Global Hospitals Outpatient Care Centers Market

Market Size in USD Billion

CAGR :

%

USD

4,997.77 Billion

USD

11,108.92 Billion

2024

2032

USD

4,997.77 Billion

USD

11,108.92 Billion

2024

2032

| 2025 –2032 | |

| USD 4,997.77 Billion | |

| USD 11,108.92 Billion | |

|

|

|

|

Hospitals and Outpatient Care Centres Market Size

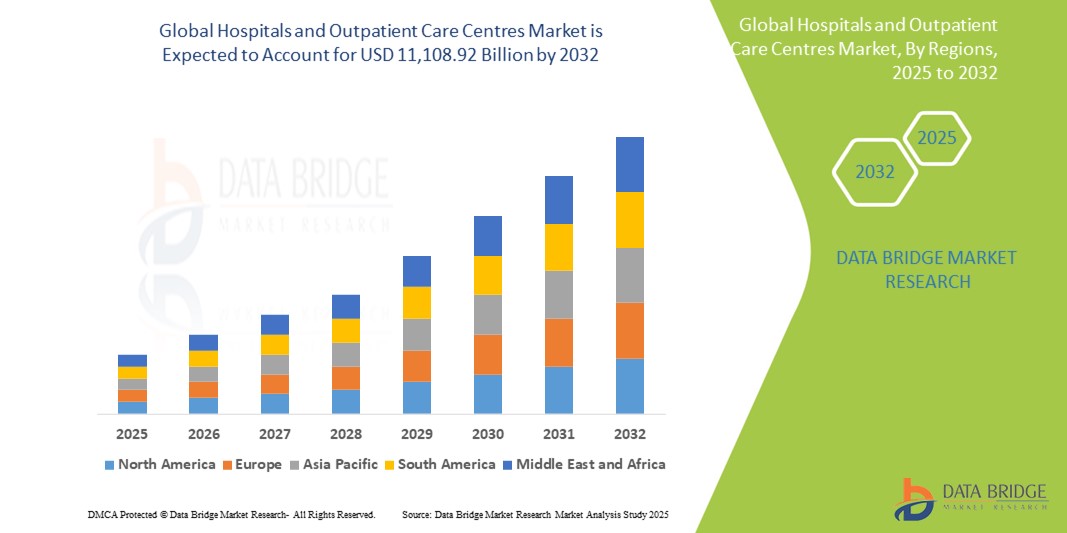

- The global hospitals and outpatient care centres market size was valued at USD 4,997.77 billion in 2024 and is expected to reach USD 11,108.92 billion by 2032, at a CAGR of 10.50% during the forecast period

- This growth is driven by factors such as the rising prevalence of chronic diseases, aging population and increasing life expectancy, and technological advancements in medical equipment and treatment

Hospitals and Outpatient Care Centres Market Analysis

- Hospitals and outpatient care centres play a critical role in the healthcare system, providing a wide range of medical services, including emergency care, surgeries, diagnostics, rehabilitation, and preventive care to patients. They are essential for delivering comprehensive care and managing chronic conditions

- The demand for hospital and outpatient care services is significantly driven by the rising prevalence of chronic diseases, the aging population, and increasing healthcare expenditure globally. These factors are creating a continuous demand for quality medical care and support services

- North America is expected to dominate the global hospitals and outpatient care centres market with 36.2% due to advanced healthcare infrastructure, high healthcare spending, and the strong presence of well-established healthcare providers. The region also benefits from a high adoption rate of cutting-edge medical technologies

- Asia-Pacific is expected to be the fastest-growing region in the global hospitals and outpatient care centres market with a share of 14.1%, driven by rapid population growth, increasing healthcare awareness, expanding middle-class populations, and significant investments in healthcare infrastructure

- General medical and surgical services segment is expected to dominate the hospitals and outpatient care centres market with a significant share of 54.6%, driven by its broad application in healthcare settings. These services, including diagnostic, therapeutic, and surgical procedures, are essential for managing a wide range of common health issues and conditions

Report Scope and Hospitals and Outpatient Care Centres Market Segmentation

|

Attributes |

Hospitals and Outpatient Care Centres Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hospitals and Outpatient Care Centres Market Trends

“Technological Advancements in Patient Monitoring and Diagnostic Systems”

- One prominent trend in the evolution of hospitals and outpatient care centers is the increasing integration of advanced patient monitoring and diagnostic systems

- These technologies enhance patient care by providing real-time health data, improving the accuracy of diagnoses, and supporting early disease detection

- For instance, modern patient monitoring systems offer continuous tracking of vital signs, allowing healthcare professionals to make more informed decisions and intervene promptly in critical situations

- These advancements are transforming patient care, improving outcomes, and driving the demand for next-generation healthcare systems with cutting-edge monitoring and diagnostic capabilities

Hospitals and Outpatient Care Centres Market Dynamics

Driver

“Rising Demand for Outpatient Care Due to Aging Population and Chronic Diseases”

- The growing aging population and the increasing prevalence of chronic diseases are significantly contributing to the rising demand for hospitals and outpatient care centers.

- As the global population ages, the incidence of age-related conditions such as cardiovascular diseases, diabetes, arthritis, and respiratory disorders continues to grow, driving the need for regular outpatient visits and specialized care.

- Outpatient care centers offer cost-effective and convenient healthcare solutions, reducing the burden on hospitals and improving patient outcomes through timely medical interventions.

For instance,

- In December 2024, according to the World Health Organization (WHO), the global population aged 65 and older is expected to double by 2050, reaching nearly 1.5 billion. This demographic shift is expected to significantly increase the demand for outpatient care services, as older adults typically require more frequent medical attention

- As a result, the rising prevalence of chronic conditions and the growing aging population are driving the expansion of hospitals and outpatient care centers worldwide

Opportunity

“Integration of Telehealth and Digital Health Solutions”

- The integration of telehealth and digital health solutions into outpatient care services presents a significant growth opportunity, allowing healthcare providers to reach a larger patient base while improving efficiency

- Telehealth platforms enable real-time consultations, remote monitoring, and follow-up care, reducing the need for in-person visits and enhancing patient convenience

- Digital health technologies, such as wearable devices and remote diagnostic tools, further enhance patient engagement and allow for continuous health monitoring

For instance,

- In January 2025, according to an article published by the American Telemedicine Association (ATA), the adoption of telehealth has surged globally, with healthcare providers increasingly using virtual care platforms to manage chronic conditions, reduce hospital readmissions, and improve patient outcomes

- The integration of telehealth and digital health solutions in outpatient care settings can reduce healthcare costs, improve access to care, and support better health outcomes, driving market growth

Restraint/Challenge

“High Operational Costs and Regulatory Challenges”

- The high operational costs associated with running hospitals and outpatient care centers pose a significant challenge for market growth

- These facilities require substantial investments in medical equipment, skilled personnel, and infrastructure, which can strain the budgets of healthcare providers, particularly in developing regions

- In addition, stringent regulatory requirements and reimbursement challenges further complicate the financial sustainability of these centers

For instance,

- In November 2024, according to an article published by the American Hospital Association (AHA), the rising costs of medical supplies, labor shortages, and regulatory compliance have increased the financial pressure on healthcare providers, limiting their ability to expand services and invest in new technologies

- These financial and regulatory barriers can hinder the growth of hospitals and outpatient care centers, reducing their ability to provide high-quality care to a growing patient population

Hospitals and Outpatient Care Centres Market Scope

The market is segmented on the basis of type, expenditure and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Expenditure Type |

|

|

By Application |

|

In 2025, the general medical and surgical Services is projected to dominate the market with a largest share in type segment

The general medical and surgical services segment is expected to dominate the hospitals and outpatient care centres market with the largest share of 54.6% in 2025 due to its broad application in healthcare settings. These services, including diagnostic, therapeutic, and surgical procedures, are crucial for addressing a wide range of common health issues and managing various medical conditions. The consistent high demand for general medical and surgical services, essential for both acute and chronic illness treatment, significantly contributes to this segment's market dominance. The widespread use of these services in hospitals and outpatient care facilities globally drives market growth.

The hospitals is expected to account for the largest share during the forecast period in application market

In 2025, the hospitals segment is expected to dominate the hospitals and outpatient care centres market with the largest market share of 51.55% due to their pivotal role in providing comprehensive healthcare services. As the primary healthcare setting for both inpatient and outpatient care, hospitals are essential for the diagnosis, treatment, and rehabilitation of patients. The growing demand for specialized medical services, advancements in medical technology, and increased healthcare accessibility are driving the expansion of hospitals. In addition, the rising healthcare needs of aging populations and the increasing prevalence of chronic diseases further contribute to the segment’s market dominance.

Hospitals and Outpatient Care Centres Market Regional Analysis

“North America Holds the Largest Share in the Hospitals and Outpatient Care Centres Market”

- North America dominates the hospitals and outpatient care centres market, holding approximately 36.2% of the global market share, driven by advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and a strong presence of key market players

- U.S. holds a significant share of the North American market, representing about 24.8% of the global market, due to advanced healthcare infrastructure, high healthcare spending, widespread insurance coverage, and early adoption of innovative medical technologies

- The availability of well-established reimbursement systems in developed region along with government-funded healthcare programs, continues to support strong patient access to hospital and outpatient services, enhancing market sustainability.

- Rising investments in R&D by leading healthcare providers and medical technology companies are accelerating the development and integration of digital health solutions, AI-driven diagnostics, and remote monitoring systems, further strengthening global market dynamics.

“Asia-Pacific is Projected to Register the Highest CAGR in the Hospitals and Outpatient Care Centres Market”

- Asia-Pacific is expected to witness the highest growth rate in the hospitals and outpatient care centres market, with an estimated 14.1% of the global market share, this growth is driven by factors such as rapid expansion in healthcare infrastructure, increasing adoption of digital health technologies, rising surgical volumes, government initiatives supporting universal healthcare access and growth of outpatient models and private investments in healthcare

- Countries such as China, India, and Japan are emerging as key markets due to the growing aging population (by 2030, over 20% will be over 60 years old), high incidence of chronic and age-related diseases (for instance, diabetes, cardiovascular disorders) and aggressive investment in hospital infrastructure and digital health platforms

- Japan, with its highly advanced healthcare system, continues to be a key market for surgical precision technologies and outpatient innovations.

- India is projected to register the highest CAGR of 6.9% in the hospitals and outpatient care centres market, driven by expanding healthcare infrastructure in Tier 2 and Tier 3 cities, growing medical tourism and public health schemes (for instance, Ayushman Bharat) and increasing awareness about preventive care

Hospitals and Outpatient Care Centres Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Kaiser Foundation Health Plan, Inc. (U.S)

- DaVita Inc. (U.S)

- Medtronic (Ireland)

- Mayo Foundation for Medical Education and Research (MFMER) (U.S)

- The Johns Hopkins Health System Corporation (U.S)

- Fresenius Medical Care AG (Germany)

- The Pennant Group, Inc. (U.S)

- Asahi Kasei Medical Co., Ltd. (Japan)

- Cleveland Clinic (U.S)

- The University of Texas MD Anderson Cancer Center (U.S)

- Johnson & Johnson Services, Inc. (U.S)

- Agfa-Gevaert Group (Belgium)

- McKesson Corporation (U.S)

- Oracle (U.S)

- Omnicell (U.S)

- Memorial Sloan Kettering Cancer Center (U.S)

- IPB (India)

- University of Maryland Medical Center (UMMC) (U.S)

- St. Jude Children's Research Hospital (U.S)

Latest Developments in Global Hospitals and Outpatient Care Centres Market

- In January 2025, Kaiser Foundation Health Plan, Inc., a leading U.S.-based healthcare provider, announced the expansion of its telehealth services to cover a broader range of outpatient procedures, including advanced cardiac care and orthopedic surgeries, to improve patient access and reduce hospital readmissions. The initiative aims to leverage digital health platforms for real-time patient monitoring and personalized care, supporting better health outcomes

- In October 2024, Mayo Clinic launched a new integrated cancer care model, the "Comprehensive Oncology Network," aimed at providing seamless, multidisciplinary care for oncology patients. The model includes the use of precision medicine, real-time data analytics, and enhanced patient navigation systems to improve survival rates and patient satisfaction

- In September 2024, The Johns Hopkins Health System Corporation introduced its "Surgical Innovations Hub" in Baltimore, focused on developing minimally invasive surgical techniques and robotic-assisted systems for outpatient care settings. The facility aims to reduce recovery times and surgical complications while enhancing patient outcomes

- In September 2024, McKesson Corporation, a major U.S. healthcare service provider, announced the rollout of its next-generation digital supply chain platform, designed to streamline the distribution of medical supplies and improve inventory management for outpatient centers and hospitals across the U.S.

- In September 2024, Fresenius Medical Care AG & Co. KGaA introduced the "Fresenius One-Stop Renal Solution" in Europe, integrating dialysis services with outpatient nephrology care to improve patient outcomes and reduce hospitalization rates for chronic kidney disease (CKD) patients. The system incorporates advanced patient monitoring and telehealth support for seamless care delivery

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.