Global Industrial Sensor Market

Market Size in USD Billion

CAGR :

%

USD

27.13 Billion

USD

56.48 Billion

2024

2032

USD

27.13 Billion

USD

56.48 Billion

2024

2032

| 2025 –2032 | |

| USD 27.13 Billion | |

| USD 56.48 Billion | |

|

|

|

|

Industrial Sensor Market Size

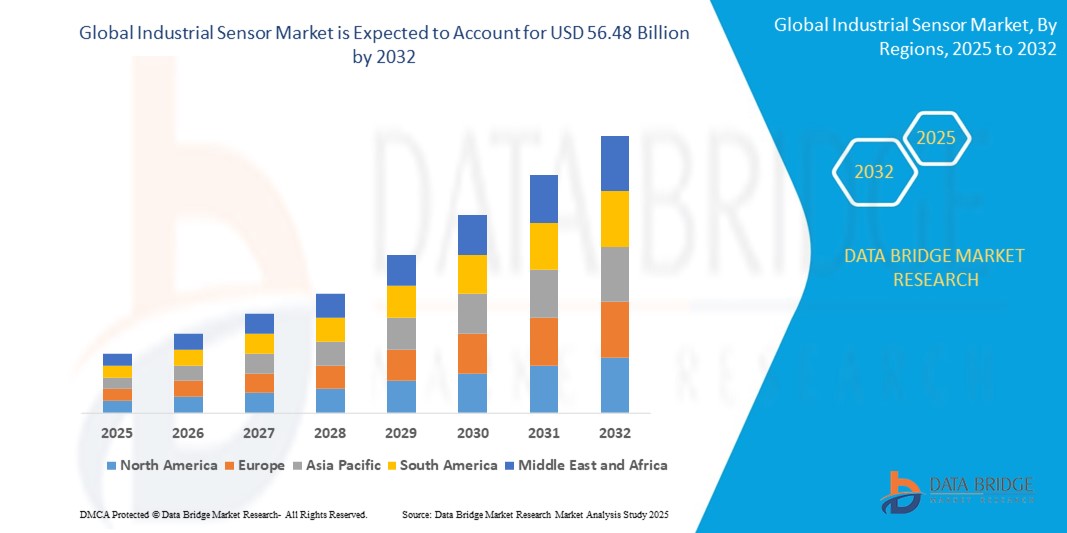

- The global industrial sensor market size was valued at USD 27.13 billion in 2024 and is expected to reach USD 56.48 billion by 2032, at a CAGR of 9.6% during the forecast period

- The market growth is largely fueled by the rapid adoption of Industry 4.0, increasing automation across various industries, and the growing demand for real-time data for predictive maintenance and operational efficiency

- Growing investments in smart factories, IoT integration, and the miniaturization of sensors are further propelling the demand for advanced industrial sensor solutions

Industrial Sensor Market Analysis

- The industrial sensor market is experiencing robust growth due to the rising emphasis on automation, safety, and operational efficiency across various industries

- The adoption of advanced sensor technologies, such as MEMS and CMOS, is enabling precise monitoring and control in complex industrial environments, boosting demand for sensors in manufacturing and energy sectors

- Asia-Pacific held the largest revenue share of 52.14% in 2024, driven by rapid industrialization, expanding manufacturing hubs, and government initiatives promoting smart factories in countries such as China, Japan, and South Korea

- North America is projected to grow at a CAGR of 13.1% from 2025 to 2032, fueled by high investments in automation, advanced manufacturing technologies, and stringent regulatory standards in industries such as oil and gas and pharmaceuticals

- The Manufacturing segment accounted for the largest market revenue share of 38.7% in 2024, attributed to the widespread use of sensors for process optimization, quality control, and predictive maintenance in industrial facilities

Report Scope and Industrial Sensor Market Segmentation

|

Attributes |

Industrial Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Industrial Sensor Market Trends

“Increasing Integration of AI and Machine Learning”

- The industrial sensor market is experiencing a significant trend toward the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies

- These technologies enhance sensor capabilities by enabling advanced data analytics, real-time monitoring, and predictive maintenance in industrial applications

- AI-powered sensors can process vast amounts of data to detect anomalies, predict equipment failures, and optimize operational efficiency, reducing downtime and maintenance costs

- For instance, companies are leveraging AI-driven sensor platforms to monitor equipment health in manufacturing plants, enabling predictive maintenance by analyzing patterns in temperature, pressure, and vibration data

- This trend is enhancing the value of industrial sensors, making them indispensable for smart factories and Industry 4.0 initiatives

- ML algorithms can analyze complex sensor data, such as flow rates, gas concentrations, or positional accuracy, to provide actionable insights for process optimization and quality control across industries such as manufacturing, oil and gas, and pharmaceuticals

Industrial Sensor Market Dynamics

Driver

“Rising Demand for Industrial Automation and Smart Manufacturing”

- The growing adoption of Industrial IoT (IIoT) and Industry 4.0 initiatives is a major driver for the industrial sensor market, as industries seek real-time data for process optimization and automation

- Industrial sensors enable enhanced monitoring of critical parameters such as temperature, pressure, flow, and position, improving operational efficiency, safety, and product quality

- Government initiatives promoting smart factories and digital transformation, particularly in regions such as Asia-Pacific and Europe, are accelerating the deployment of advanced sensor technologies

- The proliferation of high-speed connectivity, such as 5G, supports seamless data transmission from sensors, enabling real-time analytics and remote monitoring for complex industrial applications

- Manufacturers are increasingly integrating smart sensors as standard components in equipment to meet industry demands for predictive maintenance and data-driven decision-making

Restraint/Challenge

“High Initial Costs and Data Security Concerns”

- The high upfront costs associated with the development, installation, and integration of advanced industrial sensors can be a significant barrier, particularly for small and medium-sized enterprises in developing markets

- Retrofitting existing industrial systems with modern sensor technologies often involves complex and expensive modifications

- Data security and privacy concerns present a major challenge, as industrial sensors collect and transmit sensitive operational data, raising risks of cyberattacks, data breaches, or unauthorized access

- The lack of standardized regulations across countries for data handling and cybersecurity in industrial applications creates compliance challenges for global manufacturers and service providers

- These factors can slow market adoption, especially in regions with limited budgets for automation or heightened concerns about data privacy and security

Industrial Sensor Market Scope

The market is segmented on the basis of type, sensor type, technology, and end-user.

- By Type

On the basis of type, the industrial sensor market is segmented into contact and noncontact. The noncontact segment is expected to hold the largest market revenue share of 64% in 2024, primarily driven by its widespread adoption in harsh industrial environments where direct contact is not feasible, and its ability to provide real-time data without affecting the process or product.

The noncontact segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing demand for high-speed, non-intrusive monitoring, enhanced safety requirements in automated processes, and advancements in optical and proximity sensing technologies.

- By Sensor Type

On the basis of sensor type, the industrial sensor market is segmented into level sensor, temperature sensor, flow sensor, position sensor, pressure sensor, force sensor, humidity and moisture sensor, image sensor, and gas sensor. The Pressure Sensor segment is expected to hold the largest market revenue share of 22.5% in 2024, owing to its indispensable role in monitoring and controlling fluid and gas systems across almost every industrial sector, from manufacturing and chemicals to oil & gas and pharmaceuticals.

The Image Sensor segment is anticipated to experience the fastest growth from 2025 to 2032. This growth is driven by the increasing adoption of machine vision systems for quality control, automation, robotics, and security applications in smart factories, where high-resolution and intelligent imaging capabilities are crucial.

- By Technology

On the basis of technology, the industrial sensor market is segmented into Micro-Electro-Mechanical Systems (MEMS) Technology and Complementary Metal Oxide Semiconductor (CMOS) Technology. The Micro-Electro-Mechanical Systems (MEMS) Technology segment is expected to hold the largest market revenue share of 57.5% in 2024, driven by its advantages such as miniaturization, cost-effectiveness, high precision, and low power consumption, making it ideal for integration into compact and smart industrial devices.

The CMOS Technology segment is anticipated to witness significant growth from 2025 to 2032, particularly due to its increasing application in advanced image sensors and integrated sensor solutions, offering high integration density, reduced power consumption, and improved performance for complex industrial sensing tasks.

- By End User

On the basis of end user, the industrial sensor market is segmented into manufacturing, oil and gas, chemicals, pharmaceuticals, energy and power, and mining. The Manufacturing segment dominated the market revenue share of 38.7% in 2024, attributed to the extensive use of industrial sensors across various stages of production for process automation, quality inspection, asset monitoring, and predictive maintenance in factories worldwide.

The Energy and Power segment is anticipated to witness rapid growth from 2025 to 2032, fueled by increasing investments in smart grids, renewable energy infrastructure, and the growing need for real-time monitoring of critical assets such as turbines, generators, and distribution networks to ensure efficiency, safety, and reliability.

Industrial Sensor Market Regional Analysis

- Asia-Pacific held the largest revenue share of 52.14% in 2024, driven by rapid industrialization, expanding manufacturing hubs, and government initiatives promoting smart factories in countries such as China, Japan, and South Korea

- Industries in the region prioritize operational efficiency, safety, and automation, leveraging sensors for real-time monitoring, predictive maintenance, and energy optimization

- This widespread adoption is further supported by robust investments in industrial infrastructure, a growing tech-savvy workforce, and policies encouraging Industry 4.0 and IoT integration, positioning industrial sensors as a critical component across manufacturing, oil and gas, and pharmaceuticals sectors

U.S. Industrial Sensor Market Insight

The U.S. is expected to witness significant growth in the North America industrial sensor market, fueled by strong investment in industrial automation, smart manufacturing initiatives, and the increasing adoption of IoT across sectors such as automotive, aerospace, and energy. The push for operational efficiency, predictive maintenance, and stringent safety regulations further boosts market expansion. The presence of key industrial players and continuous technological advancements in sensor capabilities are also driving robust demand.

Europe Industrial Sensor Market Insight

The Europe industrial sensor market is expected to witness substantial growth, supported by a strong focus on Industry 4.0 adoption, digital transformation policies, and a high degree of industrial automation across its manufacturing, automotive, and chemicals sectors. Consumers and businesses in the region are increasingly prioritizing real-time data for process optimization, energy efficiency, and enhanced worker safety. Countries such as Germany and France are leading the uptake due to their advanced industrial bases and proactive implementation of smart factory concepts.

U.K. Industrial Sensor Market Insight

The U.K. market for industrial sensors is expected to witness a healthy growth rate, driven by increasing adoption of smart infrastructure, rising industrial automation, and a strong focus on environmental monitoring and sustainability. The demand for improved operational efficiency, data-driven insights for predictive maintenance, and the integration of IoT solutions across various industries are key drivers. Government initiatives supporting smart city developments and industrial digitalization further stimulate market expansion.

Germany Industrial Sensor Market Insight

Germany is expected to witness significant growth in industrial sensors, attributed to its pioneering role in Industry 4.0 and its highly advanced manufacturing and automotive industries. German industries are characterized by a strong emphasis on automation, precision engineering, and technological innovation. The demand for highly accurate, reliable, and intelligent sensors for process control, quality assurance, and real-time monitoring of complex machinery is consistently high, supported by robust research and development activities and a preference for high-tech solutions.

Asia-Pacific Industrial Sensor Market Insight

The Asia-Pacific region is expected to dominate the market revenue share, driven by its expansive manufacturing sector, rapid industrialization, and significant investments in smart manufacturing and automation technologies, particularly in countries such as China, Japan, and India. Increasing industrial IoT penetration, growing awareness of operational efficiency, and supportive government policies promoting advanced manufacturing further boost demand for industrial sensors across the region.

Japan Industrial Sensor Market Insight

Japan’s industrial sensor market is expected to witness robust growth due to its leading position in industrial automation, robotics, and high-tech manufacturing. There is a strong preference for high-quality, precision industrial sensors that enhance production efficiency, quality control, and workplace safety. The continuous investment by major Japanese manufacturers in advanced automation solutions and the integration of smart sensors in new industrial equipment contribute significantly to market penetration and growth.

China Industrial Sensor Market Insigh

China holds a substantial share of the Asia-Pacific industrial sensor market, propelled by its status as the world's largest manufacturing hub, rapid urbanization, and aggressive adoption of smart manufacturing and industrial IoT solutions. The country's strong domestic manufacturing capabilities, coupled with increasing demand for intelligent and connected factory systems to enhance productivity and competitiveness, are key factors driving the widespread adoption of industrial sensors across various industries.

Industrial Sensor Market Share

The industrial sensor industry is primarily led by well-established companies, including:

- Rockwell Automation (US)

- Honeywell International Inc. (US)

- Texas Instruments Incorporated (US)

- Panasonic Corporation (Japan)

- STMicroelectronics (Switzerland)

- Siemens (US)

- Amphenol Advanced Sensors (US)

- Renesas Electronics Corporation (Japan)

- Bosch Sensortec GmbH (Germany)

- TE Connectivity (Switzerland)

- Microchip Technology Inc. (US)

- NXP Semiconductors (Netherlands)

- Endress+Hauser Group Services AG (Switzerland)

- Teledyne Digital Imaging Inc. (Canada)

- Sensirion AG Switzerland (Switzerland)

Latest Developments in Global Industrial Sensor Market

- In January 2025, Emerson introduced the AVENTICS™ DS1 dew point sensor, a groundbreaking industrial device that monitors dew point, temperature, humidity, and air quality in real time. Designed to optimize pneumatic systems, the DS1 helps operators detect and mitigate excess moisture early, preventing equipment damage and ensuring consistent air quality. This innovation benefits industries such as pharmaceuticals, food and beverage, and semiconductors by enhancing reliability and regulatory compliance. The DS1 integrates seamlessly into existing systems, supporting industrial digital

- In August 2024, Renesas Electronics Corporation launched the RRH62000, a compact and advanced sensor module for indoor air quality monitoring. This all-in-one device integrates multiple sensors, including a laser-based PM1/2.5/10 sensor, ZMOD4410 gas sensor, and HS4003 humidity and temperature sensor, enabling precise detection of harmful particulates and volatile organic compounds. Equipped with an onboard MCU and embedded AI algorithms, the RRH62000 provides real-time air quality data and supports seamless integration into smart home and public building systems

- In October 2023, Rockwell Automation completed the acquisition of Clearpath Robotics Inc., including its industrial division, OTTO Motors. This strategic move enhances Rockwell’s capabilities in autonomous mobile robots (AMRs) for industrial applications, streamlining material handling across manufacturing plants. By integrating Clearpath’s expertise, Rockwell aims to provide an end-to-end production logistics solution, optimizing efficiency and automation. The acquisition marks a significant step in transforming industrial operations, reinforcing Rockwell’s leadership in automation and digital transformation

- In January 2023, Dwyer Instruments, LLC introduced the Series PI piston in-line variable area flowmeters, designed for precise fluid measurement across various industries. These patented spring-loaded piston flowmeters are ideal for applications such as cooling water monitoring, plastic injection molding coolant control, oil and gas measurement, lubricant flow control, hydraulic flow measurement, pump protection, and hazardous environments. Featuring a compact design, they require no straight pipe runs and operate without external power. This innovation enhances efficiency and reliability in fluid handling systems

- In October 2023, Piher Sensing Systems, a subsidiary of Amphenol Corporation, introduced the HCSO-1W open-loop current sensor. Designed for high-accuracy measurement, this sensor is ideal for monitoring AC and DC currents in battery management systems, industrial battery chargers, and motor control applications. Utilizing Hall effect technology, it provides precise readings while ensuring galvanic isolation between power and control circuits. The HCSO-1W supports a wide range of current measurements, making it a reliable solution for various industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Sensor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Sensor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Sensor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.