Global Industrial Oils Market

Market Size in USD Billion

CAGR :

%

USD

106.64 Billion

USD

166.15 Billion

2024

2032

USD

106.64 Billion

USD

166.15 Billion

2024

2032

| 2025 –2032 | |

| USD 106.64 Billion | |

| USD 166.15 Billion | |

|

|

|

|

Industrial Oils Market Size

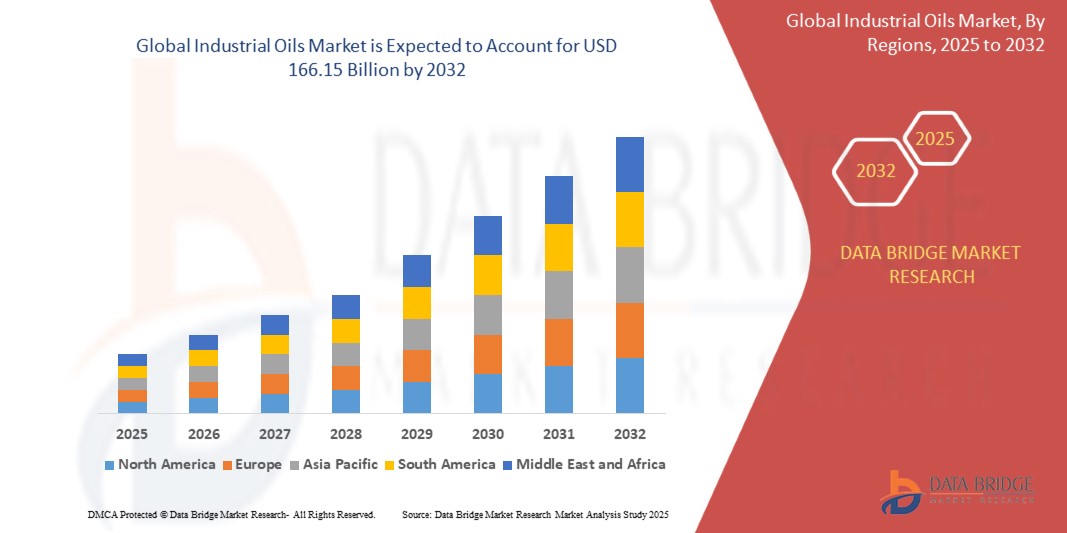

- The global industrial oils market size was valued at USD 106.64 billion in 2024 and is expected to reach USD 166.15 billion by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is largely fueled by the increasing emphasis on sustainable, bio-based alternatives across various industries, coupled with advancements in oil processing technologies that enhance the performance, efficiency, and versatility of industrial oils in end-use applications such as biofuels, paints, coatings, and chemicals

- Furthermore, rising demand for renewable energy sources, coupled with growing consumption of plant-based raw materials in personal care, pharmaceuticals, and automotive sectors, is reinforcing the adoption of industrial oils as essential components in modern manufacturing processes. These converging factors are significantly accelerating market growth

Industrial Oils Market Analysis

- Industrial oils are derived from vegetable sources such as soybean, palm, rapeseed, sunflower, and corn, and are widely used in applications including biofuel production, paints, coatings, cosmetics, and lubricants. Their chemical properties make them suitable for improving product performance, energy efficiency, and sustainability across various industries

- The escalating demand for industrial oils is primarily driven by global efforts to reduce dependency on fossil fuels, growing biofuel consumption, increasing adoption of plant-based ingredients in personal care and pharmaceuticals, and rising industrial demand for sustainable lubricants and chemical intermediates

- North America dominated the industrial oils market with a share of 18% in 2024, due to strong demand for biofuels, lubricants, and plant-based raw materials across manufacturing, automotive, and chemical industries

- Asia-Pacific is expected to be the fastest growing region in the industrial oils market during the forecast period due to rapid industrialization, rising production of biofuels, and increasing demand for sustainable industrial materials

- Grade II (Medium) segment dominated the market with a market share of 42.2% in 2024, due to its balanced viscosity and broad applicability across diverse end-use industries. Medium-grade industrial oils are widely used in paints, coatings, and biofuels, offering optimal performance, processing ease, and cost efficiency. Their versatility enables manufacturers to meet varying formulation needs without compromising product stability or efficiency

Report Scope and Industrial Oils Market Segmentation

|

Attributes |

Industrial Oils Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Oils Market Trends

“Rising Industrialization and Infrastructure Development”

- A significant and accelerating trend in the global industrial oils market is the rising demand for industrial oils driven by rapid industrialization and large-scale infrastructure development projects such as those in emerging economies

- For instance, companies such as Shell and ExxonMobil are expanding their industrial oil product lines to support the lubrication and maintenance needs of heavy machinery and construction equipment used in infrastructure projects

- The adoption of advanced industrial oils with enhanced performance properties such as high thermal stability, oxidation resistance, and extended service intervals is supporting operational efficiency across manufacturing and construction sectors

- Industrial oils are increasingly being formulated for specialized applications such as hydraulic systems, compressors, turbines, and metalworking, meeting the evolving requirements of modern industrial operations

- This trend toward high-performance and application-specific industrial oils is fundamentally reshaping procurement and maintenance strategies for manufacturers and contractors. Companies such as TotalEnergies and Fuchs are investing in research and development to create innovative formulations that improve equipment reliability and reduce downtime

- The demand for industrial oils that deliver superior lubrication, protection, and energy efficiency is growing rapidly across both established and developing markets, as industries increasingly prioritize productivity, cost savings, and equipment longevity

Industrial Oils Market Dynamics

Driver

“Growing Technological Advancements”

- The ongoing advancement of technology in industrial processes, including automation, precision manufacturing, and smart maintenance systems, is a significant driver for the increased demand for advanced industrial oils

- For instance, Chevron and BP are developing next-generation industrial oils with features such as nano-additives and real-time monitoring compatibility to support predictive maintenance and reduce unplanned equipment failures

- As industries adopt more sophisticated machinery and automated systems, the need for oils that can withstand higher loads, extreme temperatures, and longer service intervals is driving innovation in lubricant formulations

- The trend toward digitalization and Industry 4.0 is making high-performance industrial oils essential for maintaining the efficiency and reliability of interconnected production systems

- The convenience of using technologically advanced industrial oils in a wide range of applications, coupled with their ability to support sustainability goals through reduced energy consumption and waste, is propelling market growth. The expansion of manufacturing and infrastructure sectors further contributes to the growing adoption of specialized industrial oils

Restraint/Challenge

“Volatility in Raw Material Prices”

Industrial Oils Market Scope

The market is segmented on the basis of source, type, and end-use.

• By Source

On the basis of source, the industrial oils market is segmented into soybean, palm, rapeseed, sunflower, corn, cottonseed, and others. The soybean segment dominated the largest market revenue share in 2024, attributed to its abundant global production, versatile application range, and favorable oil composition for industrial processes. Soybean oil's balanced fatty acid profile and cost-effectiveness make it a preferred raw material for biofuel production, paints, coatings, and various chemical formulations. Its widespread cultivation across major economies such as the U.S., Brazil, and Argentina ensures steady supply, further reinforcing its dominance in the industrial oils market.

The rapeseed segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its increasing adoption in bio-lubricants, environmentally friendly fuels, and the chemical industry. Rapeseed oil offers low saturated fat content and superior oxidative stability, making it suitable for high-performance industrial applications. Rising demand for sustainable and renewable alternatives, particularly in Europe, is accelerating the adoption of rapeseed-based industrial oils.

• By Type

On the basis of type, the industrial oils market is segmented into Grade I (Light), Grade II (Medium), and Grade III (Heavy). The Grade II (Medium) segment held the largest market revenue share 42.2% in 2024, driven by its balanced viscosity and broad applicability across diverse end-use industries. Medium-grade industrial oils are widely used in paints, coatings, and biofuels, offering optimal performance, processing ease, and cost efficiency. Their versatility enables manufacturers to meet varying formulation needs without compromising product stability or efficiency.

The Grade I (Light) segment is anticipated to witness the fastest growth rate from 2025 to 2032, owing to its superior purity levels, lower viscosity, and enhanced compatibility with high-value applications such as cosmetics, pharmaceuticals, and personal care products. Growing consumer preference for high-quality, plant-based ingredients in these industries is contributing to the rising demand for light-grade industrial oils.

• By End-Use

On the basis of end-use, the industrial oils market is segmented into biofuel, paints and coating, cosmetics and personal care, pharmaceuticals, and others. The biofuel segment dominated the largest market revenue share in 2024, driven by escalating global emphasis on renewable energy sources and government initiatives promoting bio-based alternatives to fossil fuels. Industrial oils, especially soybean and rapeseed derivatives, are extensively utilized in biodiesel production due to their favorable chemical properties and renewability, supporting decarbonization efforts across the transport and energy sectors.

The cosmetics and personal care segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing demand for natural, sustainable, and plant-derived ingredients in beauty and wellness products. Industrial oils, particularly light-grade variants, are increasingly incorporated into skin care, hair care, and personal hygiene formulations for their emollient properties, skin compatibility, and clean-label appeal, driving significant market growth in this sector.

Industrial Oils Market Regional Analysis

- North America dominated the industrial oils market with the largest revenue share of 18% in 2024, driven by strong demand for biofuels, lubricants, and plant-based raw materials across manufacturing, automotive, and chemical industries

- The region benefits from well-established agricultural production, particularly soybean and corn, providing abundant raw materials for industrial oil processing. Additionally, rising environmental concerns and supportive government policies promoting renewable energy sources continue to stimulate market growth

- The presence of key biofuel manufacturers and increasing investment in sustainable industrial applications further strengthens North America's leadership position

U.S. Industrial Oils Market Insight

The U.S. industrial oils market captured the largest revenue share within North America in 2024, supported by large-scale soybean and corn oil production, expanding biofuel consumption, and advancements in oil processing technologies. Government mandates promoting renewable fuel usage, coupled with the rising demand for eco-friendly industrial solutions, position the U.S. as a leading contributor to the global industrial oils market.

Europe Industrial Oils Market Insight

The Europe industrial oils market is projected to grow at a substantial CAGR during the forecast period, fueled by the increasing demand for sustainable, bio-based alternatives in the chemical, cosmetics, and coatings industries. The region's strict environmental regulations, expanding renewable energy initiatives, and growing consumer preference for clean-label products are driving the steady adoption of industrial oils across diverse industrial applications.

Germany Industrial Oils Market Insight

The Germany industrial oils market is expected to witness significant growth, driven by the country’s strong manufacturing base, advanced chemical industry, and emphasis on renewable energy solutions. Rising demand for bio-based lubricants, coatings, and industrial inputs, along with Germany's focus on technological innovation and sustainability, continues to propel market expansion.

U.K. Industrial Oils Market Insight

The U.K. industrial oils market is anticipated to grow steadily during the forecast period, supported by increasing investments in renewable energy, growing demand for bio-based cosmetics and personal care products, and expanding use of sustainable materials in industrial applications. The country’s well-established biofuel sector and focus on environmentally responsible production contribute to rising industrial oil consumption.

Asia-Pacific Industrial Oils Market Insight

The Asia-Pacific industrial oils market is expected to grow at the fastest CAGR from 2025 to 2032, driven by rapid industrialization, rising production of biofuels, and increasing demand for sustainable industrial materials in countries such as China, India, and Indonesia. The region's abundant supply of raw materials such as palm, soybean, and sunflower oils, coupled with expanding manufacturing sectors, supports robust market growth.

China Industrial Oils Market Insight

The China industrial oils market accounted for the largest revenue share within Asia-Pacific in 2024, fueled by the country’s large-scale agricultural production, rapid industrial expansion, and strong demand for renewable energy sources. China's focus on sustainable development, along with its significant palm and soybean oil consumption, drives the increased use of industrial oils across energy, chemical, and personal care sectors.

India Industrial Oils Market Insight

The India industrial oils market is projected to witness remarkable growth during the forecast period, supported by rising biofuel production, growing demand for plant-based raw materials in cosmetics and chemicals, and the country’s expanding industrial base. Government initiatives promoting renewable energy and sustainable industrial practices, along with increasing consumer awareness of eco-friendly products, are key factors fueling the market.

Industrial Oils Market Share

The industrial oils industry is primarily led by well-established companies, including:

- ExxonMobil (U.S.)

- Shell (Netherlands)

- PHILLIPS 66 (U.S.)

- TotalEnergies (France)

- Chevron (U.S.)

- Gazprom (Russia)

- Rosneft (Russia)

- Quaker Houghton Chemical Corp. (U.S.)

- Lukoil (Russia)

- Petronas (Malaysia)

- Bharat Petroleum (India)

- FUCHS PETROLUB SE (Germany)

- Sinopec (China)

- Idemitsu Kosan Co., Ltd (Japan)

- Tide Water Oil Co (I) Ltd (India)

- Castrol (U.K.)

- Panama Petrochem Ltd. (India)

- Gulf Oil Lubricants India Ltd (India)

- Gandhar Oil (India)

- Savita Oil Technologies Ltd (India)

- Apar Industries Ltd. (India)

- Grauer & Weil (India) Limited (India)

- Gold Oil Corporation (India)

- Vinayak Oil (India)

Latest Developments in Global Industrial Oils Market

- In May 2025, Petronas Lubricants International introduced premium insulating oils with Glide Technology and co-branded Tutela Iveco technical fluids in collaboration with Iveco, aimed at strengthening Malaysia’s energy infrastructure and enhancing lubricant performance in commercial vehicles. This strategic launch reinforces the OEM-lubricant partnership in the region and is expected to drive demand for high-performance industrial oils, particularly in the energy and transport sectors

- In April 2024, Shell Lubricants expanded its product portfolio by launching three new variants under the Shell Helix Ultra passenger car motor oil brand, designed to meet upgraded industry standards and evolving OEM requirements. This product introduction enhances engine efficiency and performance, positioning Shell to capture greater market share in the high-performance automotive oils segment and addressing growing consumer demand for advanced engine protection solutions

- In April 2023, Bharat Petroleum announced a $50 million investment in a new facility dedicated to producing bio-based industrial lubricants. Located in Teesside, England, the facility will convert used vegetable oil into lubricants compatible with existing industrial machinery, aiming to enhance sustainability in lubricant manufacturing

- In March 2023, Shell revealed a collaboration with the University of Manchester focused on developing new methods to produce environmentally friendly industrial oils. Their goal is to utilize renewable feedstocks to create oils that maintain compatibility with current industrial machinery, advancing sustainability efforts in lubricant production

- In October 2020, FUCHS Lubritech GmbH expanded its lubricant specialty business by acquiring Welponer SRL in Italy. This acquisition was integrated into its subsidiary, FUCHS Lubrificanti S.P.A., strengthening its market presence and enhancing its capabilities in specialized lubricant solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Oils Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Oils Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Oils Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.