Global Infectious Disease Drug Market

Market Size in USD Billion

CAGR :

%

USD

84.89 Billion

USD

129.79 Billion

2024

2032

USD

84.89 Billion

USD

129.79 Billion

2024

2032

| 2025 –2032 | |

| USD 84.89 Billion | |

| USD 129.79 Billion | |

|

|

|

|

Infectious Disease Drug Market Size

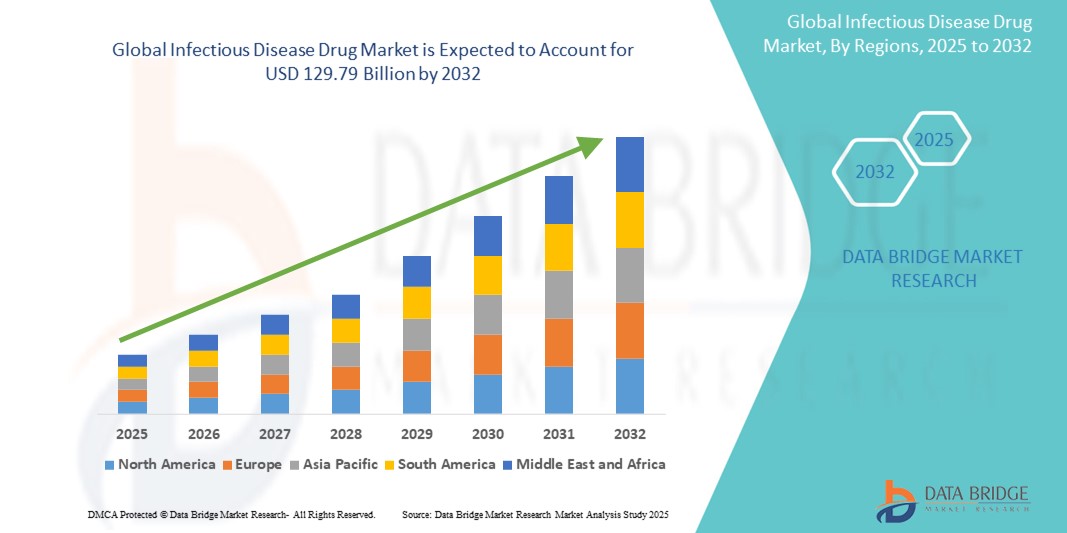

- The global infectious disease drug market size was valued at USD 84.89 billion in 2024 and is expected to reach USD 129.79 billion by 2032, at a CAGR of 5.45% during the forecast period

- The market growth is largely fueled by the increasing prevalence of infectious diseases globally, including re-emerging infections and drug-resistant strains, alongside rising awareness and government initiatives for prevention, diagnosis, and treatment

- Furthermore, continuous advancements in drug discovery, diagnostic technologies, and increased funding for research and development are driving the demand for novel and effective infectious disease therapeutics, positioning them as critical components in global healthcare. These converging factors are accelerating the uptake of infectious disease drug solutions, thereby significantly boosting the industry's growth

Infectious Disease Drug Market Analysis

- Infectious disease drugs are essential in global healthcare, targeting pathogens such as bacteria, viruses, fungi, and parasites to prevent, treat, and manage infections, significantly impacting public health outcomes

- The escalating demand for infectious disease drugs is primarily fueled by the rising global prevalence of infectious diseases, including re-emerging infections and drug-resistant strains, and continuous advancements in drug discovery and diagnostic technologies

- North America dominates the infectious disease drug market with the largest revenue share of 38.14% in 2024, characterized by a well-developed healthcare sector, high healthcare expenditure, favorable reimbursement policies, and the strong presence of major pharmaceutical companies investing heavily in R&D

- Asia-Pacific is expected to be the fastest growing region in the infectious disease drug market during the forecast period due to its large patient population, increasing prevalence of infectious diseases, improving healthcare infrastructure, and rising government initiatives for disease prevention and treatment

- Viral Diseases segment dominates the infectious disease drug market with a market share of 43.63% in 2024, driven by its increasing prevalence of viral infections such as HIV, hepatitis, and influenza, coupled with the continuous emergence of new viral threats and significant advancements in antiviral drug development

Report Scope and Infectious Disease Drug Market Segmentation

|

Attributes |

Infectious Disease Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Infectious Disease Drug Market Trends

“Advancements in Drug Discovery and Personalized Medicine””

- A significant and accelerating trend in the global infectious disease drug market is the continuous advancement in drug discovery methodologies, heavily influenced by technologies such as artificial intelligence (AI) and machine learning (ML), alongside a growing focus on personalized medicine approaches. These innovations are significantly enhancing the speed and precision of developing new treatments and improving patient outcomes

- For instance, AI and ML algorithms are increasingly being used to analyze vast datasets to identify potential drug candidates, predict molecular interactions, and optimize drug design, accelerating the discovery of new antimicrobial agents. Companies are leveraging these technologies to screen large chemical libraries, identify novel compounds, and even repurpose existing drugs for new infectious indications

- Personalized medicine in infectious diseases involves tailoring treatment based on an individual's genetic makeup, the specific characteristics of the pathogen causing the infection, and their immune response. This approach is gaining traction, particularly for complex and drug-resistant infections, leading to more targeted and effective therapies. For instance, genomic sequencing of pathogens helps in determining antibiotic susceptibility patterns and guiding treatment choices

- The seamless integration of advanced diagnostics, such as molecular diagnostics and genomic sequencing, with drug development facilitates the identification of specific infectious agents and their resistance profiles. This enables clinicians to prescribe the most appropriate and effective drug from the outset, reducing trial-and-error and improving patient care

- The demand for infectious disease drugs that incorporate these advanced discovery methods and personalized treatment strategies is growing rapidly, as healthcare providers and patients increasingly prioritize effective, targeted, and resistance-combating solutions

Infectious Disease Drug Market Dynamics

Driver

“Growing Need Due to Rising Disease Prevalence and Antimicrobial Resistance”

- The increasing prevalence of infectious diseases globally, including the re-emergence of existing pathogens and the escalating threat of antimicrobial resistance (AMR), is a significant driver for the heightened demand for infectious disease drugs

- For instance, the World Health Organization (WHO) has highlighted AMR as one of the top global public health threats, with drug-resistant infections causing millions of deaths annually. This pushes pharmaceutical companies to invest in R&D for novel antimicrobials

- As populations grow and global travel increases, the spread of infectious agents is accelerated, leading to a continuous need for effective treatments and preventive measures. Diseases such as influenza, HIV, hepatitis, and tuberculosis continue to pose significant health burdens, driving demand for innovative therapies

- Furthermore, the rising awareness of public health and increasing government and private funding for research and development initiatives, aimed at combating these diseases, further propel market growth

- The imperative to develop new drugs to overcome drug-resistant strains and to address emerging infectious threats, such as those seen with recent pandemics, are key factors propelling the adoption of advanced infectious disease drug solutions globally

Restraint/Challenge

“High Research & Development Costs and Antimicrobial Resistance Development”

- Concerns surrounding the high costs associated with the research and development (R&D) of new infectious disease drugs, coupled with the rapid development of antimicrobial resistance (AMR), pose significant challenges to the sustained growth of the market. Developing a new drug can take years and cost billions, with many potential candidates failing in clinical trials

- For instance, the high financial risk and low return on investment for novel antibiotics have led many large pharmaceutical companies to exit this R&D area, leaving a critical gap in the pipeline for new treatments against resistant pathogens. The emergence of new resistant strains also constantly renders existing drugs less effective, shortening their market lifespan and reducing profitability

- Addressing these challenges requires significant investment in basic research, innovative R&D models, and global collaborative efforts to incentivize drug development for high-need areas such as AMR. Furthermore, effective stewardship programs are essential to slow down resistance development

- While public-private partnerships and new funding mechanisms are emerging to de-risk investments in infectious disease R&D, the inherent scientific complexity and the economic disincentives remain substantial hurdles

- Overcoming these challenges through sustained funding, policy reforms that reward innovation, and robust public health strategies to combat resistance will be vital for ensuring a continuous supply of effective infectious disease drugs

Infectious Disease Drug Market Scope

The market is segmented on the basis of source type, disease type, treatment type, mode of action type, drug type, route of administration and end-users

- By Source Type

On the basis of source type, the infectious disease drug market is segmented into bacterial diseases, viral diseases, fungal disease, and parasitic disease. The viral diseases segment dominated the market with a market share of 43.63% in 2024, driven by the increasing prevalence of well-established viral infections such as HIV, various hepatitis types, and influenza, alongside the continuous emergence of new viral threats that necessitate rapid drug development.

The parasitic disease segment is anticipated to witness the fastest growth during the forecast period. This growth is fueled by the rising global burden of parasitic diseases in endemic regions, increasing challenges posed by drug resistance in existing treatments, and intensified global health initiatives aimed at disease eradication and control.

- By Disease Type

On the basis of disease type, the infectious disease drug market is segmented into jaundice, leprosy, listeria, lyme disease, malaria, measles, molluscum contagiosum, norovirus, pyelonephritis, rabies, severe acute respiratory syndrome, sepsis, tetanus, west nile, zika, ebola disease, and others. The Malaria segment held the largest market revenue share in 2024, primarily due to its high endemicity in various parts of the world, leading to a consistent demand for antimalarial drugs, often exacerbated by drug resistance and the need for new treatment regimens.

The Zika segment is anticipated to witness the fastest growth during the forecast period. This projected growth is driven by the potential for re-emergence of this diseases, the ongoing public health efforts to develop effective vaccines and therapeutics, and the rapid response required during outbreaks, necessitating swift drug development and deployment.

- By Treatment Type

On the basis of treatment type, the infectious disease drug market is segmented into medication, dietary supplements, and surgery. The medication segment held the largest market revenue share in 2024, as pharmaceutical drugs are the fundamental and most direct means for treating infectious diseases, specifically designed to target and eliminate pathogens, alleviate symptoms, and prevent severe complications, making them indispensable for disease management.

The dietary supplements segment is anticipated to witness the fastest growth during the forecast period, propelled by increasing consumer interest in preventive healthcare and immune support, particularly amplified by recent global health events, leading to a rise in demand for products perceived to boost overall health and resilience against infections

- By Mode Of Action Type

On the basis of mode of action type, the infectious disease drug market is segmented into antibacterial drugs, antiviral drugs, antifungal drugs, and antiparasitic drugs. The antibacterial drugs segment held the largest market revenue share in 2024, driven by the ubiquitous nature of bacterial infections and the widespread, often first-line, prescription of antibiotics across all healthcare settings.

The antiviral drugs segment is expected to witness the fastest growth from 2025 to 2032, propelled by the increasing prevalence of viral infections worldwide, the frequent emergence of new viral pathogens and pandemic threats, and rapid advancements in antiviral drug discovery and development leading to more targeted and effective treatments

- By Drug Type

On the basis of drug type, the infectious disease drug market is segmented into tafenoquine, omadacycline, tecovirimat, eravacycline, delafloxacin, plazomicin, benznidazole, secnidazole, daclatasvir, dalbavancin, and others. Delafloxacin held the largest market revenue share in 2024, driven by its broad-spectrum activity and effectiveness against challenging pathogens, including MRSA.

Tecovirimat segment is expected to witness the fastest CAGR from 2025 to 2032, primarily due to its specific efficacy against orthopoxviruses, including monkeypox and smallpox, positioning it as a crucial therapeutic in outbreak preparedness and response, leading to increased government stockpiling and demand.

- By Route Of Administration

On the basis of route of administration, the infectious disease drug market is segmented into oral, topical, and intravenous. The oral segment held the largest market revenue share in 2024, primarily due to the unparalleled convenience and ease of administration it offers to patients, facilitating outpatient treatment and significantly improving medication adherence.

The intravenous segment is anticipated to witness rapid growth from 2025 to 2032, particularly for severe and critical infectious diseases, as it allows for swift and potent systemic drug delivery, which is vital in hospital settings for managing life-threatening conditions and for patients unable to take oral medications.

- By End Users

On the basis of end-users, the infectious disease drug market is segmented into hospitals, homecare, specialty clinics, and others. The hospitals segment dominates the market, driven by the high volume of patients admitted for diagnosis, treatment, and management of acute, severe, and complicated infectious diseases, often requiring intensive care, specialized medical equipment, and monitoring.

The homecare segment is expected to witness the fastest growth from 2025 to 2032, largely propelled by the increasing trend towards outpatient care, the development of easier-to-administer home-based therapies, and the growing preference for receiving care in a familiar environment, especially for chronic infectious diseases or post-hospitalization recovery.

Infectious Disease Drug Market Regional Analysis

- North America dominates the infectious disease drug market with the largest revenue share of 38.14% in 2024, driven by a high prevalence of infectious diseases, advanced healthcare infrastructure, and significant pharmaceutical R&D investments.

- Consumers in the region benefit from timely access to innovative treatments, government-supported vaccination programs, and strong hospital and retail distribution networks.

- This market leadership is further supported by rising public health awareness, favorable reimbursement policies, and strategic initiatives by key pharmaceutical companies, reinforcing North America's central role in combating infectious diseases globally

U.S. Infectious Disease Drug Market Insight

The U.S. infectious disease drug market captured largest revenue share in 2024 within North America, propelled by a high prevalence of various infectious diseases and substantial healthcare expenditure. Consumers in the U.S. benefit from advanced diagnostic tools and a robust pharmaceutical research and development landscape, driving the demand for innovative treatments and novel drug formulations. Furthermore, a strong regulatory framework and a focus on combating antimicrobial resistance through new drug incentives contribute to the market's continued expansion and adoption of advanced infectious disease therapeutics.

Europe Infectious Disease Drug Market Insight

The Europe infectious disease drug market is projected to expand at a considerable CAGR throughout the forecast period, primarily driven by the ongoing burden of infectious diseases, stringent regulatory frameworks aimed at public health protection, and well-developed healthcare infrastructure across the continent. European nations are witnessing increasing investment in advanced diagnostic tools and targeted therapies, especially for emerging and drug-resistant infections. The region's emphasis on comprehensive infection control programs and a collective approach to health security further fosters the adoption of new infectious disease drugs in both hospital and community settings

U.K. Infectious Disease Drug Market Insight

The U.K. infectious disease drug market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating burden of communicable diseases such as TB, hepatitis, and influenza, coupled with a strong emphasis on public health initiatives. Concerns regarding antimicrobial resistance and the need for new treatment modalities are encouraging significant investment in drug development and research. The U.K.'s embrace of advancements in immunotherapy and vaccine development, alongside its robust National Health Service (NHS) infrastructure, is expected to continue to stimulate market growth for infectious disease therapeutics

Germany Infectious Disease Drug Market Insight

The Germany infectious disease drug market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of infectious disease threats, a strong focus on advanced healthcare infrastructure, and high healthcare expenditure. Germany's emphasis on innovation, particularly in areas such as mRNA-based treatments and novel antibiotics, promotes the adoption of cutting-edge infectious disease drugs in both residential and commercial buildings. The country's rigorous regulatory standards, while strict, ensure high-quality and effective treatments, aligning with local patient and physician expectations for secure and efficacious solutions

Asia-Pacific Infectious Disease Drug Market Insight

The Asia-Pacific infectious disease drug market is poised to grow at the fastest CAGR of 9.27% during the forecast period driven by increasing population density, rising incidence of infectious diseases and improving healthcare infrastructure in countries such as China, Japan, and India. The region's growing disposable incomes and government initiatives promoting digitalization and healthcare access are driving the adoption of modern infectious disease drugs. Furthermore, as APAC emerges as a manufacturing hub for pharmaceutical ingredients and finished products, the affordability and accessibility of infectious disease drugs are expanding to a wider consumer base

Japan Infectious Disease Drug Market Insight

The Japan infectious disease drug market is gaining momentum due to the country's high-tech culture, rising incidence of infectious diseases (such as influenza, Hepatitis B and C), and demand for advanced medical solutions. The Japanese market places a significant emphasis on public health and proactive government healthcare initiatives, driving the adoption of innovative infectious disease drugs. The integration of advanced diagnostic technologies with therapeutic approaches, coupled with Japan's aging population, which is more susceptible to infections, is likely to spur demand for effective and convenient treatment solutions in both inpatient and outpatient sectors.

India Infectious Disease Drug Market Insight

The India infectious disease drug market accounted for a large market revenue share in Asia Pacific in 2024, attributed to the country's vast population, high burden of infectious diseases (such as tuberculosis, malaria, and dengue fever), and rapid improvements in healthcare access. India stands as a major manufacturer of vaccines and anti-infective medications, and infectious disease drugs are becoming increasingly essential across residential, commercial, and public health programs. The government's push towards improving public health, alongside the availability of affordable drug options and strong domestic pharmaceutical manufacturing capabilities, are key factors propelling the market in India.

Infectious Disease Drug Market Share

The infectious disease drug industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- GSK plc. (U.K.)

- AstraZeneca (U. K.)

- Johnson & Johnson Services, Inc. (U.S.)

- AbbVie Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Novartis AG (Switzerland)

- Gilead Sciences, Inc. (U.S.)

- Sanofi (France)

- Lilly (U.S.)

- Bayer AG (Germany)

- Boehringer Ingelheim International GmbH (Germany)

- Takeda Pharmaceutical Company Limited (Japan)

- Moderna, Inc. (U.S.)

- BioNTech SE (Germany)

- Valneva SE (France)

- DAIICHI SANKYO COMPANY, LIMITED (Japan)

- Astellas Pharma Inc. (Japan)

- Xellia Pharmaceuticals (Denmark)

Latest Developments in Global Infectious Disease Drug Market

- In March 2025, AstraZeneca is showcasing innovation in infectious disease protection, presenting preclinical data on investigational monoclonal antibodies (mAbs) targeting high-priority pathogens such as Staphylococcus aureus, Pseudomonas aeruginosa, and Klebsiella pneumoniae. These targeted therapies aim to combat serious bacterial infections and address antimicrobial resistance

- In February 2025, New phase 3 randomized controlled trials (EAGLE-2 and EAGLE-3) published in February 2024 tested gepotidacin, an oral, first-in-class triazaacenaphthylene antibiotic, for uncomplicated urinary tract infections. Gepotidacin was noninferior to nitrofurantoin in EAGLE-2 and superior in EAGLE-3.

- In January 2025, A major breakthrough in HIV prevention was highlighted, with a twice-yearly injectable lenacapavir showing high efficacy. FDA approval for this game-changing intervention is anticipated

- In January 2025, Research on ridinilazole, a novel bis-benzimidazole antibiotic, for Clostridioides difficile infections (CDI) in Phase 3 trials showed it selectively kills C. difficile while preserving gut microbiota. While not superior to vancomycin in sustained clinical response, it had a significantly lower recurrence rate

- In May 2023, The FDA approved sulbactam-durlobactam (Xacduro) to treat hospital-acquired bacterial pneumonia and ventilator-associated bacterial pneumonia caused by susceptible Acinetobacter baumannii-calcoaceticus complex. This addresses a critical need for new drugs against resistant Gram-negative bacteria

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.