Global Industrial Ethanol Market, By Raw material (Bio Based and Synthetic), Type (Absolute Ethanol, Ethanol 95%, Denatured Ethanol and Others), Application (Paints and Coatings, Pharmaceutical, Food & Beverages, Printing Ink, Agricultural, Household and Industrial Cleaning Solutions, Cosmetics and Personal Care, Adhesives and Others), Country ( U.S., Canada, Mexico, Germany, U.K., Italy, France, Spain, Russia, Turkey, Switzerland, Belgium, Netherlands, rest of Europe, Japan, China, South Korea, India, Australia and New Zealand, Singapore, Thailand, Indonesia, Malaysia, Philippines, rest of Asia-Pacific, Brazil, Argentina, rest of South America, South Africa, Egypt, Saudi Arabia, United Arab Emirates, Israel and rest of Middle East and Africa) - Industry Trends and Forecast To 2030.

Industrial Ethanol Market Analysis and Size

Industrial ethanol is a colorless organic solvent obtained by both traditional fermentation and other synthetic methods. It is highly inflammable and requires specialized storage conditions. Further, it finds widespread application in several industries such as paints and coatings, cosmetics and personal care, automotive, and several others. Recently, the demand for industrial ethanol rose globally due to its widespread application as a biofuel, which is preferred in several countries such as U.S., and Brazil, among several others. The increase in the use of ethanol as marine fuel is one of the factors driving market expansion.

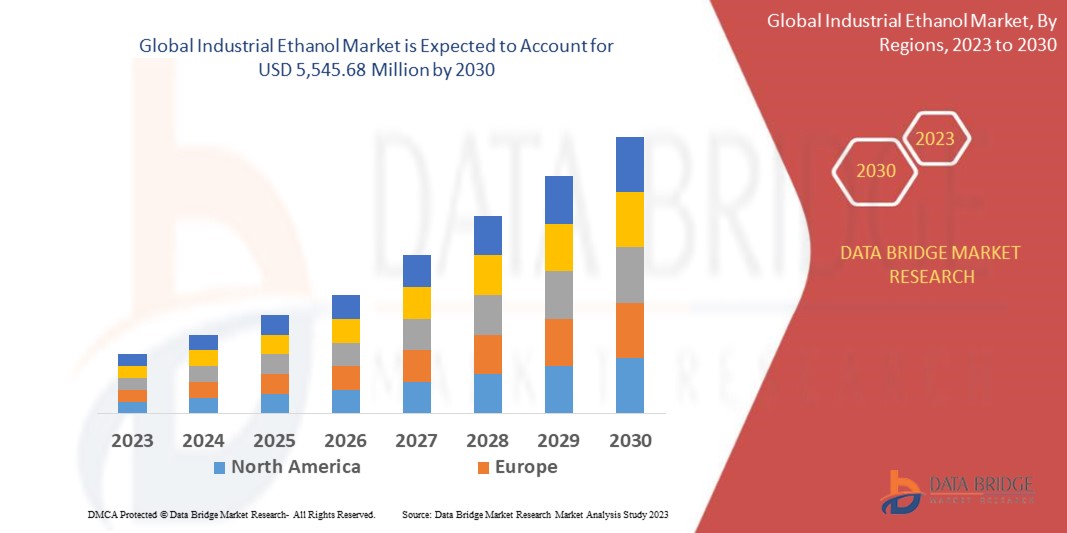

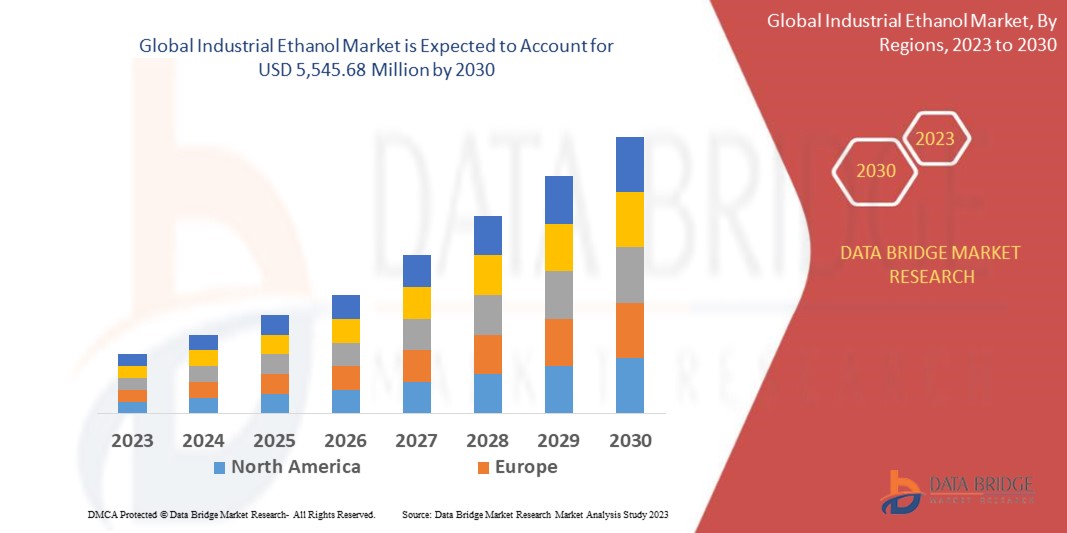

Data Bridge Market Research analyses that the Global Industrial Ethanol Market which was USD 3,361.98 million in 2022, would rocket up to USD 5,545.68 million by 2030, and is expected to undergo a CAGR of 6.2% during the forecast period of 2023 to 2030. The bio based segment is expected to dominate the market globally due to the abundant availability of raw materials and ease of production. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, pipeline analysis, pricing analysis, and regulatory framework.

Industrial Ethanol Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Thousand, Volumes in Tons, Pricing in USD

|

|

Segments Covered

|

By Raw material (Bio Based and Synthetic), Type (Absolute Ethanol, Ethanol 95%, Denatured Ethanol and Others), Application (Paints and Coatings, Pharmaceutical, Food & Beverages, Printing Ink, Agricultural, Household and Industrial Cleaning Solutions, Cosmetics and Personal Care, Adhesives and Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, U.K., Italy, France, Spain, Russia, Turkey, Switzerland, Belgium, Netherlands, rest of Europe, Japan, China, South Korea, India, Australia and New Zealand, Singapore, Thailand, Indonesia, Malaysia, Philippines, rest of Asia-Pacific, Brazil, Argentina, rest of South America, South Africa, Egypt, Saudi Arabia, United Arab Emirates, Israel and rest of Middle East and Africa.

|

|

Market Players Covered

|

Alto Ingredients, Inc.(U.S.), ADM, Bunge North America, Inc. (a subsidiary of Bunge Limited) (U.S.), Envien Group ( Slovakia), ,Calgren Renewable Fuels, LLC (U.S.), INEOS (U.K), Cargill, Incorporated, LyondellBasell Industries Holdings B.V.(Netherlands) Mitsubishi Chemical Corporation (Japan), Valero (U.S.), Flint Hills Resources (U.S.), Sasol ( Johannesburg), CropEnergies AG ( Germany), The Andersons, Inc. (U.S.), BASF SE (Germany)

|

|

Market Opportunities

|

|

Market Definition

Industrial ethanol is a highly dependent solvent vital in laboratories, households, and vehicles alike. The global industrial ethanol market is a rapidly booming market since its applications stretch over several industrial segments. The respective market is highly consolidated, and the trends experienced in the market depend on various factors.

The major restraint that affects the demand of the global industrial ethanol market is the rise in adverse environmental impact of ethanol production and the large-scale water requirement for ethanol production. Further, industrial ethanol in personal care products results in dry skin and hair loss also restraints the respective market’s growth. The major opportunities for the global industrial ethanol market are the growth in the renovation construction industry around the globe and the advents associated with greener ethyl alcohol sources. The increase in the use of ethanol as marine fuel also promotes the market growth. Some of the significant drivers related to the respective market are the increase in demand for the industrial ethanol product as an octane enhancer and ethanol as fuel in automobiles and vehicles. The increased usage of industrial ethanol in hand sanitizers and antibacterial products in the pandemic scenario is also expected to drive the global industrial ethanol market.

Global Industrial Ethanol Market Dynamics

Drivers

-

INCREASE IN THE GLOBAL TRADE OF ALCOHOL

The history of consumption of alcoholic beverages late back to 5400-5000 BC and is still one of the major social activities in many a culture. Although the sales and production of alcohol are regulated by governments worldwide, the consumption and liquor trade witnessed a constant increase over the past years. Furthermore, the lockdown associated with COVID-19 further boosted this sale as most people were confined within their houses. Therefore, many people consider the consumption of alcohol as an option to cope up and entertain them. However, this perpetual increase in the global trade of alcohol acts as a driver for the global industrial ethanol market as ethanol is the primary ingredient in these alcoholic beverages.

-

EFFECTIVE USE OF INDUSTRIAL ETHANOL IN THE PAINTS AND COATING INDUSTRY

The paints and coating industry is one of the fastest-growing markets globally and is backed by the rapid constructional developments that signify the paradigm shift in society. As a result of this rapid enlargement of the paints and coating industry, the effective utilization of industrial ethanol in this respective industry is considered one of the major market drivers for the global industrial ethanol market.

Opportunities

-

GROWING RENOVATION CONSTRUCTION INDUSTRY AROUND THE GLOBE

The renovation construction industry is one of the most prominent and upcoming industries worldwide, witnessing colossal market growths. Although the COVID-19 pandemic retracted this experienced market growth of the renovation construction industry in the past two years, the respective sector is expected to grow substantially in the upcoming years. Additionally, the growth in the renovation construction industry around the globe is considered as an opportunity for the global industrial ethanol market since the renovation construction industry requires an enormous amount of paints and coating, whose manufacturing requires an extensive amount of ethanol.

-

INCREASING ADVENT OF GREENER ETHYL ALCOHOL SOURCES

Ethyl alcohol or ethanol is a renewable and sustainable fuel primarily produced from biomasses such as corn, sugar cane and similar plant materials high in carbohydrates. Ethanol is gaining substantial popularity throughout the world, particularly in the U.S., as 98% of gasoline in the U.S. contains some amount of ethanol. The increasing advent of greener sources of ethanol could be considered an opportunity for the global industrial ethanol market. It would result in an increment in production, thereby boosting the respective industrial ethanol market revenue.

Restraints/Challenges

-

RISING ADVERSE ENVIRONMENTAL IMPACT OF ETHANOL PRODUCTION

The production of ethanol resulted in the emission of carbon dioxide (CO2) into the atmosphere. Carbon dioxide is a greenhouse gas that causes global warming, forms harmful ground-level ozone and smog. In addition, some ethanol production companies burn coal and natural gas as heat sources in the fermentation process which eventually results in the production of CO2 gas, which has hazardous effects on the environment. Ethanol is often considered a green fuel and low-cost alternative to gasoline. However, the industrial corn from which ethanol is produced still hurts the environment differently. Growing corn for ethanol involves a large amount of synthetic fertilizer and herbicide and insectoids. Naturally, corn production consists of the release of hazardous materials and chemicals that directly impact the environment. In addition, corn production causes more total soil erosion than any other crop. Recent research addresses that ethanol production from corn requires 29% more energy than ethanol can generate. All these factors degrade the environmental conditions and contribute to water pollution and air pollution.

-

FLUCTUATION IN THE PRICE OF RAW MATERIALS

The raw materials from which ethanol is produced include grains and crops with high starch and sugar content, such as corn, barley, sugar cane and sugar beets. Ethanol can also be made from grasses, trees and agricultural and forestry residues such as corn cobs and stocks, rice straw, sawdust and wood chips. As far as the prices of ethanol are considered, it depends on a variety of different factors. The main types are the type of feed used in the process, plant capacity and final product quality. In addition, types of carbohydrates contained in the meal (sugars, starch or lignocelluloses) affect the final price of ethanol. The prices of raw materials are influenced by different factors nowadays. Most industries are using corn and sugar cane as primary raw materials to prepare ethanol.

Recent Development

-

In April 2021, Sasol formed a partnership with Toyota South Africa Motors (TSAM) for the development and exploration of a green hydrogen-based mobility ecosystem in South Africa. The partnership will combine the experiences of both the companies such as the experience of Sasol regarding the production and use of grey hydrogen along with TASM’s experience with zero-emission hydrogen fuel cell vehicles. The company expects to fulfill its goal to create a sustainable and green economy along with improving its revenue and sales with this partnership.

-

In March 2020, CropEnergies AG announced that it will partially switch its focus regarding the production of fuel ethanol to the production of pure ethanol due to a surge in demand for disinfectants. The company expects to improve its pure ethanol sales and overall revenue with this production expansion.

Global Industrial Ethanol Market Scope

The Global Industrial Ethanol Market is segmented on the basis of raw material, type, application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

RAW MATERIAL

- BIO BASED

- SYNTHETIC

TYPE

- ETHANOL 95%

- ABSOLUTE ETHANOL

- DENATURED ETHANOL

- OTHERS

APPLICATION

- COSMETICS AND PERSONAL CARE

- FOOD AND BEVERAGES

- PHARMACEUTICAL

- AGRICULTURAL

- PAINTS AND COATINGS

- HOUSEHOLD AND INDUSTRIAL CLEANING SOLUTIONS

- ADHESIVES

- PRINTING INK

- OTHERS

Global Industrial Ethanol Market Regional Analysis/Insights

The Global Industrial Ethanol Market is analysed and market size insights and trends are provided by raw material, type, application as referenced above.

The countries covered in the Global Industrial Ethanol Market report are U.S., Canada, Mexico, Germany, U.K., Italy, France, Spain, Russia, Turkey, Switzerland, Belgium, Netherlands, rest of Europe, Japan, China, South Korea, India, Australia and New Zealand, Singapore, Thailand, Indonesia, Malaysia, Philippines, rest of Asia-Pacific, Brazil, Argentina, rest of South America, South Africa, Egypt, Saudi Arabia, United Arab Emirates, Israel and rest of Middle East and Africa.

North America is expected to dominate due to the large population large-scale production, and abundant availability of raw materials.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Global Industrial Ethanol industry growth and new technology penetration

The Global Industrial Ethanol Market also provides you with detailed market analysis for every country growth in nucleating and clarifying agents industry, installed new production plant, impact of technology using life line curves and changes in regulatory scenarios and their impact on the global environmental testing market. The data is available for historic period 2015-2020.

Competitive Landscape and Global Industrial Ethanol Market Share Analysis

The Global Industrial Ethanol Market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to nucleating and clarifying agents market.

Some of the major players operating in the Global Industrial Ethanol Market are:

- Alto Ingredients, Inc.(U.S.)

- ADM, Bunge North America, Inc. (a subsidiary of Bunge Limited) (U.S.)

- Envien Group ( Slovakia)

- ,Calgren Renewable Fuels, LLC (U.S.)

- INEOS (U.K)

- Cargill, Incorporated

- LyondellBasell Industries Holdings B.V.(Netherlands)

- Mitsubishi Chemical Corporation (Japan)

- Valero (U.S.)

- Flint Hills Resources (U.S.)

- Sasol ( Johannesburg)

- CropEnergies AG ( Germany)

- The Andersons, Inc. (U.S.)

- BASF SE (Germany)

SKU-