Global Integrated Circuit (IC) Temperature Sensor Market, By Output (Analog, Digital), Alloy Used (Type K, Type M, Type E, Type J, Type C, Type N, Type T, Others), Deployment (Wired, Wireless Metals (Platinum, Nickel, Copper, Tungsten, Silicon), End User (Chemicals, Oil and Gas, Consumer Electronics, Energy and Power, Healthcare, Automotive, Metals and Mining, Food and Beverages, Pulp and Paper, Advanced Fuel, Aerospace and Defence, Glass, Others) – Industry Trends and Forecast to 2029.

Integrated Circuit (IC) Temperature Sensor Market Analysis and Size

Integrated circuit (IC) temperature sensors are one of the largest adopted temperature sensors in the past few years. These sensors can work over an extensive range of temperatures. The integrated circuit (IC) temperature sensor market is mainly driven by its extreme benefits such as low power consumption, durability and accuracy. Moreover, IC temperature sensors are promptly gaining popularity in automotive applications and manufacturing industries, which drives huge market growth. IC temperature sensors are extensively used in several industries such as oil and gas, automotive and power generation, among others due to their wide temperature ranges, high-temperature limits and durable nature.

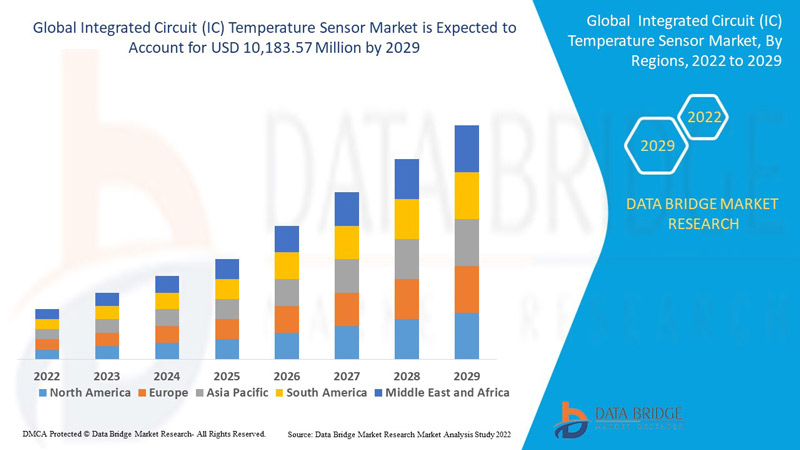

Data Bridge Market Research analyses that the integrated circuit (IC) temperature sensor market was valued at USD 6,389.30 million in 2021 and is expected to reach USD 10,183.57 million by 2029, registering a CAGR of 6.00% during the forecast period of 2022 to 2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Integrated Circuit (IC) Temperature Sensor Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014 - 2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Output (Analog, Digital), Alloy Used (Type K, Type M, Type E, Type J, Type C, Type N, Type T, Others), Deployment (Wired, Wireless Metals (Platinum, Nickel, Copper, Tungsten, Silicon), End User (Chemicals, Oil and Gas, Consumer Electronics, Energy and Power, Healthcare, Automotive, Metals and Mining, Food and Beverages, Pulp and Paper, Advanced Fuel, Aerospace and Defence, Glass, Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

OMEGA Engineering Inc. (U.S.), Endress+Hauser Group Services AG (Switzerland), Honeywell International Inc. (U.S.), ABB (Switzerland), Maxim Integrated (U.S.), Danfoss A/S (Denmark), Thermometrics Corporation (U.S.), Durex Industries (U.S.), Thermo Sensor GmbH (Germany), Microchip Technology Inc (U.S.), KEYENCE CORPORATION (Japan), Applied Sensor Technologies (U.S.), Okazaki Manufacturing Company (U.K.), SOR Inc. (U.S.), Thermo Sensors (India), Emerson Electric Co (U.S.), Pyromation, Inc. (U.S.), GÜNTHER GmbH (Germany), West Control Solutions (U.K.), WIKA Alexander Wiegand SE & Co. KG (Germany), TE Connectivity (Switzerland)

|

|

Market Opportunities

|

|

Market Definition

An IC temperature sensor is a two terminal integrated circuit temperature transducer that generates an output current which is proportional to absolute temperature. The small sensor package has a fast response time and low thermal mass. The most common temperature range is 55 to 150°C (-58 to 302°F).

Global Integrated Circuit (IC) Temperature Sensor Market Dynamics

Drivers

- Rising adoption of IC temperature sensor for various applications

IC temperature sensor is widely used in several industries such as automotive, food and beverages, aerospace and healthcare, among others which is one of the major factors expected to drive the growth of integrated circuit (IC) temperature sensor market.

- Growing demand of IC temperature sensor in automotive industry

IC temperature sensor is widely used in automobiles sector due to the increasing demand for reliability, comfort, and other innovative features in automobiles. The rising demand of IC temperature sensor for innovative features are also expected to boost the demand of the integrated circuit (IC) temperature sensor in the market.

- Increasing penetration of temperature sensors

The integrated circuit (IC) temperature sensor market is being driven by the increasing need for portable and innovative healthcare devices. The demand for integrated circuit (IC) temperature sensors is growing as new technologies emerge, such as improved portable health monitoring systems and patient monitoring systems.

Furthermore, growing adoption of building and home automation systems is also a major factor that is expected to enhance the integrated circuit (IC) temperature sensor market growth during the forecast period of 2022-2029.

Opportunities

- Technological advancement

The technological advancements for reducing the manufacturing cost of the IC temperature sensor will bring more opportunities for the major key leaders in the upcoming period. Furthermore, improvement and development in automotive, aerospace, consumer electronics, energy and power, healthcare and many other industries will further expand the integrated circuit (IC) temperature sensor market growth during the forecast period of 2022-2029.

Moreover, growing adoption of wearable devices and increasing need for IC temperature sensor in food safety will also create several opportunities to boost the growth of the IC temperature sensor during forecast period.

Restraints/ Challenges

- High cost associated with IC temperature sensor raw materials

Volatility in the cost pf raw materials which is used for the production of IC temperature sensor along with increasing cost of research and development are acting as restraints for integrated circuit (IC) temperature sensor market in the above mentioned forecasted period.

- Lower productivity

The lower productivity of the IC temperature sensor due to other alternatives might hinder the growth of the global integrated circuit (IC) temperature sensor market during the forecast period of 2022-2029.

This integrated circuit (IC) temperature sensor market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the integrated circuit (IC) temperature sensor market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

COVID-19 Impact on Integrated Circuit (IC) Temperature Sensor Market

The COVID-19 negatively impacted the integrated circuit (IC) temperature sensor market due to the strict social distancing and lockdowns to contain the widespread corona virus. The partial shutdown of the business, economic uncertainty and low consumer confidence has impacted the demand of the IC temperature sensor based technology. The supply chain was hindered during this pandemic along with delayed logistics activities. However, the integrated circuit (IC) temperature sensor market is anticipated to recover its pace during the post pandemic scenario.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Global Integrated Circuit (IC) Temperature Sensor Market Scope

The integrated circuit (IC) temperature sensor market is segmented on the basis of output, alloy used, deployment, metals and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Output

- Analog

- Digital

Alloy Used

- Type K

- Type M

- Type E

- Type J

- Type C

- Type N

- Type T

- Others

Deployment

- Wired

- Wireless

Metals

- Platinum

- Nickel

- Copper

- Tungsten

- Silicon

End User

- Chemicals

- Oil and Gas

- Consumer Electronics

- Energy and Power

- Healthcare

- Automotive

- Metals and Mining

- Food and Beverages

- Pulp and Paper

- Advanced Fuel

- Aerospace and Defence

- Glass

- Others

Integrated Circuit (IC) Temperature Sensor Market Regional Analysis/Insights

The integrated circuit (IC) temperature sensor market is analysed and market size insights and trends are provided by country, output, alloy used, deployment, metals and end user as referenced above.

The countries covered in the integrated circuit (IC) temperature sensor market report U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the integrated circuit (IC) temperature sensor market in terms of revenue growth and market share. This is due to the adoption of advanced technology and high growth of automation industry in this region.

Asia-Pacific is projected to be the fastest developing region during the forecast period of 2022-2029 due to rapid industrialisation along with improved standardisation of living in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Integrated Circuit (IC) Temperature Sensor Market Share Analysis

The integrated circuit (IC) temperature sensor market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to integrated circuit (IC) temperature sensor market.

Some of the major players operating in the integrated circuit (IC) temperature sensor market are:

- OMEGA Engineering Inc. (U.S.)

- Endress+Hauser Group Services AG (Switzerland)

- Honeywell International Inc. (U.S.)

- Maxim Integrated (U.S.)

- Danfoss A/S (Denmark)

- Thermometrics Corporation (U.S.)

- Durex Industries (U.S.)

- Thermo Sensor GmbH (Germany)

- Microchip Technology Inc (U.S.)

- KEYENCE CORPORATION (Japan)

- Applied Sensor Technologies (U.S.)

- Okazaki Manufacturing Company (U.K.)

- SOR Inc. (U.S.)

- Thermo Sensors (India)

- Emerson Electric Co (U.S.)

- Pyromation, Inc. (U.S.)

- GÜNTHER GmbH (Germany)

- West Control Solutions (U.K.)

- WIKA Alexander Wiegand SE & Co. KG (Germany)

- TE Connectivity (Switzerland)

SKU-