Global Industrial Sugar Market, By Type (White Sugar, Liquid Sugar, Brown Sugar, and Icing Sugar), By Source (Cane and Beet), Form (Granulated, Syrup, and Powdered), Packaging Type (Sacks, Bag, Box, Tote Bags, and Others), Application (Food & Beverages, Pharmaceutical, Dietary Supplements, and Others), Distribution Channel (Direct and Indirect) - Industry Trends and Forecast to 2030.

Industrial Sugar Market Analysis and Size

The global industrial sugar market is being driven by the increasing use of industrial sugar in drinks around the globe, along with the expansion of the food processing industry. In addition, rapid growth in the confectionary sector is likely to fuel the market's growth. Additionally, the increasing adoption use of bio-fuel for the production of sugar will open up more business potential for the industrial sugar market in the forecast period 2023-2030.

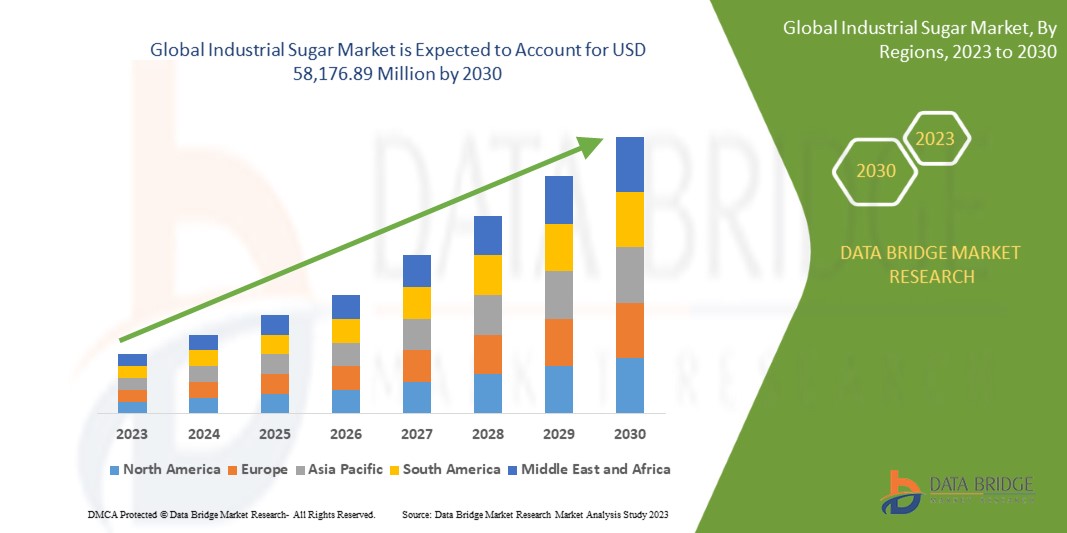

Data Bridge Market Research analyses that the global industrial sugar market is expected to reach the value of USD 58,176.89 million by 2030, at a CAGR of 3.4% during the forecast period.

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Year

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Million and Volumes in Kilo Tons

|

|

Segments Covered

|

Type (White Sugar, Liquid Sugar, Brown Sugar, and Icing Sugar), By Source (Cane and Beet), Form (Granulated, Syrup, and Powdered), Packaging Type (Sacks, Bag, Box, Tote Bags, and Others), Application (Food & Beverages, Pharmaceutical, Dietary Supplements, and Others), Distribution Channel (Direct and Indirect)

|

|

Countries Covered

|

U.S., Canada, Mexico in North America, Russia, Germany, Italy, Turkey, France, U.K., Spain, Netherlands, Belgium, Switzerland, Luxemburg, and the rest of Europe, India, China, Thailand, Australia and New Zealand, Indonesia, Vietnam, Philippines, Malaysia, Japan, South Korea, Singapore, Taiwan, and rest of Asia-Pacific, Brazil, Argentina, Rest of South America, Egypt, South Africa, Saudi Arabia, UAE, Israel, and rest of Middle East and Africa.

|

|

Market Players Covered

|

Südzucker AG(Germany), Associated British Foods.(U.K.), Michigan Sugar Company(U.S.), Amalgamated Sugar.(U.S.), RANA GROUP(India), Rajshree Sugars & Chemicals Limited (RSCL)(India), Shree Renuka Sugars Ltd(India), Upper Ganges Sugar & Industries Limited(India), Bajaj Hindusthan Sugar Ltd.(India), Mitr Phol Sugar.(Thailand), Ragus Sugars Manufacturing Ltd.(U.K.), Lantic Inc.(Canada), Nile Sugar(Egypt), AMERICAN CRYSTAL SUGAR(U.S.), and Balrampur Chini Mills Limited(India) among others

|

Market Definition

Industrial sugar, additionally referred to as bulk sugar or commercial sugar, is used in a variety of sectors and holds a significant market share. This highly refined sugar is mainly utilized for industrial purposes rather than direct consumption. Its versatile properties and wide range of applications make it an essential ingredient in a variety of industries, fueling a thriving industrial sugar market.

The food and beverage industry is a key application for industrial sugar. It is an essential ingredient in the manufacture of processed foods, confectioneries, beverages, and bakery goods. Industrial sugar's sweetness, texture, and preservative properties improve the taste and overall quality of these products, making them indispensable to manufacturers. Its ability to function as a bulking agent, stabilizer, and flavor enhancer also contributes to its widespread use in the food industry.

Global Industrial Sugar Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

DRIVER:

- Increasing Food and Beverages Consumption

Sugary drink consumption has risen as a result of rapid urbanization, which has increased the global consumption of food and beverages. Although refined sugar can be accepted as part of a healthy diet, sweetened drinks are widely advertised, inexpensive, and widely available. They include soft drinks, cordinal, energy drinks, sports drinks, and flavored mineral water. Furthermore, the standard serving size has changed from 375 ml to 600 ml bottles, which has increased the amount of industrial sugar as drink consumption has increased over the forecast period.

Sugar is a common ingredient in processed foods because it makes many foods more palatable by improving flavor and mouthfeel. It also makes foods last longer, adds viscosity, and is used as a binding agent in food and beverages. As a result, refined sugar has been added to packaged foods and drinks such as ice cream, pastries, and sodas, all of which have been heavily processed in the industries. Furthermore, refined sugar can be used to keep moisture in baked goods and prevent staleness, and improve the flavor and texture of canned fruits and vegetables. It is also used to improve the sweetness and taste of carbonated beverages and alcohol as a preservative and sweetener. Thus, the properties offered by industrial sugar in food and beverage products increased consumption due to the rising population and adoption of packaged food around the globe.

Furthermore, the global industrial sugar market has grown significantly in recent years, owing primarily to the increased use of industrial sugar in the beverage industry. Industrial sugar, derived from sugar cane or sugar beet, is used to sweeten a variety of beverages, including carbonated soft drinks, energy drinks, fruit juices, and ready-to-drink beverages. However, emerging economies, such as China, India, and Brazil, have witnessed a surge in beverage consumption due to factors such as rising disposable incomes and urbanization. As these markets expand, there is a corresponding increase in the use of industrial sugar in drinks to cater to the growing consumer demand. Thus, the increasing food and beverage consumption is expected to drive market growth.

RESTRAINT/CHALLENGE

- Availability of Substitutes and Alternatives

The global industrial sugar market is increasingly adopting substitutes and alternatives. This shift is being driven by a variety of factors, including shifting consumer preferences, health concerns, sustainability concerns, and regulatory changes. Sugar cane and sugar beet have traditionally been the primary sugar sources in the industrial sugar market. However, changing market dynamics and consumer demands have prompted the exploration and use of substitutes and alternatives to traditional industrial sugar.

Replicating the flavor and texture of traditional sugar is one of the key considerations in the adoption of substitutes and alternatives for industrial sugar. It is challenging to provide substitutes with the same level of satisfaction as consumers have developed a strong preference for the sensory qualities offered by sugar. In many cases, substitutes have a different flavor profile and might not have the desired sweetness or mouthfeel. There may be obstacles to the widespread adoption of substitutes due to consumer preferences and expectations for taste, quality, and familiarity. When new sweeteners are perceived as artificial or unnatural, some consumers may be reluctant to try them. The market share of traditional industrial sugar is in jeopardy as substitutes and alternatives gain popularity. Customers may choose products that use alternative sweeteners or cut the amount of sugar because they are looking for healthier and lower-calorie options. The demand for conventional industrial sugar may decline as a result of this change in consumer preference. The market for industrial sugar may be affected economically by the adoption of alternatives and substitutes. The profitability of sugar producers may be impacted by a decline in prices as a result of decreased demand for conventional sugar. To account for alternatives and substitutes, manufacturers may also incur additional costs for rebranding, R&D, and product reformulation.

Natural sweeteners such as stevia, monk fruit extract, and agave syrup have gained popularity as sugar substitutes. These sweeteners are perceived as healthier and more natural alternatives, appealing to consumers looking for products with clean labels. Manufacturers are incorporating these natural sweeteners into their formulations to meet consumer demand. Sucralose, aspartame, and saccharin have long been used as sugar substitutes. However, consumer concerns about potential health risks associated with these sweeteners have led to increased scrutiny and caution. Manufacturers must address these concerns and ensure the safety and efficacy of artificial sweeteners to maintain consumer trust.

OPPORTUNITY

- Increasing Demand for Natural and Organic Sweeteners

The worldwide industrial sugar industry is experiencing tremendous growth as a result of technological developments in sugar processing. As the demand for sugar continues to climb, manufacturers are looking into new technologies and methods to increase efficiency, improve quality, and meet consumers' changing expectations. Sugar processing traditionally relies on conventional methods such as milling, purification, and crystallization. However, advancements in technology have revolutionized the industry, introducing new techniques and equipment that streamline production, optimize resource utilization, and enhance product quality. These advancements are reshaping the global industrial sugar market and creating opportunities for manufacturers to stay competitive in a rapidly changing landscape.

The demand for greater efficiency and lower costs is one of the main forces behind technological developments in the sugar processing industry. Manufacturers may optimize operations, reduce waste, and increase productivity, thanks to sophisticated automation systems, computerized controls, and data analytics. These developments aid sugar producers in lowering production costs and increasing profitability. Sugar producers can improve the quality of their goods and set themselves apart from competitors thanks to technological improvements. Modern processing methods, such as centrifugal separators and continuous vacuum pan systems, provide better control over variables such as crystal size, color, and moisture content. Manufacturers are able to produce high-quality sugar with consistent qualities to satisfy the demands of numerous industries and consumer preferences.

Sugar refineries are becoming intelligent factories, thanks to digitalization. Real-time data gathering, analysis, and remote monitoring are made possible by the deployment of sensors, Internet of Things (IoT) gadgets, and cloud-based platforms. This supply chain integration is made possible by digital transformation, which also increases operational effectiveness and makes predictive maintenance easier. The technological advancements in sugar processing have significant prospects for the industrial sugar sector. The emphasis on efficiency, quality improvement, sustainability, and product diversity are driving factors behind the use of cutting-edge technology and procedures. Manufacturers who adopt these innovations can boost output, develop new product lines, and maintain their competitiveness in a market that is changing quickly. Automation, artificial intelligence, digitalization, and sustainable practices will play a crucial role in shaping the future of the market. By embracing technological advancements, manufacturers can optimize their operations, meet consumer demands, and capitalize on the opportunities presented by the evolving sugar processing landscape.

Hence, the key market players are exploring opportunities to develop advancements in production technologies and launching new innovative products, thus offering a wide opportunity for market growth.

Recent Developments

- In May 2023, Mitr Phol Group announced the launch of new packaging material that is sustainable and eco-friendly. They stated to transform the packaging for sugar products into sustainable material due to rising concern among the consumers. This development will help the company to attract the large consumer base.

- In February 2018, American Crystal Sugar Subsidiary United Sugars announced it parternship with Wyoming Sugar Company. This partnership will help in the expansion and suppling of their products in large areas

Global Industrial Sugar Market Scope

The global industrial sugar market is segmented into six notable segments based on type, source, form, packaging type, application and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- White Sugar

- Liquid Sugar

- Brown Sugar

- Icing Sugar

On the basis of type, the market is segmented into white sugar, liquid sugar, brown sugar, and icing sugar.

Source

- Cane

- Beet

On the basis of source, the market is segmented into cane and beet.

Form

- Granulated

- Syrup

- Powdered

On the basis of form, the market is segmented into granulated, syrup, and powdered.

Packaging Type

- Sacks

- Bag

- Box

- Tote bags

- Others

On the basis of packaging type, the market is segmented into sacks, bag, box, tote bags, and others.

Application

- Food & Beverages

- Pharmaceutical

- Dietary Supplements

- Others

On the basis of application, the global industrial sugar market is segmented into food & beverages, pharmaceutical, dietary supplements, and others.

Distribution Channel

- Direct

- Indirect

On the basis of distribution channel, the global industrial sugar market is segmented into direct and indirect.

Global Industrial Sugar Market Regional Analysis/Insights

The global industrial sugar market is analyzed, and market size insights and trends are provided by country, type, source, form, packaging type, application, and distribution channel, as referenced above.

The countries covered in the global industrial sugar market report are U.S., Canada, Mexico in North America, Russia, Germany, Italy, Turkey, France, U.K., Spain, Netherlands, Belgium, Switzerland, Luxemburg, and the rest of Europe, India, China, Thailand, Australia and New Zealand, Indonesia, Vietnam, Philippines, Malaysia, Japan, South Korea, Singapore, Taiwan, and rest of Asia-Pacific, Brazil, Argentina, Rest of South America, Egypt, South Africa, Saudi Arabia, UAE, Israel, and rest of Middle East and Africa.

Asia-Pacific is dominating and is expected to show the highest growth in the forecast period in the global industrial sugar market, with a CAGR of around 3.6%, due to large production, easy availability of products and an increase in customer base.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Industrial Sugar Market Share Analysis

The global industrial sugar market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus on the global industrial sugar market.

Some of the major players operating in the global industrial sugar market are Südzucker AG, Associated British Foods, Michigan Sugar Company, Amalgamated Sugar., RANA GROUP, Rajshree Sugars & Chemicals Limited (RSCL), Shree Renuka Sugars Ltd, Upper Ganges Sugar & Industries Limited, Bajaj Hindusthan Sugar Ltd., Mitr Phol Sugar., Ragus Sugars Manufacturing Ltd., Lantic Inc., Nile Sugar, AMERICAN CRYSTAL SUGAR, and Balrampur Chini Mills Limited among others.

SKU-