Global Infection Control Market

Market Size in USD Million

CAGR :

%

USD

51.45 Million

USD

74.87 Million

2024

2032

USD

51.45 Million

USD

74.87 Million

2024

2032

| 2025 –2032 | |

| USD 51.45 Million | |

| USD 74.87 Million | |

|

|

|

|

Infection Control Market Size

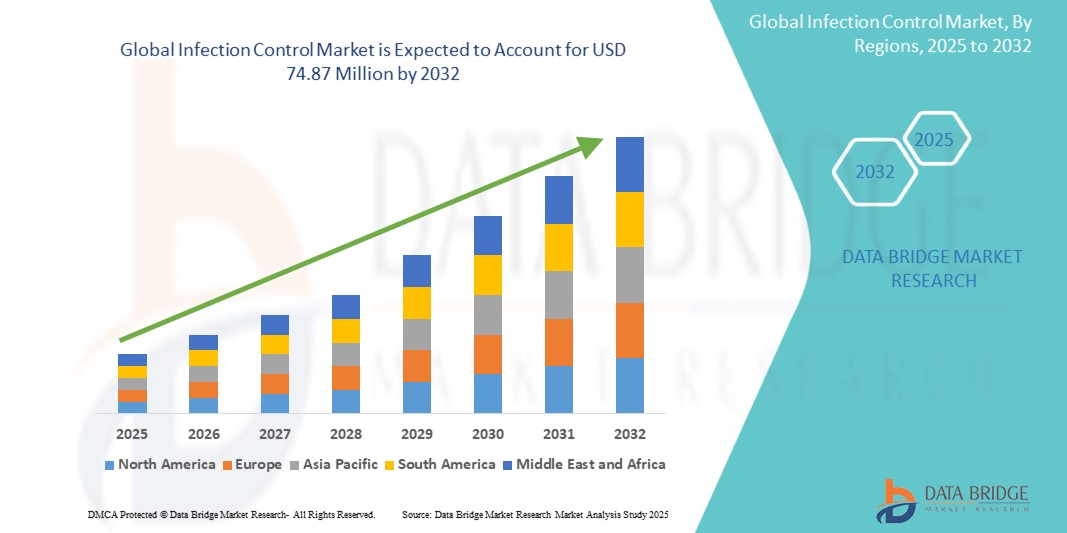

- The global infection control market size was valued at USD 51.45 million in 2024 and is expected to reach USD 74.87 million by 2032, at a CAGR of 4.80% during the forecast period

- This growth is driven by rise in the cases of Hospital-Acquired Infections (HAIS)

Infection Control Market Analysis

- Infection Control solutions are essential across healthcare settings to prevent and reduce healthcare-associated infections (HAIs) through sterilization, disinfection, and containment measures

- The growing demand for infection control is fueled by the increasing prevalence of HAIs, the rising number of surgical and hospital admissions, and stringent regulatory mandates on hygiene and disinfection protocols.

- North America is expected to dominate the infection control market with the largest market share of 33.85%, driven by the strong presence of leading infection control companies, high awareness regarding healthcare-associated infections (HAIs), and strict regulatory standards around sterilization and disinfection practices

- Asia-Pacific is projected to register the highest growth rate in the infection control market during the forecast period, due to rapid urbanization, increased healthcare expenditures, and rising incidences of HAIs in densely populated countries

- The sterilization products segment is expected to dominate the infection control market with the largest market share of 47.22%, due to growing need to reduce surgical site infections, strict sterilization rules, and the extensive use of sterilizers in various applications

Report Scope and Infection Control Market Segmentation

|

Attributes |

Infection Control Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Infection Control Market Trends

“Rising Adoption of UV-C Disinfection and No-Touch Technologies”

- A notable trend in the infection control market is the rapid adoption of UV-C disinfection systems and no-touch technologies, which provide fast, efficient, and chemical-free sterilization of healthcare environments

- These systems are increasingly used in operating rooms, ICUs, and diagnostic labs to reduce human contact and enhance sterilization consistency across high-touch surfaces

- The use of automated disinfection robots and fixed UV installations is growing due to their ability to eliminate pathogens, including drug-resistant strains, within minutes

- For instance, in 2023, Xenex Disinfection Services expanded its U.S. hospital client base with its LightStrike UV robot, which demonstrated a significant reduction in HAI incidence in clinical trials

- This trend is reshaping infection prevention strategies, enabling healthcare facilities to improve safety while minimizing manual disinfection errors

Infection Control Market Dynamics

Driver

“Increasing Surgical Volumes and Hospital-Acquired Infection (HAI) Awareness”

- One of the significant drivers for the infection control market is the rising number of surgical procedures worldwide, accompanied by growing awareness of hospital-acquired infections (HAIs)

- Governments and healthcare agencies are actively promoting infection control policies to curb HAI rates, which account for substantial patient morbidity and increased healthcare costs

- High-volume surgical environments such as trauma centers and transplant units now mandate comprehensive infection control systems to ensure patient safety

- For instance, in 2023, the World Health Organization (WHO) launched a new global initiative encouraging hospitals to report and track HAI incidence, accelerating demand for sterilization and disinfection tools

- This emphasis on procedural hygiene and public reporting is pushing healthcare providers to invest heavily in infection prevention systems

Opportunity

“Expansion of Infection Control in Non-Hospital Settings”

- A growing opportunity lies in the expansion of infection control technologies beyond hospitals—into ambulatory surgical centers, long-term care facilities, dental clinics, and home healthcare

- As outpatient procedures and home care services increase, the need for compact, easy-to-use sterilization and disinfection equipment is rising significantly

- Infection control product manufacturers are developing portable sterilizers, disinfectant wipes, and surface cleaners to meet the demand of decentralized healthcare

- For instance, in 2023, Metrex Research introduced a new line of compact disinfection wipes designed specifically for use in dental and outpatient clinics, targeting small practices with limited sterilization infrastructure

- This trend offers untapped market potential, especially in developing regions where healthcare access is expanding rapidly

Restraint/Challenge

“High Cost of Advanced Infection Control Systems”

- A major restraint for market growth is the high upfront and maintenance cost of advanced infection control systems such as automated sterilizers, endoscope reprocessors, and UV-C robots

- Smaller hospitals and clinics, particularly in low- and middle-income countries, often lack the capital to invest in high-end systems, limiting market penetration

- Moreover, training requirements and infrastructure modifications increase the total cost of ownership, further hampering adoption in budget-constrained settings

- For instance, in 2023, several rural hospitals in Latin America reported postponing the purchase of high-end disinfection systems due to budget reallocations during economic recovery post-COVID

- The financial barrier to adoption remains a significant challenge for achieving universal infection control standards globally

Infection Control Market Scope

The market is segmented on the basis of product, application, distribution channel and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

|

By Distribution Channel |

|

|

By End User |

|

In 2025, the sterilization products is projected to dominate the market with a largest share in product segment

The sterilization products segment is expected to dominate the infection control market with the largest market share of 47.22% in 2025 due to growing need to reduce surgical site infections, strict sterilization rules, and the extensive use of sterilizers in various applications such as medical device sterilization, food and beverage sterilization, pharmaceutical sterilization, and sterilization in the life sciences industry.

The surgical instruments is expected to account for the largest share during the forecast period in application segment

In 2025, the surgical instruments segment is expected to dominate the market with the largest market share of 56.14% due to the increasing number of surgical interventions globally necessitates stringent infection control measures for surgical instruments.

Infection Control Market Regional Analysis

“North America Holds the Largest Share in the Infection Control Market”

- North America is expected to dominate the global infection control market with the largest market share of 33.85%, driven by the strong presence of leading infection control companies, high awareness regarding healthcare-associated infections (HAIs), and strict regulatory standards around sterilization and disinfection practices

- The U.S. holds the largest share within the region due to extensive hospital networks, widespread adoption of advanced sterilization technologies, and significant healthcare spending focused on patient safety and infection prevention

- Continued investments in hospital infrastructure, expansion of outpatient surgical centers, and favorable government policies promoting infection prevention are expected to solidify North America's dominance in the coming years

“Asia-Pacific is Projected to Register the Highest CAGR in the Infection Control Market”

- Asia-Pacific is expected to witness the highest compound annual growth rate (CAGR) in the infection control market due to rapid urbanization, increased healthcare expenditures, and rising incidences of HAIs in densely populated countries

- Key markets such as China, India, and Japan are accelerating growth through government-backed healthcare reforms, expanded hospital construction, and adoption of modern sterilization and disinfection solutions

- Japan, with its strong emphasis on hygiene and advanced medical technology, is actively deploying cutting-edge infection control protocols, while China and India are experiencing growth through enhanced public health initiatives, local production of sterilization equipment, and greater focus on infection prevention training in medical institutions

Infection Control Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- 3M (U.S.)

- STERIS (U.S.)

- Getinge (Sweden)

- MATACHANA GROUP (Spain)

- Ecolab (U.S.)

- BELIMED, INC. (Switzerland)

- Cardinal Health (U.S.)

- Steelco S.p.A. (Italy)

- Reckitt Benckiser Group plc (U.K.)

- Stryker (U.S.)

- B. Braun SE (Germany)

- Covalon Technologies Ltd. (Canada)

- SKYTRON, LLC (U.S.)

- Olympus Corporation (Japan)

- COLTENE Group (Switzerland)

- Pal International (U.K.)

- MELAG Medizintechnik GmbH & Co. KG (Germany)

- Terragene (U.K.)

- The Clorox Company (U.S.)

Latest Developments in Global Infection Control Market

- In October 2023, Getinge AB (Sweden) acquired Healthmark Industries Co. Inc., a U.S.-based leader in instrument care and infection control consumables, to strengthen its presence in sterile reprocessing within the U.S. market. This acquisition reinforces Getinge’s strategic commitment to expanding its infection control portfolio in North America

- In February 2023, Ecolab Inc. (U.S.) launched the Ecolab Scientific Clean, a new retail product line delivering cleaning solutions tailored for commercial, industrial, and residential use. This launch marks Ecolab’s expansion into the consumer-facing hygiene solutions market

- In October 2021, 3M (U.S.) partnered with Thermo Fisher Scientific to simplify the adoption of 3M Harvest RC Chromatographic Clarifier for biopharmaceutical customers.This collaboration aims to enhance operational efficiency in biopharmaceutical filtration processes

- In February 2022, Lumalier introduced EDU-C, a portable emergency disinfection unit designed for universal use across facilities and institutions. This debut expands Lumalier’s role in providing flexible infection prevention solutions

- In January 2021, Steris plc announced the acquisition of Cantel Medical, with the strategic intent to broaden its infection control product offerings. This acquisition positions Steris to deliver more comprehensive infection prevention solutions globally

- In November 2020, Applicon Biotechnology, a Getinge subsidiary, launched AppliFlex ST, a customizable single-use bioreactor that streamlines lab processes and reduces manual workload. This innovation highlights Getinge’s commitment to automation and efficiency in bioprocessing

- In September 2020, Midmark Corp., a key provider of dental solutions, launched the Sterilizer Data Logger and M3 Steam Sterilizer, aiming to enhance instrument processing with improved speed, compliance, and ease. This launch demonstrates Midmark’s dedication to advancing sterilization technology in dental practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.