Global Identity Verification Market Segmentation, By Application (Credit Card Fraud, Bank Fraud, Phone or Utility Fraud, and Employment or Tax-related Fraud), Component (Solution and Services), Type (Non-Biometrics and Biometrics), Deployment Mode (On-Premise and Cloud), Organization Size (Large Enterprises and SME’S), Vertical (BFSI, Government & Defense, Energy & Utilities, Retail & Ecommerce, IT & Telecom, Healthcare, Gaming, and Others) – Industry Trends and Forecast to 2031

Identity Verification Market Analysis

The global identity verification market is experiencing robust growth, driven by heightened concerns over identity fraud and the increasing digitization of services across various sectors. Emerging trends indicate a significant shift towards biometric verification methods, such as facial recognition and fingerprint scanning, which enhance security while improving user experience. The implementation of stringent regulatory frameworks further propels the adoption of identity verification solutions, compelling businesses to prioritize compliance and security. Additionally, advancements in artificial intelligence and machine learning are transforming how organizations assess and verify identities, making processes faster and more accurate. As consumers demand seamless online interactions, companies are integrating sophisticated identity verification technologies into their platforms, creating a more secure environment for transactions. This dynamic landscape reflects the market's evolution, positioning identity verification as a critical component of digital security strategies moving forward.

Identity Verification Market Size

The global Identity Verification market size was valued at USD 11.18 billion in 2023 and is projected to reach USD 35.04 billion by 2031, with a CAGR of 15.34% during the forecast period of 2024 to 2031. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Identity Verification Market Trends

“Rising Adoption of Biometric Verification Technologies”

The identity verification market is witnessing significant growth due to the increasing demand for security in digital transactions and the rise in identity fraud. A notable trend in this market is the adoption of biometric verification technologies, such as facial recognition and fingerprint scanning, which enhance security while improving user experience. For instance, companies such as Apple and Samsung have integrated biometric authentication into their devices, enabling secure access through facial or fingerprint recognition. This shift towards biometric solutions streamlines the verification process and builds consumer trust, as users feel more secure knowing that their identities are protected by advanced technology. Furthermore, the rise of remote work has accelerated the need for robust identity verification solutions across industries, making it imperative for businesses to invest in secure and efficient identity management systems to protect sensitive information.

Report Scope and Identity Verification Market Segmentation

|

Attributes

|

Identity Verification Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

Experian (Ireland), G.B. Group plc (‘GBG’) (U.K.), Equifax, Inc. (U.S.), Mitek Systems, Inc. (U.S.), Thales (France), LexisNexis Risk Solutions (U.S.), Onfido (U.K.), Trulioo (Canada), Acuant, Inc. (U.S.), IDEMIA (France), Jumio (U.S.), TransUnion LLC (U.S.), AU10TIX (Israel), IDology (U.S.), Innovatrics (Slovakia), Applied Recognition (Canada), Signicat (Norway), SecureKey Technologies Inc. (Canada), and Baldor Technologies Pvt Ltd (India)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Identity Verification Market Definition

Identity verification is the process of confirming the identity of an individual or entity through various means to ensure that they are who they claim to be. This process typically involves collecting and assessing personal information, such as government-issued identification, biometric data (such as fingerprints or facial recognition), and other identifiers, to validate a person’s identity. By employing advanced technologies and methodologies, organizations aim to enhance security, streamline user experiences, and comply with legal requirements.

Identity Verification Market Dynamics

Drivers

- Rising Cybersecurity Threats

Rising cybersecurity threats are significantly driving the identity verification market, as organizations face increasing incidents of identity theft, fraud, and data breaches. According to the 2023 Cybercrime Report by Cybersecurity Ventures, global cybercrime damages are projected to reach USD 10.5 trillion annually by 2025, highlighting the urgent need for robust security measures. In 2022 alone, the Identity Theft Resource Center reported over 1,800 data breaches in the U.S., exposing approximately 300 million records, underscoring the vulnerability of personal information. These alarming statistics are prompting businesses to invest in advanced identity verification solutions that protect sensitive information and help mitigate the risks associated with cyber threats. As a result, organizations are increasingly recognizing the necessity of implementing strong identity verification processes as a proactive measure to safeguard against evolving cybersecurity risks, thereby propelling growth in the identity verification market.

- Increasing Stringent Regulations and Guidelines

Regulatory compliance is a significant driver of the identity verification market, as stringent regulations such as the General Data Protection Regulation (GDPR) and Know Your Customer (KYC) guidelines necessitate the implementation of effective identity verification processes. The GDPR, which imposes hefty fines of up to USD 21.79 million or four percent of a company’s global annual turnover for non-compliance, emphasizes the importance of protecting personal data and ensuring individuals’ rights. Similarly, KYC regulations require financial institutions to verify the identities of their customers to prevent fraud and money laundering. As businesses strive to avoid substantial penalties and enhance customer trust, the demand for robust identity verification solutions is growing, thereby driving the expansion of the identity verification market.

Opportunities

- Increasing Number of Digital Transactions

The growth of digital transactions is a major market opportunity for the identity verification sector, as the increasing prevalence of online banking, e-commerce, and digital services demands secure identity verification methods to authenticate users effectively. In 2023, global e-commerce sales were projected to exceed USD 5.8 trillion, reflecting a dramatic shift in consumer behavior toward online shopping and digital financial services. For instance, platforms such as PayPal and Shopify have implemented robust identity verification processes to protect users from fraudulent activities and ensure secure transactions. This growing reliance on digital transactions highlights the necessity for businesses to adopt advanced identity verification solutions, such as multi-factor authentication and biometric verification, to enhance security while providing a seamless user experience. Consequently, the rising volume of digital transactions presents a substantial opportunity for identity verification providers to develop innovative solutions that address security concerns and facilitate the safe exchange of information in an increasingly digital economy.

- Increasing Technological Innovations

The shift towards remote work and digital transformation has significantly increased the demand for secure identity verification solutions, presenting a notable market opportunity. As companies adapt to a hybrid workforce model, the need to verify the identities of employees and customers accessing services from various locations has become paramount. For instance, organizations such as Zoom have implemented advanced identity verification techniques, including two-factor authentication and single sign-on, to enhance security for remote users. This rise in remote work environments compels businesses to invest in identity verification technologies that ensure secure access to digital resources and streamline on-boarding and authentication processes. As a result, the ongoing transition to remote work and digital services creates a substantial opportunity for identity verification providers to deliver innovative solutions that safeguard organizational integrity while facilitating flexible work arrangements.

Restraints/Challenges

- Fraud and Identity Theft

Fraud and identity theft represent a formidable challenge in the identity verification market, as the methods used by fraudsters grow increasingly sophisticated alongside technological advancements. For instance, the rise of deep fakes and synthetic identities where criminals create entirely fabricated personas using advanced AI technology complicates the ability of identity verification solutions to accurately authenticate users. For instance, the financial services sector, where institutions must implement stringent verification processes to detect these fraudulent tactics while ensuring that the legitimate user experience remains seamless. If a bank’s identity verification system requires overly complex procedures, such as multiple forms of biometric verification or extensive documentation, it may frustrate genuine customers and lead to abandonment of the on-boarding process. Striking this balance is critical; failure to do so can result in lost business opportunities and diminished user trust. Thus, identity verification solutions must continually evolve to address the sophisticated nature of fraud while also enhancing the user experience, making this an ongoing market challenge.

- High Costs and Investment Requirements

High costs and investment requirements pose a considerable challenge in the identity verification market, as organizations often face significant financial barriers when implementing advanced identity verification solutions. The integration of sophisticated technologies, such as biometric systems and artificial intelligence, can entail substantial initial investments in both software and hardware. For instance, deploying a comprehensive identity verification system across an organization can cost hundreds of thousands of dollars, which may be prohibitive for smaller businesses or those operating with tight budgets. Furthermore, ongoing maintenance and updates to these systems can add to the financial burden, making it challenging for businesses to allocate resources effectively. As a result, the high costs associated with identity verification technologies represent a significant market challenge that providers must overcome to facilitate broader adoption across diverse sectors.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Identity Verification Market Scope

The market is segmented on the basis application, component, type, deployment mode, organization size, and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Application

- Credit Card Fraud

- Bank Fraud

- Phone or Utility Fraud

- Employment or Tax-related Fraud

Component

- Solution

- Services

Type

- Non-Biometrics

- Document Verification

- Knowledge Based Authentication

- Two-Factor Authentication

- Others(Online Verification and Others)

- Biometrics

Deployment Mode

- On-Premise

- Cloud

Organization Size:

- Large Enterprises

- SMEs

Vertical

- BFSI (Banking, Financial Services, and Insurance)

- Government & Defense

- Energy & Utilities

- Retail & E-commerce

- IT & Telecom

- Healthcare

- Gaming

- Others

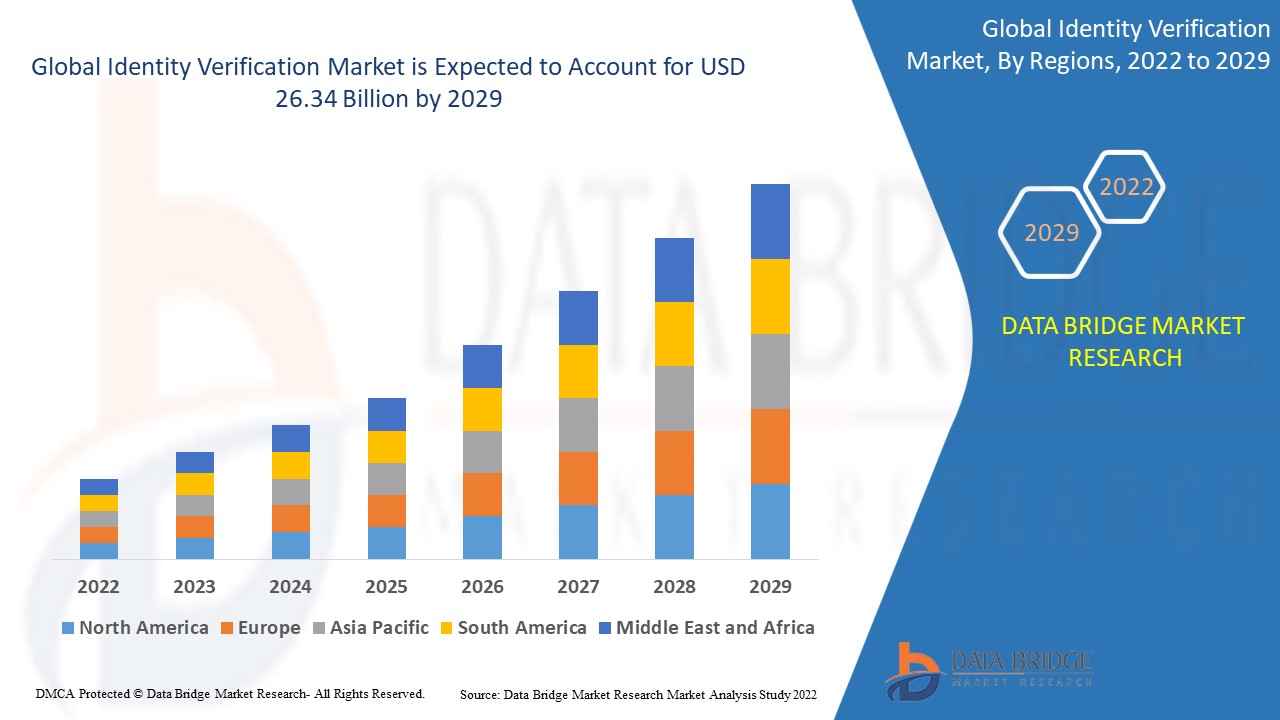

Identity Verification Market Regional Analysis

The market is analyzed and market size insights and trends are provided by application, component, type, deployment mode, organization size, and vertical as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America leads the identity verification market, primarily driven by substantial investments in cutting-edge technologies and the significant presence of many of the industry's most advanced companies. The region's well-established infrastructure further enhances its competitive edge, facilitating the rapid implementation and adoption of innovative identity verification solutions. Additionally, a strong focus on regulatory compliance and data security in North America propels demand for these technologies, reinforcing the market's growth. Together, these factors solidify North America's position as a dominant force in the identity verification landscape.

Asia-Pacific is poised for significant growth in the identity verification market, with the highest projected growth rate during the forecast period. This momentum is largely attributed to the rising adoption of identity verification solutions and the Bring Your Own Device (BYOD) trend, which is transforming workplace security dynamics. Additionally, the region's expanding IT infrastructure is enhancing connectivity and access to advanced technologies, making it easier for organizations to implement effective identity verification measures. The increasing presence of key industry players further accelerates innovation and competition, positioning Asia-Pacific as a dynamic hub for identity verification advancements.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Identity Verification Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Identity Verification Market Leaders Operating in the Market Are:

- Experian (Ireland)

- G.B. Group plc (‘GBG’) (U.K.)

- Equifax, Inc. (U.S.)

- Mitek Systems, Inc. (U.S.)

- Thales (France)

- LexisNexis Risk Solutions (U.S.)

- Onfido (U.K.)

- Trulioo (Canada)

- Acuant, Inc. (U.S.)

- IDEMIA (France)

- Jumio (U.S.)

- TransUnion LLC (U.S.)

- AU10TIX (Israel)

- IDology (U.S.)

- Innovatrics (Slovakia)

- Applied Recognition (Canada)

- Signicat (Norway)

- SecureKey Technologies Inc. (Canada)

- Baldor Technologies Pvt Ltd (India)

Latest Developments in Identity Verification Market

- In February 2024, AU10TIX, a provider of identification services, launched a new Know Your Business (KYB) solution designed to help businesses identify their partners and mitigate potential financial and reputational risks. This new offering integrates KYB with Know Your Customer (KYC) processes to address all KYB-related business needs

- In January 2024, Onfido, a technology company, introduced its all-in-one ID verification solution, enabling enterprises to expand into new markets while addressing local regulatory requirements for customer onboarding

- In December 2023, HireRight, LLC, an employment background screening firm, unveiled "Global ID," a new ID verification solution that allows for verifying a candidate’s identity through the optional digital liveness and biometric face match feature of Global ID

- In October 2023, Veriff announced the launch of two new fraud mitigation tools to enhance its Identity Verification (IDV) protection portfolio. These newly released packages utilize advanced machine learning models, behavioral insights, and Veriff's in-house fraud detection expertise to strengthen organizations' ability to combat evolving fraud tactics. The platform analyzes user documents, facial biometrics, device data, network details, and previous fraud patterns during the IDV process, providing leading fraud prevention capabilities

- In October 2023, IDology, a GBG company, announced an expanded range of gaming solutions aimed at optimizing player acquisition, enhancing revenue, and fostering loyalty, while also protecting operators against fraud and money laundering through strategic automation. This ensures compliance with both state and federal regulations

SKU-