Global Implantable Biomaterial Market

Market Size in USD Billion

CAGR :

%

USD

165.50 Billion

USD

248.26 Billion

2025

2033

USD

165.50 Billion

USD

248.26 Billion

2025

2033

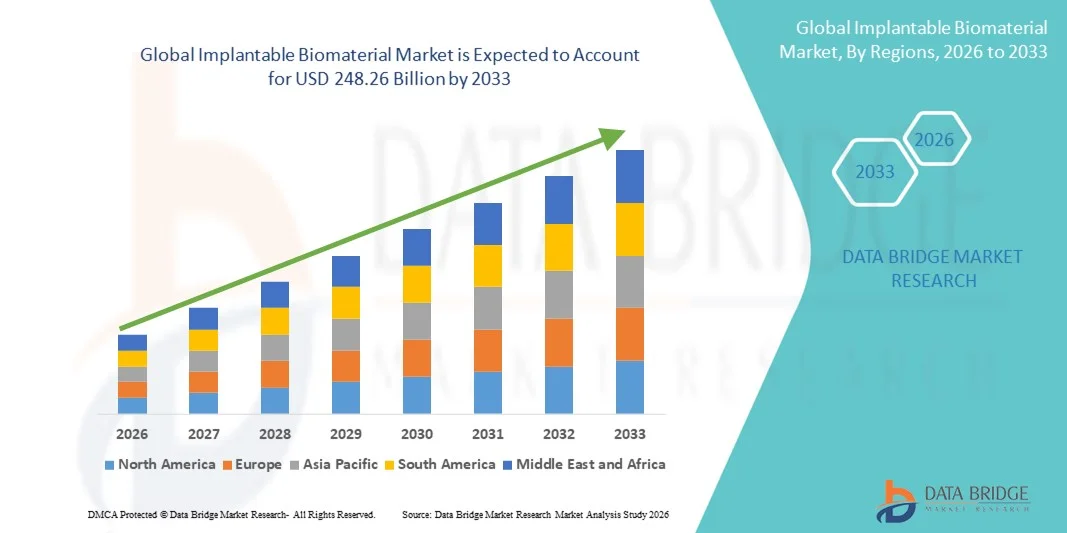

| 2026 –2033 | |

| USD 165.50 Billion | |

| USD 248.26 Billion | |

|

|

|

|

Implantable Biomaterial Market Size

- The global Implantable Biomaterial market size was valued at USD 165.5 billion in 2025 and is expected to reach USD 248.26 billion by 2033, at a CAGR of 5.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced medical implant technologies and continuous innovations in biomaterials, leading to improved biocompatibility, durability, and clinical outcomes across orthopedic, dental, cardiovascular, and cosmetic applications.

- Furthermore, rising demand for minimally invasive procedures, longer-lasting implants, and patient-specific solutions is establishing implantable biomaterials as essential components of modern medical treatments. These converging factors are accelerating the uptake of implantable biomaterial solutions, thereby significantly boosting overall market growth

Implantable Biomaterial Market Analysis

- Implantable biomaterials, which are used in medical implants to replace or support damaged biological tissues, are increasingly vital components of modern healthcare due to their role in improving patient outcomes across orthopedic, cardiovascular, dental, and soft tissue applications

- The escalating demand for implantable biomaterials is primarily fueled by the rising prevalence of chronic diseases, growing aging population, increasing volume of surgical procedures, and continuous advancements in biocompatible and bioresorbable material technologies

- North America dominated the implantable biomaterial market with the largest revenue share of approximately 42.1% in 2025, supported by advanced healthcare infrastructure, high adoption of innovative implant technologies, strong reimbursement systems, and the presence of leading medical device manufacturers, with the U.S. accounting for the majority of regional demand

- Asia-Pacific is expected to be the fastest-growing region in the implantable biomaterial market during the forecast period, registering a CAGR of approximately 19.6%, driven by expanding healthcare infrastructure, increasing surgical volumes, rising medical tourism, and growing investments in advanced biomaterial research across emerging economies

- The metallic segment dominated the largest market revenue share of 42.5% in 2025, driven by its extensive use in orthopedic and cardiovascular implants due to high strength and durability

Report Scope and Implantable Biomaterial Market Segmentation

|

Attributes |

Implantable Biomaterial Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Implantable Biomaterial Market Trends

Advancements in Biocompatible and Bioactive Implant Materials

- A significant and accelerating trend in the global implantable biomaterial market is the development of advanced biocompatible and bioactive materials that enhance tissue integration, reduce rejection risk, and improve long-term implant performance

- For instance, bioactive ceramics and polymer-based biomaterials are increasingly used in orthopedic and dental implants due to their ability to promote bone regeneration and improve implant stability

- Innovations in surface modification technologies, such as nano-coatings and porous structures, are improving cell adhesion and accelerating healing processes. These advancements are particularly impactful in cardiovascular and orthopedic implant applications.

- The integration of smart and biodegradable biomaterials that gradually dissolve or adapt within the body is gaining traction, reducing the need for secondary surgeries and improving patient outcomes

- This shift toward more durable, biologically compatible, and application-specific implant materials is reshaping clinical expectations and driving continuous research and development across the implantable biomaterial industry

- As a result, manufacturers are increasingly focusing on customized and next-generation biomaterials tailored for specific therapeutic areas such as orthopedics, dental, cardiovascular, and neurological implants

Implantable Biomaterial Market Dynamics

Driver

Rising Demand for Medical Implants and Growth in Surgical Procedures

- The increasing prevalence of chronic diseases, musculoskeletal disorders, cardiovascular conditions, and dental problems is a major driver fueling demand for implantable biomaterials worldwide

- For instance, the growing number of joint replacement surgeries and dental implant procedures globally is significantly boosting the demand for biocompatible metals, ceramics, and polymers

- The aging global population is further contributing to market growth, as elderly individuals are more prone to conditions requiring implants, such as hip and knee replacements

- Technological advancements in minimally invasive surgical techniques are increasing the adoption of implant-based treatments, thereby driving demand for high-performance implantable biomaterials

- In addition, rising healthcare expenditure, expanding access to advanced medical care, and increasing awareness about implant-based therapies are supporting market expansion across both developed and emerging economies

Restraint/Challenge

High Development Costs and Stringent Regulatory Requirements

- One of the major challenges restraining the implantable biomaterial market is the high cost associated with research, development, and manufacturing of advanced biomaterials

- For instance, extensive biocompatibility testing, clinical trials, and regulatory approvals required for implantable biomaterials significantly increase time-to-market and overall development costs

- Stringent regulatory frameworks imposed by authorities such as the FDA and EMA require manufacturers to meet rigorous safety and performance standards, which can delay product launches

- In addition, the risk of implant failure, post-surgical complications, and material-related adverse reactions can limit adoption and increase liability concerns for manufacturers

- Overcoming these challenges through cost-effective manufacturing processes, advanced material engineering, and streamlined regulatory pathways will be critical for sustaining long-term growth in the implantable biomaterial market

Implantable Biomaterial Market Scope

The market is segmented on the basis of material, application, and end user.

- By Material

On the basis of material, the Implantable Biomaterial market is segmented into metallic, ceramic, polymers, natural, and composite. The metallic segment dominated the largest market revenue share of 42.5% in 2025, driven by its extensive use in orthopedic and cardiovascular implants due to high strength and durability. Metallic biomaterials such as titanium alloys and stainless steel are preferred for load-bearing implants like hip and knee prostheses. Their proven biocompatibility and corrosion resistance make them ideal for long-term implantation. The high adoption in major surgical procedures contributes significantly to market dominance. Metal implants also support advanced surface coatings for improved integration and reduced rejection. Strong manufacturing capabilities and established supply chains strengthen the segment’s growth. Major orthopedic device companies continue to focus on metal-based innovations. In addition, the growing elderly population increases demand for joint replacement surgeries, further boosting metallic biomaterials. The increasing preference for long-term durable implants supports the dominance. Metallic materials also dominate in dental implants and bone fixation devices. As a result, the metallic segment remains the largest in 2025.

The polymers segment is anticipated to witness the fastest CAGR of 18.7% from 2026 to 2033, driven by rising demand for lightweight and flexible implant solutions. Polymers such as polyethylene, PMMA, and biodegradable polymers are increasingly used in orthopedic spacers, wound dressings, and tissue scaffolds. Polymer-based implants offer advantages such as reduced weight, flexibility, and customization using 3D printing. Growing research in biodegradable polymers for temporary implants supports adoption. Increased use of polymer scaffolds in tissue engineering further accelerates growth. The expanding market for drug-eluting polymer implants in cardiovascular applications also boosts demand. Polymer biomaterials are gaining traction in minimally invasive procedures due to ease of handling. Advancements in polymer surface modification improve biocompatibility and integration. As a result, polymer biomaterials are expected to show rapid growth in the forecast period.

- By Application

On the basis of application, the Implantable Biomaterial market is segmented into dental, cardiovascular, ophthalmology, orthopedic, plastic surgery, wound healing, neurological disorders, tissue engineering, and other. The orthopedic segment dominated the largest market revenue share of 38.9% in 2025, driven by rising prevalence of osteoarthritis and joint disorders worldwide. Orthopedic implants require strong and durable biomaterials to support weight-bearing and mobility. The increasing number of joint replacement surgeries, especially hip and knee arthroplasty, significantly boosts demand. Aging population and lifestyle-related disorders increase orthopedic procedure volumes. Implantable biomaterials are also used in spinal fixation and trauma repair, further contributing to market share. Technological advancements in implant design and coatings enhance outcomes and encourage adoption. High adoption in developed regions supports market dominance. Increasing government initiatives for improved healthcare access also boost orthopedic implant procedures. The strong presence of leading orthopedic device manufacturers supports segment growth. Overall, orthopedic application remains the largest revenue contributor.

The tissue engineering segment is expected to witness the fastest CAGR of 20.1% from 2026 to 2033, driven by rising investments in regenerative medicine and scaffold development. Tissue engineering uses biomaterials as scaffolds to support cell growth and tissue regeneration. Increasing research in stem cell therapy and bioactive scaffolds accelerates market growth. The demand for customized implants through 3D bioprinting further fuels the segment. Tissue engineering is gaining traction in wound healing and organ regeneration applications. Collaboration between biotech companies and research institutes enhances innovation. The growing need for personalized medicine supports adoption. Regulatory support for regenerative therapies also encourages investment. As a result, tissue engineering is expected to grow rapidly during the forecast period.

- By End User

On the basis of end user, the Implantable Biomaterial market is segmented into hospitals, ambulatory surgical centers, and specialty clinics. The hospitals segment accounted for the largest market revenue share of 44.8% in 2025, driven by the high volume of surgical procedures and availability of advanced surgical facilities. Hospitals perform most orthopedic, cardiovascular, and neurological implant surgeries, which require complex infrastructure and skilled surgeons. The presence of well-equipped operating theaters and advanced post-surgery care supports adoption. Hospitals also participate in clinical trials and research programs, increasing biomaterial usage. Higher purchasing power and bulk procurement agreements strengthen hospital dominance. In addition, hospitals often have dedicated departments for implant surgeries, increasing demand. The strong presence of trained surgeons and specialists supports market growth. Hospitals also have the capacity to use high-cost premium implants, boosting revenue. As a result, hospitals remain the largest end-user segment.

The ambulatory surgical centers (ASCs) segment is expected to witness the fastest CAGR of 17.3% from 2026 to 2033, driven by the rising preference for outpatient procedures and cost-effective surgical care. ASCs provide a convenient alternative for patients seeking same-day surgeries. Increasing adoption of minimally invasive procedures supports growth. ASCs offer lower treatment costs compared to hospitals, encouraging patient preference. Expansion of ASCs in emerging markets supports market growth. The rising trend of outpatient orthopedic and dental surgeries increases biomaterial demand. In addition, ASCs are adopting advanced implants and technologies to attract patients. This trend is expected to continue, driving rapid growth in the ASC segment.

Implantable Biomaterial Market Regional Analysis

- North America dominated the implantable biomaterial market with the largest revenue share of approximately 42.1% in 2025, supported by advanced healthcare infrastructure, high adoption of innovative implant technologies, strong reimbursement systems, and the presence of leading medical device manufacturers

- The region benefits from a high volume of orthopedic, dental, cardiovascular, and neurosurgical procedures, which increases demand for implantable biomaterials. Ongoing technological advancements and strong research activities in biomaterials and medical devices further support market growth

- In addition, the growing focus on personalized medicine and improved patient outcomes is driving adoption of advanced biomaterials across hospitals and specialty clinics

U.S. Implantable Biomaterial Market Insight

The U.S. implantable biomaterial market accounted for the majority of regional demand in North America in 2025. This is attributed to strong healthcare expenditure, robust clinical research and development, and widespread adoption of advanced implant technologies. The U.S. has a large number of leading medical device manufacturers and specialized hospitals, which accelerate product launches and adoption of innovative biomaterials. Favorable reimbursement policies and increasing demand for minimally invasive surgeries are also supporting the market expansion in the U.S.

Europe Implantable Biomaterial Market Insight

The Europe implantable biomaterial market is projected to expand at a substantial CAGR during the forecast period, driven by strong healthcare systems, increasing prevalence of chronic diseases, and rising demand for advanced surgical implants. Growing investments in medical research and high adoption of innovative implant technologies are supporting market growth. In addition, increasing awareness about bone and cardiovascular disorders is boosting the demand for implantable biomaterials across Europe.

U.K. Implantable Biomaterial Market Insight

The U.K. implantable biomaterial market is expected to grow at a notable CAGR during the forecast period, supported by advanced healthcare infrastructure and rising number of surgical procedures. The increasing focus on improving patient outcomes and the growing adoption of high-performance biomaterials in orthopedic and dental applications are driving market growth. In addition, government initiatives supporting healthcare innovation and increased access to advanced treatment options are further strengthening the market.

Germany Implantable Biomaterial Market Insight

Germany implantable biomaterial market is anticipated to witness considerable growth in the implantable biomaterial market during the forecast period, driven by strong healthcare infrastructure and high medical device innovation. The country has a well-established medical technology sector and high adoption of advanced implant materials, especially in orthopedics and cardiovascular applications. Increasing healthcare expenditure and growing number of surgeries are also supporting the demand for implantable biomaterials in Germany.

Asia-Pacific Implantable Biomaterial Market Insight

Asia-Pacific implantable biomaterial market is expected to be the fastest-growing region in the implantable biomaterial market during the forecast period, registering a CAGR of approximately 19.6%. This rapid growth is driven by expanding healthcare infrastructure, increasing surgical volumes, rising medical tourism, and growing investments in advanced biomaterial research across emerging economies. Improving access to advanced healthcare services and increasing awareness about implant-based treatments are boosting the adoption of implantable biomaterials in the region. In addition, rapid economic growth and increasing healthcare spending in countries such as China, India, and Japan are supporting market expansion.

Japan Implantable Biomaterial Market Insight

Japan’s implantable biomaterial market is gaining momentum due to the country’s advanced healthcare system, high healthcare expenditure, and growing demand for innovative implant technologies. The aging population and rising prevalence of chronic conditions such as osteoporosis and cardiovascular diseases are increasing demand for orthopedic and cardiovascular implants. Moreover, Japan’s strong focus on medical research and technological innovation is further supporting market growth.

China Implantable Biomaterial Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2025, driven by increasing healthcare spending, expanding number of hospitals, and rising surgical procedures. The growing medical tourism industry and government initiatives to improve healthcare access are also supporting market growth. Furthermore, increasing investments in advanced biomaterial research and development are encouraging local manufacturing and adoption of implantable biomaterials.

Implantable Biomaterial Market Share

The Implantable Biomaterial industry is primarily led by well-established companies, including:

- Stryker Corporation (U.S.)

- Zimmer Biomet (U.S.)

- Johnson & Johnson (U.S.)

- Medtronic (Ireland)

- Smith & Nephew (U.K.)

- Boston Scientific (U.S.)

- B. Braun Melsungen AG (Germany)

- Baxter International (U.S.)

- Terumo Corporation (Japan)

- 3M Company (U.S.)

- Gore Medical (U.S.)

- Corbion (Netherlands)

- DSM Biomedical (Netherlands)

- Baxter (U.S.)

- Cook Medical (U.S.)

- Integra LifeSciences (U.S.)

- Teleflex (U.S.)

- Evonik Industries (Germany)

- Heraeus Medical (Germany)

- Mitsubishi Chemical Group (Japan)

Latest Developments in Global Implantable Biomaterial Market

- In September 2021, Osfirm launched a new implantable Whitlockite biomaterial, a magnesium tricalcium phosphate-based material with enhanced bioactive regenerative and reconstructive properties, aimed at improving bone healing and compatibility in orthopedic applications. This launch marked a significant advancement in bioactive ceramic implants for musculoskeletal repair

- In February 2023, Bioretec Ltd. received FDA approval for the RemeOs trauma screw, the first bioresorbable metal implant for treating ankle fractures. This bioresorbable metal implant represents a key regulatory milestone for biodegradable metallic biomaterials designed to eliminate the need for removal surgery after healing

- In March 2023, Invibio Biomaterial Solutions launched PEEK-OPTIMA AM Filament, a specially optimized polyetheretherketone (PEEK) polymer for additive manufacturing of medical implants, supporting the rapid expansion of 3D printed, patient-specific implantable biomaterials in surgical and orthopedic applications

- In May 2024, Zimmer Biomet introduced an innovative orthopaedic implant made from highly porous titanium biomaterial, designed to enhance osseointegration and long-term stability in joint replacement surgeries, reflecting major progress in implant surface and structural engineering

- In January 2024, Xenco Medical LLC launched the TrabeculeX Continuum platform, combining regenerative biomaterials with digital health monitoring to optimize bone healing and enable continuous patient support post-surgery — a notable evolution toward integrating biomaterials with personalized post-operative care

- In August 2025, Nobel Biocare expanded its biomaterial offerings in dental implants with new ceramic implant solutions, targeting patients with metal sensitivities and emphasizing hypoallergenic, aesthetic implant options that promote broader adoption of advanced biomaterials in dentistry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.