Global Hsr Coatings Market

Market Size in USD Billion

CAGR :

%

USD

7.42 Billion

USD

2,032.00 Billion

2024

2032

USD

7.42 Billion

USD

2,032.00 Billion

2024

2032

| 2025 –2032 | |

| USD 7.42 Billion | |

| USD 2,032.00 Billion | |

|

|

|

|

High-Speed Rail (HSR) Coatings Market Size

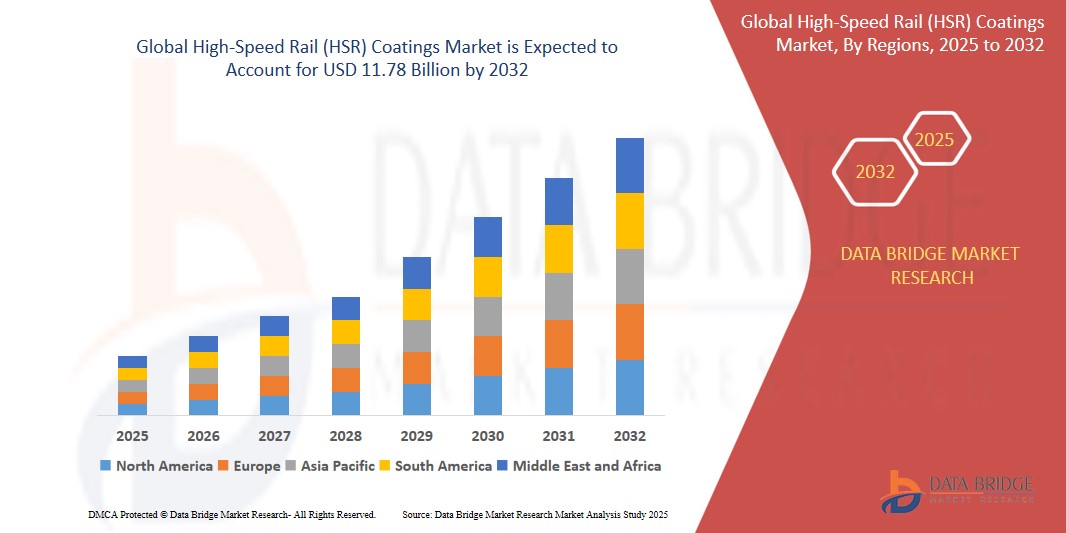

- The global High-Speed Rail (HSR) Coatings market size was valued at USD 7.42 billion in 2024 and is projected to reach USD 11.78 billion by 2032, growing at a CAGR of 6.0% during the forecast period.

- This growth is primarily fuelled by increasing consumer demand for innovative cosmetic products, the rising influence of social media and beauty influencers, and greater focus on self-care and aesthetic appeal post-pandemic. Additionally, urbanization, rising disposable incomes, and changing beauty standards across emerging markets are contributing to rapid market expansion

High-Speed Rail (HSR) Coatings Market Analysis

- High-speed rail (HSR) coatings can be described as the protecting layer of coatings and paints that are applied to the exterior and interior of the high-speed rail to defend from corrosion and wear and tear protection owing to the high levels of velocity.

- The increase in demand for mass transportation has highly influenced growth of the high-speed rail (HSR) coatings market. In line with this, the rapid surge in investments in the development of railway networks across both developing and developed economies are also acting as a key determinant favoring the growth of the high-speed rail (HSR) coatings market

- Asia-Pacific led the global High-Speed Rail (HSR) Coatings market in 2024, accounting for the largest regional share of approximately 42.7%. This dominance is attributed to massive government investments in rail infrastructure, extensive high-speed rail networks in countries like China and Japan, and ongoing expansion projects in India and Southeast Asia

- North America is projected to register the highest CAGR of 6.9% in the High-Speed Rail (HSR) Coatings market during the forecast period of 2025 to 2032, The growth is driven by renewed federal funding for sustainable transportation, rising adoption of advanced coating materials for rail durability, and the development of major HSR projects like the California High-Speed Rail and the Texas Central Railway.

- In 2025, the Epoxy segment is projected to dominate the Product Type segment of the global High-Speed Rail (HSR) Coatings market, holding the largest share of approximately 39.4%. This dominance is driven by epoxy’s superior corrosion resistance, strong adhesion to metal substrates, and long-lasting durability under mechanical stress and extreme weather conditions

Report Scope and High-Speed Rail (HSR) Coatings Market Segmentation

|

Attributes |

High-Speed Rail (HSR) Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

High-Speed Rail (HSR) Coatings Market Trends

“Rising Demand for Low-VOC and Eco-Friendly Coatings in Rail Infrastructure”

- A prominent trend in the global High-Speed Rail (HSR) Coatings market is the growing adoption of low-VOC (volatile organic compounds) and environmentally friendly coating solutions. As governments worldwide tighten emissions regulations and prioritize sustainable infrastructure, manufacturers are focusing on coatings that reduce environmental impact without compromising performance

- These eco-friendly coatings provide critical benefits such as corrosion resistance, UV protection, and long-term durability, while minimizing harmful emissions during application and curing processes. The shift is particularly noticeable in regions like North America and Europe, where public infrastructure projects are increasingly subject to green procurement standards

- For instance, in March 2025, PPG Industries introduced a new water-based HSR coating system in partnership with U.S. rail authorities, designed to meet both environmental compliance and high-performance durability standards for trains operating in extreme conditions

- This trend is accelerating innovation across the industry, prompting greater R&D investment and positioning green coatings as a critical component of the next generation of high-speed rail systems

High-Speed Rail (HSR) Coatings Market Dynamics

Driver

“Surging Investments in High-Speed Rail Infrastructure Development Worldwide”

- A major driver in the global High-Speed Rail (HSR) Coatings market is the rapid increase in investments for developing and expanding high-speed rail networks across key regions such as Asia-Pacific, North America, and Europe. Governments are allocating significant budgets toward modernizing transportation systems to improve connectivity, reduce traffic congestion, and support eco-friendly mass transit

- This surge in infrastructure development has amplified the demand for durable, high-performance coatings that can withstand harsh environmental conditions, reduce maintenance costs, and extend the lifecycle of trains and supporting rail infrastructure

- In particular, the focus on energy-efficient, weather-resistant, and corrosion-protective coatings has grown, with manufacturers responding by offering advanced products tailored to high-speed rail requirements

For instance,

- in February 2025, China Railway Rolling Stock Corporation (CRRC) announced a strategic partnership with a leading European coatings firm to supply eco-friendly, high-durability coatings for the next phase of China’s Belt and Road HSR initiatives

- This driver not only supports long-term market expansion but also encourages innovation in coating materials and application technologies aligned with global transport sustainability goals

Opportunity

“Growing Demand for Advanced Coating Solutions in Next-Generation Bullet Trains”

- A key opportunity in the High-Speed Rail (HSR) Coatings market lies in the rising demand for innovative coating technologies tailored for next-generation bullet trains. As countries push to increase train speeds, reduce drag, and enhance energy efficiency, there's a growing need for aerodynamically optimized and performance-enhancing coatings that also improve safety and aesthetics

- These advanced coatings can offer multifunctional benefits—ranging from anti-graffiti and self-cleaning surfaces to heat-reflective and noise-reducing properties—that align with the evolving needs of modern, high-speed rail systems

For instance,

- In January 2025, Nippon Paint Holdings Co. Ltd. introduced a nanotech-based coating specifically developed for Japan’s new Shinkansen models, offering enhanced aerodynamic efficiency and long-term weather resistance under extreme operating conditions

- This opportunity allows coating manufacturers to lead in high-tech R&D partnerships with rail companies, differentiate their portfolios with smart and sustainable solutions, and capture a competitive edge in global HSR expansions

Restraint/Challenge

“High Costs and Technical Complexity Associated with Advanced Coating Technologies”

- The High-Speed Rail (HSR) Coatings market faces a major restraint due to the high costs and technical complexity of developing and applying advanced coatings tailored for high-speed rail systems. These coatings often require specialized materials, precision formulations, and labor-intensive application processes, which can significantly increase overall manufacturing and maintenance expenses

- Moreover, ensuring compatibility with varying climate conditions, aerodynamic requirements, and long-term durability expectations adds further R&D and engineering challenges for coating manufacturers and rail operators

For instance,

- In 2024, several railway operators in Europe delayed procurement of nano-ceramic coatings for new train models due to budget constraints and unanticipated installation complexities, causing rollout delays.

- This cost barrier not only limits adoption in emerging economies but also discourages smaller coating suppliers from entering the market, thereby slowing innovation and reducing competitive diversity

High-Speed Rail (HSR) Coatings Market Scope

The market is segmented on the basis of product type, technology and end use.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Technology |

|

|

By End-Use |

|

In 2025, the Epoxy segment is projected to dominate the market with a largest share in Product Type segment

In 2025, the Epoxy segment is projected to dominate the Product Type segment of the global High-Speed Rail (HSR) Coatings market, holding the largest share of approximately 39.4%. This dominance is driven by epoxy’s superior corrosion resistance, strong adhesion to metal substrates, and long-lasting durability under mechanical stress and extreme weather conditions.

The Water-Based is expected to account for the largest share during the forecast period in Technology market

In 2025, the Water-Based segment is expected to lead the Technology segment of the global High-Speed Rail (HSR) Coatings market with a share of around 37.8%. This growth is supported by the global shift toward eco-friendly solutions, stricter environmental policies on VOC emissions, and the ongoing demand for sustainable infrastructure.

High-Speed Rail (HSR) Coatings Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the High-Speed Rail (HSR) Coatings Market”

-

Asia-Pacific leads the global High-Speed Rail (HSR) Coatings market, accounting for the largest regional share of approximately 37.8% in 2025. This dominance is driven by the region’s vast investments in high-speed rail infrastructure, particularly in China, Japan, South Korea, and India, where growing urbanization and public transport modernization efforts are boosting demand for advanced coating solutions

- China and India continue to benefit from large-scale rail construction projects and robust domestic manufacturing, creating sustained demand for durable, anti-corrosion, and cost-effective coatings used in both rolling stock and track-side equipment

- Japan and South Korea, with their technologically mature HSR systems, are promoting the use of eco-friendly, high-performance coatings including nanocoatings and water-based formulations, contributing significantly to regional market share

- The region is also experiencing a transition toward low-VOC and sustainable coatings, supported by regional green initiatives, making Asia-Pacific a key innovation hub in the HSR coatings space

“North America is Projected to Register the Highest CAGR in the High-Speed Rail (HSR) Coatings Market”

-

North America is projected to register the highest CAGR of 6.9% in the High-Speed Rail (HSR) Coatings market during the forecast period of 2025 to 2032, The growth is driven by renewed federal funding for sustainable transportation, rising adoption of advanced coating materials for rail durability, and the development of major HSR projects like the California High-Speed Rail and the Texas Central Railway.

- U.S. is a frontrunner with demand for anti-graffiti, weather-resistant coatings used in both interior and exterior train components. The buyers are focusing on energy-efficient coatings that help reduce rail energy consumption

- North American countries are also driving R&D efforts for bio-based and recyclable coatings, aligned with broader goals of achieving carbon neutrality in the transport sector

- The region’s strong regulatory focus and public-private rail investments in countries including the U.S. and Canada are expected to remain one of the key factors to promote the global HSR Coatings market movement

High-Speed Rail (HSR) Coatings Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Axalta Coating Systems (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Alstom (France)

- Siemens (Germany)

- Arkema (France)

- BASF SE (Germany)

- Oriental Yuhong Waterproof Technology Co. Ltd. (China)

- GLS Coatings Ltd (U.K.)

- Henkel Adhesives Technologies India Private Limited (India)

- KANSAI PAINT CO. LTD. (Japan)

- Solvay (Belgium)

- PSG Limited (South Africa)

- Nippon Paint Holdings Co. Ltd. (Japan)

- PPG Industries, Inc. (U.S.)

- KOBE STEEL, LTD. (Japan)

- The Sherwin-Williams Company (U.S.)

- Valspar (U.S.)

- HIPPO Multipower (U.K.)

- ClearClad Coatings, Inc. (U.S.)

- Zytexx (U.K.)

Latest Developments in Global High-Speed Rail (HSR) Coatings Market

- In May 2025, Jindal Poly Films Limited unveiled plans to invest ₹700 crore in expanding its Nashik facility. The expansion aims to increase the production capacity of biaxially oriented polypropylene (BOPP), polyethylene terephthalate (PET), and cast polypropylene (CPP) films, which are integral to medical and pharmaceutical packaging. This move is expected to bolster the company's position in the flexible packaging industry

- In May 2025, Hindalco Industries Limited announced a partnership with Italian company Metra SpA to manufacture high-precision extruded products for high-speed aluminium rail coaches in India. This collaboration aims to bring advanced aluminium extrusion technology to India, enhancing the production of lightweight and energy-efficient trains

- As of May 2025, the Mumbai–Ahmedabad high-speed rail corridor is progressing, with an initial section in Gujarat expected to open by 2027 and the full line to Mumbai by 2028. This project is anticipated to boost demand for high-performance coatings suitable for high-speed rail applications.

- In June 2024, Advanced Polymer Coatings (APC) introduced TriFLEX, a new exterior coating system designed specifically for the rail industry. This direct-to-metal coating combines three powerful resin systems, offering superior chemical resistance and enhanced mechanical toughness. TriFLEX aims to provide maximum protection for high-speed rail applications, addressing the industry's need for durable and long-lasting coatings.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Hsr Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Hsr Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Hsr Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.