Global Industrial Automation Market

Market Size in USD Billion

CAGR :

%

USD

196.94 Billion

USD

372.70 Billion

2024

2032

USD

196.94 Billion

USD

372.70 Billion

2024

2032

| 2025 –2032 | |

| USD 196.94 Billion | |

| USD 372.70 Billion | |

|

|

|

|

Industrial Automation Market Size

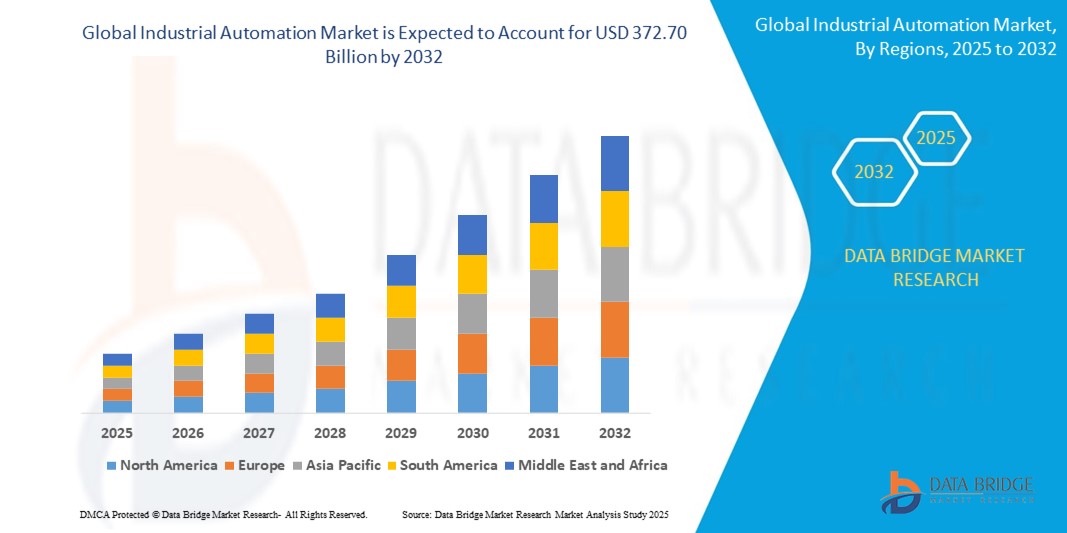

- The global industrial automation market size was valued at USD 196.94 billion in 2024 and is expected to reach USD 372.70 billion by 2032, at a CAGR of 8.30% during the forecast period

- This growth is driven by factors such as the increase in demand for automation in various industries, advancements in technologies such as artificial intelligence (AI), machine learning (ML), and robotics, and the need for efficient and cost-effective manufacturing processes

Industrial Automation Market Analysis

- The industrial automation market is experiencing rapid growth, with significant investments in advanced technologies and increased adoption across various sectors. As industries focus on improving operational efficiency, the demand for automation systems is intensifying

- The market is highly competitive, with key players constantly innovating and introducing new solutions. Companies are collaborating with technology providers to enhance their product offerings and cater to the evolving needs of customers

- North America is expected to dominate the Industrial Automation market due to its advanced technological infrastructure, high adoption of automation across various industries, and strong support for smart manufacturing initiatives

- Asia-Pacific is expected to be the fastest growing region in the Industrial Automation market during the forecast period due to rapid industrialization, increasing demand for advanced manufacturing technologies, and significant investments in automation solutions

- The sensors segment is expected to dominate the industrial automation market with the largest share of 39.1% in 2025 due to its crucial role in enabling real-time monitoring, precision control, and data-driven decision-making across industrial processes

Report Scope and Industrial Automation Market Segmentation

|

Attributes |

Industrial Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Industrial Automation Market Trends

“Adoption of Artificial Intelligence and Machine Learning in Industrial Automation”

- Artificial intelligence and machine learning are becoming essential in industrial automation, allowing for smarter and more efficient operations

- AI and ML enable predictive maintenance, reducing downtime by predicting potential failures before they occur

- For instance, GE uses AI to predict equipment failures in real-time, minimizing unplanned downtime across its manufacturing plants

- These technologies enhance production quality by enabling automated quality control systems that detect defects and anomalies during manufacturing processes

- For instance, Tesla uses AI to inspect vehicle parts and ensure quality standards are met with precision

- Automation systems powered by AI and ML can adapt and learn from operational data, improving over time for better resource management

- For instance, Siemens has implemented AI to optimize its factory processes, improving overall productivity

- The integration of AI and ML with robotics is improving overall production flexibility, making it easier to reprogram machines for different tasks, ultimately enhancing efficiency and reducing the need for manual intervention

Industrial Automation Market Dynamics

Driver

“Growing Demand for Operational Efficiency”

- Rising global competition and customer expectations are pushing industries to enhance productivity, minimize errors, and reduce operational downtime. Automation technologies help meet these demands effectively

- For instance, Toyota’s implementation of robotic arms in assembly lines has drastically reduced error margins and cycle times

- Advanced tools such as robotics, PLCs, DCS, and AI-based systems streamline operations by reducing manual intervention, especially in repetitive and hazardous tasks, while ensuring production consistency

- For instance, In the pharmaceutical industry, Pfizer utilizes automation to handle sterile manufacturing environments, improving safety and precision

- Automation enables real-time data collection and analytics, empowering organizations to make quicker, data-driven decisions for better operational control and planning

- Lean manufacturing practices benefit significantly from automation, as it helps eliminate waste, optimize workflows, and maintain continuous production flow with fewer resources

- With rising labor costs and scarcity of skilled workers, especially in developed economies such as Germany and Japan, automation offers a sustainable alternative by ensuring scalability, enhanced safety, and reduced dependency on human labor

Opportunity

“Integration of Internet of Things (IoT) with Automation”

- IoT-enabled systems create a smart, interconnected manufacturing environment by linking machines, devices, sensors, and control systems—also known as the Industrial Internet of Things (IIoT)

- For instance, General Electric’s Predix platform uses IIoT to collect real-time data across manufacturing plants, improving asset performance and reducing failures

- Real-time insights enable predictive maintenance and remote monitoring, helping companies move from reactive to proactive maintenance, reducing downtime and extending machine lifespan

- For instance, Siemens uses IoT-enabled sensors in its turbines to detect component stress and schedule maintenance before failures occur

- IoT integration enhances supply chain visibility, quality control, and energy efficiency, leading to smarter decision-making and operational excellence

- Cloud and edge computing strengthen automation by enabling scalable data storage and processing, ensuring fast response times and higher productivity in distributed environments

- Industries such as oil & gas, manufacturing, logistics, and utilities are especially positioned to benefit from IoT integration, as it supports agile, adaptive operations in alignment with Industry 4.0 initiatives and smart factory trends

Restraint/Challenge

“High Initial Investment Costs”

- The deployment of industrial automation systems involves high upfront costs, including expenses for robotics, control systems, IoT infrastructure, installation, training, and integration

- For instance, a report by Deloitte noted that a full-scale smart factory transformation can exceed USD 1 million per plant, a steep entry point for many manufacturers

- Small and medium-sized enterprises (SMEs) face greater difficulty justifying the investment, as limited budgets make it harder to absorb these costs despite potential long-term ROI

- Upgrading from legacy systems often leads to operational disruptions and downtime, which may temporarily reduce productivity and revenue during the transition period

- For instance, an Indian textile SME delayed automation after facing a 3-week production halt during initial PLC system integration

- Customization of automation solutions to fit specific industry needs further increases expenses, especially when factoring in workforce training, tailored software, and integration with existing processes

- Additional hidden costs such as cybersecurity, regulatory compliance, and data infrastructure also deter adoption, particularly in developing countries with limited access to advanced technology and financing solutions

Industrial Automation Market Scope

The market is segmented on the basis of components, mode of automation, systems, solution, type, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Components |

|

|

By Mode of Automation |

|

|

By Systems |

|

|

By Solution |

|

|

By Type |

|

|

By End User |

|

In 2025, the sensors is projected to dominate the market with a largest share in component segment

The sensors segment is expected to dominate the industrial automation market with the largest share of 39.1% in 2025 due to its crucial role in enabling real-time monitoring, precision control, and data-driven decision-making across industrial processes.

The distributed control system is expected to account for the largest share during the forecast period in solution market

In 2025, the distributed control system segment is expected to dominate the market with the largest market share of 35.5% due to its widespread use in controlling complex and large-scale industrial operations

Industrial Automation Market Regional Analysis

“North America Holds the Largest Share in the Industrial Automation Market”

- North America is projected to dominate the industrial automation market, holding the largest market share of approximately 41.3%

- The region's dominance is attributed to its robust manufacturing infrastructure and early adoption of advanced technologies, including robotics, sensors, and industrial IoT solutions

- Industries such as automotive, electronics, food & beverages, and oil & gas have significantly boosted automation demand in the U.S. and Canada

- Government initiatives such as Industry 4.0 have focused on digitizing manufacturing processes, enhancing efficiency and productivity across sectors

- Major companies have invested heavily in upgrading plants with the latest automation technologies, ensuring North America's leading position in the global market

“Asia-Pacific is Projected to Register the Highest CAGR in the Industrial Automation Market”

- Asia-Pacific is anticipated to be the fastest-growing region in the industrial automation market

- Rapid industrialization and urbanization in countries such as China, India, and Japan are driving the adoption of automation technologies across various industries

- Government initiatives such as China's "Made in China 2025" and India's "Make in India" are promoting advanced manufacturing and automation adoption

- The region is witnessing significant investments in smart factories and the integration of AI, IoT, and robotics into manufacturing processes

- Asia-Pacific's expanding industrial base and focus on technological innovation position it as a key growth driver in the global industrial automation landscape

Industrial Automation Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Siemens AG (Germany)

- Analog Devices, Inc. (U.S.)

- Schneider Electric SE (France)

- General Electric Company (U.S.)

- Mitsubishi Electric Corporation (Japan)

- FANUC America Corporation (U.S.)

Latest Developments in Global Industrial Automation Market

- In July 2021, Rockwell Automation formed a strategic partnership with Kezzler AS to enhance product traceability through digital supply chain solutions. This development integrates Kezzler’s serialization and traceability platform with Rockwell’s automation expertise. The partnership aims to improve supply chain transparency, safety, and compliance across industries such as food, beverage, and life sciences. It is expected to boost demand for digital traceability solutions, strengthening Rockwell's position in the industrial automation market

- In April 2021, Siemens and SAP expanded their partnership to deliver intelligent service and asset lifecycle management solutions. By integrating Siemens’ Xcelerator portfolio with SAP’s Intelligent Asset Management, the collaboration aims to improve asset performance and operational efficiency. This solution helps companies reduce downtime and shorten design cycles, providing real-time insights across the entire asset lifecycle. It is expected to drive digital transformation and enhance competitiveness in the industrial sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Industrial Automation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Industrial Automation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Industrial Automation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.