Global Idle Air Control Valve Market

Market Size in USD Billion

CAGR :

%

USD

8.96 Billion

USD

25.39 Billion

2024

2032

USD

8.96 Billion

USD

25.39 Billion

2024

2032

| 2025 –2032 | |

| USD 8.96 Billion | |

| USD 25.39 Billion | |

|

|

|

|

Idle Air Control Valve Market Size

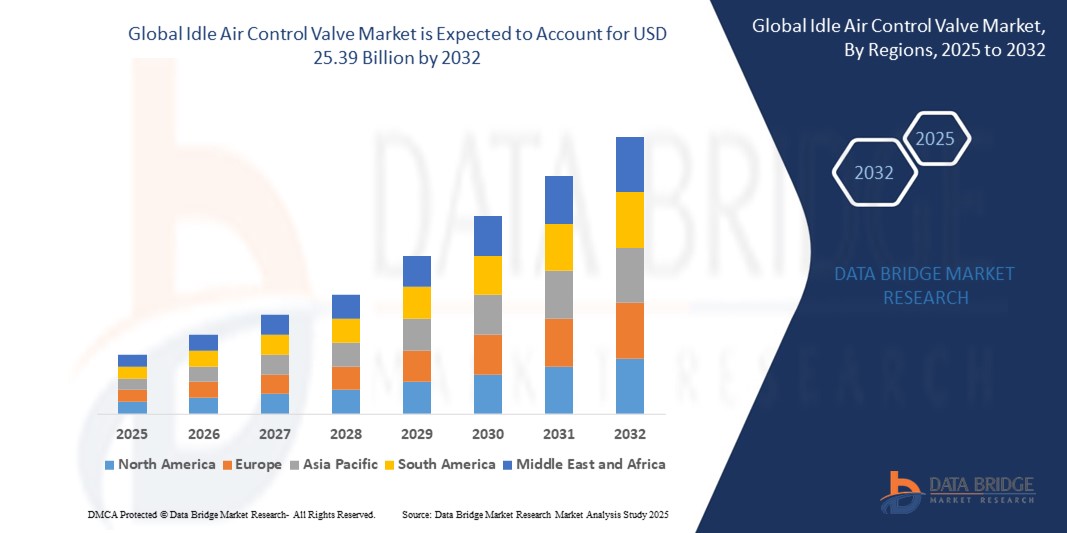

- The global idle air control valve market size was valued at USD 8.96 billion in 2024 and is expected to reach USD 25.39 billion by 2032, at a CAGR of 13.90% during the forecast period

- The market growth is largely fueled by the increasing demand for improved engine performance, fuel efficiency, and emissions control in internal combustion engine vehicles across both developed and developing regions

- Furthermore, rising production of passenger and commercial vehicles, coupled with advancements in automotive engine management systems, is driving the adoption of idle air control valves as a critical component in maintaining optimal engine idling. These converging factors are accelerating the deployment of precision-engineered idle control systems, thereby significantly boosting the industry's growth

Idle Air Control Valve Market Analysis

- Idle air control valves are electronically controlled components that regulate the engine’s idle speed by managing airflow bypassing the throttle plate. These valves play a crucial role in stabilizing engine performance during start-up, deceleration, and idle phases

- The demand for idle air control valves is primarily driven by the rising need for smoother engine operation, reduced fuel consumption, and compliance with stringent emission regulations. Their continued integration in gasoline-powered vehicles, particularly in regions with aging vehicle fleets, supports sustained market growth across OEM and aftermarket channels

- Europe dominated the idle air control valve market with a share of 21.1% in 2024, due to its strong automotive manufacturing base, stringent emissions standards, and a high concentration of internal combustion engine (ICE) vehicles

- Asia-Pacific is expected to be the fastest growing region in the idle air control valve market during the forecast period due to surging automotive production, rapid urbanization, and government initiatives supporting industrial development

- Pulse solenoid valve type segment dominated the market with a market share of 48.1% in 2024, due to its cost-effectiveness, robust construction, and wide adoption in older and mid-range vehicle models. This type is favored for its simple on-off actuation mechanism, which effectively regulates engine idle speed without complex feedback systems. Its proven performance, ease of manufacturing, and compatibility with a range of engine configurations have sustained strong demand, particularly in markets with a large stock of internal combustion engine (ICE) vehicles

Report Scope and Idle Air Control Valve Market Segmentation

|

Attributes |

Idle Air Control Valve Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Idle Air Control Valve Market Trends

“Increasing Adoption of Advanced Engine Control Systems”

- A significant and accelerating trend in the global idle air control valve (IAC) market is the increasing adoption of advanced engine control systems, which improve engine performance, fuel efficiency, and emission compliance

- For instance, major companies such as Denso Corporation, Delphi Technologies, and Hitachi Astemo are integrating sophisticated microcontrollers and sensors into their IAC valves to enhance idle speed regulation and responsiveness, supporting smoother engine operation and reduced emissions

- The move toward more fuel-efficient and emission-compliant vehicles, driven by stricter regulatory standards in regions such as North America, Europe, and Asia-Pacific, is prompting automakers to adopt advanced IAC valves as part of comprehensive engine management systems

- Recent innovations in materials and design are improving the durability and longevity of IAC valves, reducing maintenance needs and supporting the trend toward longer vehicle lifespans

- The demand for advanced IAC valves is growing rapidly, especially as automotive OEMs and aftermarket suppliers respond to the need for enhanced engine management in modern vehicles

Idle Air Control Valve Market Dynamics

Driver

“Increasing Vehicle Production”

- The rising global vehicle production is a major driver for the idle air control valve (IAC) market, as these valves are essential for regulating engine idle speed and maintaining emissions compliance in internal combustion engine vehicles

- For instance, automotive leaders such as Toyota, Ford, and Volkswagen are ramping up vehicle manufacturing to meet growing consumer demand, which directly increases the need for reliable and advanced IAC valves

- The expansion of production in emerging markets such as Asia-Pacific and Latin America further fuels demand, as these regions experience rapid urbanization and rising vehicle ownership

- In addition, the increasing complexity of modern engine management systems in new vehicle models necessitates sophisticated IAC valves for optimal performance and fuel efficiency

- The growing aftermarket for vehicle maintenance and replacement parts also contributes to sustained demand for IAC valves, as aging vehicle fleets require part replacements to maintain engine functionality and emission standards

Restraint/Challenge

“Electrification of Vehicles”

- The growing electrification of vehicles presents a significant challenge to the idle air control valve market, as electric vehicles (EVs) do not require IAC valves due to the absence of traditional internal combustion engines

- For instance, as companies such as Tesla, BYD, and Hyundai expand their electric vehicle offerings, the demand for IAC valves is expected to decline in segments shifting toward full electrification

- Hybrid vehicles, which may still use IAC valves, are also increasingly adopting alternative engine management technologies that reduce reliance on traditional idle air control systems

- The transition to EVs is accelerating in major automotive markets, driven by government incentives, stricter emission targets, and consumer preference for sustainable mobility, further limiting the growth potential for IAC valves in the long term

- Overcoming this challenge will require IAC valve manufacturers to diversify their product portfolios, invest in R&D for new automotive components, and explore opportunities in emerging markets where internal combustion vehicles remain prevalent

Idle Air Control Valve Market Scope

The market is segmented on the basis of type, sales channel, and end use.

- By Type

On the basis of type, the idle air control valve market is segmented into Pulse Solenoid Valve Type, Rotary Solenoid Valve Type, and Stepping Motor Type. The Pulse Solenoid Valve Type segment dominated the largest market revenue share of 48.1% in 2024, owing to its cost-effectiveness, robust construction, and wide adoption in older and mid-range vehicle models. This type is favored for its simple on-off actuation mechanism, which effectively regulates engine idle speed without complex feedback systems. Its proven performance, ease of manufacturing, and compatibility with a range of engine configurations have sustained strong demand, particularly in markets with a large stock of internal combustion engine (ICE) vehicles.

The Stepping Motor Type segment is projected to witness the fastest growth rate from 2025 to 2032, driven by its precise control capabilities and growing integration in modern engine management systems. Stepping motor IAC valves offer finer incremental control over airflow, improving engine idling, fuel efficiency, and emissions. Their adoption is accelerating as automakers seek enhanced performance and compliance with stringent emission norms. Moreover, the expanding production of high-performance and fuel-efficient passenger vehicles is further supporting the segment's rapid growth trajectory.

- By Sales Channel

On the basis of sales channel, the idle air control valve market is divided into Original Equipment Manufacturers (OEM) and Aftermarket. The OEM segment accounted for the largest market share in 2024, supported by strong ties with automakers and the inclusion of IAC valves as integral components in factory-assembled vehicles. OEM-supplied valves ensure optimal compatibility and quality, meeting exact design and performance specifications required by vehicle manufacturers. The increasing volume of global vehicle production, coupled with a focus on reliability and compliance, continues to solidify OEMs’ dominance in the market.

The Aftermarket segment is anticipated to grow at the highest CAGR during the forecast period, propelled by the aging vehicle fleet and rising need for maintenance and part replacement in both developed and emerging regions. Vehicle owners seeking cost-effective repair solutions often turn to aftermarket IAC valves, especially for older vehicles beyond warranty coverage. The availability of a broad range of compatible, value-driven aftermarket options is contributing to the segment’s upward momentum.

- By End Use

On the basis of end use, the idle air control valve market is segmented into Light Commercial Vehicles, Heavy Commercial Vehicles, Passenger Cars, Two and Three Wheelers, and Sports Cars. The Passenger Cars segment held the largest revenue share in 2024, attributed to the sheer volume of production and widespread incorporation of IAC valves in gasoline-powered models. As passenger vehicles represent the bulk of the global vehicle population, especially in Asia-Pacific and North America, the demand for reliable engine idle management solutions remains high. The growing consumer preference for smooth engine performance and enhanced fuel economy further bolsters this segment.

The Sports Cars segment is expected to experience the fastest growth from 2025 to 2032, driven by rising global interest in performance vehicles and increasing sales in niche luxury markets. High-performance sports cars demand advanced engine management systems, including high-precision IAC valves that ensure stable idle under varying load and temperature conditions. Technological enhancements in sports car design and the integration of performance-optimized idle air control systems are playing a pivotal role in accelerating the segment’s expansion.

Idle Air Control Valve Market Regional Analysis

- Europe dominated the idle air control valve market with the largest revenue share of 21.1% in 2024, driven by its strong automotive manufacturing base, stringent emissions standards, and a high concentration of internal combustion engine (ICE) vehicles

- The region's demand is further fueled by advanced engine technologies, emphasis on vehicle efficiency, and increasing consumer expectations for smooth engine performance

- Countries such as Germany, France, and Italy are leading contributors, with a robust aftermarket ecosystem and widespread use of passenger cars and light commercial vehicles supporting continued market expansion

Germany Idle Air Control Valve Market Insight

The Germany idle air control valve market held the largest revenue share within Europe in 2024, supported by the country’s leadership in automotive innovation and precision engineering. OEM partnerships, technological advancement in ICE management, and the growing emphasis on environmental standards are accelerating the adoption of advanced idle air control valves. Germany's strong automotive exports and demand for high-quality, efficient components further solidify its market position.

U.K. Idle Air Control Valve Market Insight

The U.K. idle air control valve market is projected to grow at a healthy CAGR during the forecast period, fueled by an aging vehicle fleet, rising maintenance needs, and the country’s transition toward higher efficiency automotive systems. Increasing consumer focus on engine smoothness and fuel economy, along with well-established distribution channels, is expected to support steady aftermarket growth.

North America Idle Air Control Valve Market Insight

North America accounted for a significant share of the idle air control valve market in 2024, driven by consistent vehicle usage and strong demand for replacement components. The region’s highly developed automotive aftermarket and consumer focus on preventive vehicle maintenance are key contributors to market growth.

U.S. Idle Air Control Valve Market Insight

The U.S. idle air control valve market captured the largest revenue share within North America in 2024, fueled by widespread vehicle ownership and high reliance on ICE vehicles. Increased awareness of emissions control and engine optimization, along with a large aftermarket service network, is reinforcing demand across both commercial and personal vehicle segments.

Asia-Pacific Idle Air Control Valve Market Insight

The Asia-Pacific market is expected to grow at the fastest CAGR from 2025 to 2032, driven by surging automotive production, rapid urbanization, and government initiatives supporting industrial development. Countries such as China, Japan, and India are major contributors, with expanding vehicle fleets and rising adoption of emission-control technologies.

China Idle Air Control Valve Market Insight

China dominated the Asia-Pacific region in 2024 by revenue share, backed by its massive vehicle production capacity, booming aftermarket, and government support for pollution reduction. Domestic manufacturers offering cost-effective valve solutions and increasing adoption in passenger cars and commercial fleets are key growth drivers.

Japan Idle Air Control Valve Market Insight

Japan’s idle air control valve market is propelled by the country's emphasis on engineering precision, environmental efficiency, and engine optimization. The widespread adoption of advanced ICE management systems and the nation’s sustained vehicle usage are supporting market growth across both OEM and aftermarket segments.

Idle Air Control Valve Market Share

The idle air control valve industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- BorgWarner Inc. (U.S.)

- Continental AG (Germany)

- EDELBROCK, LLC. (U.S.)

- GB Remanufacturing, Inc. (U.S.)

- DENSO CORPORATION (Japan)

- Hitachi Automotive Systems, Ltd. (Japan)

- Kinsler Fuel Injection (U.S.)

- Tenneco Inc. (U.S.)

- AISIN SEIKI Co., Ltd. (Japan)

- Mikuni Corporation (Japan)

- NINGBO MIDLAND AUTO PARTS CO. LTD (China)

- Guangzhou Marvine Auto Parts Co., Ltd. (China)

- Jiangsu Great Industrials (Group) Corp.Ltd. (China)

- Tridon Australia (Australia)

- Ruian Fanwei Auto Parts Co.,Ltd. (China)

- Wenzhou Guocheng Electrical Parts Co., Ltd. (China)

- Ruian Kingway Auto Parts Manufacturing Co.,Limited (China)

- PUCHENG SENSORS(SHANGHAI)CO, LTD. (China)

Latest Developments in Global Idle Air Control Valve Market

- In January 2023, Emerson introduced the ASCO Series 209 proportional flow control valves, featuring advanced precision and energy efficiency in a purpose-built design. With exceptional pressure ratings and accurate flow control, these valves are engineered for precise management of fluid flow across a range of industrial applications, setting a new standard in the industry

- In July 2022, Honeywell International, Inc. formed a strategic alliance with Archer Aviation Inc., with Archer selecting Honeywell as the supplier for its actuator system—an essential component of its 12 tilt 6 configuration. This collaboration is expected to positively influence the market by advancing the adoption of precision actuation technologies in next-generation mobility solutions, thereby elevating demand for high-performance control components

- In July 2022, Conex Bänninger expanded its product portfolio by adding pressure-independent control valves (PICVs). These valves improve energy efficiency in plumbing, heating, and cooling systems by utilizing dynamic balancing to manage pressure fluctuations. This innovation can result in up to 30% energy savings and ensures consistent temperature control, enhancing occupant comfort

- In February 2022, CIRCOR International, Inc. launched the CIR 3100 control valve, offering a range of internal configurations to meet diverse needs across various industries, including oil and gas, power generation, processing, maritime, and renewables. This versatile valve is designed to deliver reliable performance and adaptability for multiple application environments

- In January 2022, CIRCOR International, Inc. introduced the CIR 3100 Control Valve, designed with a cost-effective valve body and multiple internal configurations. This launch is likely to enhance market growth by offering versatile and affordable solutions across various industrial applications, expanding accessibility for a wider customer base seeking efficient flow control systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.