Global In Wheel Motors Market

Market Size in USD Billion

CAGR :

%

USD

2.74 Billion

USD

26.68 Billion

2025

2033

USD

2.74 Billion

USD

26.68 Billion

2025

2033

| 2026 –2033 | |

| USD 2.74 Billion | |

| USD 26.68 Billion | |

|

|

|

|

In-Wheel Motors Market Size

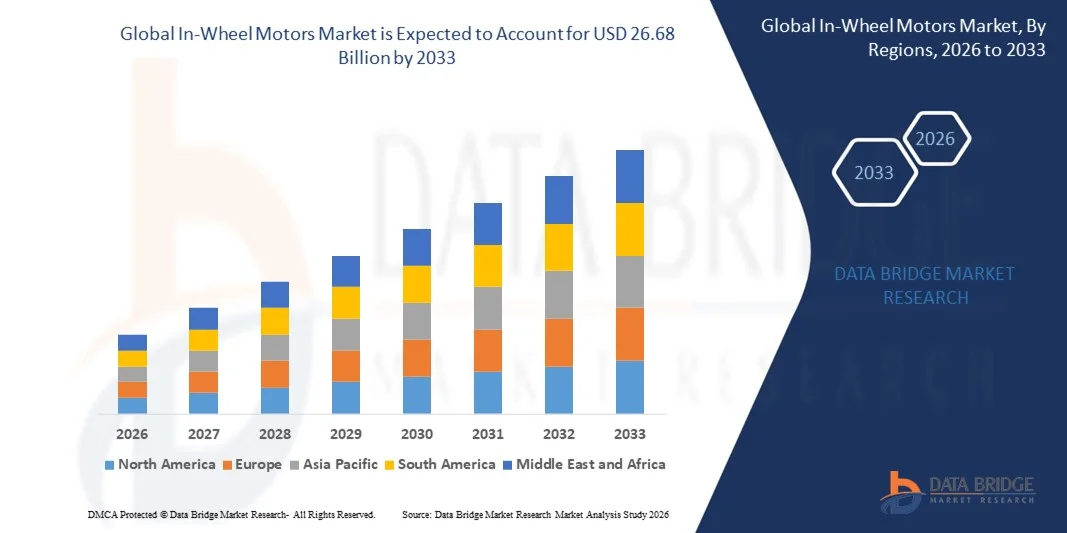

- The global in-wheel motors market size was valued at USD 2.74 billion in 2025 and is expected to reach USD 26.68 billion by 2033, at a CAGR of 32.85% during the forecast period

- The market growth is largely fueled by the increasing adoption of electric and hybrid vehicles across passenger and commercial segments, coupled with technological advancements in compact and high-efficiency in-wheel motor systems, leading to enhanced vehicle performance and energy efficiency

- Furthermore, rising demand for lightweight, modular, and high-torque electric drivetrains is establishing in-wheel motors as a preferred solution for next-generation EV architectures. These converging factors are accelerating the integration of in-wheel motor technology, thereby significantly boosting the industry's growth

In-Wheel Motors Market Analysis

- In-wheel motors are electric motors integrated directly into the wheel hub, enabling direct-drive propulsion, improved torque control, regenerative braking, and reduced drivetrain complexity. These systems enhance vehicle efficiency, handling, and space utilization in electric and hybrid vehicles

- The escalating demand for in-wheel motors is primarily fueled by global EV adoption, stricter emission regulations, increasing investments in EV R&D, and the growing need for energy-efficient, high-performance electric mobility solutions across both passenger cars and commercial vehicles

- Asia-Pacific dominated the in-wheel motors market with a share of around 50% in 2025, due to rising adoption of electric vehicles, supportive government policies for EV manufacturing, and the presence of leading EV OEMs and component suppliers

- North America is expected to be the fastest growing region in the in-wheel motors market during the forecast period due to increasing EV penetration, federal and state-level incentives, and rising investments in domestic EV and component manufacturing

- Axial flux motor segment dominated the market with a market share of 60.5% in 2025, due to its high power density, compact design, and superior efficiency in converting electrical energy into torque. Automotive manufacturers prefer axial flux motors for modern EVs as they enable space-saving integration directly into the wheel hub. Their high torque-to-weight ratio supports better acceleration and handling characteristics, making them popular for performance-oriented vehicles. The segment is further strengthened by ongoing technological innovations and increasing collaborations between motor manufacturers and EV OEMs

Report Scope and In-Wheel Motors Market Segmentation

|

Attributes |

In-Wheel Motors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

In-Wheel Motors Market Trends

Rising Adoption of In-Wheel Motors in Electric and Hybrid Vehicles

- A significant trend in the in-wheel motors market is the growing integration of in-wheel motor technology into electric and hybrid vehicles, driven by the need for higher energy efficiency, reduced drivetrain complexity, and improved vehicle handling. These motors provide direct-drive propulsion at each wheel hub, enabling better torque control, space optimization, and enhanced regenerative braking, positioning them as key enablers for next-generation EV architectures

- For instance, Tesla has experimented with wheel hub motors in concept studies for future EV models, emphasizing improved efficiency and compact drivetrain design. Such initiatives highlight the strategic importance of in-wheel motor adoption among leading EV OEMs

- The trend is further strengthened by rising consumer and fleet demand for EVs that deliver both performance and sustainability, prompting manufacturers to explore lightweight and modular motor solutions. These in-wheel motors allow for more flexible vehicle designs, especially in urban and compact EV segments, enhancing overall mobility efficiency

- Automakers and component suppliers are increasingly investing in advanced in-wheel motor designs that incorporate axial flux and high-torque configurations, enabling premium electric vehicles to deliver superior acceleration and handling. This positions in-wheel motors as a critical component for differentiating vehicle performance in competitive EV markets

- The commercial vehicle sector is also beginning to adopt in-wheel motors for applications such as electric buses and delivery vans, where energy recovery and precise torque distribution improve efficiency and operational cost-effectiveness. This expansion reflects the versatility and scalability of in-wheel motor technology across diverse vehicle types

- Overall, the market is witnessing sustained growth in adoption as OEMs and technology developers seek to leverage in-wheel motors to enhance efficiency, vehicle dynamics, and system integration, reinforcing their role as a transformative technology in the EV industry

In-Wheel Motors Market Dynamics

Driver

Increasing Demand for Lightweight and High-Efficiency EV Drivetrains

- The growing need for lightweight, high-performance electric drivetrains is driving the adoption of in-wheel motors, as these systems reduce mechanical complexity and allow direct torque application to the wheels. In-wheel motors improve energy efficiency and enable regenerative braking, which extends driving range and reduces overall vehicle weight

- For instance, Elaphe Propulsion Technologies has developed high-torque in-wheel motors that are increasingly used in passenger EVs and light commercial vehicles, providing optimized energy usage and superior handling characteristics. Such deployments demonstrate the driver role of efficiency and lightweight design in accelerating market growth

- The shift toward electric and hybrid mobility across Europe, North America, and Asia-Pacific is boosting investments in compact, modular drivetrain solutions where in-wheel motors can replace traditional central motors. OEMs leverage these motors to achieve more flexible vehicle layouts, improve interior space utilization, and reduce drivetrain losses

- Increasing consumer preference for high-performance EVs with better acceleration, stability, and noise reduction also supports in-wheel motor adoption. By integrating motors into the wheel hub, manufacturers can achieve precise torque vectoring and smoother handling, enhancing the overall driving experience

- Government regulations promoting low-emission vehicles are further stimulating demand for high-efficiency drivetrains, pushing manufacturers to adopt in-wheel motors in both passenger and commercial EV segments

Restraint/Challenge

High Manufacturing Costs and Technical Complexity

- The in-wheel motors market faces challenges due to the intricate engineering and precision required for integrating motors directly into the wheel hub, which involves high torque density, thermal management, and compact packaging. These factors increase production costs and require advanced manufacturing capabilities

- For instance, Continental AG has invested in specialized production facilities to manufacture high-performance in-wheel motors, reflecting the capital-intensive nature of this technology. Such investments indicate the complexity and cost barriers for widespread adoption

- Developing in-wheel motors also requires stringent quality control to ensure reliability under high mechanical stress, vibration, and temperature fluctuations, which further adds to production complexity. OEMs must balance motor performance with durability and safety standards, creating additional design and manufacturing challenges

- The reliance on advanced materials, precision components, and specialized assembly processes can limit large-scale manufacturing and slow down market expansion. These challenges place pressure on manufacturers to innovate cost-effective solutions without compromising performance

- Overall, while in-wheel motors offer significant benefits, their high cost and technical complexity remain key hurdles that must be addressed to accelerate adoption across mainstream EV segments

In-Wheel Motors Market Scope

The market is segmented on the basis of components, cooling type, motor type, power output, propulsion type, and vehicle type.

- By Components

On the basis of components, the in-wheel motors market is segmented into suspension, rotor and stator, wheel bearings, and regenerative braking system. The rotor and stator segment dominated the largest market revenue share in 2025, driven by its critical role in energy conversion and efficient torque generation directly at the wheel hub. Manufacturers prioritize high-performance rotor and stator designs to enhance vehicle efficiency, reduce weight, and improve driving dynamics. The growing adoption of advanced materials and precision engineering has further strengthened demand for rotor and stator components in electric vehicles. Their integration ensures higher reliability, reduced energy loss, and compatibility with regenerative braking systems, making them a preferred choice among OEMs.

The regenerative braking system segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing emphasis on energy recovery and extending vehicle range. Regenerative braking components allow electric and hybrid vehicles to convert kinetic energy into electrical energy, enhancing overall efficiency. The rising focus on sustainable mobility and government incentives for energy-efficient technologies are further boosting adoption in new EV models.

- By Cooling Type

On the basis of cooling type, the in-wheel motors market is segmented into air cooling and liquid cooling. The liquid cooling segment dominated the largest market revenue share in 2025, driven by its superior heat dissipation capabilities, which ensure optimal motor performance under high-load conditions. OEMs increasingly prefer liquid-cooled motors for high-power applications in passenger cars and commercial electric vehicles to prevent overheating and maintain efficiency. The integration of liquid cooling enables higher torque density and longer motor lifespan, which are crucial for high-performance electric mobility solutions. This cooling type also supports compact motor designs, facilitating easier integration into wheel hubs without compromising vehicle dynamics.

The air cooling segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by its cost-effectiveness and simpler design that reduces overall manufacturing complexity. Air-cooled in-wheel motors are increasingly adopted in small to mid-range electric vehicles where moderate performance is sufficient. Rising demand for lightweight and low-maintenance solutions is accelerating the adoption of air-cooled systems in emerging EV markets.

- By Motor Type

On the basis of motor type, the in-wheel motors market is segmented into axial flux motor and radial flux motor. The axial flux motor segment dominated the largest market revenue share of 60.5% in 2025, driven by its high power density, compact design, and superior efficiency in converting electrical energy into torque. Automotive manufacturers prefer axial flux motors for modern EVs as they enable space-saving integration directly into the wheel hub. Their high torque-to-weight ratio supports better acceleration and handling characteristics, making them popular for performance-oriented vehicles. The segment is further strengthened by ongoing technological innovations and increasing collaborations between motor manufacturers and EV OEMs.

The radial flux motor segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by its proven reliability, cost-effectiveness, and compatibility with mass-market electric vehicles. Radial flux designs are widely adopted in mid-range passenger cars and commercial EVs due to simpler manufacturing processes. Government initiatives supporting affordable EV adoption are boosting demand for radial flux in-wheel motors across emerging markets.

- By Power Output

On the basis of power output, the in-wheel motors market is segmented into up to 60 KW, 60–90 KW, and above 90 KW. The 60–90 KW segment dominated the largest market revenue share in 2025, driven by its balanced power delivery suitable for both passenger and light commercial electric vehicles. Motors within this range provide sufficient torque and speed for urban and highway driving, making them ideal for mainstream EV applications. OEMs prioritize this range due to its ability to meet performance requirements without excessively increasing motor size or cost. The growing demand for versatile electric powertrains in emerging EV models further supports the segment’s dominance.

The above 90 KW segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for high-performance electric vehicles and premium EV models. High-power in-wheel motors enable superior acceleration, higher top speeds, and advanced torque vectoring capabilities. Manufacturers are investing in R&D to optimize thermal management and durability in these motors for high-performance EV applications.

- By Propulsion Type

On the basis of propulsion type, the in-wheel motors market is segmented into battery electric vehicle (BEV), fuel cell electric vehicle (FCEV), hybrid electric vehicle (HEV), and plug-in hybrid electric vehicle (PHEV). The BEV segment dominated the largest market revenue share in 2025, driven by the widespread adoption of fully electric vehicles across global markets. BEVs rely entirely on electric motors for propulsion, making in-wheel motors a preferred choice for maximizing efficiency, range, and vehicle dynamics. Government incentives, emission regulations, and the expanding charging infrastructure are further supporting BEV adoption.

The HEV segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing consumer interest in transitional electric mobility solutions. HEVs combine internal combustion engines with in-wheel motors to optimize fuel efficiency and reduce emissions. Rising demand in regions with limited EV infrastructure is accelerating HEV adoption with in-wheel motor integration.

- By Vehicle Type

On the basis of vehicle type, the in-wheel motors market is segmented into passenger cars and commercial vehicles. The passenger cars segment dominated the largest market revenue share in 2025, driven by the growing adoption of electric and hybrid passenger vehicles for urban commuting and personal mobility. Passenger car manufacturers are increasingly integrating in-wheel motors to improve efficiency, reduce drivetrain complexity, and enhance handling characteristics. Consumer preference for advanced mobility solutions with high performance and low maintenance further supports this segment.

The commercial vehicle segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the electrification of buses, delivery vans, and light trucks for sustainable transportation. In-wheel motors enable precise torque control and better energy recovery in heavy-duty applications. Rising regulations on emission reductions in logistics and public transport are driving the adoption of commercial electric vehicles with in-wheel motor technology.

In-Wheel Motors Market Regional Analysis

- Asia-Pacific dominated the in-wheel motors market with the largest revenue share of around 50% in 2025, driven by rising adoption of electric vehicles, supportive government policies for EV manufacturing, and the presence of leading EV OEMs and component suppliers

- The region’s cost-effective manufacturing, increasing investments in battery and motor production, and growing urban mobility projects are accelerating market expansion

- Availability of skilled workforce, rapid industrialization, and expanding EV charging infrastructure are contributing to increased deployment of in-wheel motors across passenger and commercial vehicles

China In-Wheel Motors Market Insight

China held the largest share in the Asia-Pacific in-wheel motors market in 2025, owing to its leadership in electric vehicle production and battery technology. The country’s robust industrial base, government incentives for EV adoption, and strong local supply chain for EV components are major growth drivers. Demand is further supported by ongoing investments in advanced motor technologies and collaborations between local manufacturers and global EV brands.

India In-Wheel Motors Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by government initiatives such as FAME II to promote electric mobility, expanding EV manufacturing capabilities, and rising adoption of hybrid and electric two-wheelers and passenger cars. Increasing local manufacturing of components, growing R&D in motor efficiency, and supportive infrastructure development are driving market expansion.

Europe In-Wheel Motors Market Insight

The Europe in-wheel motors market is expanding steadily, supported by stringent emission regulations, increasing demand for electric and hybrid vehicles, and investments in advanced drivetrain technologies. Countries across Western Europe emphasize sustainable mobility, high-performance motor integration, and compliance with environmental standards, driving adoption in both passenger and commercial vehicles.

Germany In-Wheel Motors Market Insight

Germany’s in-wheel motors market is driven by its strong automotive industry, leadership in electric mobility innovation, and extensive EV R&D ecosystem. OEMs and suppliers focus on high-efficiency motors and integration with battery electric and hybrid platforms. Demand is particularly strong for premium EVs and commercial fleet electrification projects.

U.K. In-Wheel Motors Market Insight

The U.K. market is supported by growing EV adoption, local manufacturing of electric drivetrains, and government incentives for green mobility. Focus on research collaborations, battery and motor innovations, and integration of in-wheel motors in light commercial vehicles and passenger EVs is enhancing market growth.

North America In-Wheel Motors Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing EV penetration, federal and state-level incentives, and rising investments in domestic EV and component manufacturing. OEMs are focusing on high-efficiency, compact in-wheel motors for passenger cars, commercial vehicles, and autonomous mobility solutions.

U.S. In-Wheel Motors Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its strong EV industry, advanced R&D in electric drivetrains, and growing collaborations between OEMs and motor technology providers. Rising emphasis on sustainability, fleet electrification, and integration of in-wheel motors in high-performance EVs is boosting demand. Presence of key manufacturers and well-established distribution networks further solidify the country’s leading position in the region.

In-Wheel Motors Market Share

The in-wheel motors industry is primarily led by well-established companies, including:

- Protean (U.K.)

- Elaphe Propulsion Technologies Ltd. (Slovenia)

- ZIEHL-ABEGG (Germany)

- Printed Motor Works (U.S.)

- NTN Corporation (Japan)

- e-Traction B.V. (Netherlands)

- DANA TM4 INC. (Canada)

- ECOMOVE (U.S.)

- NSK Ltd. (Japan)

- TAJIMA MOTOR CORPORATION (Japan)

- YASA Limited (U.K.)

- Schaeffler India Limited (India)

- Tesla (U.S.)

- Ford Motor Company (U.S.)

- BMW AG (Germany)

- MICHELIN (France)

- GEM motors d.o.o. (Slovenia)

- HYUNDAI TRANSYS (South Korea)

- ORBIS Wheels, Inc. (U.S.)

- Volkswagen (Germany)

Latest Developments in Global In-Wheel Motors Market

- In January 2026, WATT and Donut Lab announced a strategic collaboration to integrate in-wheel motor technology into WATT’s lightweight skateboard platform, representing a significant step forward in modular EV architecture that enhances torque vectoring and direct-drive efficiency. This development underscores the industry trend toward lightweight, energy-efficient electric vehicle designs that reduce mechanical complexity and improve performance, potentially accelerating adoption of in-wheel systems across multiple EV segments

- In December 2025, British motor specialist YASA unveiled a prototype axial flux in-wheel motor powertrain achieving record-setting power density and integrated high-density inverters, marking a breakthrough in in-wheel motor performance and efficiency. This innovation is poised to transform EV drivetrain design by reducing component weight, boosting regenerative energy recovery, and enabling higher continuous power outputs, encouraging OEMs to adopt these systems for both high-performance and mainstream electric vehicles

- In November 2025, Nidec Corporation (JP) announced a strategic partnership with a leading automotive manufacturer to co-develop next-generation in-wheel motors, leveraging Nidec's expertise in electric motor technology. The collaboration is expected to enhance the performance and efficiency of electric vehicles, reflecting a broader market trend where companies seek partnerships to accelerate product development and reduce time-to-market

- In October 2025, Elaphe Propulsion Technologies (SI) unveiled a new in-wheel motor model designed for high-performance electric vehicles, positioning the company as a key player in the premium segment. This launch strengthens Elaphe's competitive edge and attracts collaborations with high-end automotive brands, supporting differentiation through advanced technology and enhanced motor capabilities

- In September 2025, Continental AG (DE) expanded its production capabilities by opening a new facility dedicated to in-wheel motor manufacturing, increasing production capacity and addressing growing demand for electric vehicle components. The new facility strengthens Continental's market position, enabling faster response to customer needs and supporting the broader adoption of in-wheel motor technology across passenger and commercial EVs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.