Global Household Appliances Market

Market Size in USD Billion

CAGR :

%

USD

577.23 Billion

USD

839.93 Billion

2024

2032

USD

577.23 Billion

USD

839.93 Billion

2024

2032

| 2025 –2032 | |

| USD 577.23 Billion | |

| USD 839.93 Billion | |

|

|

|

|

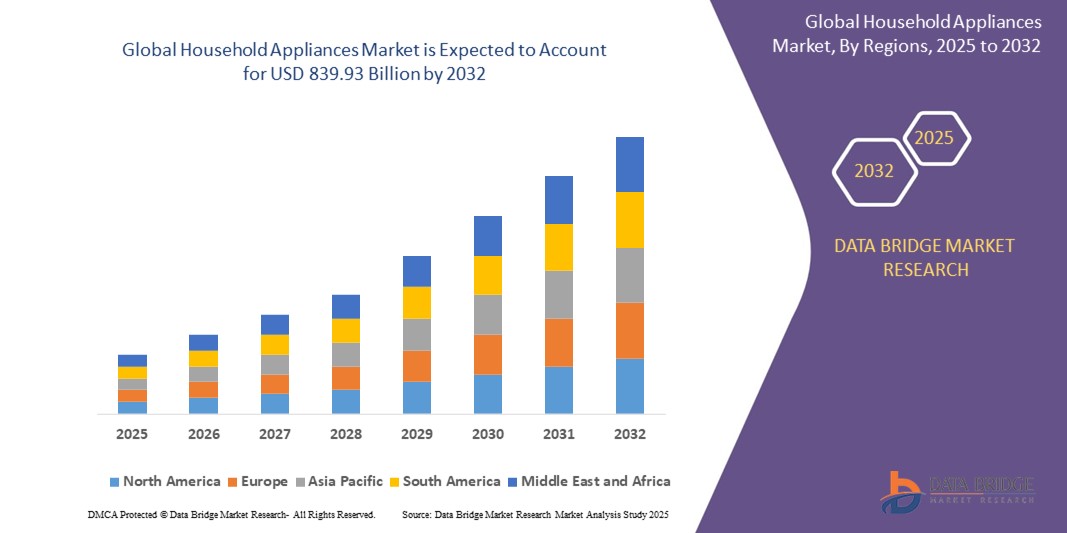

What is the Global Household Appliances Market Size and Growth Rate?

- The global household appliances market size was valued at USD 577.23 billion in 2024 and is expected to reach USD 839.93 billion by 2032, at a CAGR of 4.80% during the forecast period

- This market expansion is fueled by increasing urbanization, rising disposable incomes, and the widespread adoption of energy-efficient and smart home appliances globally

- The growing demand for technologically advanced, connected, and sustainable appliances—such as AI-powered washing machines, smart refrigerators, and voice-controlled ovens—is transforming consumer behavior and reshaping product offerings

What are the Major Takeaways of Household Appliances Market?

- Household appliances are a cornerstone of modern living, playing a critical role in cooking, cleaning, food preservation, air conditioning, and laundry across both residential and commercial settings

- The market is gaining momentum due to smart home integration, eco-friendly design trends, and innovations in energy- and water-saving technologies that align with evolving regulatory standards and consumer preferences

- Advancements in IoT connectivity, appliance customization, and compact, multifunctional designs are driving replacement cycles and boosting sales, making the Household Appliances market a key contributor to global home innovation

- Asia-Pacific dominated the global household appliances market, accounting for the largest revenue share of 42.12% in 2024, driven by a large consumer base, rising disposable incomes, and the rapid adoption of smart and energy-efficient appliances across emerging economies such as China, India, and Southeast Asia

- North America is expected to grow at the fastest CAGR of 11.89% from 2025 to 2032, primarily driven by increasing consumer inclination toward smart, connected, and sustainable home appliances

- The refrigerators & freezers segment dominated the household appliances market with the largest market revenue share of 32.4% in 2024, attributed to their essential role in food preservation, technological advancements such as inverter compressors, and rising demand for energy-efficient and smart refrigerators across urban households

Report Scope and Household Appliances Market Segmentation

|

Attributes |

Household Appliances Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Household Appliances Market?

“Rising Integration of Smart and Energy-Efficient Technologies”

- A significant and evolving trend in the global household appliances market is the increasing integration of smart features and energy-efficient technologies, driven by the rising adoption of IoT, consumer demand for convenience, and global sustainability goals

- Appliances embedded with AI-powered diagnostics, remote control via smartphones, and real-time energy usage tracking are gaining popularity in both residential and commercial settings

- For instance, in March 2024, Samsung Electronics launched a new line of BESPOKE AI appliances, including refrigerators and washing machines with AI energy mode and automatic maintenance features

- The demand for ENERGY STAR-rated and low-power consumption appliances is increasing across developed and emerging markets, particularly as governments introduce stricter energy regulations and offer incentives

- This trend is transforming the global household appliances landscape, encouraging innovation and fostering long-term value through reduced energy costs, sustainability, and user-friendly interfaces

What are the Key Drivers of the Household Appliances Market?

- Rising disposable incomes, rapid urbanization, and a growing middle class are fueling the demand for advanced household appliances, especially in emerging economies such as India, China, and Brazil

- For instance, in April 2024, Whirlpool Corporation reported a 17% increase in appliance sales in Southeast Asia, driven by growing urban populations and first-time buyers

- Increasing awareness about sustainable living and government programs supporting energy-efficient appliances, such as rebates and eco-labeling, are further propelling market growth

- The shift toward modular kitchens, smart homes, and connected lifestyles is boosting sales of appliances such as dishwashers, robotic vacuum cleaners, and smart refrigerators

- Moreover, product innovation, such as appliances with multiple functionalities, voice assistance, and automatic sensing technology, is attracting tech-savvy consumers worldwide

Which Factor is challenging the Growth of the Household Appliances Market?

- One of the primary challenges in the household appliances market is the fluctuating prices of raw materials, including metals (steel, aluminum) and plastics, which increase production costs and affect manufacturers’ profit margins

- For instance, in late 2023, the surge in global steel prices impacted the cost structure of appliance manufacturers such as LG and Electrolux, forcing temporary pricing adjustments

- In addition, logistical constraints, supply chain disruptions, and trade restrictions—especially post-pandemic—have resulted in delays and shortages in critical components such as semiconductors

- The limited penetration of smart appliances in rural and price-sensitive markets, due to high costs and lack of infrastructure, also hinders wider adoption

- To mitigate these issues, companies are focusing on local sourcing, vertical integration, and expansion of affordable product lines to increase accessibility and market resilience

How is the Household Appliances Market Segmented?

The market is segmented on the basis of product and distribution channel.

• By Product

On the basis of product, the household appliances market is segmented into Refrigerators & Freezers, Washers & Dryers, Dishwashers, Air Conditioners, and Cooking Appliances. The Refrigerators & Freezers segment dominated the Household Appliances market with the largest market revenue share of 32.4% in 2024, attributed to their essential role in food preservation, technological advancements such as inverter compressors, and rising demand for energy-efficient and smart refrigerators across urban households. Increasing product launches and customizable designs have also contributed to this segment’s sustained growth.

The Air Conditioners segment is projected to witness the fastest CAGR from 2025 to 2032, driven by rising global temperatures, increasing disposable incomes in emerging markets, and higher adoption in residential and commercial settings. Technological innovations such as inverter technology, smart connectivity, and eco-friendly refrigerants are key contributors to its accelerating demand.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Supermarket & Hypermarket, Specialty Stores, E-Commerce, and Others. The Supermarket & Hypermarket segment accounted for the largest market revenue share of 38.7% in 2024, supported by the wide product availability, in-store promotions, and customer preference for physical verification before high-value appliance purchases. These stores provide brand variety, bundled discounts, and post-purchase services, which continue to attract a large consumer base.

The E-Commerce segment is anticipated to grow at the fastest CAGR during 2025 to 2032, owing to the convenience of online shopping, growing penetration of internet and smartphones, and availability of attractive discounts and financing options. Enhanced logistics infrastructure and exclusive online product lines by major appliance brands are further fueling this growth.

Which Region Holds the Largest Share of the Household Appliances Market?

- Asia-Pacific dominated the global household appliances market, accounting for the largest revenue share of 42.12% in 2024, driven by a large consumer base, rising disposable incomes, and the rapid adoption of smart and energy-efficient appliances across emerging economies such as China, India, and Southeast Asia

- The region’s growth is fueled by urbanization, electrification, and an expanding middle-class population increasingly investing in convenience-focused home technologies

- Supportive government policies, technological innovation from regional manufacturers, and competitive pricing are further boosting the household appliances market in Asia-Pacific

China Household Appliances Market Insight

China dominates the Asia-Pacific household appliances market, thanks to its robust manufacturing ecosystem, large domestic consumer base, and progressive government policies encouraging green and smart technologies. In 2024, China led the region in terms of production and consumption, with appliances such as smart refrigerators, washing machines, and air conditioners seeing widespread adoption. The country’s “Made in China 2025” initiative aims to transition from labor-intensive to innovation-driven industries, further advancing domestic capabilities. In addition, increased urbanization and housing developments are creating strong demand for appliances, while government subsidies for energy-efficient products have made modern appliances more accessible across urban and rural regions.

India Household Appliances Market Insight

India is emerging as one of the fastest-growing household appliances markets in Asia-Pacific due to a surge in urbanization, rising disposable incomes, and increasing aspirations of middle-class consumers. Rural electrification initiatives and programs such as UJALA and Smart Cities Mission are driving appliance penetration even in underserved areas. The shift toward nuclear families and rapid housing construction further contributes to higher adoption of refrigerators, washing machines, and kitchen appliances. Moreover, e-commerce growth has made appliances more accessible across the country. With government incentives for energy-efficient products and increased focus on domestic manufacturing under the “Make in India” initiative, India’s market outlook remains highly promising.

Japan Household Appliances Market Insight

Japan’s household appliances market is known for its technological sophistication and compact, energy-efficient products. In 2024, consumer demand remained strong for smart and space-saving appliances suited to smaller urban homes. With an aging population, there is growing interest in user-friendly and automated appliances that offer convenience and safety. Japan also leads in innovations such as AI-powered washing machines and IoT-connected air conditioners. Government regulations supporting low-energy consumption and sustainable product design have pushed manufacturers to introduce eco-friendly appliances. In addition, renovation of aging housing infrastructure and growing smart city development contribute to consistent demand across both urban and rural markets.

Which Region is the Fastest Growing in the Household Appliances Market?

North America is expected to grow at the fastest CAGR of 11.89% from 2025 to 2032, primarily driven by increasing consumer inclination toward smart, connected, and sustainable home appliances. The region is experiencing a shift toward home automation and lifestyle-centric products due to high internet penetration, remote work trends, and growing environmental awareness. Rising renovation and remodeling activities, especially in the U.S., are leading to upgrades and replacement of outdated appliances. Incentives such as Energy Star programs further encourage purchases of energy-efficient products. Strong retail infrastructure and rapid e-commerce expansion also support market acceleration across residential and small commercial segments.

U.S. Household Appliances Market Insight

The U.S. accounted for the largest share of the North American household appliances market in 2024 due to high levels of consumer spending, established retail chains, and a mature smart home ecosystem. The rise in home improvement projects and a growing preference for luxury and connected appliances are key factors driving growth. The demand for sustainable appliances that align with federal energy efficiency regulations is also increasing. In addition, innovations in smart kitchen and laundry appliances have gained traction, particularly among millennials and tech-savvy homeowners. Government-backed incentives and rebates for energy-efficient products further stimulate growth and encourage brand competition.

Canada Household Appliances Market Insight

Canada's household appliances market is witnessing steady growth, driven by rising residential construction, increased homeownership rates, and heightened environmental consciousness. Consumers are increasingly opting for appliances with higher energy efficiency ratings and smart features. Government initiatives promoting green technology and rebates for eco-friendly purchases have supported this shift. Moreover, demand for compact and multi-functional appliances is increasing, particularly in urban areas with smaller living spaces. E-commerce platforms and local appliance brands are expanding their reach, making it easier for Canadians to access the latest models. These factors are contributing to a sustained rise in demand across the country’s diverse consumer segments.

Which are the Top Companies in Household Appliances Market?

The household appliances industry is primarily led by well-established companies, including:

- Friedr. Dick GmbH & Co. (Germany)

- GLOBAL APPLIANCES USA (U.S.)

- KAI USA Ltd. (U.S.)

- Kiya Corp. (Japan)

- M.A.C. Knife (U.S.)

- Messermeister (Germany)

- Victorinox AG (Switzerland)

- Anker Innovation Technology Co., Ltd. (China)

- Samsung Electronics Co., Ltd. (South Korea)

- Shenzhen Proscenic Technology Co. Ltd. (China)

- Neato Robotics, Inc. (U.S.)

- Cecotec Innovaciones S.L. (Spain)

- LG Electronics Inc. (South Korea)

- Dyson Limited (U.K.)

- Panasonic Corporation (Japan)

- Sharp Corporation (U.S.)

What are the Recent Developments in Global Household Appliances Market?

- In August 2024, Samsung Electronics Co., Ltd. launched 10 large-capacity Bespoke AI washing machines tailored for Indian consumers, integrating intelligent features such as AI Wash for optimized water and detergent usage, and AI EcoBubble for energy-efficient deep cleaning. These models also feature Wi-Fi connectivity, allowing users to manage wash cycles remotely via the SmartThings app. This move underscores Samsung’s commitment to delivering personalized, sustainable, and smart home appliance experiences in the Indian market

- In January 2024, Bosch introduced updated features in its dishwasher lineup, including sleek touch controls, anti-fingerprint finishes, and PowerControl spray arm technology for enhanced cleaning. The integration of the Home Connect app enables remote operation, cycle customization, and safety notifications. With this innovation, Bosch aims to broaden its product appeal and offer advanced dishwashing convenience to a diverse customer base

- In September 2023, BSH Home Appliances Pvt. Ltd. rolled out a new line of fully automatic All Round Care front-load washing machines, highlighting Bosch’s ongoing focus on simplifying daily chores through innovation. The product launch reaffirms the company’s mission to deliver smart, user-centric solutions for modern households

- In January 2023, Samsung added to its customizable home appliance offerings with the introduction of the Bespoke AI Oven and an expanded range of Bespoke refrigerators. These appliances feature modern design and seamless integration with SmartThings for automation, savings, and enhanced control. The launch marked another step in Samsung’s vision of smart and flexible living environments

- In September 2022, Samsung unveiled a new series of semi-automatic washing machines packed with practical features such as auto restart, rat protection, and air turbo drying systems for improved reliability and ease of use. This launch was part of Samsung’s strategy to meet diverse consumer needs through technology-focused home care products

- In August 2022, Haier China signed a memorandum of understanding with the Investment Authority of Egypt to build a USD 130 million industrial complex for manufacturing home appliances in Egypt. This strategic expansion enhances Haier’s global manufacturing footprint and reflects its ambition to deepen its presence in the Middle East and African markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.