomalies that might be missed by manual analysis. For instance, some advanced IR spectroscopy systems utilize AI to improve spectral interpretation, classify unknown materials, and even predict properties based on spectral data, leading to faster and more reliable results

- The seamless integration of IR spectroscopy with AI and automation tools facilitates streamlined workflows and reduces the time and expertise required for data processing. This allows researchers and analysts to focus on higher-level interpretation and decision-making, while repetitive and complex data analysis tasks are handled by intelligent algorithms.

- This trend towards more intelligent, efficient, and interconnected analytical systems is fundamentally reshaping user expectations for spectroscopic analysis. Consequently, leading companies in the market, such as Thermo Fisher Scientific and Agilent Technologies, are actively exploring and implementing AI and machine learning for next-generation IR analysis workflows

- The demand for IR spectroscopy systems that offer seamless AI and automation integration is growing rapidly across various industries, as users increasingly prioritize enhanced analytical capabilities, improved accuracy, and operational efficiency

Infrared Spectroscopy Market Dynamics

Driver

“Growing Need Due to Stringent Regulatory Standards and Expanding Industrial Applications”

- The increasing prevalence of stringent regulatory standards across various industries, coupled with the expanding range of industrial applications, is a significant driver for the heightened demand for infrared spectroscopy

- For instance, in the pharmaceutical sector, regulatory bodies such as the FDA and EMA mandate precise quality control and impurity detection, for which IR spectroscopy is an indispensable tool. Similarly, growing concerns about food safety and environmental pollution are leading to greater adoption of IR spectroscopy for analysis and monitoring

- As industries face stricter compliance requirements and seek to ensure product quality and safety, IR spectroscopy offers rapid, accurate, and often non-destructive analysis, providing a compelling solution over traditional methods

- Furthermore, the growing demand for real-time and on-site analysis in diverse fields such as chemical manufacturing, forensics, and material science is making IR spectroscopy an integral component of modern analytical workflows

- The continuous technological advancements, including the development of portable and handheld IR spectrometers, alongside integration with automation and AI, are key factors propelling the adoption of IR spectroscopy across both industrial and research sectors. The increasing availability of user-friendly IR spectroscopy solutions further contributes to market growth

Restraint/Challenge

“Complexity of Spectral Interpretation and High Initial Instrument Costs”

- Concerns regarding the interpretation of infrared spectra, particularly for intricate samples or mixtures, coupled with the relatively high initial cost of advanced IR spectroscopy instruments, poses a significant challenge to broader market penetration. Users often require specialized expertise to accurately analyze data, which can be a barrier for new adopters or smaller organizations

- For instance, distinguishing overlapping peaks in complex biological samples or identifying trace components in environmental matrices requires advanced knowledge and sophisticated software, leading to a steeper learning curve and potential for misinterpretation

- Addressing these interpretation challenges through enhanced software with advanced algorithms, AI-driven data analysis tools, and comprehensive training programs is crucial for simplifying the use of IR spectroscopy. Companies such as Thermo Fisher Scientific and Bruker are investing in user-friendly interfaces and automated spectral libraries to streamline the analytical process. In addition, the high initial investment required for high-resolution FTIR spectrometers or specialized IR microscopy systems can be a deterrent for price-sensitive consumers and institutions, particularly in developing regions or for smaller laboratories. While more affordable, basic models are available, their capabilities might be limited for certain advanced applications

- While prices are gradually decreasing due to technological advancements and increased competition, the perceived premium for advanced IR spectroscopy technology can still hinder widespread adoption, especially for those who prioritize cost-effectiveness over cutting-edge features

- Overcoming these challenges through continuous development of more intuitive software, robust educational initiatives, and the introduction of cost-effective, high-performance IR spectroscopy solutions will be vital for sustained market growth

Infrared Spectroscopy Market Scope

The market is segmented on the basis of product type, spectrum, application, and technology.

- By Product Type

On the basis of product type, the infrared spectroscopy market is segmented into benchtop IR spectroscope, IR microscopy, portable IR spectroscope, hyphenated IR spectroscope, and terahertz IR spectroscope. The benchtop IR spectroscope segment dominates the largest market revenue share, driven by its established reputation for high precision, versatility, and comprehensive analytical capabilities crucial for in-depth research and quality control across diverse industries. Laboratories often prioritize benchtop instruments for their robust performance and the ability to handle a wide range of sample types. The market also sees strong demand for benchtop types due to their compatibility with various accessories and the availability of diverse features enhancing analytical depth and accuracy

The portable IR spectroscope segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption in field applications, on-site analysis, and rapid quality control. Portable instruments offer unparalleled convenience and mobility, making them suitable for environmental monitoring, food safety inspections, and point-of-care diagnostics. Their ease of use and ability to provide immediate results also contribute to their growing popularity in industrial settings and for quick screening purposes

- By Spectrum

On the basis of spectrum, the infrared spectroscopy market is segmented into near infrared, far infrared, and mid infrared. The mid-infrared (MIR) segment held the largest market revenue share in 2024, driven by its widespread utility for identifying and characterizing molecular structures due to strong and distinct absorption bands. MIR-enabled spectroscopy is often considered the "fingerprint region" of a molecule, offering critical information for chemical identification, pharmaceutical analysis, and material science

The near-infrared (NIR) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its non-destructive, rapid, and often non-invasive analytical capabilities. NIR-enabled spectroscopy is particularly ideal for quality control in industries such as food and beverage, agriculture, and pharmaceuticals, where rapid screening and process monitoring are essential, and its ability to penetrate samples makes it highly versatile

- By Application

On the basis of application, the infrared spectroscopy market is segmented into pharma and biotech, food and beverages, environmental testing, academics, security, industrial, petrochemicals, semiconductors, and others. The pharma and biotech segment accounted for the largest market revenue share in 2024, driven by stringent regulatory requirements for drug quality control, research and development of new drugs, and the increasing demand for active pharmaceutical ingredient (API) analysis and impurity detection. The critical role of IR spectroscopy in ensuring product safety and efficacy is a key factor

The food and beverages segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing need for quality control, authentication, and contaminant detection in food products. Businesses benefit from rapid, non-destructive analytical solutions that can ensure product consistency, detect adulteration, and comply with evolving food safety regulations

- By Technology

On the basis of technology, the infrared spectroscopy market is segmented into dispersive infrared spectroscopy and Fourier Transform Infrared (FTIR) spectroscopy. The fourier transform Infrared (FTIR) spectroscopy segment held the largest market revenue share of 30.5% in 2024, driven by its superior spectral resolution, high speed, and excellent sensitivity, making it the preferred choice for a vast majority of analytical applications. FTIR offers significant advantages in terms of signal-to-noise ratio and data acquisition speed compared to dispersive methods

The dispersive infrared spectroscopy segment is anticipated to witness steady growth, favored for its simpler design, lower initial cost, and robustness, providing a reliable and accessible option for routine analysis in educational settings or for specific industrial applications where high resolution is not paramount

Infrared Spectroscopy Market Regional Analysis

- North America dominates the infrared spectroscopy market with the largest revenue share of 35.5% in 2024, driven by the region's robust pharmaceutical and healthcare sectors, advanced research infrastructure, and substantial investments in R&D, particularly in the U.S.

- Consumers in the region highly value the precision, speed, and reliability offered by IR spectroscopy, leading to its widespread adoption in industries such as drug development, quality assurance, and environmental analysis

- This widespread adoption is further supported by a strong presence of key industry players and continuous technological advancements, establishing IR spectroscopy as a favored analytical solution across both industrial and academic sectors

U.S. Infrared Spectroscopy Market Insight

The U.S. infrared spectroscopy market captured a significant revenue share within North America, fueled by the robust growth in demand for IR spectroscopy across various industries such as healthcare, pharmaceuticals, chemicals, and food and beverages. Research institutions and academic organizations heavily rely on IR spectroscopy for diverse scientific and industrial applications. This widespread adoption is further propelled by substantial investment in research and development and a strong emphasis on technological advancements. Moreover, the increasing integration of advanced data analysis tools, including AI and machine learning, is significantly contributing to the market's expansion

Europe Infrared Spectroscopy Market Insight

The Europe infrared spectroscopy market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulatory guidelines in industries such as pharmaceuticals and food safety, and the escalating need for enhanced quality control and analytical precision. The presence of well-established pharmaceutical and semiconductor companies, coupled with continuous R&D activities and government support for technological advancements, is fostering the adoption of IR spectroscopy. European industries are also drawn to the efficiency and comprehensive analytical capabilities these devices offer. The region is experiencing significant growth across research, industrial, and environmental monitoring applications, with IR spectroscopy being incorporated into various analytical workflows

U.K. Infrared Spectroscopy Market Insight

The U.K. infrared spectroscopy market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing investments in research and development, particularly in the pharmaceutical and biotech sectors, and a desire for heightened analytical precision. Concerns regarding quality control, environmental pollution, and food safety are encouraging both industries and research institutions to choose advanced spectroscopic solutions. The UK’s embrace of advanced analytical technologies, alongside its robust academic and research infrastructure, is expected to continue to stimulate market growth

Germany Infrared Spectroscopy Market Insight

The Germany infrared spectroscopy market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of the importance of precise material characterization and the demand for technologically advanced, high-performance analytical solutions. Germany’s well-developed industrial infrastructure, combined with its emphasis on innovation and stringent quality standards, promotes the adoption of IR spectroscopy, particularly in chemical manufacturing, automotive, and pharmaceutical industries. The integration of IR spectroscopy with automated systems and process analytical technology (PAT) is also becoming increasingly prevalent, with a strong preference for reliable and accurate analytical solutions aligning with local industry expectations

Asia-Pacific Infrared Spectroscopy Market Insight

The Asia-Pacific infrared spectroscopy market is poised to grow at the fastest CAGR during the forecast period, driven by increasing industrialization, rising investments in R&D, and technological advancements in countries such as China, Japan, and India. The region's growing emphasis on quality control and regulatory compliance, supported by government initiatives promoting advanced manufacturing and scientific research, is driving the adoption of IR spectroscopy. Furthermore, as APAC emerges as a global manufacturing hub for pharmaceuticals, chemicals, and electronics, the demand for sophisticated analytical instruments is expanding to a wider industrial base

Japan Infrared Spectroscopy Market Insight

The Japan infrared spectroscopy market is gaining momentum due to the country’s high-tech manufacturing culture, strong research and development activities, and demand for precision analytical tools. The Japanese market places a significant emphasis on quality control and innovation, and the adoption of IR spectroscopy is driven by its increasing use in advanced materials research, semiconductor manufacturing, and pharmaceutical development. The integration of IR spectroscopy with other analytical techniques and automation systems is fueling growth. Moreover, Japan's robust academic and industrial collaboration is likely to spur demand for cutting-edge spectroscopic solutions in both research and industrial sectors

India Infrared Spectroscopy Market Insight

The India infrared spectroscopy market accounted for a significant market revenue share in Asia Pacific in 2024, attributed to the country's expanding pharmaceutical and chemical industries, rapid growth in research and development, and increasing awareness of quality standards. India stands as a rapidly growing market for analytical instruments, and IR spectroscopy is becoming increasingly popular in drug discovery, food safety, and environmental analysis. The push towards modernizing industrial processes and the availability of advanced analytical solutions, alongside strong domestic research capabilities, are key factors propelling the market in India

Infrared Spectroscopy Market Share

The Infrared Spectroscopy industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- PerkinElmer (U.S.)

- Medtronic (Ireland)

- HORIBA (Japan)

- Teledyne FLIR LLC (U.S.)

- Shimadzu Corporation (Japan)

- Miltenyi Biotec (U.S.)

- Metrohm AG (Switzerland)

- Bruker (U.S.)

- Hitachi High-Tech Corporation (Japan)

- JASCO (Japan)

- Newport Corporation (U.S.)

- Bruker (U.S.)

- Abbott (U.S.)

- Oxford Instruments (U.K.)

- Quest Medical Imaging B.V. (Netherlands)

- Sartorius AG (Germany)

- Teledyne Princeton Instruments (U.S.)

Latest Developments in Global Infrared Spectroscopy Market

- In April 2024, ABB launched the MB3600 Fourier Transform FT-NIR spectrometer, showcasing continuous innovation in FT-NIR technology for industrial and research applications. This highlights a focus on advanced analytical solutions for specialized industry needs

- In December 2023, Shimadzu Scientific Instruments launched the IRSpirit-X series Fourier Transform Infrared (FTIR) spectrophotometers. This series features a compact design, a navigation program for easy data acquisition, and a spectrum advisor function to improve measurement quality. This emphasizes the trend toward user-friendly and intelligent instrumentation

- In July 2023, Bruker launched the MOBILE-IR II FT-IR Spectrometer, a portable spectrometer designed for use in harsh environments (IP65 protection) without compromising analytical results, demonstrating a focus on rugged, high-performance portable solutions. This caters to the increasing demand for on-site and field-based analysis.

- In March 2023, Edinburgh Instruments launched the IR5, a modern, high-performance benchtop FTIR instrument, which can be configured with a second detector or with Fourier Transform Photoluminescence (FT-PL) capability, expanding its versatility for demanding research applications. This illustrates continued innovation in benchtop systems for advanced research.

- In March 2023, The Rapid Screening Research Center for Toxicology and Biomedicine (RSRCTB) at National Sun Yat-sen University (NSYSU) in Taiwan established its first Satellite Laboratory, utilizing various chemical analytical instruments from Shimadzu Corporation, including FTIR, to broaden the use of advanced spectroscopy in research. This highlights the growing integration of IR spectroscopy in research and academic settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.