Global Hub Motor For Electric Vehicle Market

Market Size in USD Billion

CAGR :

%

USD

17.20 Billion

USD

84.98 Billion

2025

2033

USD

17.20 Billion

USD

84.98 Billion

2025

2033

| 2026 –2033 | |

| USD 17.20 Billion | |

| USD 84.98 Billion | |

|

|

|

|

Hub Motor for Electric Vehicle Market Size

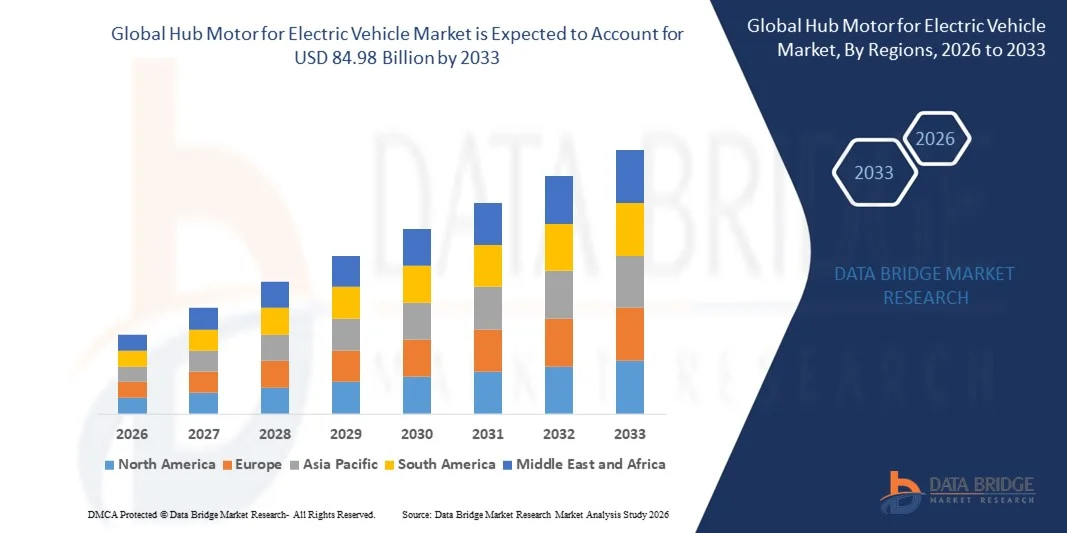

- The global hub motor for electric vehicle market size was valued at USD 17.20 billion in 2025 and is expected to reach USD 84.98 billion by 2033, at a CAGR of 22.1% during the forecast period

- The market growth is largely fueled by the increasing adoption of electric vehicles across passenger, commercial, and two- and three-wheeler segments, coupled with ongoing technological advancements in hub motor design, efficiency, and integration, which are enhancing vehicle performance and energy utilization

- Furthermore, rising demand for compact, high-efficiency, and low-maintenance propulsion solutions is establishing hub motors as a preferred drivetrain option for modern electric mobility. These converging factors are accelerating the deployment of hub motor systems, thereby significantly boosting the industry's growth

Hub Motor for Electric Vehicle Market Analysis

- Hub motors, providing in-wheel or integrated electric propulsion, are becoming essential components of modern electric vehicles due to their ability to reduce drivetrain complexity, improve energy efficiency, and offer flexible vehicle design solutions across passenger and commercial platforms

- The escalating demand for hub motors is primarily driven by growing EV adoption globally, increasing focus on sustainable and low-emission transportation, and consumer preference for high-performance, compact, and maintenance-friendly propulsion systems

- Asia-Pacific dominated the hub motor for electric vehicle market with a share of over 85% in 2025, due to rapid adoption of electric two-wheelers, three-wheelers, and passenger vehicles, increasing urbanization, and supportive government policies promoting EV adoption

- North America is expected to be the fastest growing region in the hub motor for electric vehicle market during the forecast period due to rising adoption of electric cars, e-bikes, and commercial EVs, along with government incentives and emission reduction mandates

- Passenger vehicle segment dominated the market with a market share of 62.5% in 2025, due to the rapid penetration of electric cars, two-wheelers, and three-wheelers for personal mobility. Hub motors are widely adopted in passenger vehicles due to their compact design, reduced drivetrain complexity, and improved energy efficiency

Report Scope and Hub Motor for Electric Vehicle Market Segmentation

|

Attributes |

Hub Motor for Electric Vehicle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Hub Motor for Electric Vehicle Market Trends

Rising Adoption of Hub Motors in Passenger and Commercial EVs

- A significant trend in the hub motor for electric vehicle market is the growing integration of hub motors into both passenger and commercial EV platforms, driven by the increasing need for compact, energy-efficient, and low-maintenance propulsion systems. Hub motors reduce drivetrain complexity, enhance vehicle design flexibility, and improve overall efficiency, making them highly attractive for urban mobility solutions, delivery fleets, and high-performance electric vehicles

- For instance, Protean Electric supplies in-wheel hub motors for companies such as Dongfeng Motor Corporation, enabling next-generation EVs in China with simplified drivetrain architectures and improved energy utilization. Similarly, Hyundai Motor Group has integrated advanced hub motor systems in its new EV platform to optimize cabin space and drivetrain efficiency

- The adoption of hub motors is growing in electric two- and three-wheelers, particularly in Asia-Pacific markets where urban mobility demands compact and efficient propulsion. This positioning is reinforcing hub motors as a core component of modern electric mobility, supporting low-emission and last-mile delivery solutions

- Commercial vehicle electrification is further fueling this trend, as hub motors offer independent torque control, regenerative braking compatibility, and reduced mechanical losses, which are critical for delivery vans, buses, and light trucks

- The trend is also reinforced by increasing regulatory pressure for zero-emission urban transport and the rise of shared mobility solutions, which prioritize vehicles with lower maintenance requirements and higher energy efficiency. Hub motors meet these criteria, making them integral to future-ready electric vehicle fleets

- Growing collaboration between EV OEMs, hub motor specialists, and component suppliers is accelerating adoption, as integrated solutions reduce design complexity and time-to-market. This convergence of technological innovation and market demand is positioning hub motors as a standard propulsion option across a wide spectrum of electric vehicles

Hub Motor for Electric Vehicle Market Dynamics

Driver

Increasing Global Electric Vehicle Penetration

- The increasing adoption of electric vehicles worldwide is driving demand for hub motors, as OEMs and fleet operators seek efficient, compact, and low-maintenance propulsion solutions. Hub motors enhance vehicle performance while enabling more flexible designs, which is critical for urban mobility, passenger cars, and commercial EVs

- For instance, ZF Friedrichshafen AG supplies hub motors for urban EV buses and passenger cars in Europe, supporting OEMs such as Solaris Bus & Coach with high-efficiency in-wheel propulsion. Similarly, Schaeffler Group is developing advanced hub motors for electric scooters and compact city cars to meet rising European urban mobility demands

- Growing government incentives, such as subsidies for EV adoption in China, India, and the U.S., are accelerating hub motor deployment across multiple vehicle types. These policies encourage OEMs to integrate hub motors to enhance vehicle range and energy efficiency while complying with emission reduction targets

- The expanding EV charging infrastructure and consumer awareness about sustainability are further boosting market demand. Hub motors are particularly advantageous in applications requiring regenerative braking and independent wheel control, making them attractive for both commercial fleets and private electric vehicles

- The rising penetration of electric two-wheelers, delivery vans, and last-mile vehicles is reinforcing hub motors as essential components in electrified urban transport. Their ability to simplify drivetrain design, improve efficiency, and reduce maintenance costs strengthens the overall market growth

Restraint/Challenge

High Manufacturing and Integration Costs

- The hub motor for electric vehicle market faces challenges due to the complex design, precision engineering, and advanced materials required for high-performance hub motors. Manufacturing these motors involves tight tolerances, advanced thermal management systems, and integration with regenerative braking and vehicle control units, which increases production costs

- For instance, Elaphe Propulsion Technologies and Protean Electric implement sophisticated in-wheel motor designs that require precision assembly and specialized testing, raising operational expenses and limiting large-scale cost reductions

- Integration of hub motors into existing EV platforms can be challenging for OEMs, as it may require reconfiguration of chassis, suspension, and electronic control systems. These engineering complexities further elevate overall deployment costs

- High-quality components such as rare-earth magnets, advanced winding materials, and power electronics are essential for achieving efficiency and durability, which also increases supply chain dependency and cost volatility

- Scaling hub motor production while maintaining performance, reliability, and safety standards remains a significant challenge. Companies must balance cost efficiency with technological sophistication to meet growing demand from passenger and commercial EV segments

Hub Motor for Electric Vehicle Market Scope

The market is segmented on the basis of vehicle type, drive type, electric vehicle type, cooling type, brake type, torque, and distribution channel.

- By Vehicle Type

On the basis of vehicle type, the hub motor for electric vehicle market is segmented into passenger vehicle and commercial vehicle. The passenger vehicle segment dominated the market with the largest share of 62.5% in 2025, driven by the rapid penetration of electric cars, two-wheelers, and three-wheelers for personal mobility. Hub motors are widely adopted in passenger vehicles due to their compact design, reduced drivetrain complexity, and improved energy efficiency. Automakers increasingly favor hub motors to enhance vehicle range and optimize cabin and cargo space. The rising focus on cost-effective urban mobility solutions further strengthens demand from the passenger vehicle category.

The commercial vehicle segment is expected to witness the fastest growth from 2026 to 2033, supported by the electrification of delivery vans, light trucks, and shared mobility fleets. Fleet operators are adopting hub motors to lower maintenance requirements and improve operational efficiency. Government incentives for electric commercial fleets and last-mile delivery electrification are accelerating adoption. The ability of hub motors to support high load cycles and frequent stop-and-go operations contributes to this growth trajectory.

- By Drive Type

On the basis of drive type, the market is segmented into all-wheel drive, front wheel drive, and rear wheel drive. Front wheel drive dominated the market in 2025 due to its extensive use in compact and mid-sized electric vehicles. Hub motors integrated into front wheels support simpler vehicle architectures and improved traction for urban driving conditions. Manufacturers prefer this configuration to reduce vehicle weight and optimize energy consumption. The dominance is reinforced by high adoption in electric scooters and entry-level electric cars.

All-wheel drive is projected to register the fastest growth during the forecast period, driven by rising demand for performance-oriented and premium electric vehicles. Hub motors enable independent torque control at each wheel, improving stability and handling. This configuration supports advanced vehicle dynamics and enhanced safety features. Increasing consumer interest in electric SUVs and off-road capable EVs is further accelerating adoption.

- By Electric Vehicle Type

On the basis of electric vehicle type, the market is segmented into battery electric vehicle, plug-in hybrid electric vehicle, and hybrid electric vehicle. The battery electric vehicle segment held the largest market share in 2025, supported by global decarbonization targets and expanding charging infrastructure. Hub motors align well with BEV architectures by eliminating mechanical transmission components and improving drivetrain efficiency. Automakers are leveraging hub motors to extend driving range and reduce system losses. Strong policy support and declining battery costs reinforce the dominance of this segment.

The plug-in hybrid electric vehicle segment is anticipated to grow at the fastest rate from 2026 to 2033, driven by transitional demand in regions with limited charging infrastructure. Hub motors support flexible power distribution between electric and internal combustion systems. This configuration enhances fuel efficiency and enables short-range electric driving. Consumer preference for range flexibility is sustaining rapid growth.

- By Cooling Type

On the basis of cooling type, the hub motor for electric vehicle market is segmented into water cooled and air cooled. The air-cooled segment dominated the market in 2025 due to its simple design and lower manufacturing cost. Air-cooled hub motors are widely used in low- to mid-power applications such as electric two-wheelers and compact passenger vehicles. Reduced system complexity supports easier integration and maintenance. High adoption in cost-sensitive markets reinforces its leading position.

The water-cooled segment is expected to witness the fastest growth over the forecast period, driven by demand for high-performance and high-torque applications. Water cooling enables better thermal management under continuous and heavy load conditions. This supports use in commercial vehicles and premium electric cars. Increasing focus on durability and performance consistency is accelerating adoption.

- By Brake Type

On the basis of brake type, the market is segmented into regenerative brake and conventional brake. The regenerative brake segment dominated the market in 2025, supported by its ability to recover energy during deceleration and improve overall vehicle efficiency. Hub motors integrated with regenerative braking systems enhance driving range and reduce brake wear. Automakers are prioritizing this technology to meet efficiency and sustainability targets. Widespread integration across electric vehicle platforms sustains its dominance.

The conventional brake segment is projected to grow at the fastest pace from 2026 to 2033, driven by continued demand in entry-level and hybrid electric vehicles. Conventional braking systems are often used alongside hub motors in cost-optimized vehicle designs. Regulatory requirements for braking redundancy also support adoption. Gradual electrification of existing platforms contributes to growth momentum.

- By Torque

Based on torque, the hub motor market is segmented into less than 700 Nm and more than 700 Nm. The less than 700 Nm segment dominated the market in 2025 due to its extensive application in electric two-wheelers, three-wheelers, and passenger cars. These motors offer sufficient torque for urban mobility while maintaining high efficiency. Manufacturers favor this range to balance performance and energy consumption. High production volumes in mass-market vehicles reinforce segment leadership.

The more than 700 Nm segment is expected to register the fastest growth during the forecast period, driven by increasing electrification of commercial vehicles and performance-oriented EVs. High-torque hub motors support heavy loads and demanding driving conditions. Adoption is rising in electric buses, trucks, and premium SUVs. Advancements in motor materials and thermal management are enabling wider deployment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into aftermarket and OEM. The OEM segment dominated the market in 2025, driven by direct integration of hub motors during vehicle manufacturing. Automakers are collaborating with motor suppliers to optimize system compatibility and performance. OEM adoption ensures quality assurance and compliance with regulatory standards. Increasing production of electric vehicles globally sustains this dominance.

The aftermarket segment is anticipated to grow at the fastest rate from 2026 to 2033, supported by rising demand for vehicle electrification and retrofitting solutions. Consumers and fleet operators are adopting hub motors to convert conventional vehicles into electric variants. Growth is further supported by expanding availability of standardized hub motor kits. Cost-effective conversion solutions are accelerating aftermarket expansion.

Hub Motor for Electric Vehicle Market Regional Analysis

- Asia-Pacific dominated the hub motor for electric vehicle market with the largest revenue share of over 85% in 2025, driven by rapid adoption of electric two-wheelers, three-wheelers, and passenger vehicles, increasing urbanization, and supportive government policies promoting EV adoption

- The region’s cost-effective manufacturing base, growing investments in EV component production, and strong presence of EV startups and OEMs are accelerating market expansion

- Availability of skilled labor, robust R&D capabilities, and government incentives for electrification and sustainable transportation are contributing to increased deployment of hub motors across multiple vehicle segments

China Hub Motor for Electric Vehicle Market Insight

China held the largest share in the Asia-Pacific hub motor for electric vehicle market in 2025, owing to its position as the global leader in electric vehicle production and strong hub motor manufacturing ecosystem. The country’s supportive policies, extensive EV production infrastructure, and focus on reducing emissions are major growth drivers. Demand is also boosted by rising adoption of electric scooters, cars, and delivery vehicles in urban and semi-urban areas, as well as continued investments in local motor R&D.

India Hub Motor for Electric Vehicle Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by the expanding electric two- and three-wheeler market, government initiatives such as FAME II, and rising domestic EV production. Investments in EV manufacturing clusters and supportive policies for local motor production are strengthening the demand for hub motors. In addition, the growth of last-mile delivery services and e-commerce fleets is driving adoption across commercial and passenger vehicle segments.

Europe Hub Motor for Electric Vehicle Market Insight

The Europe hub motor for electric vehicle market is expanding steadily, supported by increasing electrification of passenger cars and commercial fleets, stringent emissions regulations, and growing investments in EV infrastructure. The region emphasizes high-quality manufacturing standards, advanced motor technologies, and sustainable production practices. Rising adoption of electric buses, commercial vans, and premium passenger vehicles is further enhancing market growth.

Germany Hub Motor for Electric Vehicle Market Insight

Germany’s hub motor for electric vehicle market is driven by leadership in premium electric vehicle manufacturing, strong automotive engineering expertise, and export-oriented production capabilities. Well-established collaborations between universities, OEMs, and suppliers foster continuous innovation in motor efficiency and performance. Demand is particularly strong for high-torque and water-cooled hub motors used in commercial and high-performance EVs.

U.K. Hub Motor for Electric Vehicle Market Insight

The U.K. market is supported by a growing focus on EV adoption, local manufacturing incentives, and development of electrified public transport and fleet vehicles. Rising investment in EV technology R&D and strategic partnerships with international OEMs are enhancing hub motor deployment. The country is also witnessing increasing adoption in last-mile delivery vehicles and urban mobility solutions, boosting market demand.

North America Hub Motor for Electric Vehicle Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising adoption of electric cars, e-bikes, and commercial EVs, along with government incentives and emission reduction mandates. Strong technological capabilities, investments in EV startups, and increasing consumer preference for sustainable transportation are boosting demand. Increasing reshoring of EV component manufacturing and strategic collaborations between OEMs and motor suppliers are further supporting market growth.

U.S. Hub Motor for Electric Vehicle Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by a mature EV industry, strong innovation ecosystem, and expanding production of hub motors for passenger and commercial vehicles. Focus on sustainability, advanced motor technologies, and supportive federal and state policies are encouraging widespread adoption. Presence of major EV manufacturers and a robust supply chain infrastructure further consolidate the U.S.’s leading position in the region.

Hub Motor for Electric Vehicle Market Share

The hub motor for electric vehicle industry is primarily led by well-established companies, including:

- Schaeffler Group (Germany)

- Michelin (France)

- QS MOTOR (China)

- Elaphe Propulsion Technologies Ltd. (Slovenia)

- NTN Corporation (Japan)

- TAJIMA EV CORPORATION (Japan)

- TDCM (China)

- ZF Friedrichshafen AG (Germany)

- Kolektor (Slovenia)

- SONA COMSTAR (India)

- Protean Electric (U.K.)

- Leaf Motor (China)

- Robert Bosch GmbH (Germany)

- Siemens (Germany)

- YASA Limited (U.K.)

- Evans Electric (U.K.)

- Heinzmann GmbH & Co. KG (Germany)

- Accell Group (Netherlands)

- MERIDA BIKES (Taiwan)

- UU Motor (China)

Latest Developments in Global Hub Motor for Electric Vehicle Market

- In 2024, Elaphe Propulsion Technologies raised Series B funding to scale its hub motor manufacturing capabilities, significantly strengthening its position in the global EV market. The capital infusion enables accelerated development of advanced hub motor solutions for various electric vehicle applications, supporting growing demand from both passenger and commercial EV segments. This expansion is expected to enhance the company’s competitiveness and contribute to wider adoption of hub motors, particularly in high-efficiency urban mobility vehicles

- In 2024, Schaeffler introduced a next-generation electric hub motor tailored for urban mobility solutions, including electric scooters and compact city cars. The new offering focuses on improved energy efficiency, reduced weight, and simplified integration, addressing the rising need for sustainable urban transportation. By enhancing performance and lowering operational costs, this development is expected to drive increased deployment of hub motors in densely populated urban markets, reinforcing Schaeffler’s role as a key supplier in the EV hub motor segment

- In 2024, NTN Corporation inaugurated a dedicated manufacturing facility in Japan to produce hub motors, aiming to meet the surging demand from regional electric vehicle manufacturers. The new plant strengthens local production capabilities, reduces supply chain constraints, and supports rapid scaling of hub motor supply for both passenger and commercial EVs. This expansion positions NTN to capture a larger share of the Asia-Pacific market and aligns with growing government incentives promoting EV adoption across the region

- In 2024, Protean Electric formed a strategic partnership with Dongfeng Motor Corporation to supply in-wheel hub motors for Dongfeng’s next-generation electric vehicles. This collaboration is poised to accelerate the integration of hub motor technology in China’s rapidly expanding EV market. By leveraging Dongfeng’s extensive vehicle production network, Protean Electric can enhance market penetration, support localized manufacturing, and drive broader adoption of efficient, space-saving hub motor solutions in passenger and commercial electric vehicles

- In 2024, Hyundai Motor Group launched a new electric vehicle platform incorporating advanced hub motor systems designed to improve efficiency and offer greater design flexibility for upcoming EV models. This platform enables simplified drivetrain architecture and optimized cabin space, positioning Hyundai to strengthen its competitive edge in both passenger and commercial EV segments. The introduction of hub motor technology at the platform level is expected to accelerate adoption across the company’s future vehicle lineup and influence broader industry trends toward integrated, high-performance EV propulsion systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.