Global Indoor Positioning And Navigation System Market

Market Size in USD Billion

CAGR :

%

USD

32.18 Billion

USD

338.50 Billion

2024

2032

USD

32.18 Billion

USD

338.50 Billion

2024

2032

| 2025 –2032 | |

| USD 32.18 Billion | |

| USD 338.50 Billion | |

|

|

|

|

Indoor Positioning and Navigation System Market Size

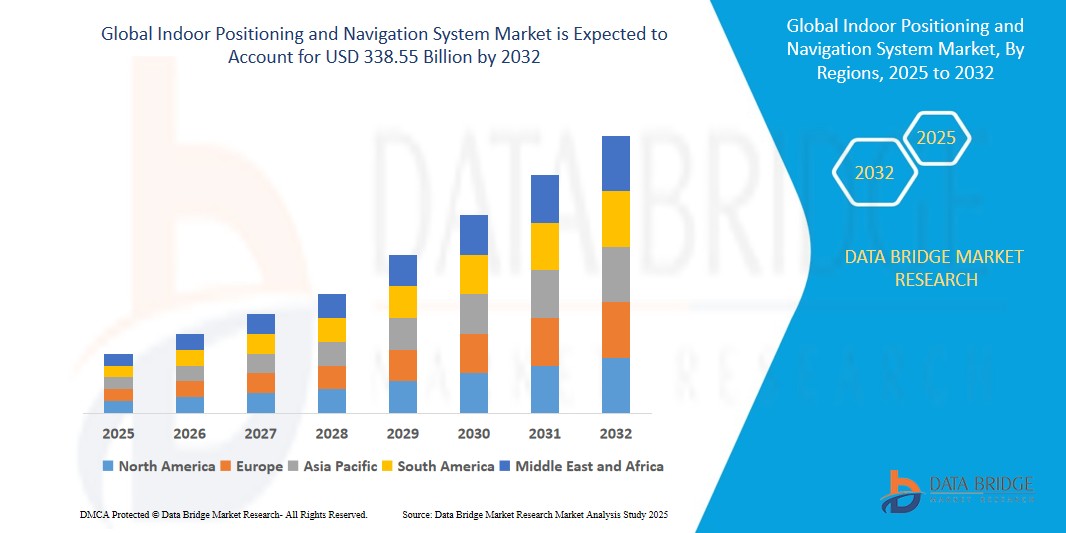

- The global Indoor Positioning and Navigation System market size was valued at USD 32.18 billion in 2024 and is expected to reach USD 338.55 billion by 2032, at a CAGR of 34.20% during the forecast period

- Market growth is largely driven by the proliferation of IoT devices, location-based services, and smart infrastructure initiatives across sectors such as healthcare, retail, manufacturing, and logistics. The increasing deployment of IPNS solutions in complex indoor environments—like shopping malls, airports, hospitals, and industrial plants—underscores their critical role in asset tracking, personnel monitoring, and spatial analytics.

- Additionally, the rise in demand for real-time location systems (RTLS) for inventory and workforce management, particularly post-pandemic, is propelling adoption. Innovations in Bluetooth Low Energy (BLE), Ultra-Wideband (UWB), Wi-Fi RTT, and geomagnetic positioning are significantly improving the accuracy and efficiency of indoor positioning systems, further accelerating market penetration.

Indoor Positioning and Navigation System Market Analysis

- Indoor Positioning and Navigation Systems are becoming critical enablers of smart infrastructure across sectors such as retail, healthcare, logistics, and manufacturing, owing to their ability to deliver real-time tracking, navigation, and location-based services within complex indoor environments. Their integration with IoT networks and facility management systems enhances operational efficiency, asset management, and user experience

- The market growth is largely propelled by the adoption of smart building technologies and the increasing demand for RTLS (Real-Time Location Systems) to optimize indoor navigation, asset tracking, and safety in large facilities. Applications in patient tracking in hospitals, inventory monitoring in warehouses, and personalized in-store experiences in retail are among the key drivers

- North America dominates the Indoor Positioning and Navigation System market, holding the largest revenue share of over 40.01% in 2025, supported by the early adoption of digital infrastructure, strong technological ecosystem, and the presence of industry leaders such as Cisco Systems, Apple Inc., and Microsoft. The U.S. market continues to lead innovation through the integration of BLE beacons, UWB, and AI-powered analytics in smart commercial spaces and public venues

- Asia-Pacific is expected to be the fastest-growing region in the market during the forecast period, fueled by rapid urbanization, digital transformation policies, and a surge in smart city projects. Countries such as China, Japan, South Korea, and India are investing heavily in connected infrastructure and indoor mapping solutions to enhance transportation, retail, and healthcare environments

- The Bluetooth Low Energy (BLE) technology segment is projected to dominate the market due to its cost-efficiency, low power consumption, and compatibility with most consumer devices. BLE-based positioning is becoming the standard for large-scale indoor navigation deployments in shopping malls, airports, and corporate offices

Report Scope and Indoor Positioning and Navigation System Market Segmentation

|

Attributes |

Indoor Positioning and Navigation System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Indoor Positioning and Navigation System Market Trends

“Enhanced Convenience Through AI and Voice Integration”

- A major trend reshaping the global Indoor Positioning and Navigation System market is the integration of artificial intelligence (AI) and voice assistant technologies such as Amazon Alexa, Google Assistant, and Apple HomeKit, leading to smarter and more intuitive navigation and access solutions

- In October 2023, Apple enhanced its Find My Indoor Location features using Ultra-Wideband (UWB) and AI-powered algorithms to improve precision location services within indoor environments, particularly useful in malls, airports, and event venues.

- Similarly, Cisco Meraki updated its Wi-Fi 6 access points in August 2023 to support enhanced indoor location services using AI, allowing retailers and healthcare providers to track people and assets with higher accuracy

- In June 2023, Zebra Technologies launched its MotionWorks Enterprise Edge platform, integrating AI-powered indoor location tracking with real-time analytics for large warehouses and manufacturing environments, allowing predictive movement tracking and asset utilization

- The trend of AI-augmented Indoor Positioning Systems (IPS) allows predictive location awareness and pattern recognition, which in commercial settings improves customer engagement, while in healthcare it supports efficient staff and equipment management.

- Integration with smart assistants enables seamless voice commands for navigation assistance and real-time indoor directions — a feature being adopted in smart buildings and campuses. Companies such as Mapwize (acquired by Mappedin in 2023) are developing AI-integrated navigation platforms for enterprise clients with built-in voice control and automated path suggestions

Indoor Positioning and Navigation System Market Dynamics

Driver

“Growing Need Due to Rising Security Concerns and Smart Infrastructure Adoption”

- The global surge in smart city projects and connected infrastructure is a key driver fueling demand for Indoor Positioning and Navigation Systems across public safety, retail, healthcare, and logistics sectors

- In November 2023, Siemens collaborated with the City of Vienna to deploy an AI-powered indoor navigation solution in public transit hubs as part of its smart city initiative, helping passengers with disabilities navigate complex facilities

- In July 2023, Honeywell partnered with Hospital Israelita Albert Einstein in Brazil to integrate indoor positioning with hospital infrastructure for patient flow and asset tracking, aimed at improving operational efficiency and security

- Indoor positioning technologies are also increasingly being integrated with access control systems to enhance building security. In April 2024, Onity (a Honeywell company) advanced its IoT-based Passport locking solution for secure indoor asset tracking in self-storage environments

- Furthermore, the boom in contactless and remote-access technologies post-COVID-19 continues to drive the market, as businesses seek scalable, secure, and user-friendly indoor navigation solutions that can integrate with mobile devices and enterprise platforms

Restraint/Challenge

“Concerns Regarding Cybersecurity and Integration Costs”

- Cybersecurity remains a pressing concern for Indoor Positioning and Navigation Systems, especially those integrated with smart building or healthcare data infrastructure. Vulnerabilities in connected systems may expose sensitive location and behavioral data.

- For example, in September 2023, a cybersecurity audit of hospital IoT systems by Kaspersky found that improperly secured indoor location systems could allow third-party manipulation of asset location data, highlighting the need for encrypted protocols.

- Moreover, the cost and complexity of integrating IPS with legacy infrastructure — particularly in older buildings or low-budget public institutions — remains a significant barrier.

- In February 2023, a report from ABI Research noted that while BLE and Wi-Fi-based systems are becoming more affordable, UWB and AI-enhanced systems still require substantial upfront investment, limiting adoption in price-sensitive sectors.

- Companies are responding with modular systems and open APIs. For instance, Navigine’s 2023 platform update emphasized SDK-based integration for hospitals and malls, reducing deployment cost and complexity. Still, consumer education and standardization will be crucial for addressing cybersecurity risks and enabling broader market growth

Indoor Positioning and Navigation System Market Scope

The market is segmented on the basis component, deployment mode, application, vertical, device, platform and technology.

• By Component

The Indoor Positioning and Navigation System market is segmented into technology, software tools, and services.

The technology segment dominated the market in 2024 due to the rising adoption of advanced sensors, BLE beacons, UWB modules, and geolocation frameworks powering real-time positioning and indoor navigation.

Recent developments such as Cisco’s launch of enhanced BLE-enabled wireless access points in 2023 have further improved positioning accuracy, boosting technology demand.

The software tools segment is projected to grow at the fastest rate between 2025 and 2032, fueled by the increasing demand for indoor mapping platforms, data analytics, and location-aware applications. Companies like Esri and IndoorAtlas are actively investing in AI-driven indoor location software for diverse sectors.

Services such as system integration, consulting, and support are crucial in large-scale enterprise deployments, especially in transportation hubs and healthcare facilities.

• By Deployment Mode

The market is bifurcated into cloud and on-premises.

The cloud segment held the largest market share in 2024 due to growing demand for scalable, remote-accessible indoor navigation systems integrated with real-time analytics and cloud-based dashboards.

For example, in February 2024, Cisco Meraki expanded cloud support for indoor positioning across educational and retail institutions.

The on-premises segment remains relevant in applications requiring data control and security compliance, such as government and defense infrastructure, where sensitive location data must remain on-site.

• By Application

The market is segmented into sales and marketing optimization, customer experience management, remote monitoring, inventory management, predictive asset analytics, risk management, and emergency response management.

Customer experience management held the largest share in 2024, driven by the retail and hospitality sectors leveraging indoor navigation to improve visitor journeys, queue management, and targeted promotions.

In October 2023, Mappedin announced a new partnership with shopping malls in Canada to enhance indoor wayfinding and engagement.

Inventory management and predictive asset analytics are expected to grow rapidly due to strong adoption in logistics, warehousing, and manufacturing, where real-time asset visibility reduces costs and increases efficiency.

Emergency response management is gaining traction across public buildings and airports, enabling quicker personnel deployment and optimized evacuation routes.

• By Vertical

The market is segmented into retail, transportation, entertainment, hospitality, and public buildings.

The retail segment led the market in 2024, fueled by the deployment of indoor maps, navigation, and heatmaps to improve operational efficiency and marketing effectiveness.

For instance, in March 2024, Zebra Technologies deployed indoor tracking for inventory and shopper behavior at a large U.S. supermarket chain.

The transportation and hospitality sectors are projected to see the fastest growth through 2032 due to rising investments in traveler navigation, baggage tracking, and seamless guest experience.

Entertainment venues and public buildings like museums and hospitals are also adopting indoor positioning to assist visitors, track resources, and enable inclusive accessibility solutions.

• By Device

The market is segmented into software, hardware, and services.

Hardware dominated the market in 2024, owing to extensive deployment of sensors, BLE beacons, and RFID tags enabling real-time indoor tracking.

Services are essential for large installations and system lifecycle management, especially in complex environments like airports or smart hospitals.

The software segment is projected to experience robust growth due to increasing demand for location intelligence, map rendering, route optimization, and analytics.

• By Platform

The market is segmented into Android and iOS.

The Android platform held a larger share in 2024, supported by the high global penetration of Android smartphones and wide OEM support for BLE and location APIs.

However, iOS is expected to grow steadily due to superior indoor mapping frameworks like Apple’s Indoor Maps and tight integration with Apple devices, which appeals to users in developed markets.

In 2023, Apple expanded its indoor positioning capabilities in airports and malls across the U.S., driving growth in iOS-specific indoor navigation solutions.

• By Technology

The market is segmented into Ultra-Wideband (UWB), Bluetooth Low Energy (BLE), and Wi-Fi.

Bluetooth Low Energy (BLE) held the largest market share in 2024 due to its widespread use in retail, healthcare, and hospitality for indoor positioning at a low cost and low energy consumption.Ultra-Wideband (UWB) is projected to grow at the fastest CAGR from 2025 to 2032, particularly in applications requiring high-precision tracking such as logistics, robotics, and emergency services.In September 2023, Apple’s UWB-based U1 chip was utilized in location-sharing and AirTag tracking, showcasing the growing consumer use case of this technology.

Wi-Fi-based systems continue to see adoption due to their broad infrastructure footprint and integration with enterprise access points.

Indoor Positioning and Navigation System Market Regional Analysis

- North America dominates the Indoor Positioning and Navigation System market with the largest revenue share of 40.01% in 2024, primarily driven by the rapid adoption of indoor tracking solutions across sectors such as retail, healthcare, and transportation.

- The region benefits from a strong technological infrastructure, presence of leading solution providers like Cisco, Apple, and Zebra Technologies, and widespread implementation of IoT-based indoor analytics.

- Additionally, growing investments in smart buildings and the need for real-time asset and personnel tracking are further fueling the market's expansion across both public and private sectors..

U.S. Indoor Positioning and Navigation System Market Insight

The U.S. accounted for the largest revenue share of 81% in the North American market in 2025, driven by extensive deployment of indoor mapping and navigation technologies in airports, shopping malls, and hospitals. Government initiatives like the Infrastructure Investment and Jobs Act and smart city projects are bolstering demand. Moreover, increasing use of indoor positioning for emergency response, visitor analytics, and predictive maintenance in commercial buildings is accelerating the adoption of both BLE- and UWB-based solutions.

Europe Indoor Positioning and Navigation System Market Insight

The European Indoor Positioning and Navigation System market is projected to grow at a substantial CAGR throughout the forecast period, propelled by stringent regulations on building safety and the increasing implementation of smart infrastructure projects.Countries across Europe are focusing on enhancing indoor navigation for public safety, accessibility, and efficient resource utilization, particularly in transportation terminals, universities, and hospitals. The adoption of GDPR-compliant indoor tracking and data anonymization technologies is making indoor systems more favorable among European users.

U.K. Indoor Positioning and Navigation System Market Insight

The U.K. market is expected to grow significantly, fueled by the increasing adoption of digital technologies in retail and logistics. The emergence of smart retail environments and demand for enhanced customer navigation and location-based marketing is boosting market uptake. Public institutions are also integrating indoor positioning into heritage sites and museums to deliver enhanced visitor experiences.

Germany Indoor Positioning and Navigation System Market Insight

Germany’s Indoor Positioning and Navigation System market is expanding due to its strong focus on industry digitization (Industrie 4.0) and smart building solutions. Indoor tracking and asset management tools are increasingly integrated into manufacturing floors and commercial real estate. German enterprises are particularly inclined towards eco-conscious and privacy-focused indoor navigation tools that align with national regulations and sustainable construction practices.

Asia-Pacific Indoor Positioning and Navigation System Market Insight

Asia-Pacific is projected to grow at the fastest CAGR of over 24% in 2025, owing to rapid urbanization, increasing smart city initiatives, and mass adoption of connected devices across China, India, and Southeast Asia. Public infrastructure upgrades—particularly in airports, shopping centers, and public transportation systems—are driving demand for precise indoor positioning. The presence of regional tech giants like Alibaba Cloud, Xiaomi, Huawei, and Samsung, and the availability of low-cost components, makes APAC a high-volume and cost-competitive market.

Japan Indoor Positioning and Navigation System Market Insight

Japan’s high-tech ecosystem supports growing adoption of Indoor Positioning and Navigation Systems in smart buildings, hospitals, and elderly care facilities. The demand is particularly strong in multi-functional buildings, where navigation and emergency preparedness are key concerns. Japan’s leadership in robotics and automation is also contributing to the integration of indoor navigation in logistics and warehouse management.

China Indoor Positioning and Navigation System Market Insight

China accounted for the largest share of the Asia-Pacific Indoor Positioning and Navigation System market in 2025. This is attributed to the country's aggressive digitalization strategy, growth in e-commerce infrastructure, and adoption of BLE- and UWB-based tracking in mega malls, warehouses, and airports. Massive investments in smart city projects, such as Xiong’an New Area, are also creating new opportunities for indoor mapping, security navigation, and people-flow optimization solutions.

Indoor Positioning and Navigation System Market Share

The Indoor Positioning and Navigation System industry is primarily led by well-established companies, including:

- Apple, Inc. (U.S.)

- Google LLC (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Broadcom, Inc. (U.S.)

- HERE Technologies (Netherlands)

- IndoorAtlas (Finland)

- Senion AB (Sweden)

- Pointr Limited (U.K.)

- Zebra Technologies Corporation (U.S.)

Latest Developments in Global Indoor Positioning and Navigation System Market

- In April 2024, Zebra Technologies announced the enhancement of its MotionWorks Enterprise platform by integrating real-time indoor tracking capabilities for improved workforce efficiency and asset visibility. The update allows users in manufacturing, healthcare, and logistics sectors to leverage Bluetooth Low Energy (BLE) and Ultra-Wideband (UWB) technologies for precise indoor positioning, streamlining operations and enhancing safety protocols across facilities. This development reinforces Zebra’s leadership in enterprise-level indoor navigation and RTLS (Real-Time Location Systems).

- In March 2024, Esri introduced Indoor Viewer 2.0, a significant update to its ArcGIS Indoors solution, enabling more interactive indoor mapping and real-time tracking in complex buildings such as airports, hospitals, and corporate campuses. This upgrade includes features like real-time wayfinding, emergency routing, and occupancy analytics, aimed at improving space management and operational efficiency. Esri's continual innovation supports growing demand in public infrastructure and smart building projects worldwide.

- In January 2024, Apple Inc. expanded its Indoor Maps service to include additional airports, malls, and transit hubs across Europe and Asia. These maps offer turn-by-turn indoor navigation for iOS users, leveraging Wi-Fi and Bluetooth beacons for real-time accuracy. Apple’s continued roll-out of indoor mapping through its native platforms reinforces its role in consumer-grade indoor positioning and contributes to the standardization of indoor navigation experiences.

- In December 2023, HERE Technologies partnered with Infsoft GmbH to integrate indoor positioning capabilities into HERE’s Location Services platform. The collaboration combines HERE’s mapping engine with Infsoft’s BLE beacon and sensor fusion technologies, providing customers with scalable indoor tracking solutions for logistics, airports, and industrial automation. This integration allows for seamless transitions between outdoor and indoor navigation—a critical need in large-scale enterprise environments.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Indoor Positioning And Navigation System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Indoor Positioning And Navigation System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Indoor Positioning And Navigation System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.