Global Immuno Ivd Market

Market Size in USD Billion

CAGR :

%

USD

19.89 Billion

USD

28.89 Billion

2024

2032

USD

19.89 Billion

USD

28.89 Billion

2024

2032

| 2025 –2032 | |

| USD 19.89 Billion | |

| USD 28.89 Billion | |

|

|

|

|

Immuno In-Vitro Diagnostics (IVD) Market Size

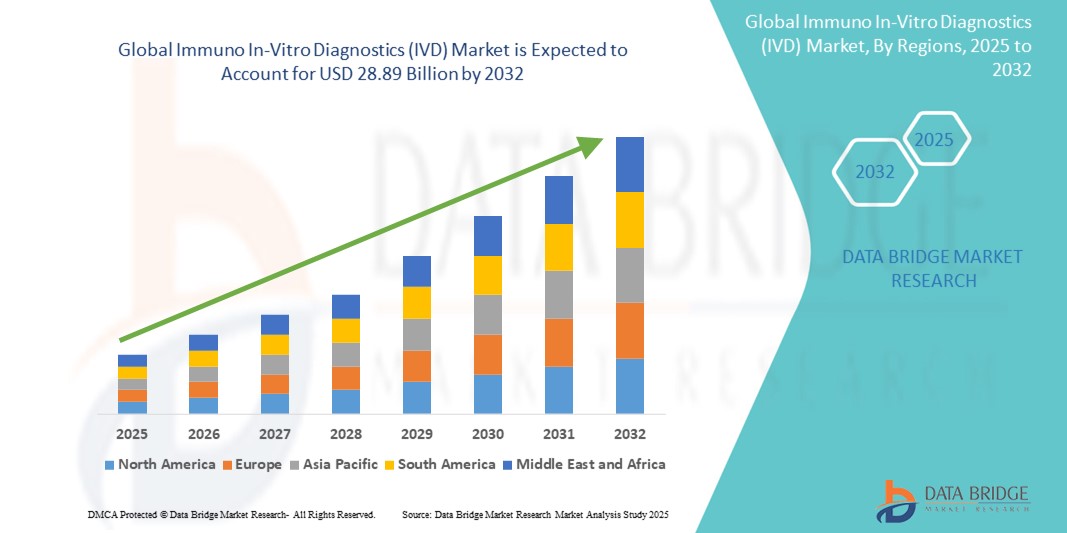

- The global Immuno In-Vitro Diagnostics (IVD) market size was valued at USD 19.89 billion in 2024 and is expected to reach USD 28.89 billion by 2032, at a CAGR of 4.78% during the forecast period

- This growth is driven by factors such as increasing geriatric population

Immuno In-Vitro Diagnostics (IVD) Market Analysis

- Immuno In-Vitro Diagnostics (IVD) are essential diagnostic tools used for the detection of diseases by analyzing samples such as blood, urine, or tissue outside the body. These diagnostics play a crucial role in the early detection, monitoring, and management of conditions such as infectious diseases, diabetes, cancer, and autoimmune disorders

- The growing burden of chronic and infectious diseases, increased focus on personalized medicine, and advancements in diagnostic technologies are major drivers propelling the IVD market forward

- North America is expected to dominate the Immuno IVD market with the largest market share of 48.98% due to well-established healthcare systems, high diagnostic test adoption, and the presence of leading market players such as Abbott, Danaher, and Thermo Fisher Scientific

- Asia-Pacific is expected to be the fastest growing region in the Immuno In-Vitro Diagnostics (IVD) market during the forecast period due to improving healthcare infrastructure, rising healthcare awareness, and government support for early disease detection programs

- Reagents segment is expected to dominate the market with a market share of 66.22% in 2025 due to its essential role in diagnostic and imaging processes, increasing adoption in ophthalmic testing procedures, and consistent demand for consumables in both clinical and research settings

Report Scope and Immuno In-Vitro Diagnostics (IVD) Market Segmentation

|

Attributes |

Immuno In-Vitro Diagnostics (IVD) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Immuno In-Vitro Diagnostics (IVD) Market Trends

“Expansion of Point-of-Care (POC) Testing for Rapid Diagnostics”

- One major trend in the Immuno IVD market is the rapid expansion of Point-of-Care (POC) diagnostic solutions, which enable testing to be conducted closer to the patient, such as in clinics, pharmacies, or at home.

- POC diagnostics allow for faster decision-making, especially in emergency and outpatient settings, improving patient management and reducing the burden on centralized labs

- For instance, Abbott’s i-STAT Alinity system is gaining global adoption due to its handheld design and ability to deliver lab-accurate results in minutes, revolutionizing diagnostics in remote and resource-limited settings

- This trend is transforming the IVD landscape by promoting accessibility, decentralization, and speed in diagnostics, especially in infectious disease screening and chronic disease monitoring

Immuno In-Vitro Diagnostics (IVD) Market Dynamics

Driver

“Rising Demand for Early Disease Detection and Personalized Medicine”

- The increasing awareness and demand for early and precise disease detection, coupled with the global shift toward personalized healthcare, are key factors propelling the IVD market

- Immunoassay-based diagnostics help detect biomarkers and monitor responses to therapies, supporting tailored treatment plans that improve patient outcomes

- As governments and healthcare providers emphasize preventive care, the demand for immunodiagnostic tools across oncology, cardiology, and infectious diseases continues to rise

- For instance, in August 2024, Roche launched its Elecsys GAAD panel for early detection of Alzheimer’s disease biomarkers, reinforcing the growing role of immunodiagnostics in neurodegenerative disease management

- The market is witnessing substantial growth as immunodiagnostics align with the global movement toward precision medicine and predictive diagnostics

Opportunity

“Growing Adoption in Emerging Economies Due to Expanding Healthcare Infrastructure”

- Emerging markets such as India, Brazil, and Southeast Asia present significant opportunities for Immuno IVD manufacturers, driven by rapid healthcare infrastructure development and increasing healthcare access

- Governments are investing in national screening programs and public health campaigns to detect diseases such as HIV, TB, and hepatitis at earlier stages

- Moreover, international collaborations and subsidies are encouraging the local availability and affordability of diagnostic solutions

- For instance, in October 2024, India’s National Health Authority partnered with diagnostic companies to integrate immunodiagnostic tests under the Ayushman Bharat Digital Mission, aiming to broaden disease detection coverage

- These developments open a lucrative avenue for global players to introduce cost-effective, scalable immunoassay technologies tailored to the needs of growing populations

Restraint/Challenge

“Stringent Regulatory Approvals and Compliance Hurdles”

- The Immuno IVD industry is heavily regulated to ensure test accuracy, safety, and reliability, which can slow product launches and increase development costs

- Navigating diverse regulatory frameworks across countries such as FDA (U.S.), EMA (Europe), and CDSCO (India) can be complex and time consuming for global manufacturers

- In addition, the transition to IVDR compliance in the EU is pushing companies to reassess and relabel products, delaying market entry

- For instance, in July 2024, multiple small IVD manufacturers reported delays in European launches due to the increased documentation and testing required under IVDR regulations

- These regulatory hurdles can reduce agility in innovation, increase operational costs, and act as a significant barrier, especially for startups and small-scale diagnostic firms

Immuno In-Vitro Diagnostics (IVD) Market Scope

The market is segmented on the basis of product type, immunodiagnostics technique, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Immunodiagnostics Technique |

|

|

By Application |

|

|

By End User |

|

In 2025, the reagents is projected to dominate the market with a largest share in product type segment

The reagents segment is expected to dominate the Immuno In-Vitro Diagnostics (IVD) market with the largest share of 66.22% in 2025 due to its essential role in diagnostic and imaging processes, increasing adoption in ophthalmic testing procedures, and consistent demand for consumables in both clinical and research settings.

The infectious diseases is expected to account for the largest share during the forecast period in application segment

In 2025, the infectious diseases segment is expected to dominate the market, due to the rising global burden of infectious outbreaks, increasing demand for early and accurate diagnostics, and expanding public health initiatives aimed at controlling disease spread.

Immuno In-Vitro Diagnostics (IVD) Market Regional Analysis

“North America Holds the Largest Share in the Immuno In-Vitro Diagnostics (IVD) Market”

- North America dominates the Immuno In-Vitro Diagnostics (IVD) market with the largest market share of , driven by its robust healthcare infrastructure, rapid adoption of advanced diagnostic tools, and presence of major IVD manufacturers

- The U.S. contributes significantly due to its strong focus on preventive healthcare, growing geriatric population, and high prevalence of chronic and infectious diseases requiring accurate diagnostic testing

- Favorable reimbursement policies, increased healthcare spending, and consistent technological advancements in immunodiagnostics further enhance regional growth

- The presence of leading market players, ongoing research initiatives, and strategic collaborations between public and private sectors continue to propel innovation and market expansion in the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Immuno In-Vitro Diagnostics (IVD) Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the Immuno In-Vitro Diagnostics (IVD) market, driven by due to rising healthcare awareness, increasing investments in diagnostics, and government support for healthcare reforms

- Countries such as China, India, South Korea, and Japan are driving regional growth owing to increasing incidence of infectious and lifestyle-related diseases, improved access to healthcare services, and the development of diagnostic laboratories

- China’s expanding healthcare infrastructure and India’s rapid adoption of point-of-care testing and self-diagnosis solutions are significantly contributing to the rising demand for IVDs

- Japan remains a leader in diagnostic technology adoption, while Southeast Asian nations are witnessing a surge in immunodiagnostic testing as part of national disease control programs

Immuno In-Vitro Diagnostics (IVD) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Danaher (U.S.)

- Abbott (U.S.)

- Siemens (Germany)

- Thermo Fisher Scientific, Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- BD (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Sysmex Corporation (Japan)

- bioMérieux SA (France)

- DiaSorin S.p.A. (Italy)

- Ortho Clinical Diagnostics (U.S.)

- Agilent Technologies, Inc. (U.S.)

- QIAGEN (Netherlands)

- Bayer AG (Germany)

- Cepheid (U.S.)

- Leica Biosystems Nussloch GmbH (Germany)

- Quidel Corporation (U.S.)

- CARIS LIFE SCIENCES (U.S.)

- GenomeMe (Canada)

Latest Developments in Global Immuno In-Vitro Diagnostics (IVD) Market

- In February 2025, ABL Diagnostics announced it would begin manufacturing and commercializing a comprehensive range of UltraGene PCR tests acquired from its parent company, Advanced Biological Laboratories, covering more than 100 pathogens for infectious disease diagnostics across various conditions, and plans to integrate these with its DeepChek sequencing tools to expand its footprint in precision medicine, thereby reinforcing its position in advanced molecular diagnostics

- In January 2025, QIAGEN received U.S. FDA clearance for its QIAstat-Dx Gastrointestinal Panel 2 Mini B&V, a targeted syndromic test designed to detect bacterial and viral gastrointestinal infections, with a planned product launch aimed at broadening QIAGEN's syndromic testing capabilities in both inpatient and outpatient settings, enhancing its market presence in precision diagnostics

- In October 2024, Becton, Dickinson and Company (BD) obtained Health Canada approval for its Onclarity HPV Assay to be used with self-collected vaginal samples, enabling at-home human papillomavirus (HPV) testing, which improves accessibility to early cervical cancer screening solutions

- In June 2024, bioMérieux announced that its BIOFIRE SPOTFIRE Respiratory/Sore Throat (R/ST) Panel Mini received FDA Special 510(k) clearance and a CLIA waiver, offering a point-of-care multiplex PCR solution that can detect five common respiratory and sore throat pathogens in approximately 15 minutes using relevant swab samples, thus enhancing rapid diagnostic capabilities in clinical settings

- In January 2024, ELITechGroup expanded its in-vitro diagnostics portfolio by launching the CE-IVDR-certified GI bacterial PLUS ELITe MGB kit, capable of identifying bacterial pathogens linked to gastrointestinal infections, aiming to boost adoption of advanced diagnostics in GI testing

- In January 2024, HORIBA Medical introduced its CE-IVDR-certified 2.0 high-throughput automated hematology platform, engineered to deliver high-quality and scalable analytical performance for clinical laboratories, supporting improved efficiency and reliability in hematology testing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.