Global In Vitro Diagnostics Ivd Market

Market Size in USD Billion

CAGR :

%

USD

135.73 Billion

USD

200.54 Billion

2025

2033

USD

135.73 Billion

USD

200.54 Billion

2025

2033

| 2026 –2033 | |

| USD 135.73 Billion | |

| USD 200.54 Billion | |

|

|

|

|

In Vitro Diagnostics (IVD) Market Size

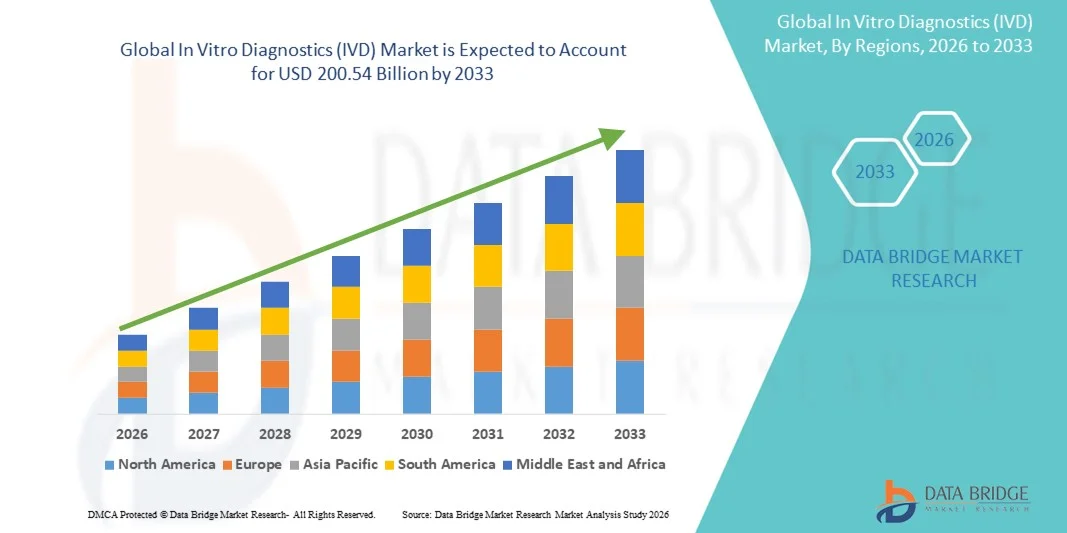

- The global In Vitro Diagnostics (IVD) market size was valued at USD 135.73 billion in 2025 and is expected to reach USD 200.54 billion by 2033, at a CAGR of 5.00% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic and infectious diseases, growing demand for early and accurate disease detection, and rapid technological advancements such as molecular diagnostics, point-of-care testing, and automation across laboratories

- Furthermore, increasing emphasis on personalized medicine, expanding usage of diagnostic testing in preventive care, and growing adoption of AI-driven and integrated diagnostic platforms are solidifying IVD as a critical component of modern healthcare. These converging factors are accelerating the uptake of advanced diagnostic solutions, thereby significantly boosting the industry’s growth

In Vitro Diagnostics (IVD) Market Analysis

- In Vitro Diagnostics (IVD), encompassing diagnostic tests performed on blood, tissues, and other biological samples, are increasingly vital components of modern healthcare systems due to their essential role in disease detection, monitoring, and personalized treatment decisions across hospitals, laboratories, and home-testing environments

- The accelerating demand for IVD solutions is primarily fueled by the rising global prevalence of chronic and infectious diseases, greater emphasis on early and accurate diagnosis, and rapid technological advancements such as molecular diagnostics, point-of-care testing, automation, and AI-enhanced platforms that improve testing speed, precision, and clinical outcomes

- North America dominated the In Vitro Diagnostics (IVD) market with the largest revenue share of 40.8% in 2025, supported by advanced healthcare infrastructure, strong reimbursement systems, high adoption of innovative diagnostic technologies, and the presence of leading global manufacturers that continue to expand molecular and immunoassay test portfolios across the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region in the In Vitro Diagnostics (IVD) market during the forecast period due to rising healthcare expenditure, expanding diagnostic laboratory networks, increasing awareness of preventive healthcare, and growing demand for accessible and affordable testing in densely populated countries such as China and India

- The reagents segment dominated the In Vitro Diagnostics (IVD) market in 2025 with the largest market share of 65.50%, driven by consistent recurring demand for consumables, expanding use of molecular and immunoassay tests, and continuous advancements in assay development that support a wide range of diagnostic applications across clinical settings

Report Scope and In Vitro Diagnostics (IVD) Market Segmentation

|

Attributes |

In Vitro Diagnostics (IVD) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

In Vitro Diagnostics (IVD) Market Trends

Enhanced Diagnostic Accuracy Through AI and Automation Integration

- A significant and accelerating trend in the global In Vitro Diagnostics (IVD) market is the deepening integration of artificial intelligence (AI), automation, and digital analytics within clinical diagnostic systems, substantially improving testing accuracy, efficiency, and workflow management across hospitals and laboratories

- For instance, automated immunoassay analyzers from Roche and Abbott seamlessly integrate AI-enabled algorithms to optimize processing, reduce manual errors, and deliver faster turnaround times for high-volume diagnostic environments. Similarly, platforms such as Siemens Healthineers’ Atellica incorporate intelligent automation for precise sample handling

- AI integration in IVD instruments enables capabilities such as predictive maintenance, automated quality control, and advanced interpretation of test results. For instance, AI-driven molecular systems can enhance pathogen detection accuracy and provide intelligent alerts for unusual test patterns, while automated workflows significantly improve laboratory productivity

- The seamless integration of IVD analyzers with electronic health records (EHRs) and digital diagnostic platforms facilitates centralized data management, enabling clinicians to access patient results alongside imaging, treatment history, and decision-support tools, creating a unified diagnostic ecosystem

- This trend toward more intelligent, automated, and interconnected diagnostic systems is fundamentally reshaping expectations for laboratory performance. Consequently, companies such as Sysmex and Beckman Coulter are developing advanced analyzers featuring AI-supported decision tools and real-time monitoring capabilities for improved operational efficiency

- The demand for IVD systems that offer seamless automation, AI-powered analytics, and integrated digital connectivity is growing rapidly across clinical laboratories and point-of-care settings, as healthcare providers increasingly prioritize accuracy, speed, and comprehensive diagnostic functionality

In Vitro Diagnostics (IVD) Market Dynamics

Driver

Growing Need Due to Rising Disease Burden and Preventive Healthcare Adoption

- The increasing global burden of chronic and infectious diseases, coupled with rising emphasis on preventive healthcare practices, is a significant driver for the heightened demand in the In Vitro Diagnostics (IVD) market

- For instance, in April 2025, Abbott announced advancements in its molecular diagnostics platforms with upgraded high-throughput capabilities to support faster pathogen detection. Such developments by key players are expected to drive the IVD industry growth in the forecast period

- As healthcare providers become more aware of rising disease risks and the need for early detection, IVD solutions offer advanced capabilities such as real-time monitoring, high-sensitivity screening, and rapid diagnostic results, providing a compelling advantage over conventional manual testing methods

- Furthermore, the growing adoption of digital healthcare systems and integrated diagnostic networks is making IVD solutions essential components of modern medical infrastructure, offering seamless interoperability with electronic health records and clinical decision platforms

- The convenience of rapid testing, remote diagnostic capabilities, and improved accessibility through point-of-care devices are key factors propelling the adoption of IVD technologies across hospitals, clinics, and home-care settings. The rise of decentralized testing and user-friendly molecular and immunoassay devices further contributes to market growth

Restraint/Challenge

Data Accuracy Concerns and Stringent Regulatory Compliance Hurdle

- Concerns surrounding data accuracy, analytical variability, and cybersecurity vulnerabilities in connected diagnostic systems pose significant challenges to broader IVD market penetration. As modern analyzers rely on software, connectivity, and automation, they are susceptible to data integrity risks and system breaches

- For instance, reports of inconsistencies in certain rapid test kits and cybersecurity gaps in network-connected diagnostic instruments have made some healthcare facilities cautious about adopting newer digital IVD platforms

- Addressing these concerns through robust data-protection measures, advanced quality-control mechanisms, and regular software upgrades is essential for building user confidence. Companies such as Roche and Siemens Healthineers highlight their strong compliance frameworks and security standards to reassure buyers. In addition, the relatively high cost of advanced IVD systems compared to traditional laboratory methods can be a barrier for budget-constrained healthcare settings in developing regions

- While affordability has improved through compact, cost-efficient analyzers, premium technologies such as next-generation sequencing (NGS), high-throughput molecular systems, and automated immunoassay platforms still remain expensive for many institutions, limiting widespread adoption

- Overcoming these challenges through strengthened regulatory compliance, enhanced system security, and the development of more affordable high-accuracy diagnostic solutions will be crucial for sustained market expansion

In Vitro Diagnostics (IVD) Market Scope

The market is segmented on the basis of technique, application, end-user, and product & service.

- By Technique

On the basis of technique, the In Vitro Diagnostics (IVD) market is segmented into immunodiagnostics, hematology, molecular diagnostics, tissue diagnostics, in vitro diagnostics (IVD), and others. The immunodiagnostics segment dominated the market with the largest revenue share in 2025, driven by its extensive use in detecting infectious diseases, autoimmune disorders, cardiovascular conditions, and chronic illnesses. The segment benefits from high test reliability, automation compatibility, and continuous advancements in chemiluminescence, ELISA, and rapid immunoassay technologies. Immunodiagnostics also remains preferred due to its scalability in both high-volume laboratories and decentralized settings. Furthermore, strong demand for antibody-based tests and growing adoption in point-of-care environments reinforce its leadership within the IVD landscape. Increasing prevalence of infectious diseases and rising screening programs continue to propel the segment’s strong market contribution.

The molecular diagnostics segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by rising demand for precision medicine, genomics-based testing, and early disease detection. Molecular diagnostics is rapidly expanding due to its high accuracy in identifying genetic material from pathogens and in supporting oncology, infectious disease testing, and personalized therapy selection. Advancements in PCR, multiplex assays, NGS platforms, and rapid molecular test kits are accelerating its adoption worldwide. Growing focus on early cancer detection and outbreak preparedness is further strengthening this segment. In addition, the shift toward decentralized testing through portable molecular devices is enabling significant penetration in both clinical and non-clinical settings.

- By Application

On the basis of application, the In Vitro Diagnostics (IVD) market is segmented into infectious diseases, cancer, cardiac diseases, immune system disorders, nephrological diseases, gastrointestinal diseases, and others. The infectious diseases segment dominated the market with the largest revenue share in 2025, supported by high global testing volumes for respiratory infections, sexually transmitted infections, and viral diseases. Strong demand for rapid diagnostic tests, PCR assays, and antigen-based kits has reinforced the leadership of this segment. The rising incidence of emerging and re-emerging pathogens continues to drive routine screening and diagnostic activity in hospitals and laboratories. Infectious disease testing is also expanding due to growing awareness, government surveillance programs, and increasing availability of decentralized testing solutions. The segment benefits from robust innovation in both rapid testing technologies and automated laboratory systems.

The cancer segment is expected to witness the fastest growth rate from 2026 to 2033, driven by expanding adoption of genetic and biomarker-based testing for early diagnosis and treatment planning. The rise in cancer prevalence globally is strengthening the need for accurate and sensitive diagnostic tools across oncology care pathways. Liquid biopsies, tumor marker tests, and molecular oncology platforms are gaining strong traction. Advancements in genomic profiling and companion diagnostics are enabling personalized treatment decisions, accelerating segment growth. Increasing investments in cancer screening programs, coupled with technological progress in minimally invasive diagnostics, further support this segment’s rapid expansion.

- By End-User

On the basis of end-user, the In Vitro Diagnostics (IVD) market is segmented into standalone laboratories, hospitals, academic and medical schools, point of care, and others. The standalone laboratory segment dominated the market with the largest revenue share in 2025, driven by high testing volumes, strong infrastructure for complex diagnostics, and broad adoption of automation and digital workflows. Standalone labs often serve as centralized hubs for specialized testing, enabling faster turnaround times and enhanced accuracy through advanced equipment. Their ability to process large sample loads positions them as key providers for national and regional diagnostic services. Furthermore, increased partnerships with healthcare providers and the expansion of diagnostic networks strengthen the leadership of this segment. Growth in preventive healthcare screening and chronic disease monitoring further enhances demand for standalone laboratory testing.

The point-of-care segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for rapid, portable, and decentralized testing solutions across clinical and non-clinical settings. Point-of-care devices support real-time decision-making, enabling faster diagnosis and treatment initiation. Growing use of compact analyzers, rapid antigen tests, glucose monitoring devices, and molecular POC platforms is enhancing adoption. The segment is benefiting from advancements in connectivity and miniaturization, making testing more accessible in rural, remote, and home-care environments. Rising demand for convenience, reduced dependency on centralized labs, and expanding applications in infectious disease and chronic care management continue to propel segment growth.

- By Product and Service

On the basis of product and service, the In Vitro Diagnostics (IVD) market is segmented into reagents, instruments, and software & services. The reagents segment dominated the market with the largest revenue share of 65.50% in 2025, supported by the recurring demand for consumables used in daily laboratory operations and clinical testing. Reagents form the backbone of IVD processes, enabling continuous use in immunoassays, molecular diagnostics, hematology, and biochemistry. The segment benefits from expanding test volumes, growing prevalence of chronic diseases, and regular procurement cycles by laboratories and hospitals. Advancements in assay chemistry and increasing adoption of high-sensitivity reagents support consistent market leadership. In addition, frequent launches of disease-specific test kits continue to reinforce reagents as the highest-selling product category.

The software & services segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising integration of digital diagnostics, laboratory information systems (LIS), and data analytics platforms. The segment is expanding rapidly due to the need for enhanced workflow automation, improved interoperability, and real-time data management across diagnostic environments. Growing adoption of AI-driven interpretation tools and cloud-connected diagnostic platforms further strengthens its growth potential. Increasing focus on patient-centric diagnostics and remote monitoring is also supporting demand for digital service-based solutions. In addition, software-enabled automation is improving lab efficiency, reducing errors, and supporting faster clinical decision-making.

In Vitro Diagnostics (IVD) Market Regional Analysis

- North America dominated the In Vitro Diagnostics (IVD) market with the largest revenue share of 40.8% in 2025, supported by advanced healthcare infrastructure, strong reimbursement systems, high adoption of innovative diagnostic technologies, and the presence of leading global manufacturers that continue to expand molecular and immunoassay test portfolios across the U.S. and Canada

- Consumers and healthcare providers in the region prioritize accurate, rapid, and reliable diagnostic solutions, leading to strong demand for molecular diagnostics, immunoassays, and point-of-care testing technologies. The strong emphasis on early disease detection, preventive healthcare, and personalized medicine continues to reinforce North America’s market leadership

- This dominance is further supported by favorable reimbursement policies, high awareness of routine health screening, and continuous technological innovation, establishing IVD solutions as essential tools for clinical decision-making and chronic disease management across both public and private healthcare settings

U.S. In Vitro Diagnostics (IVD) Market Insight

The U.S. In Vitro Diagnostics (IVD) market captured the largest revenue share within North America in 2025, driven by high diagnostic testing volumes, strong adoption of advanced laboratory technologies, and a well-established healthcare infrastructure. The country’s increasing demand for early disease detection, companion diagnostics, and routine screening continues to fuel market expansion. Rising prevalence of chronic and infectious diseases has accelerated the use of molecular diagnostics, immunoassays, and point-of-care devices across clinical settings. The growing emphasis on personalized medicine and rapid treatment decisions strengthens the role of IVD solutions in the U.S. market. Moreover, continuous innovation by domestic manufacturers and the integration of digital diagnostic platforms significantly contribute to the market's growth trajectory.

Europe In Vitro Diagnostics (IVD) Market Insight

The Europe In Vitro Diagnostics (IVD) market is projected to expand at a substantial CAGR throughout the forecast period, supported by stringent regulatory standards, strong diagnostic awareness, and widespread adoption of technologically advanced testing methods. Rising healthcare expenditure across major European economies is driving the adoption of innovative diagnostic platforms in hospitals and laboratories. The region's growing focus on preventive healthcare, along with a rising geriatric population, is increasing demand for frequent diagnostic testing. European consumers and healthcare providers show strong preference for highly accurate, automated, and standardized diagnostic systems. Furthermore, growth in screening programs for cancer, cardiovascular disorders, and infectious diseases is reinforcing IVD adoption across multiple clinical environments.

U.K. In Vitro Diagnostics (IVD) Market Insight

The U.K. In Vitro Diagnostics (IVD) market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising diagnostic needs, increasing chronic disease burden, and expanding demand for innovative testing solutions. The country’s strong focus on preventive healthcare and early diagnosis continues to accelerate adoption of advanced IVD technologies. Growing emphasis on digital health and the integration of laboratory information systems are enhancing diagnostic efficiency across medical facilities. The expansion of molecular testing and point-of-care diagnostics is supported by investments in modernizing healthcare infrastructure. In addition, rising awareness regarding screening programs and disease surveillance is further stimulating IVD market growth in the U.K.

Germany In Vitro Diagnostics (IVD) Market Insight

The Germany In Vitro Diagnostics (IVD) market is expected to expand at a considerable CAGR during the forecast period, propelled by high investment in healthcare technology and strong demand for reliable diagnostic systems. Germany’s advanced laboratory infrastructure and emphasis on precision testing continue to drive widespread adoption of automated platforms and molecular diagnostics. The country’s strong focus on quality, data security, and regulatory compliance aligns with the rising need for sophisticated diagnostic solutions. Increasing prevalence of chronic conditions and the growing demand for personalized treatment planning support ongoing expansion of the IVD sector. The integration of innovative technologies, including AI-assisted diagnostics, is also becoming more prevalent across healthcare facilities in Germany.

Asia-Pacific In Vitro Diagnostics (IVD) Market Insight

The Asia-Pacific In Vitro Diagnostics (IVD) market is poised to grow at the fastest CAGR during the forecast period, driven by large population bases, rapid urbanization, and rising healthcare awareness across countries such as China, Japan, and India. Increasing incidence of infectious diseases and chronic illnesses is significantly accelerating diagnostic test usage. Government initiatives promoting healthcare digitalization and expanding laboratory infrastructure are enhancing IVD adoption throughout the region. Moreover, APAC’s role as a global manufacturing hub for diagnostic kits, reagents, and instruments increases affordability and accessibility for local consumers. Growing preference for point-of-care testing and rapid diagnostics continues to strengthen the region’s high-growth trajectory.

Japan In Vitro Diagnostics (IVD) Market Insight

The Japan In Vitro Diagnostics (IVD) market is gaining momentum due to the country’s technologically advanced healthcare environment and increasing demand for high-precision diagnostic testing. Japan’s aging population is driving strong utilization of diagnostic solutions for chronic disease management and preventive screening. The adoption of molecular diagnostics, automated analyzers, and biomarker-based platforms is expanding across hospitals and laboratories. Integration of IVD systems with broader digital health ecosystems, including electronic medical records and AI-enabled platforms, continues to fuel growth. In addition, the country’s focus on innovation, efficiency, and early disease detection reinforces the rising adoption of state-of-the-art diagnostic technologies.

India In Vitro Diagnostics (IVD) Market Insight

The India In Vitro Diagnostics (IVD) market accounted for one of the largest market revenue shares in Asia Pacific in 2025, supported by rapid urbanization, expanding healthcare access, and rising awareness of preventive diagnostics. The country’s growing middle-class population and increasing burden of infectious and chronic diseases are driving strong demand for affordable and accurate testing solutions. India is emerging as a dynamic market for both laboratory-based and point-of-care diagnostics due to rising hospital investments and expanding private diagnostic networks. Government initiatives such as Digital Health Mission and increased healthcare spending are further accelerating market growth. The presence of strong domestic manufacturers and availability of cost-effective test kits continue to propel widespread IVD adoption across urban and rural settings.

In Vitro Diagnostics (IVD) Market Share

The In Vitro Diagnostics (IVD) industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- Danaher (U.S.)

- BD. (U.S.)

- BIOMÉRIEUX (France)

- Bio-Rad Laboratories (U.S.)

- Hologic, Inc. (U.S.)

- QIAGEN (Netherlands)

- PerkinElmer (U.S.)

- DiaSorin S.p.A. (Italy)

- Luminex Corporation (U.S.)

- QuidelOrtho Corporation (U.S.)

- Nova Biomedical Corporation (U.S.)

- Meso Scale Diagnostics, LLC (U.S.)

- Ortho Clinical Diagnostics (U.S.)

- Sysmex Corporation (Japan)

- Seegene Inc. (South Korea)

What are the Recent Developments in Global In Vitro Diagnostics (IVD) Market?

- In January 2024, the European Commission proposed extending transition periods for manufacturers under the In Vitro Diagnostic Medical Devices Regulation (IVDR). The update aims to prevent shortages of critical diagnostic tests by giving companies more time to comply with stricter regulatory requirements. It also introduces a gradual rollout of the EUDAMED database, strengthening transparency and post-market surveillance

- In April 2023, Thermo Fisher Scientific partnered with ALPCO-GeneProof to expand its CE-IVD molecular diagnostic test portfolio. The collaboration introduced 37 PCR-based assays under the TaqPath Menu | GeneProof line, covering infectious diseases such as STIs, respiratory viruses, and gastrointestinal pathogens. This significantly broadened the menu available to diagnostic labs already using Thermo Fisher’s PCR systems

- In January 2023, QIAGEN launched the EZ2 Connect MDx, an automated CE-IVD marked system for DNA/RNA extraction. The platform can purify nucleic acids from up to 24 samples simultaneously in ~30 minutes, boosting laboratory efficiency. Its automation reduces manual handling, minimizing contamination risks and improving reproducibility

- In June 2021, Thermo Fisher Scientific released the TaqPath COVID-19 Fast PCR Combo Kit 2.0, a CE-IVD diagnostic assay. The kit detects SARS-CoV-2 directly from raw saliva samples, eliminating the need for complex extraction steps. It delivers results in under two hours, enabling high-frequency testing in hospitals, airports, and workplaces

- The assay uses multiple genetic targets to maintain accuracy even as new variants emerge.

- In March 2021, QIAGEN unveiled the QIAcube Connect MDx, a CE-IVD marked automaton for standardized sample preparation. The instrument enables diagnostic labs to run a wide range of IVD-approved protocols with high consistency. It supports full automation of purification workflows for DNA, RNA, and proteins. This reduces variability between technicians and ensures tight quality control in clinical testing environments.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.