Global Independent Software Vendors Market

Market Size in USD Billion

CAGR :

%

USD

1.52 Billion

USD

3.74 Billion

2024

2032

USD

1.52 Billion

USD

3.74 Billion

2024

2032

| 2025 –2032 | |

| USD 1.52 Billion | |

| USD 3.74 Billion | |

|

|

|

|

Independent Software Vendors Market Analysis

The global independent software vendors market is experiencing significant growth as businesses increasingly rely on third-party software solutions to enhance their operations and drive innovation. Independent software vendors create and distribute software designed to run on specific platforms or integrate with other technologies, offering customized solutions across industries such as healthcare, finance, retail, and more. The market is being fueled by the growing demand for cloud-based software, digital transformation, and the need for businesses to adopt advanced technologies such as AI, IoT, and big data analytics. Recent developments show an increasing trend toward partnerships and collaborations between independent software vendors and cloud service providers to offer scalable and secure software solutions. In addition, the shift to subscription-based models and SaaS platforms is contributing to the market's growth. With the rise of e-commerce and the expansion of digital infrastructures worldwide, the independent software vendors market is poised for continued expansion, providing opportunities for innovation and customization in software development.

Independent Software Vendors Market Size

The global independent software vendors market size was valued at USD 1.52 billion in 2024 and is projected to reach USD 3.74 billion by 2032, with a CAGR of 11.9% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Independent Software Vendors Market Trends

“Adoption of Advanced Technologies”

The global independent software vendors market is evolving rapidly as businesses embrace digital transformation and increasingly rely on third-party software solutions. Innovation is driving this growth, with independent software vendors adopting advanced technologies such as artificial intelligence (AI), machine learning, and big data analytics to meet the complex needs of industries such as healthcare, finance, and retail. A key trend shaping the market is the shift towards cloud-based solutions, with more ISVs offering software-as-a-service (SaaS) platforms to provide scalable, cost-effective, and flexible services. This trend is helping businesses improve efficiency and reduce infrastructure costs. As digital infrastructures expand globally, the independent software vendors market continues to grow, creating ample opportunities for innovation and custom software solutions.

Report Scope and Independent Software Vendors Market Segmentation

|

Attributes |

Independent Software Vendors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

IBM (U.S.), Google (U.S.), Broadcom (U.S.), Cisco Systems, Inc. (U.S.), Microsoft (U.S.), Salesforce, Inc. (U.S.), ASG Africa (South Africa), Veradigm LLC (U.S.), Oracle (U.S.), Hewlett Packard Enterprise Development LP (U.S.), Phoenix Software International, Inc. (U.S.), ServiceNow (U.S.), Virtusa Corp. (U.S.), Red Hat, Inc. (U.S.), Numerical Algorithms Group Ltd. (U.K.), Magic Software Enterprises (Israel), Kellton (India), Wipro (India), and Accenture (Ireland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Independent Software Vendors Market Definition

Global independent software vendors are companies that develop, market, and sell software solutions designed to run on third-party platforms or integrate with other technologies. These vendors create applications that serve a wide range of industries, including healthcare, finance, retail, and manufacturing, offering specialized solutions tailored to meet the unique needs of businesses. Unlike platform providers, independent software vendors focus on delivering software that can be used on various operating systems, devices, or cloud environments.

Independent Software Vendors Market Dynamics

Drivers

- Rise of Digital Transformation

As businesses increasingly adopt digital transformation strategies, there is a growing demand for innovative software solutions that enhance operational efficiency, scalability, and data management. Independent software vendors are well-positioned to meet this demand by developing customized software that addresses specific business needs. These solutions help organizations streamline their processes, improve decision-making, and support the transition to more agile, tech-driven operations. With industries across the globe embracing digital technologies to stay competitive, independent software vendors play a crucial role in providing the tools necessary for businesses to thrive in a rapidly evolving digital landscape. This surge in demand drives the growth of the market.

- Increased Demand for Customized Software Solutions

The increasing demand for customized software solutions tailored to specific industries, such as healthcare, finance, and retail, is significantly boosting the growth of independent software vendors. As businesses in these sectors seek specialized software to meet their unique needs—whether it’s improving patient care, streamlining financial transactions, or enhancing customer experiences—independent software vendors are responding by developing targeted solutions. These vendors are able to offer highly specific and adaptable products that cater to the challenges faced by different industries. This trend of industry-specific customization drives demand for these solutions and contributes to the overall growth of the independent software vendors market.

Opportunities

- Subscription-Based Pricing Models

The growing preference for subscription-based pricing models presents a significant market opportunity for independent software vendors. By offering software on a subscription basis, vendors can generate a steady stream of recurring revenue, providing financial stability and long-term growth potential. This model allows vendors to build strong, ongoing relationships with clients, fostering customer loyalty and satisfaction. In addition, subscription models enable vendors to quickly adapt to shifting market demands by offering continuous updates, new features, and improved functionality. As businesses increasingly seek flexible, cost-effective software solutions, independent software vendors are well-positioned to capitalize on this trend and meet evolving customer needs.

- AI and Machine Learning Integration

The increasing adoption of artificial intelligence (AI) and machine learning presents a significant opportunity for independent software vendors to innovate and enhance their offerings. By integrating these advanced technologies into their software solutions, vendors can provide businesses with powerful tools for automation, predictive analytics, and improved decision-making. AI and machine learning enable businesses to analyze large datasets, uncover insights, and streamline operations, making them highly valuable across industries such as healthcare, finance, and retail. Independent software vendors that embrace AI and machine learning technologies are well-positioned to meet the growing demand for smart, data-driven solutions, creating a competitive edge in the market.

Restraints/Challenges

- Intense Competition

The increasing number of software solutions available in the market presents a significant challenge for independent software vendors. As competition intensifies, vendors face pressure from both established large tech companies and new market entrants, all vying for market share. This environment makes it difficult for smaller independent vendors to differentiate their offerings and stand out in a crowded market. With many similar solutions available, customers may be more inclined to choose well-known, established vendors, making it harder for independent vendors to capture and retain customers. To overcome this challenge, independent software vendors must innovate, offer unique value propositions, and build strong customer relationships.

- High Development Costs

The cost of developing and maintaining cutting-edge software solutions, particularly with the integration of advanced technologies such as AI and machine learning, is a significant restraint for independent software vendors. These technologies require substantial investments in research, development, and skilled talent, which can be financially taxing for smaller vendors. Without the resources and financial backing of larger companies, smaller vendors may struggle to compete, limiting their ability to innovate and scale. In addition, ongoing maintenance and updates for sophisticated software can add further strain on budgets. This high cost structure can make it challenging for smaller independent software vendors to stay competitive in the evolving market.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Independent Software Vendors Market Scope

The market is segmented on the basis of type, application, enterprise type, and products. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Cloud

- On-Premise

Application

- Financial Services

- Healthcare

- Industrial and Manufacturing

- Public Sector and Utilities

- Retail

- Service Providers

- Telecom

- E-Commerce

- Media and Entertainment

- Education

- Others

Enterprise Type

- SMEs

- Large Enterprises

Products

- Security Software

- Business Intelligence & Analytics

- Business Applications

- Consumer-facing applications

- Others

Independent Software Vendors Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, type, application, enterprise type, and products as referenced above.

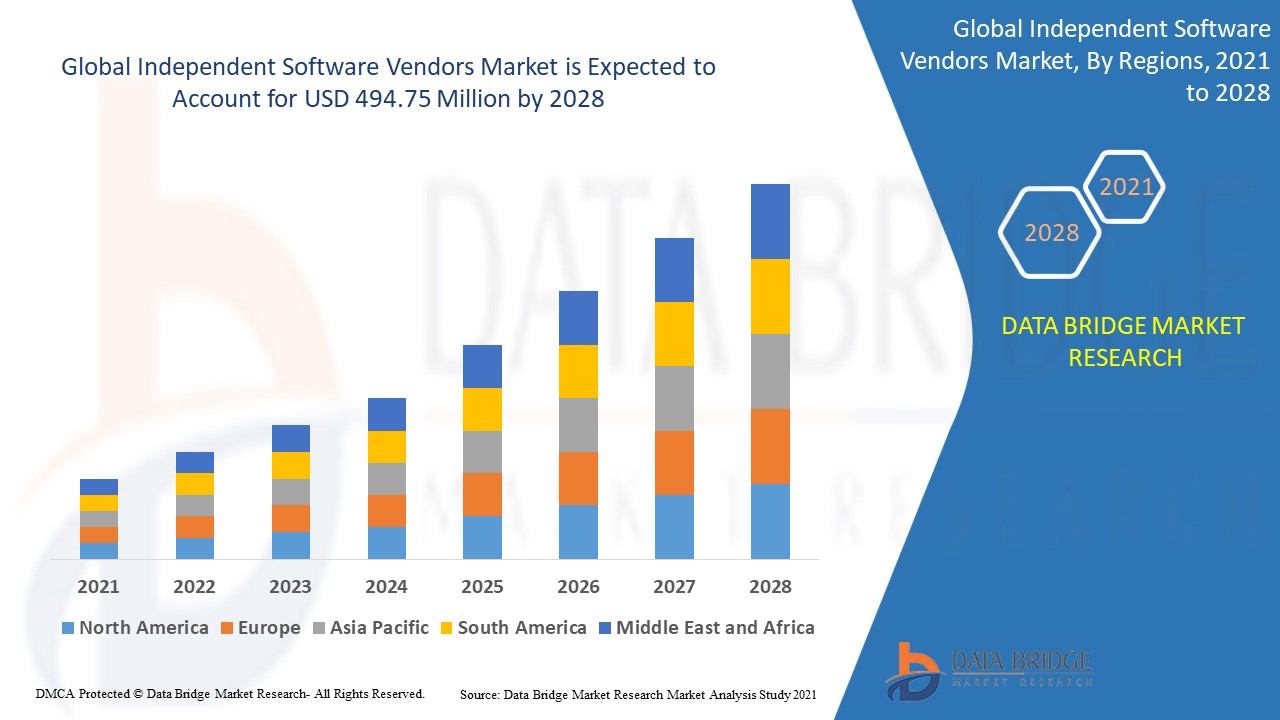

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

Asia-Pacific is dominates the independent software vendors market, driven by the growing adoption of cloud-based solutions across various sectors, including financial services and healthcare. The region's expanding digital transformation efforts are fueling the demand for scalable, flexible software solutions. As businesses in Asia-Pacific increasingly embrace cloud technologies, the market for independent software vendors continues to see significant growth and opportunity.

North America is projected to experience significant growth from 2025 to 2032, driven by the increasing adoption of enterprise solutions to support a highly distributed workforce. The demand for scalable, efficient software solutions is rising as businesses adapt to remote work trends. As organizations in North America continue to embrace digital transformation, the market for independent software vendors is expected to expand rapidly during this period.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Independent Software Vendors Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Independent Software Vendors Market Leaders Operating in the Market Are:

- IBM (U.S.)

- Google (U.S.)

- Broadcom (U.S.)

- Cisco Systems, Inc. (U.S.)

- Microsoft (U.S.)

- Salesforce, Inc. (U.S.)

- ASG Africa (South Africa)

- Veradigm LLC (U.S.)

- Oracle (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Phoenix Software International, Inc. (U.S.)

- ServiceNow (U.S.)

- Virtusa Corp. (U.S.)

- Red Hat, Inc. (U.S.)

- Numerical Algorithms Group Ltd. (U.K.)

- Magic Software Enterprises (Israel)

- Kellton (India)

- Wipro (India)

- Accenture (Ireland)

Latest Developments in Independent Software Vendors Market

- In August 2023, Commvault, a leading data management and protection software provider, became part of the Amazon Web Services (AWS) ISV Workload Migration Program. This partnership aims to enhance technical support for customers migrating to AWS, ensuring smoother transitions. By joining the program, Commvault strengthens its commitment to helping organizations optimize their data migration processes to the cloud

- In May 2023, Alibaba Cloud launched a new ISV program aimed at expanding its business throughout the Asia Pacific region. The program includes offering global independent software vendors (ISVs) enhanced financial incentives and technical support. This initiative is designed to attract ISVs, helping them scale their solutions in the rapidly growing Asia Pacific market

- In October 2023, BMC Software revealed that its Control-M platform received the highest overall score for the seventh consecutive year in the 2023 EMA Radar. The platform, along with BMC Helix Control-M, provides an innovative approach to orchestrating data pipelines, enhancing flexibility and efficiency in business operations. This recognition highlights Control-M's continued leadership in streamlining business processes and optimizing data management for enterprises

- In March 2023, Intel collaborated with its alliance's Titanium member, Avalue, to launch the ATX server board powered by the latest 4th generation Intel Xeon SP CPU. This server board integrates Baseboard Management Controller (BMC) and IPMI 2.0, enabling administrators to remotely access the system 24/7. With this setup, administrators can adjust startup settings, perform real-time system health diagnostics, manage firmware and OS upgrades, and implement predictive maintenance tasks efficiently

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.