Global Industrial Services Market

Market Size in USD Billion

CAGR :

%

USD

41.78 Billion

USD

64.61 Billion

2024

2032

USD

41.78 Billion

USD

64.61 Billion

2024

2032

| 2025 –2032 | |

| USD 41.78 Billion | |

| USD 64.61 Billion | |

|

|

|

|

Industrial Services Market Analysis

The global industrial services market is experiencing significant growth, driven by increasing demand for automation, technological advancements, and the need for improved operational efficiency across various industries. Industrial services encompass a wide range of offerings, including maintenance, repair, consulting, installation, and commissioning of equipment and machinery used in manufacturing, energy, and infrastructure sectors. The market is bolstered by the rising emphasis on digital transformation and the integration of advanced technologies such as artificial intelligence (AI), machine learning, Internet of Things (IoT), and robotics. Recent advancements in these technologies have enabled more predictive and proactive maintenance strategies, improving equipment uptime and reducing operational costs. Companies are increasingly adopting automation solutions, such as robotics and AI-powered systems, to optimize production, enhance safety, and address labor shortages. Additionally, the growing focus on sustainability and energy efficiency is prompting the development of innovative solutions, such as energy management systems and smart grids. With these ongoing developments, the global industrial services market is poised for sustained expansion.

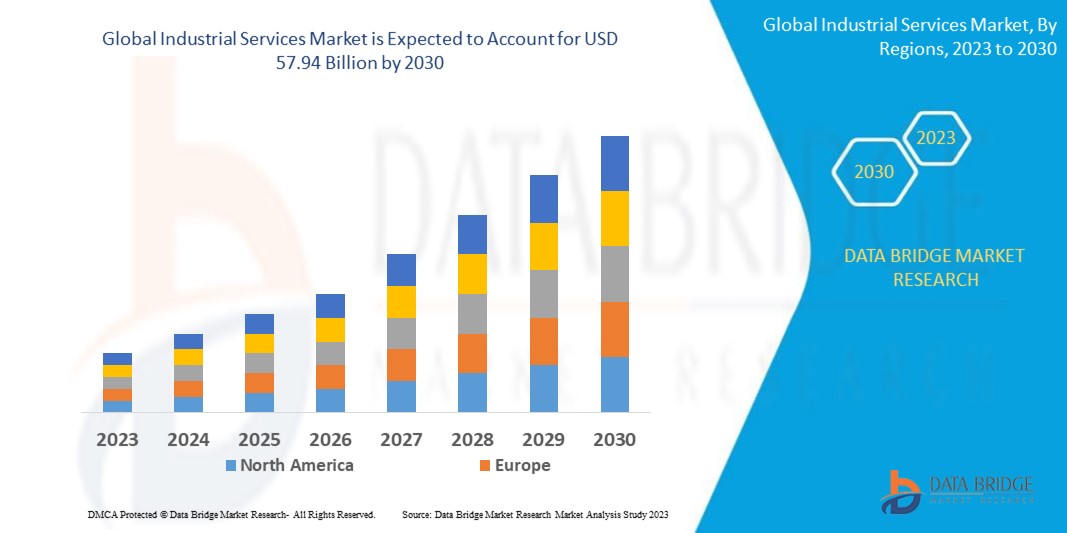

Industrial Services Market Size

The global industrial services market size was valued at USD 41.78 billion in 2024 and is projected to reach USD 64.61 billion by 2032, with a CAGR of 5.60% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Industrial Services Market Trends

“Increasing Integration of Predictive Maintenance”

A key trend driving the global industrial services market is the integration of predictive maintenance powered by AI and IoT technologies. This trend is reshaping how industries approach equipment maintenance by moving from traditional reactive models to more proactive, data-driven strategies. Predictive maintenance utilizes advanced sensor technology and machine learning algorithms to analyze real-time data from machines, identifying potential issues before they result in costly breakdowns. For instance, General Electric has implemented predictive maintenance in its turbines and generators, significantly improving operational efficiency and reducing downtime in power plants. By predicting failures and scheduling maintenance only when needed, companies can reduce costs associated with unplanned shutdowns, extend the lifespan of equipment, and enhance overall operational efficiency. This shift is particularly valuable in heavy industries such as manufacturing and energy, where equipment downtime can lead to substantial financial losses. As more companies embrace this trend, the industrial services market continues to grow, driven by advancements in AI, IoT, and real-time data analytics.

Report Scope and Industrial Services Market Segmentation

|

Attributes |

Industrial Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

ABB (Switzerland), Siemens (Germany), Schneider Electric (France), General Electric Company (U.S.), Emerson Electric Co. (U.S.), Honeywell International Inc. (U.S.), Rockwell Automation (U.S.), Johnson Controls Inc. (Ireland), SKF AB (Sweden), Mitsubishi Electric Corporation (Japan), Eaton (Ireland), DAIKIN INDUSTRIES, Ltd. (Japan), Yokogawa Electric Corporation (Japan), SGS Société Générale de Surveillance SA. (Switzerland), and Cognizant (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Industrial Services Market Definition

Industrial services refer to a broad range of services provided to support, maintain, and optimize the operations of industrial systems, machinery, and infrastructure. These services include activities such as installation, maintenance, repair, consulting, and commissioning of equipment These services also encompass digital solutions such as predictive maintenance, system integration, and automation, often leveraging advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and robotics. The goal of industrial services is to minimize downtime, reduce operational costs, and optimize the performance of industrial operations across various industries.

Industrial Services Market Dynamics

Drivers

- Increasing Focus on Outsourcing

Increasing focus on outsourcing is a major driver in the growth of the industrial services market, as companies look to optimize costs, improve efficiency, and focus on core business functions. For instance, companies in the manufacturing sector are increasingly outsourcing maintenance services to third-party providers who specialize in predictive maintenance and repair, allowing businesses to avoid the high costs associated with in-house teams and focus on production. This trend is further accelerated by the need for technological expertise that may not be available internally. As outsourcing helps companies streamline operations, reduce overhead costs, and improve service delivery, it is driving the demand for industrial services, particularly in sectors such as manufacturing, energy, and utilities. The growing reliance on outsourcing is thus a key factor propelling the expansion of the industrial services market globally.

- Growing Complexity of Industrial Operations

The growing complexity of industrial operations is a significant driver of the industrial services market, as companies face more intricate production processes, regulatory demands, and technological advancements. As industries become more integrated with digital technologies such as AI, IoT, and automation, managing these systems requires specialized knowledge and expertise. For instance, the manufacturing sector is increasingly adopting smart factories with interconnected systems that demand continuous monitoring, real-time data analysis, and predictive maintenance. Complexity pushes companies to rely on external industrial services providers who can offer tailored solutions, optimize operations, and ensure smooth integration of new technologies. As a result, the demand for comprehensive industrial services ranging from system integration to ongoing maintenance and automation is growing, driving the market's expansion as businesses seek to stay competitive and efficient in an increasingly complex industrial landscape.

Opportunities

- Growing Emphasis on Sustainability and Efficiency

The growing emphasis on sustainability and efficiency is a major driver in the industrial services market, as industries are increasingly focusing on reducing their environmental footprint while improving operational performance. Governments, consumers, and regulatory bodies are pushing for stricter environmental standards, which has led companies to seek solutions that ensure compliance and drive cost savings. For instance, Schneider Electric has developed energy management solutions that help industrial operations optimize energy consumption, reduce carbon emissions, and enhance sustainability practices. By integrating real-time energy monitoring and analytics, businesses can identify inefficiencies, make informed decisions to lower energy use, and meet sustainability targets. As companies across sectors such as manufacturing, chemicals, and energy strive to implement green initiatives, there is a rising demand for services such as energy audits, waste management, and carbon footprint reduction. This growing focus on sustainability is creating significant market opportunities for industrial service providers who offer innovative, eco-friendly solutions that enable companies to achieve both environmental and economic goals.

- Growing Government Initiatives and Investments

Government initiatives and investments in industrial modernization and digital transformation are significantly driving the demand for industrial services, as countries seek to enhance their competitiveness and drive economic growth. For instance, the European Union's Horizon 2020 program has allocated substantial funding to support the development and adoption of advanced manufacturing technologies such as robotics, AI, and IoT, encouraging industries to upgrade their operations. Similarly, China’s “Made in China 2025” initiative focuses on increasing automation and digital technologies across sectors such as manufacturing and energy, creating opportunities for industrial services providers who can help with the installation, integration, and maintenance of these new technologies. These government-led efforts are pushing for the deployment of smarter, more efficient industrial systems, creating a strong market opportunity for service providers offering expertise in digital transformation, system integration, and ongoing maintenance. As nations continue to prioritize industrial development and innovation, there will be increasing demand for specialized industrial services to help businesses adopt, implement, and maintain cutting-edge technologies.

Restraints/Challenges

- Fluctuations in the Economy

Economic uncertainty presents a significant challenge to the industrial services market, as fluctuations in the economy, such as recessions, inflation, or geopolitical instability, can directly impact the demand for services such as maintenance, repair, and installation. During periods of economic downturn, companies often face financial constraints and may delay or scale back investments in equipment upgrades or service contracts. For instance, during the COVID-19 pandemic and the subsequent economic downturn, many manufacturers temporarily halted production, reducing their need for routine maintenance and emergency repairs, which in turn led to a decrease in demand for industrial services. Similarly, geopolitical tensions or trade wars can lead to uncertainty in supply chains, making businesses hesitant to commit to long-term service agreements. As a result, service providers may experience lower revenue, longer contract cycles, and increased difficulty in acquiring new clients, especially in sectors heavily impacted by global economic shifts. This makes economic uncertainty a critical market challenge for the industrial services sector, as it leads to fluctuating demand and operational volatility.

- Labor Shortages

Labor shortages are a significant challenge for the global industrial services market, particularly as industries become more reliant on specialized skills and expertise to manage increasingly complex systems and technologies. The demand for qualified professionals, especially in fields such as engineering, machine maintenance, and technical support, has far outpaced the supply of skilled workers. For instance, industries such as manufacturing and energy, which depend heavily on advanced machinery and automation, often struggle to find technicians who can operate, troubleshoot, and repair these sophisticated systems. This shortage can lead to delays in service delivery, reduced service quality, and longer response times, as businesses are forced to rely on a smaller pool of available talent. For instance, in the oil and gas sector, the need for engineers and technicians to maintain equipment in remote locations has grown significantly, but the lack of skilled professionals has caused slowdowns in maintenance and repair schedules, resulting in costly downtime. This gap in skilled labor negatively impacts the ability of industrial service providers to meet customer demands in a timely and efficient manner, thereby hindering market growth and operational efficiency.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Industrial Services Market Scope

The market is segmented on the basis of type, application, and end-user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Engineering and Consulting

- Installation and Commissioning

- Operational Improvement and Maintenance

Application

- Distributed Control System (DCS)

- Programmable Logic Controller (PLC)

- Supervisory Control and Data Acquisition (SCADA)

- Electric Motors and Drives

- Valves and Actuators

- Human Machine Interface (HMI)

- Manufacturing Execution System (MES)

- Safety Systems

- Industrial PC

- Industrial 3D Printing

- Industrial Robotics

End-User

- Oil and Gas

- Healthcare and Pharmaceuticals

- Chemicals

- Automotive

- Water and Wastewater

- Food and Beverages

- Energy and Power

- Semiconductor and Electronics

- Paper and Pulp

- Metals and Mining

- Aerospace

- Others

Industrial Services Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, application, and end-user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America leads the industrial services market and is experiencing the highest compound annual growth rate (CAGR) due to its robust technology and innovation ecosystem. A significant number of top companies in this sector are headquartered in the U.S., driving continuous advancements and setting global industry standards. These companies prioritize substantial investments in research and development, ensuring the creation of innovative solutions that shape the market's future. This strong focus on technological progress has positioned North America as a dominant player in the global industrial services landscape.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Industrial Services Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Industrial Services Market Leaders Operating in the Market Are:

- ABB (Switzerland)

- Siemens (Germany)

- Schneider Electric (France)

- General Electric Company (U.S.)

- Emerson Electric Co. (U.S.)

- Honeywell International Inc. (U.S.)

- Rockwell Automation (U.S.)

- Johnson Controls Inc. (Ireland)

- SKF AB (Sweden)

- Mitsubishi Electric Corporation (Japan)

- Eaton (Ireland)

- DAIKIN INDUSTRIES, Ltd. (Japan)

- Yokogawa Electric Corporation (Japan)

- SGS Société Générale de Surveillance SA. (Switzerland)

- Cognizant (U.S.)

Latest Developments in Industrial Services Market

- In June 2024, Honeywell introduced its Battery Manufacturing Excellence Platform (Battery MXP), an AI-powered solution designed to optimize gigafactory operations from the outset. This platform aims to increase battery cell yields, accelerate facility startup times, and reduce material waste by up to 60% during the initial stages. By utilizing AI and machine learning, Battery MXP proactively identifies and resolves quality issues, enabling manufacturers to improve efficiency, shorten production ramp-up times, and meet the growing demand for lithium-based batteries. It also ensures real-time traceability of battery cells from raw materials to finished products, bolstering quality control and safety measures in gigafactories worldwide. This innovation supports Honeywell's commitment to advancing industrial automation and addressing global electrification needs

- In August 2023, Schneider Electric launched a Managed Security Services (MSS) offering aimed at helping customers in operational technology (OT) environments mitigate the increased cybersecurity risks arising from the growing demand for remote access and connectivity technologies

- In February 2023, ABB unveiled its ABB Ability Symphony Plus distributed control system (DCS), designed to drive digital transformation in the electricity generation and water industries. This system facilitates seamless access to a broader digital ecosystem and supports secure OPC UA connections to Edge and Cloud platforms while maintaining core control functionalities. The update includes HTML5 web-based mobile operations, providing real-time access to critical data and fostering collaboration to maximize plant uptime. These advancements are intended to enhance productivity, sustainability, and operational efficiency across industrial sectors

- In February 2023, Schneider Electric also launched its new Industrial Digital Transformation Services, a global offering designed to help industrial enterprises achieve sustainable, innovative, and effective end-to-end digital transformation, preparing them for the future of industrial operations

- In August 2022, Yokogawa Electric Corporation announced the release of its OpreX IT/OT Security Operations Center (IT/OT SOC) service. Developed primarily for industrial enterprises, this service enhances IT and OT network security by detecting, analyzing, and enabling quick responses to cybersecurity incidents, offering remote monitoring and support for global operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Services Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Services Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Services Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.