Global Industrial Wastewater Treatment Market

Market Size in USD Billion

CAGR :

%

USD

299.83 Billion

USD

497.50 Billion

2022

2030

USD

299.83 Billion

USD

497.50 Billion

2022

2030

| 2023 –2030 | |

| USD 299.83 Billion | |

| USD 497.50 Billion | |

|

|

|

|

Industrial Wastewater Treatment Market Analysis and Size

Wastewater treatment is the industrial procedure of converting wastewater into soft water to make it usable for industrial processing. Wastewater treatment equipment is required to remove microbial contaminants such as viruses, unwanted bacteria, protozoa, and other suspended solid particles from the water. The utilization of poor water quality in the industry is hazardous for processing. Wastewater treatment equipment is selected based on the properties of water and its constituents such as quantity, boiling point density, melting point, and velocity.

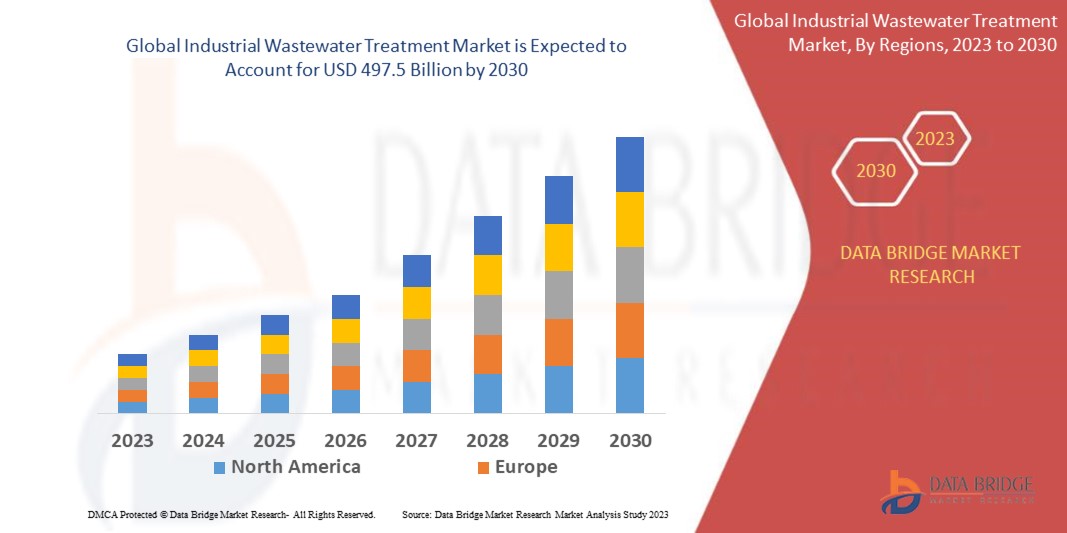

Data Bridge Market Research analyses that the global industrial wastewater treatment market which was USD 299.83 billion in 2022, would rocket up to USD 497.5 billion by 2030, and is expected to undergo a CAGR of 6.53% during the forecast period of 2023 to 2030.

“Coagulants” dominates the type segment of the global industrial wastewater treatment market as they help destabilize suspended particles by neutralizing their charges, while flocculants aid in forming larger, settle able flocs from these destabilized particles. This process is crucial for effectively removing solids and impurities from wastewater. They find extensive application across various industries, including municipal wastewater treatment, industrial wastewater treatment, and even in some specialized processes like mining and pulp and paper production. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Industrial Wastewater Treatment Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Tons, Pricing in USD |

|

Segments Covered |

Type (Coagulants, Flocculants, Corrosion Inhibitors, Scale Inhibitors, Biocides and Disinfectants, Anti-foaming Agents, pH Adjusters and Stabilizers, Chelating Agents, and Others), End-Use Industry (Power Generation, Oil and Gas, Chemical, Food and Beverage, Mining, and Others) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, and the rest of Middle East and Africa |

|

Market Players Covered |

Ecolab (U.S.), SUEZ (France), Kemira (Finland), SNF (U.S.), Evoqua Water Technologies LLC (U.S.), Veolia (France), Solenis (U.S.), Feralco AB (U.S.), IXOM (Australia), Hydrite Chemical (U.S.), Kurita Water Industries Ltd. (Brazil), Dow (U.S.), BWA WATER ADDITIVES UK LIMITED (Europe), Cortec Corporation (U.S.), Grupo BAUMINAS (Brazil), Buckman (U.S.), Akzo Nobel N.V. (Europe), Solvay (Europe), The Water Treatment Products Ltd (Europe), Geo Specialty Chemicals, Inc. (U.S.), Thermax Limited (India), Lenntech B.V. (Europe), HOLLAND COMPANY (U.S.), and Aries Chemical, Inc (U.S.) |

|

Market Opportunities |

|

Market Definition

Industrial wastewater is water discarded, which is dissolved and suspended in water, usually during the industrial manufacturing process. To protect the wastage of water, there is the development of industrial wastewater treatment, which involves the methods and processes used to treat waters contaminated by industrial or commercial activities prior to its release into the environment or reuse.

Global Industrial Wastewater Treatment Market Dynamics

Drivers

- Growing Demand for Energy-Efficient and Advanced Water Treatment Technologies

The increasing demand for energy-efficient and advanced water treatment technologies is a significant driver shaping the landscape of the global industrial wastewater treatment market. This trend is propelled by a confluence of factors that underscore the industry's commitment to sustainability, operational efficiency, and responsible resource management. Energy efficiency has become a paramount consideration for businesses aiming to reduce operational costs and meet sustainability goals.

- Stringent Environmental Regulations

Governments worldwide are imposing increasingly stringent environmental regulations to curb pollution and protect ecosystems. These regulations set limits on pollutant discharge, wastewater quality, and treatment standards, compelling industries to invest in advanced wastewater treatment technologies to ensure compliance.

- Growing Awareness of Corporate Social Responsibility (CSR)

Companies are recognizing the significance of CSR and sustainable practices. Investing in industrial wastewater treatment aligns with their CSR goals by reducing their environmental footprint, enhancing their reputation, and attracting environmentally conscious consumers and investors.

Opportunities

- Technological innovation and Research & Development

Ongoing advancements in wastewater treatment technologies, including membrane filtration, electrochemical processes, and artificial intelligence applications, open up opportunities for more efficient and cost-effective solutions. These innovations can drive market growth by improving treatment effectiveness and reducing operational costs.

- Decentralized Wastewater Treatment Systems

The adoption of decentralized treatment systems is gaining momentum. These systems can provide efficient and cost-effective solutions, particularly in remote areas or industries where centralized infrastructure is not feasible. This creates opportunities for technology providers to cater to diverse market segments.

Restraints/Challenges

- High Operational and Maintenance Costs

Beyond the initial capital outlay, the ongoing operational and maintenance costs of wastewater treatment facilities can be significant. Industries must budget for expenses related to energy consumption, chemical treatment, equipment maintenance, and skilled labour. These costs can act as a barrier, particularly for cash-strapped businesses.

- Lack of Awareness and Education

Some industries and regions may lack awareness about the environmental and economic benefits of wastewater treatment. Inadequate education and information dissemination can lead to underinvestment and slow adoption of treatment solutions. The installation of industrial wastewater treatment systems often requires a substantial upfront capital investment. Many industries, especially small and medium-sized enterprises (SMEs), may find it challenging to allocate these resources, which can hinder adoption and market growth.

- Limited Space and Infrastructure Constraints

Some industries, especially in densely populated urban areas, may face space constraints that limit the construction of treatment facilities. Additionally, inadequate infrastructure for transporting and treating wastewater can hinder market growth. Advanced wastewater treatment technologies can be complex to implement and operate. The lack of in-house expertise and the need for skilled personnel can act as barriers, especially for smaller companies, making technology adoption challenging.

- Resistance to Change

Resistance to change within organizations can hinder the adoption of new wastewater treatment technologies and practices. Established processes and attitudes may need to be overcome to implement effective treatment solutions. Industries often prioritize short-term returns on investment (ROI) over long-term sustainability. The longer payback periods associated with wastewater treatment projects can deter companies seeking quick financial gains.

This global industrial wastewater treatment market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global industrial wastewater treatment market contact Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- In October 2022, Xylem Water Solutions Singapore and Gross-Wen Technologies have forged a strategic partnership. Announced on October 5, 2022, this collaboration is aimed at advancing algae-based wastewater treatment solutions in Singapore. The primary objective is to enhance Gross-Wen Technologies' revolving algal biofilm (RAB®) technology, renowned for its eco-friendly wastewater treatment capabilities, including nutrient recovery and reduced carbon footprints. This initiative, part of PUB's Carbon Zero Grand Challenge, entails implementing a small-scale RAB® system at Xylem's Singapore facility, with potential for wider adoption in Singapore's National Water Agency, PUB, demonstrating the industry's commitment to sustainable wastewater management and emission reduction

- In July 2022, Pentair plc has successfully concluded its acquisition of Manitowoc Ice from Welbilt, Inc. for $1.6 billion, subject to customary adjustments. Manitowoc Ice is a renowned provider of commercial ice makers. This strategic move enhances Pentair's Commercial Water Solutions business, enabling them to offer comprehensive water management solutions to foodservice and hospitality clients worldwide. With Manitowoc Ice's extensive global presence, including over 1 million commercial ice machines installed globally, Pentair strengthens its position in the market, reaffirming its commitment to providing sustainable water solutions to a broader network of customers

Global Industrial Wastewater Treatment Market Scope

The global industrial wastewater treatment market is segmented on the basis of type, and end-use industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Coagulants

- Flocculants

- Corrosion Inhibitors

- Scale Inhibitors

- Biocides and Disinfectants

- Anti-foaming Agents

- pH Adjusters and Stabilizers

- Chelating Agents

- Others

End-Use Industry

- Power Generation

- Oil and Gas

- Chemical

- Food and Beverage

- Mining

- Others

Global Industrial Wastewater Treatment Market Regional Analysis/Insights

The global industrial wastewater treatment market is analysed and market size insights and trends are provided by type and end-use industry and are referenced above.

The countries covered in the global industrial wastewater treatment market report are U.S., Canada, and Mexico in North America, Brazil, Argentina, and the rest of South America in South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, and the rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, and the rest of Asia-Pacific in Asia-Pacific, and U.A.E., Saudi Arabia, Egypt, South Africa, Israel, and the rest of the Middle East and Africa in Middle East and Africa

Asia-Pacific dominates the global industrial wastewater treatment market and is expected to be the fastest growing market during the forecast period of 2023 to 2030 owing to the large-scale production activities and the rise in demand from power generation, mining, food and beverage, chemical, pulp and paper, and textile industries within the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Industrial Wastewater Treatment Market Share Analysis

The global industrial wastewater treatment market competitive landscape provides details by competitors. details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the global industrial wastewater treatment MARKET.

Some of the major players operating in the global industrial wastewater treatment market are:

- Ecolab (U.S.)

- SUEZ (France)

- Kemira (Finland)

- SNF (U.S.)

- Evoqua Water Technologies LLC (U.S.)

- Veolia (France)

- Solenis (U.S.)

- Feralco AB (U.S.)

- IXOM (Australia)

- Hydrite Chemical (U.S.)

- Kurita Water Industries Ltd. (Brazil)

- Dow (U.S.)

- BWA WATER ADDITIVES UK LIMITED (Europe)

- Cortec Corporation (U.S.)

- Grupo BAUMINAS (Brazil)

- Buckman (U.S.)

- Akzo Nobel N.V. (Europe)

- Solvay (Europe)

- The Water Treatment Products Ltd (Europe)

- Geo Specialty Chemicals, Inc. (U.S.)

- Thermax Limited (India)

- Lenntech B.V. (Europe)

- HOLLAND COMPANY (U.S.)

- Aries Chemical, Inc (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Wastewater Treatment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Wastewater Treatment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Wastewater Treatment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.