Global In Vitro Colorectal Cancer Screening Tests Market

Market Size in USD Million

CAGR :

%

USD

943.76 Million

USD

1,633.70 Million

2022

2030

USD

943.76 Million

USD

1,633.70 Million

2022

2030

| 2023 –2030 | |

| USD 943.76 Million | |

| USD 1,633.70 Million | |

|

|

|

|

In-Vitro Colorectal Cancer Screening Tests Market Analysis and Size

Colorectal cancer (CRC) is the third most widespread form of cancer. CRC results for around a tenth of all cancer incidences globally. Regular screening enables early detection, which could result in a 60% reduction in CRC fatalities. Also, with regular annual screening, using in-vitro colorectal cancer screening tests is anticipated to increase the average 5-year survival rate from 46% to 73%. This increasing incidence of colorectal cancer is anticipated to surge the market growth for in-vitro colorectal cancer screening tests.

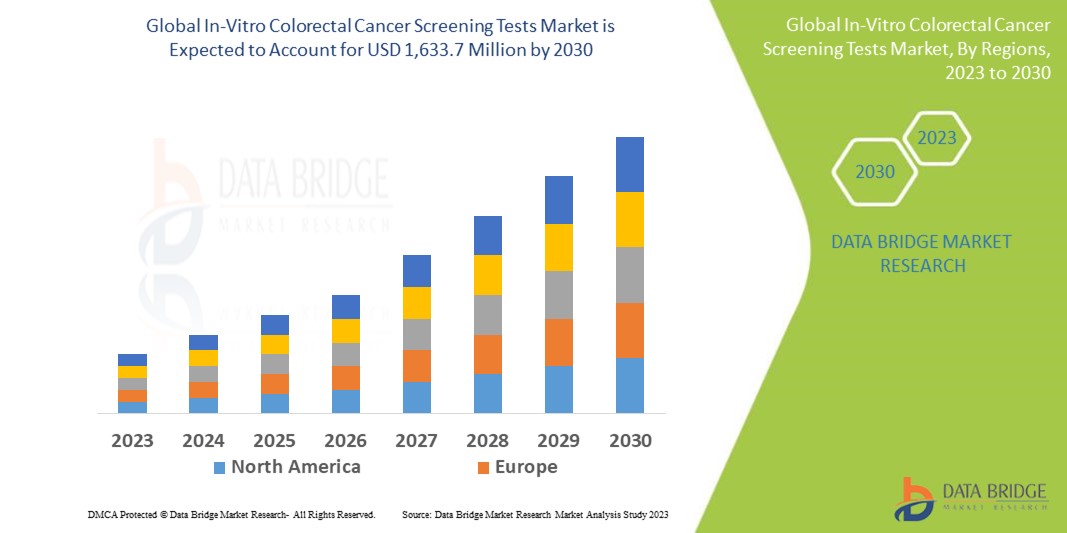

Data Bridge Market Research analyses the in-vitro colorectal cancer screening tests market growth rate in the 2023-2030. The expected CAGR of the in-vitro colorectal cancer screening tests market is around 7.10% in the mentioned forecast period. The market was valued at USD 943.76 million in 2022 and would grow to USD 1,633.7 million by 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

In-Vitro Colorectal Cancer Screening Tests Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Fecal Occult Blood Test, Biomarker Tests, and CRC DNA Screening Tests), End-User (Hospitals, Clinics, Diagnostics laboratories, and Ambulatory Surgical Centers), Imaging Type (Colonoscopy, Proctoscopy, CT Scan, Ultrasound, MRI, PET Scan), Application (MarCarePlex, Cologic, Colox, miRDIGN, PanCDx, and MeSorce CRC) |

|

Countries Covered |

U.S., Canada, and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Abbott (U.S.), Clinical Genomics Technologies Pty, Ltd (U.S.), Epigenomics AG (Germany), Hemosure, Inc (U.S.), Exact Sciences Corporation (U.S.), NOVIGENIX SA (Switzerland), Sekisui Diagnostics (U.S.), Medline Industries, Inc (U.S.), Beckman Coulter, Inc (U.S.), Eiken Chemical Co, Ltd (Japan), Sysmex Corporation (Japan), Siemens Healthcare Private Limited (Japan), Quest Diagnostics Incorporated (U.S.), Oncocyte Corporation (U.S.), Merck KGaA (Germany), Immunostics Inc (U.S.) |

|

Market Opportunities |

|

Market Definition

Colorectal cancer screening tests in-vitro are widely used to detect the presence of the disease. Colorectal cancer grows in the rectum or colon. It is also called rectal or colon cancer, depending on where it originates. Most colorectal cancers begin as a growth on the inner layer of the rectum or colon. Also, a colonoscopy is one of the most sensitive tests for colon cancer screening.

In-Vitro Colorectal Cancer Screening Tests Market Dynamics

Drivers

- Increased Developments of Colorectal Cancer Screening

Technological advancements in colorectal cancer screening are anticipated to boost market growth during the forecast period. Lately, the FDA approved the fecal DNA test and blood test to detect colorectal cancer to meet the market requirements for minimally invasive diagnostic tests. Furthermore, developments in industrial genetics have used DNA sequencing with high speeds and at affordable costs, enhancing the adoption rate for in-vitro colorectal cancer screening tests, thus increasing market growth. Thus, this is expected to boost market growth.

- Increasing Incidence of Colorectal Cancer

Colorectal cancer (CRC) is the third most common cancer globally, with 1.36 million people affected globally, resulting in approximately 10% of cancers. About 142,820 new cases with 50,830 deaths were accounted for in the U.S. in 2013 because of colorectal cancer, and around 447,000 new cases of CRC and 215,000 deaths in European countries were witnessed in 2012. The new cases of colorectal cancer in China were expected to be around 400000 in 2012. Thus, this increasing number of cancer cases leads to higher screening tests which will help in patient recovery. Thus, this boosts the market growth

Opportunities

- Increasing Number of Genetic Tests

Various genetic tests have been developed for colon cancer, which include the hereditary non-polyposis colon cancer (HNPCC) test and familial adenomatous polyposis (FAP) test. Genetic testing for colon cancer creates much better opportunities for early diagnosis. For instance, the most common genetic changes associated with colon cancer are familial adenomatous polyposis (FAP) and hereditary non-polyposis colorectal cancer (HNPCC). These genetic changes could be identified at a very early age with the help of genetic testing. Thus, this factor boosts market growth.

- Increasing Demand for Colonoscopy

Colonoscopy has been the preferred mode of colorectal cancer screening and prevention for many years. As per the U.S. Preventive Services Task Force, in 2021, the recommended age at which adults are eligible for screening for colorectal cancer is 45-75. The decision to be screened after the age of 75 years should be made on an individual basis. Therefore, many people can be screened for the disease because of the age criteria. Therefore, this factor helps in the growth of the market.

Restraints/Challenges

- High Cost of Screening Tests

Numerous hospitals in underdeveloped and developing nations cannot invest in colorectal cancer screening because of high costs and budget constraints. Though, because of the high demand for diagnostic imaging procedures in these countries, the hospitals that can't afford to buy new and advanced machines for screening opt for other alternatives. Thus, this factor restraints the market growth.

This in-vitro colorectal cancer screening tests market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the In-vitro colorectal cancer screening tests market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2021, the U.S. Food and Drug Administration (U.S. FDA) announced the approval of GI Genius, a device that uses artificial intelligence based on machine learning. It is revealed to help clinicians identify lesions such as polyps or suspected tumors in the colon during a colonoscopy.

Global In-Vitro Colorectal Cancer Screening Tests Market Scope

The in-vitro colorectal cancer screening tests market is segmented on the basis of product, imaging type, application and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Fecal Occult Blood Test

- Guaiac FOB Stool Test

- Immuno-FOB Agglutination Test

- Lateral Flow Immuno-FOB Test

- Immuno-FOB ELISA Test

- Biomarker Tests

- Tumor M2-PK Stool Test

- Transferrin Assasys

- CRC DNA Screening Tests

- Methylated Gene Test

- Panel DNA Test

Imaging Type

- Colonoscopy

- Proctoscopy

- CT Scan

- Ultrasound

- MRI

- PET Scan

End-User

- Hospitals

- Clinics

- Diagnostics laboratories

- Ambulatory Surgical Centers

Application

- MarCarePlex

- Cologic

- Colox

- miRDIGN

- PanCDx

- MeSorce CRC

In-Vitro Colorectal Cancer Screening Tests Market Regional Analysis/Insights

The in-vitro colorectal cancer screening tests market is analyzed and market size insights and trends are provided by product, imaging type, application and end-user as referenced above.

The major countries covered in the in-vitro colorectal cancer screening tests market report are the U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the market due to the increasing incidence rate and improved healthcare infrastructure. Factors such as a larger elderly population also led to market growth.

Asia Pacific is projected to witness huge growth in the market to the growing predominance of cancer in this region. Also, cancer is an increasing concern in this region because of the elderly population's expanding base and lifestyle modifications in Asian countries, leading to market growth.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global In-Vitro Colorectal Cancer Screening Tests Market Share Analysis

The in-vitro colorectal cancer screening tests market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related in-vitro colorectal cancer screening tests market.

Key players operating in the in-vitro colorectal cancer screening tests market include:

- Abbott (U.S.)

- Clinical Genomics Technologies Pty, Ltd (U.S.)

- Epigenomics AG (Germany)

- Hemosure, Inc (U.S.)

- Exact Sciences Corporation (U.S.)

- NOVIGENIX SA (Switzerland)

- Sekisui Diagnostics (U.S.)

- Medline Industries, Inc (U.S.)

- Beckman Coulter, Inc (U.S.)

- Eiken Chemical Co, Ltd (Japan)

- Sysmex Corporation (Japan)

- Siemens Healthcare Private Limited (Japan)

- Quest Diagnostics Incorporated (U.S.)

- Oncocyte Corporation (U.S.)

- Merck KGaA (Germany)

- Immunostics Inc (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.