Global Indoor Led Lighting Market

Market Size in USD Billion

CAGR :

%

USD

48.76 Billion

USD

132.31 Billion

2024

2032

USD

48.76 Billion

USD

132.31 Billion

2024

2032

| 2025 –2032 | |

| USD 48.76 Billion | |

| USD 132.31 Billion | |

|

|

|

|

Indoor led lighting Market Size

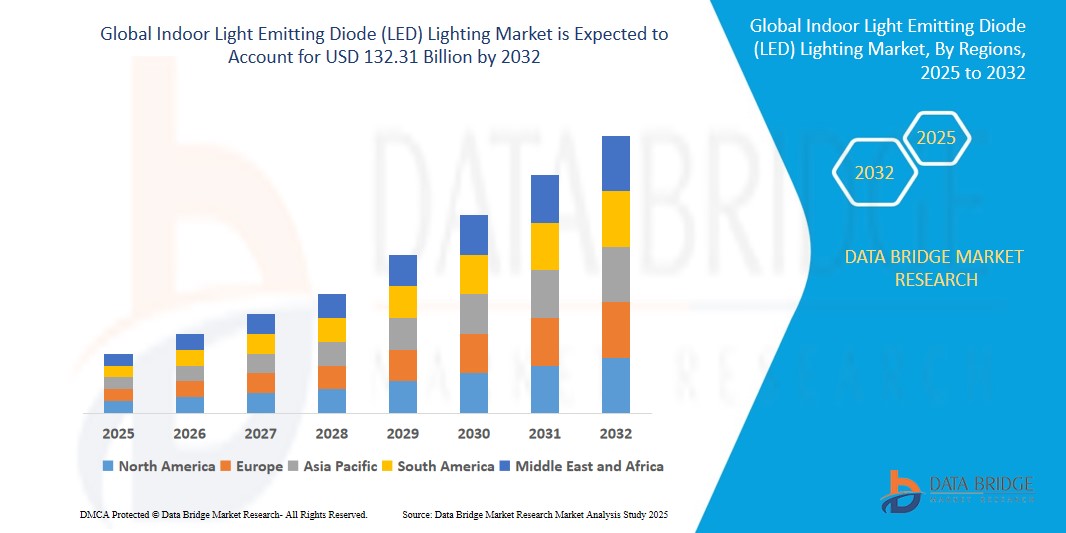

- The global indoor led lighting market size was valued at USD 48.76 billion in 2024 and is expected to reach USD 132.31 billion by 2032, at a CAGR of 15.3% during the forecast period

- The Market expansion is driven by increasing demand for energy-efficient lighting solutions, supportive government regulations promoting sustainable technologies, and growing adoption of smart lighting systems in residential and commercial sectors.

- Rising consumer awareness of environmental sustainability, coupled with the declining cost of LED technology, is positioning indoor LED lighting as a preferred choice for modern illumination, further accelerating market growth.

Indoor led lighting Market Analysis

- Indoor LED lighting, encompassing energy-efficient lamps and luminaires, is a cornerstone of modern lighting solutions, offering superior energy savings, longevity, and versatility compared to traditional lighting technologies in residential, commercial, and industrial settings.

- The surge in demand for indoor LED lighting is propelled by global energy conservation initiatives, rapid urbanization, and the integration of smart home and building automation systems, which enhance user control and convenience.

- North America holds the largest market share, accounting for 38.5% of global revenue in 2025, driven by advanced infrastructure, high consumer awareness, and the presence of leading manufacturers. The U.S. leads the region, with significant adoption in commercial buildings and smart homes, supported by innovations in IoT-enabled lighting.

- Asia-Pacific is anticipated to be the fastest-growing region during the forecast period, fueled by rapid urbanization, increasing construction activities, and government incentives for energy-efficient technologies in countries like China and India.

- The luminaires segment is expected to dominate the market with a share of 62.1% in 2025, attributed to its widespread use in commercial and institutional applications, offering design flexibility and enhanced lighting performance.

Report Scope and Indoor led lighting Market Segmentation

|

Attributes |

Indoor led lighting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Indoor led lighting Market Trends

“Smart Lighting Integration with IoT and Voice Control”

-

A key trend in the global indoor LED lighting market is the increasing integration with Internet of Things (IoT) platforms and voice-controlled ecosystems such as Amazon Alexa, Google Assistant, and Apple HomeKit, enhancing user convenience and energy efficiency.

- For instance, Signify’s Philips Hue ecosystem allows users to control LED lighting via voice commands or mobile apps, enabling customized lighting scenes and schedules. Similarly, LIFX LED lights integrate with smart home platforms for seamless automation.

- IoT-enabled LED lighting systems offer features like occupancy sensing, daylight harvesting, and remote monitoring, optimizing energy use in commercial and residential spaces. For instance, Acuity Brands’ nLight platform uses IoT to provide real-time data analytics for lighting management.

- The integration of LED lighting with smart building systems enables centralized control of lighting, HVAC, and security through a single interface, creating energy-efficient and user-friendly environments.

- Companies like Osram are developing AI-enhanced LED lighting solutions that adapt to user preferences and environmental conditions, such as adjusting brightness based on natural light levels.

- The growing demand for smart, connected lighting systems is transforming the market, with consumers prioritizing solutions that offer both functionality and sustainability.

Indoor led lighting Market Dynamics

Driver

“Rising Demand for Energy Efficiency and Government Regulations”

- The global push for energy conservation, coupled with stringent government regulations promoting energy-efficient technologies, is a primary driver of the indoor LED lighting market.

- For instance, in June 2024, the European Union introduced updated energy labeling requirements for lighting products, encouraging the adoption of LED solutions. Such policies are expected to accelerate market growth during the forecast period.

- LED lighting consumes up to 80% less energy than traditional incandescent and fluorescent lights, making it a preferred choice for reducing carbon footprints in commercial and residential buildings.

- The increasing adoption of smart home and building automation systems, which rely on LED lighting for energy-efficient operations, further drives demand.

- The declining cost of LED components and the availability of retrofit solutions are making LED lighting accessible to a broader consumer base, particularly in developing regions.

Restraint/Challenge

“High Initial Costs and Compatibility Issues”

- The high upfront cost of advanced LED lighting systems, particularly those with smart and IoT capabilities, remains a significant barrier to adoption, especially for small businesses and price-sensitive consumers.

- For instance, premium smart LED lighting systems from brands like Philips Hue or LIFX can be costly compared to conventional lighting, deterring budget-conscious buyers.

- Compatibility issues with existing electrical infrastructure and smart home ecosystems can also hinder adoption, as some LED lighting systems require specific hubs or protocols (e.g., Zigbee or Z-Wave) for full functionality.

- Addressing these challenges through cost reduction, standardized protocols, and consumer education on long-term savings is critical for sustained market growth.

Indoor led lighting Market Scope

The market is segmented based on product type, application, installation type, connectivity, and distribution channel.

- By Product Type

On the basis of product type, the indoor LED lighting market is segmented into lamps and luminaires. The luminaires segment dominates the market, commanding an impressive market share of 62.1% in 2025, driven by its extensive adoption in commercial, institutional, and industrial applications. Luminaires are favored for their superior design flexibility, high energy efficiency, and seamless integration with smart lighting control systems, making them ideal for large-scale installations in offices, retail spaces, and educational facilities. The lamps segment, encompassing retrofit LED bulbs and tubes, is projected to grow at a robust CAGR of 14.2% from 2025 to 2032, fueled by increasing consumer demand for cost-effective, energy-efficient replacements for traditional lighting in residential and small commercial settings.

- By Application

On the basis of application, the market is segmented into commercial, residential, industrial, institutional, and others. The commercial segment holds the largest market share in 2025, driven by the widespread adoption of LED lighting in office buildings, retail stores, hospitality venues, and healthcare facilities, where energy efficiency and aesthetic appeal are paramount. The residential segment is anticipated to witness the fastest CAGR of 15.1% from 2025 to 2032, propelled by the growing popularity of smart home lighting systems, increasing consumer awareness of energy savings, and the rising trend of home automation.

- By Installation Type

On the basis of application, the market is segmented into commercial, residential, industrial, institutional, and others. The commercial segment holds the largest market share in 2025, driven by the widespread adoption of LED lighting in office buildings, retail stores, hospitality venues, and healthcare facilities, where energy efficiency and aesthetic appeal are paramount. The residential segment is anticipated to witness the fastest CAGR of 15.1% from 2025 to 2032, propelled by the growing popularity of smart home lighting systems, increasing consumer awareness of energy savings, and the rising trend of home automation.

- By Connectivity

On the basis of connectivity, the market is segmented into wired and wireless. The wireless segment holds the largest market share in 2025, driven by the rapid adoption of IoT-enabled and smart lighting systems that offer remote control, automation, and integration with voice assistants and mobile applications. The wired segment continues to be relevant for industrial and institutional applications, where stable and reliable connectivity is critical for large-scale lighting deployments.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into online and offline. The online segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by the convenience of e-commerce platforms, the availability of a diverse range of LED lighting products, and the growing trend of online purchasing among tech-savvy consumers. The offline segment, encompassing traditional retail stores and specialty lighting outlets, remains significant, particularly for commercial and institutional buyers who prefer in-person consultations and bulk purchasing.

Indoor led lighting Market Regional Analysis

- North America dominates the global indoor LED lighting market, capturing a substantial revenue share of 38.5% in 2025, driven by its advanced technological infrastructure, high consumer awareness of energy-efficient solutions, and robust government incentives promoting sustainable lighting technologies.

- The region benefits from widespread adoption of smart lighting systems in both commercial and residential sectors, supported by the presence of leading manufacturers such as Cree Lighting, Acuity Brands, and GE Lighting, which continuously innovate to meet evolving consumer demands.

U.S. Indoor led lighting Market Insight

The United States accounts for an impressive 79% of the North American market share in 2025, fueled by the rapid adoption of smart home technologies, increasing demand for energy-efficient lighting in commercial buildings, and the growing trend of green building certifications, such as Leadership in Energy and Environmental Design (LEED). The integration of LED lighting with voice-controlled systems and mobile applications is further driving market expansion, as consumers prioritize convenience and sustainability.

Europe Indoor led lighting Market Insight

The European indoor LED lighting market is projected to grow at a significant CAGR throughout the forecast period, driven by stringent energy efficiency regulations, such as the EU’s Ecodesign Directive, and the increasing adoption of smart lighting solutions in residential, commercial, and public buildings. Countries like Germany, France, and the United Kingdom are at the forefront, supported by their focus on sustainability, innovation, and urban development.

U.K. Indoor led lighting Market Insight

The United Kingdom’s indoor LED lighting market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by government-led initiatives promoting energy-efficient lighting, such as the Energy Saving Trust programs, and the rising popularity of smart home systems among tech-savvy consumers. The demand for retrofit LED solutions in historic buildings and residential properties is also contributing to market growth, as homeowners seek to modernize lighting without compromising architectural integrity.

Germany Indoor led lighting Market Insight

Germany’s indoor LED lighting market is expected to expand at a considerable CAGR, fueled by its leadership in sustainable building technologies, strong consumer demand for eco-conscious lighting solutions, and well-developed infrastructure supporting smart city initiatives. The integration of LED lighting with advanced building management systems is becoming increasingly prevalent, driven by Germany’s emphasis on energy efficiency, innovation, and data privacy.

Asia-Pacific Indoor led lighting Market Insight

The Asia-Pacific region is poised to register the fastest CAGR of 16.8% in 2025, driven by rapid urbanization, booming construction activities, and government-backed initiatives promoting energy-efficient technologies in countries such as China, India, Japan, and South Korea. The region’s emergence as a manufacturing hub for LED components and systems is enhancing affordability and accessibility, further fueling market growth.

Japan Indoor led lighting Market Insight

The Japan’s indoor LED lighting market is gaining significant momentum, driven by its high-tech culture, rapid urbanization, and strong consumer preference for energy-efficient and smart lighting solutions. The country’s aging population is also spurring demand for user-friendly lighting systems in residential and healthcare settings, where features like tunable lighting and circadian rhythm support are increasingly valued.

China Indoor led lighting Market Insight

The China commands the largest market share in the Asia-Pacific region in 2025, attributed to its massive construction sector, government-supported smart city initiatives, and the presence of leading domestic manufacturers such as NVC Lighting and Opple Lighting. The country’s expanding middle class, rapid urbanization, and high rates of technological adoption are driving the widespread adoption of LED lighting in residential, commercial, and institutional applications.

Indoor led lighting Market Share

The indoor led lighting industry is primarily led by well-established companies, including:

- Signify (Philips Lighting) (Netherlands)

- Osram (Germany)

- Cree Lighting (U.S.)

- GE Lighting (U.S.)

- Acuity Brands (U.S.)

- Zumtobel Group (Austria)

- Eaton Corporation (Ireland)

- Hubbell Incorporated (U.S.)

- Panasonic Corporation (Japan)

- Toshiba Lighting (Japan)

- Wipro Lighting (India)

- Thorn Lighting (U.K.)

- Dialight (U.K.)

- NVC Lighting (China)

- Fagerhult Group (Sweden)

- Seoul Semiconductor (South Korea)

- Legrand (France)

- Lutron Electronics (U.S.)

- Havells India Ltd. (India)

- Syska LED (India)

Latest Developments in Global Indoor led lighting Market

- In June 2024, Signify (Philips Lighting) unveiled its advanced Philips Hue Dymera Pro series, a next-generation smart LED lighting solution designed for both residential and commercial applications. This innovative product line features enhanced IoT integration, voice control compatibility with Amazon Alexa, Google Assistant, and Apple HomeKit, and advanced energy-saving features, catering to the growing demand for sustainable and connected lighting systems.

- In May 2024, Osram GmbH launched its cutting-edge DEXAL Pro technology, a smart LED driver platform engineered to enhance connectivity, data analytics, and energy efficiency in large-scale commercial lighting installations, such as office complexes, retail spaces, and educational institutions, reinforcing Osram’s commitment to smart building solutions.

- In April 2024, Acuity Brands, Inc. announced a strategic collaboration with Microsoft to integrate its nLight AIR platform with Microsoft Azure IoT, enabling real-time lighting management, predictive maintenance, and energy optimization for smart buildings, marking a significant step toward intelligent infrastructure development.

- In March 2024, Cree Lighting introduced its Cadiant Dynamic Lighting Pro system, a tunable LED lighting solution tailored for institutional applications, such as hospitals and schools. This system supports circadian rhythm alignment, promotes occupant well-being, and delivers up to 30% energy savings, addressing the growing demand for human-centric lighting.

- In February 2024, Zumtobel Group AG debuted its TECTON LED Plus system, a modular and highly customizable LED lighting solution designed for industrial and commercial environments. Featuring advanced connectivity options and IoT-enabled controls, this system enhances operational efficiency and supports sustainable building certifications, catering to the evolving needs of modern facilities.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Indoor Led Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Indoor Led Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Indoor Led Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.