Global Hybrid Integration Platform Market

Market Size in USD Billion

CAGR :

%

USD

48.22 Billion

USD

126.39 Billion

2025

2033

USD

48.22 Billion

USD

126.39 Billion

2025

2033

| 2026 –2033 | |

| USD 48.22 Billion | |

| USD 126.39 Billion | |

|

|

|

|

What is the Global Hybrid Integration Platform Market Size and Growth Rate?

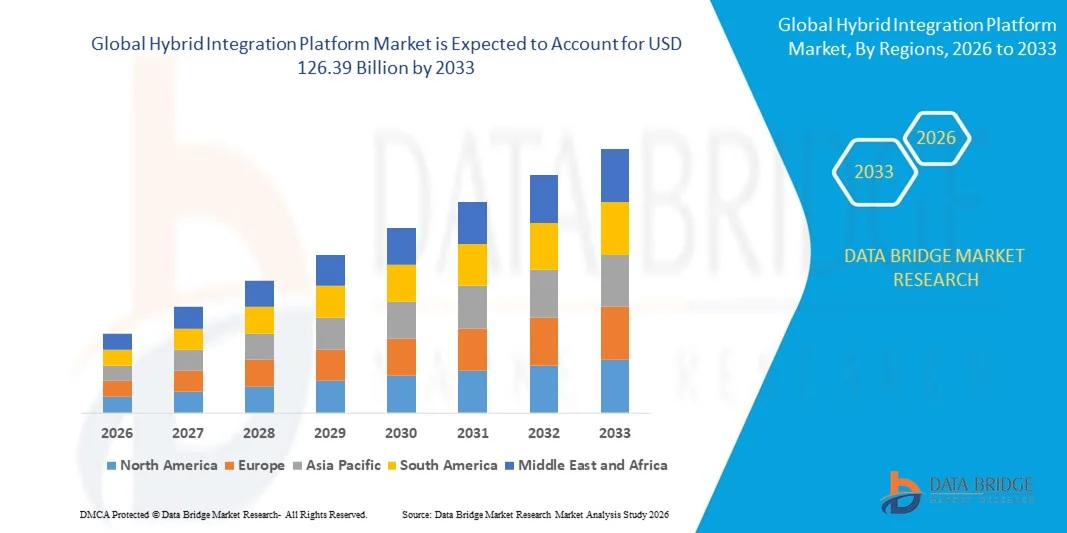

- The global hybrid integration platform market size was valued at USD 48.22 billion in 2025 and is expected to reach USD 126.39 billion by 2033, at a CAGR of 12.8% during the forecast period

- The increase in need of integrating on-premises and cloud applications for driving digital business transformation is expected to influence the growth of hybrid integration platform market

- Also, the high demand for hosting apps, data and services on the cloud is also anticipated to flourish the growth of the hybrid integration platform market

What are the Major Takeaways of Hybrid Integration Platform Market?

- The introduction of “business user”-friendly hybrid integration platform offerings and hybrid integration platforms’ capabilities to undertake the business challenges are also such asly to positively impact the growth of the hybrid integration platform market

- Moreover, the high demand for hybrid cloud along with favorable government regulations are also expected create a huge demand for hybrid integration platform as well as lifting the growth of the hybrid integration platform market

- North America dominated the hybrid integration platform market with the largest revenue share of 36.31% in 2025, driven by early adoption of cloud computing, strong presence of global integration platform providers, and widespread digital transformation initiatives across enterprises in the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.25% from 2026 to 2033, driven by rapid digitalization, expanding cloud adoption, and increasing enterprise focus on hybrid and multi-cloud strategies across emerging and developed economies

- The Solutions segment dominated the market with a 68.4% revenue share in 2025, driven by rising demand for high-density racks, cable-optimized structures, tool-less designs, PDUs, and mounting accessories essential for modern data centre buildouts

Report Scope and Hybrid Integration Platform Market Segmentation

|

Attributes |

Hybrid Integration Platform Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Hybrid Integration Platform Market?

Increasing Shift Toward Cloud-Native, API-Driven, and Low-Code Hybrid Integration Platforms

- The hybrid integration platform market is witnessing strong adoption of cloud-native, API-led, and low-code integration platforms designed to connect on-premise systems, cloud applications, SaaS platforms, and legacy infrastructure

- Vendors are introducing modular, microservices-based integration platforms offering pre-built connectors, event-driven architectures, real-time data synchronization, and enhanced scalability

- Growing demand for faster application integration, reduced IT complexity, and seamless data flow across hybrid and multi-cloud environments is driving adoption across enterprises of all sizes

- For instance, companies such as IBM, Informatica, MuleSoft, Boomi, and Oracle are enhancing their hybrid integration offerings with AI-powered automation, API management, and cloud-based orchestration capabilities

- Increasing need for real-time analytics, digital transformation, and agile IT operations is accelerating the shift toward unified hybrid integration platforms

- As enterprises adopt complex IT ecosystems, hybrid integration platforms will remain critical for secure connectivity, operational efficiency, and scalable digital innovation

What are the Key Drivers of Hybrid Integration Platform Market?

- Rising demand for seamless integration between cloud applications, on-premise systems, and third-party services to support digital transformation initiatives

- For instance, in 2025, leading providers such as Microsoft, IBM, and Informatica expanded their hybrid integration portfolios with enhanced AI-driven workflows, automation tools, and API lifecycle management

- Growing adoption of SaaS applications, cloud migration strategies, and multi-cloud architectures across BFSI, healthcare, retail, and manufacturing sectors is boosting market demand globally

- Advancements in API management, data integration, event streaming, and low-code/no-code platforms are improving deployment speed and integration efficiency

- Increasing reliance on real-time data exchange, analytics, and automation in enterprise operations is strengthening demand for scalable hybrid integration solutions

- Supported by continuous enterprise IT spending and cloud infrastructure investments, the Hybrid Integration Platform market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Hybrid Integration Platform Market?

- High implementation costs, integration complexity, and licensing expenses associated with enterprise-grade hybrid integration platforms limit adoption among small and mid-sized organizations

- For instance, during 2024–2025, rising cloud infrastructure costs and increasing cybersecurity compliance requirements raised total cost of ownership for several enterprise integration solutions

- Complexity in managing hybrid environments, legacy system compatibility, and API governance increases the need for skilled integration professionals

- Limited awareness among SMEs regarding hybrid integration capabilities, ROI benefits, and best implementation practices slows market penetration

- Intense competition from open-source integration tools, point-to-point connectors, and native cloud provider services creates pricing pressure

- To address these challenges, vendors are focusing on simplified deployment models, subscription-based pricing, AI-assisted integration, and enhanced security features to expand global adoption of hybrid integration platforms

How is the Hybrid Integration Platform Market Segmented?

The market is segmented on the basis of integration type, service type, organization size, and end user.

- By Integration Type

On the basis of integration type, the hybrid integration platform market is segmented into Application Integration, Data Integration, B2B Integration, and Cloud Integration. The Application Integration segment dominated the market with a 38.6% share in 2025, driven by rising demand for seamless connectivity between enterprise applications, SaaS platforms, and legacy systems. Organizations increasingly rely on application integration to automate workflows, improve data consistency, and enable real-time business processes across hybrid IT environments. Pre-built connectors, API-led architectures, and low-code capabilities further strengthen adoption across industries.

The Cloud Integration segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by accelerating cloud migration, multi-cloud strategies, and increasing adoption of cloud-native applications. Enterprises are prioritizing scalable, secure, and flexible cloud integration solutions to enable real-time data exchange, improve agility, and support digital transformation initiatives.

- By Service Type

Based on service type, the hybrid integration platform market is segmented into Digital Business Services and Professional Services. The Digital Business Services segment held the largest market share of 55.2% in 2025, as enterprises increasingly adopt managed integration services, integration-as-a-service (iPaaS), and cloud-based orchestration solutions to reduce operational complexity. These services enable continuous integration, automated monitoring, and faster deployment while minimizing internal IT burden.

The Professional Services segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for consulting, implementation, system customization, and integration strategy development. As hybrid IT environments become more complex, enterprises require specialized expertise for platform deployment, API governance, security compliance, and legacy system modernization, accelerating demand for professional integration services globally.

- By Organization Size

On the basis of organization size, the hybrid integration platform market is segmented into Small and Medium-Sized Enterprises (SMEs) and Large Enterprises. The Large Enterprises segment dominated the market with a 62.8% share in 2025, supported by complex IT infrastructures, high data volumes, and strong investments in digital transformation initiatives. Large organizations rely heavily on hybrid integration platforms to connect multiple enterprise applications, manage cross-departmental data flows, and ensure operational scalability.

The SMEs segment is expected to register the fastest growth from 2026 to 2033, driven by increasing adoption of cloud-based solutions, SaaS applications, and low-code integration tools. Cost-effective subscription models, simplified deployment, and growing awareness of integration benefits are enabling SMEs to adopt hybrid integration platforms to enhance agility and competitiveness.

- By End User

On the basis of end user, the hybrid integration platform market is segmented into Banking, Finance Services, and Insurance (BFSI), Retail, Government and Public Sector, Manufacturing, Telecommunication, IT, ITES, and Others. The BFSI segment dominated the market with a 34.9% share in 2025, driven by the need for secure data integration, real-time transaction processing, regulatory compliance, and omnichannel service delivery. Financial institutions extensively use hybrid integration platforms to connect core banking systems, digital channels, and third-party services.

The Retail segment is anticipated to grow at the fastest CAGR from 2026 to 2033, supported by rapid digitalization, omnichannel commerce, and increasing reliance on real-time customer data integration. Growing use of cloud platforms, analytics, and automated supply chain systems is accelerating adoption across global retail enterprises.

Which Region Holds the Largest Share of the Hybrid Integration Platform Market?

- North America dominated the hybrid integration platform market with the largest revenue share of 36.31% in 2025, driven by early adoption of cloud computing, strong presence of global integration platform providers, and widespread digital transformation initiatives across enterprises in the U.S. and Canada

- High adoption of SaaS applications, API-led integration, and hybrid cloud architectures across BFSI, healthcare, retail, manufacturing, and IT sectors continues to fuel demand for Hybrid Integration Platforms

- Strong innovation ecosystems, high IT spending, availability of skilled integration professionals, and continuous investments in cloud and data infrastructure further reinforce North America’s leadership in the Hybrid Integration Platform market

U.S. Hybrid Integration Platform Market Insight

The U.S. is the largest contributor in North America, supported by rapid cloud migration, extensive use of SaaS-based enterprise applications, and strong focus on automation and data-driven operations. Enterprises are increasingly deploying Hybrid Integration Platforms to connect legacy systems with modern cloud applications, enable real-time data exchange, and support API management. Presence of major technology vendors, strong startup ecosystems, and high enterprise IT budgets continues to drive market growth.

Canada Hybrid Integration Platform Market Insight

Canada contributes significantly to regional growth, driven by increasing adoption of cloud services, expansion of digital government initiatives, and growing demand for enterprise integration solutions across BFSI, retail, and telecom sectors. Organizations are leveraging Hybrid Integration Platforms to improve operational efficiency, enhance customer experience, and ensure secure data integration. Government-backed digitalization programs and growing cloud investments further strengthen market adoption across the country.

Asia-Pacific Hybrid Integration Platform Market

Asia-Pacific is projected to register the fastest CAGR of 8.25% from 2026 to 2033, driven by rapid digitalization, expanding cloud adoption, and increasing enterprise focus on hybrid and multi-cloud strategies across emerging and developed economies. Rising adoption of SaaS platforms, e-commerce systems, and digital payment solutions is accelerating demand for scalable and flexible Hybrid Integration Platforms across the region. Strong growth in IT services, expanding startup ecosystems, and government-led digital transformation initiatives position Asia-Pacific as the fastest-growing region in the hybrid integration platform market

China Hybrid Integration Platform Market Insight

China is a major contributor within Asia-Pacific, supported by large-scale enterprise digitalization, rapid cloud deployment, and growing adoption of API-based integration platforms. Enterprises are increasingly integrating cloud-native applications with on-premise systems to improve agility and data visibility. Strong domestic technology ecosystems and investments in digital infrastructure support sustained market growth.

Japan Hybrid Integration Platform Market Insight

Japan shows steady growth driven by modernization of enterprise IT systems, increasing adoption of cloud services, and strong focus on data security and reliability. Organizations are using Hybrid Integration Platforms to streamline business processes, enable real-time data integration, and support digital innovation across manufacturing and financial services sectors.

India Hybrid Integration Platform Market Insight

India is emerging as a high-growth market, supported by expanding IT services industry, rapid SaaS adoption, and increasing cloud migration among enterprises and SMEs. Government-backed digital initiatives, growing startup activity, and demand for cost-effective integration solutions are accelerating adoption of Hybrid Integration Platforms.

South Korea Hybrid Integration Platform Market Insight

South Korea contributes steadily due to strong digital infrastructure, high cloud adoption, and increasing demand for enterprise automation and real-time data integration. Enterprises across telecom, manufacturing, and IT sectors are deploying Hybrid Integration Platforms to support scalable and secure hybrid IT environments.

Which are the Top Companies in Hybrid Integration Platform Market?

The hybrid integration platform industry is primarily led by well-established companies, including:

- Software AG (Germany)

- Informatica Corporation (U.S.)

- Boomi, Inc. (U.S.)

- Infosys Limited (India)

- Dell Inc. (U.S.)

- MuleSoft, LLC (U.S.)

- IBM (U.S.)

- TIBCO Software Inc. (U.S.)

- Oracle (U.S.)

- WSO2 (Sri Lanka)

- SnapLogic (U.S.)

- Google (U.S.)

- Red Hat, Inc. (U.S.)

- Axway (France)

- RoboMQ (U.S.)

- Cleo (U.S.)

- Microsoft (U.S.)

- elastic.io GmbH (Germany)

- Wipro Limited (India)

- Cognizant (U.S.)

What are the Recent Developments in Global Hybrid Integration Platform Market?

- In May 2025, IBM introduced new hybrid cloud technologies aimed at helping enterprises scale AI workloads and build AI agents using internal enterprise data, addressing the challenge of managing highly fragmented IT environments as application development accelerates, thereby strengthening enterprise readiness for large-scale hybrid and AI-driven operations

- In May 2025, Red Hat launched Red Hat Enterprise Linux 10, offering a more secure and intelligent foundation for hybrid cloud and AI workloads through AI-driven management, post-quantum encryption, and container-optimized system design, enhancing platform resilience and future-proofing enterprise hybrid infrastructures

- In November 2022, Hewlett-Packard Enterprise and VMware, Inc., serving over 200,000 customers, announced the next phase of their strategic partnership at VMware Explore 2022 Europe by integrating HPE GreenLake with VMware Cloud to deliver a unified hybrid cloud consumption model, simplifying hybrid cloud deployment and management for enterprises

- In September 2022, Wipro partnered with Cisco to deliver an agile and programmable hybrid cloud solution integrating edge, private, and public cloud environments, supported by Cisco’s observability, optimization, and security platforms, enabling enterprises to achieve greater visibility, flexibility, and operational efficiency

- In March 2022, Kyndryl and Cloudera announced a global partnership focused on supporting mission-critical hybrid cloud, multi-cloud, and edge data systems, helping organizations modernize data architectures and improve scalability across complex IT environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hybrid Integration Platform Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hybrid Integration Platform Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hybrid Integration Platform Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.